Market Overview - Page 40

September 17, 2024

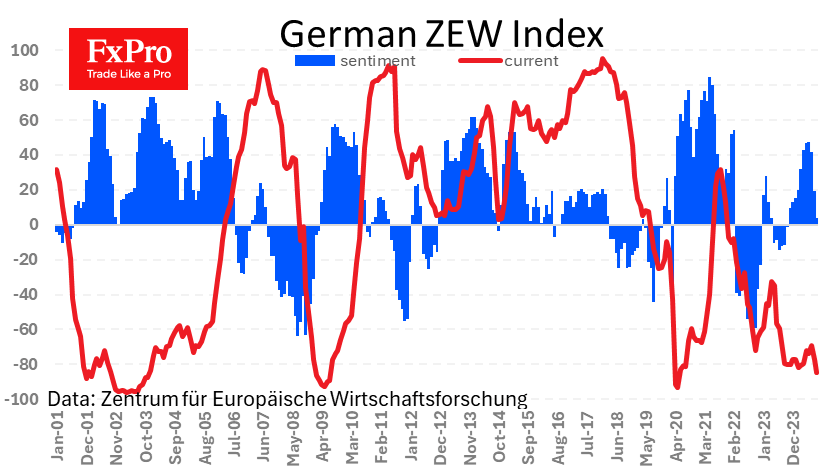

German business sentiment deteriorated sharply in September, according to ZEW data. The relevant index fell to 3.6, the lowest level since October 2023. The situation was even worse for the component assessing current conditions, which fell to -84.5, the lowest.

September 16, 2024

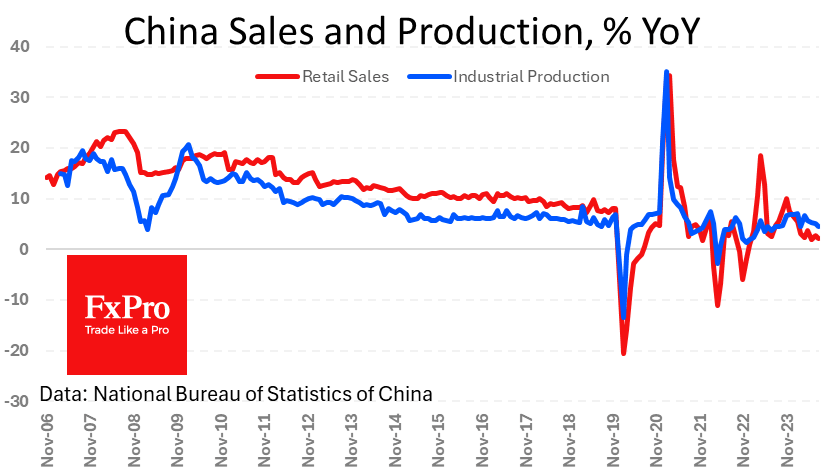

Saturday’s statistics from China added to fears of a slowdown in the world’s second-largest economy, forcing the central bank to promise additional measures to lower borrowing costs. This is a fresh attempt to reverse the deteriorating trend in the economy.

September 15, 2024

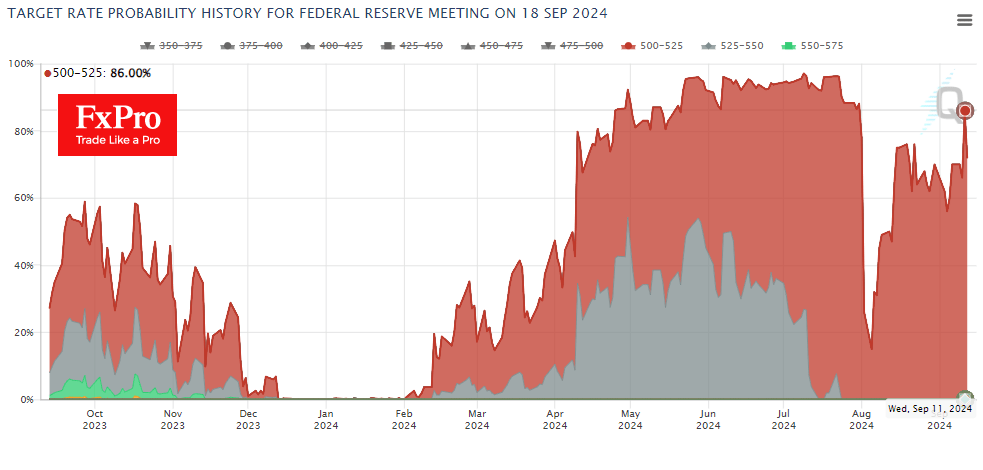

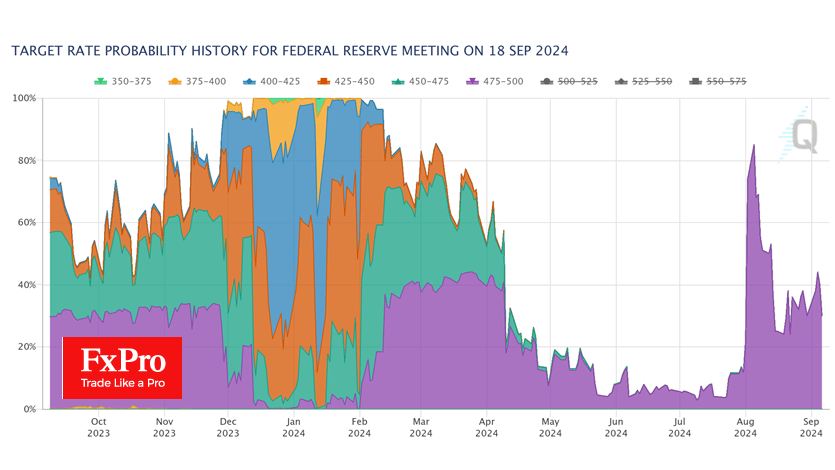

Influential financial media are promoting the need for a 50-basis point rate cut. The Fed’s blackout period starts 10 days before the rate decision is released, so the main influence on the markets during this time comes from traders’ interpretation.

September 13, 2024

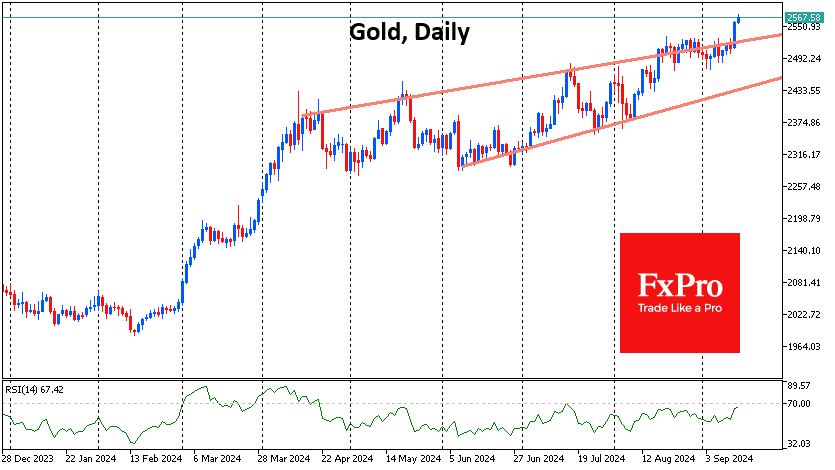

After three weeks of consolidation, gold moved decisively upwards, hitting a record above $2572 per troy ounce on the spot market on Friday. The price rise has approached 3% since the beginning of the week and 25% since the beginning.

September 12, 2024

US inflation in August was in line with expectations but caused some interesting market movements. The initial reaction was neutral, but then markets began reassessing expectations for the Fed Funds rate. The shift in expectations towards a 25bp cut rather.

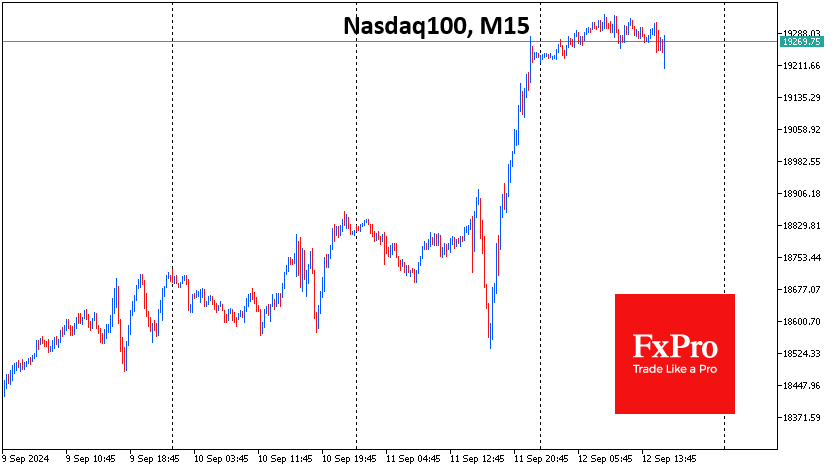

September 12, 2024

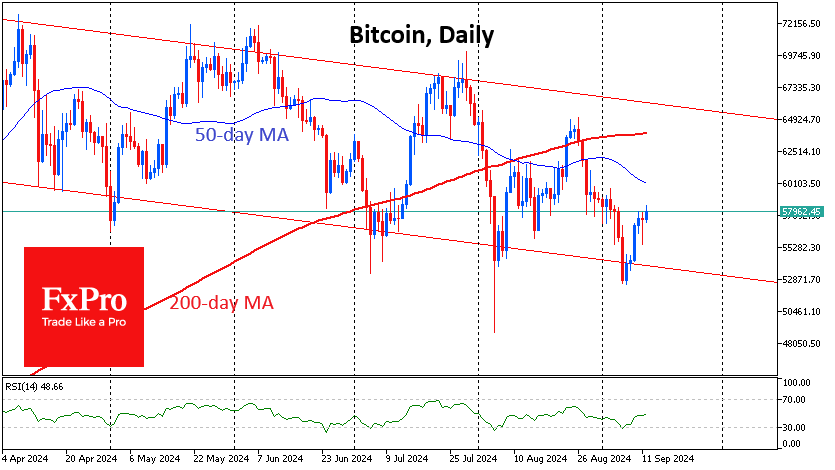

Market picture US financial markets closed higher on Wednesday despite a rough start to the day. A strong performance from the technology sector helped the crypto market cross the $2 trillion mark, up 3% in 24 hours. The positive sentiment.

September 11, 2024

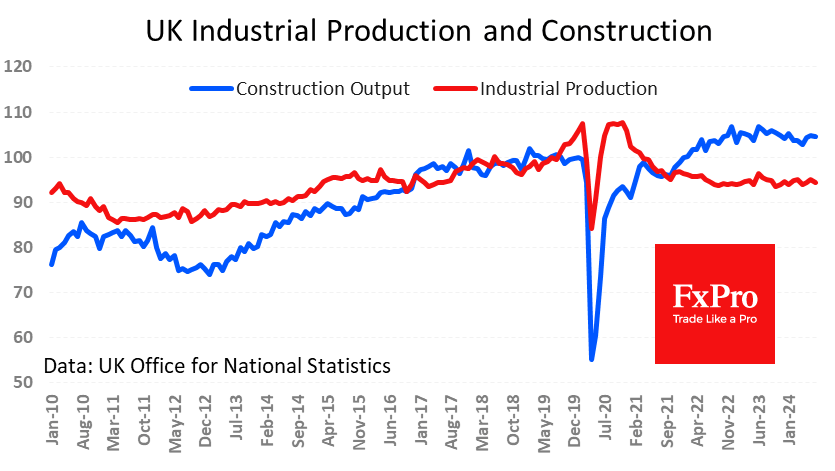

Disappointing economic data from the UK prevented the Pound from rallying despite the Dollar’s weakness. Statistics for July showed that the economy’s volume was almost unchanged from the previous month, much weaker than the expected 0.2% m/m growth. The biggest.

September 10, 2024

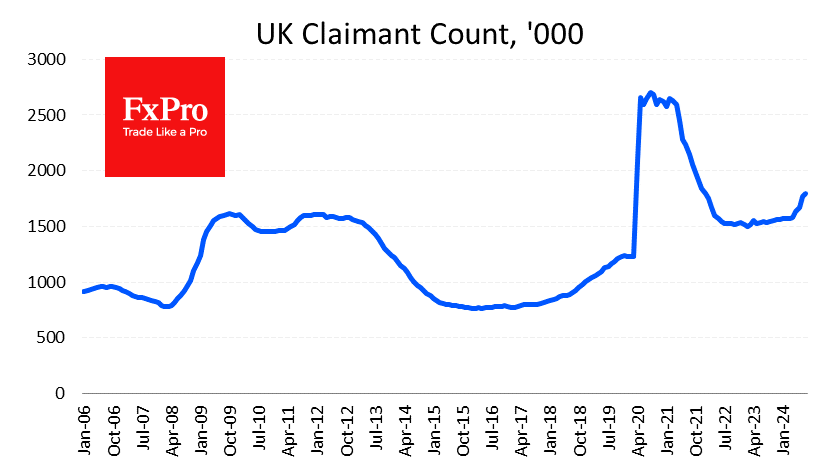

In the UK, jobless claims rose by 23.7K in August, much better than the 95.5K expected and the 102.3K rise in the previous month. This is relatively positive data as it suggests that the rate of deterioration in the UK.

September 10, 2024

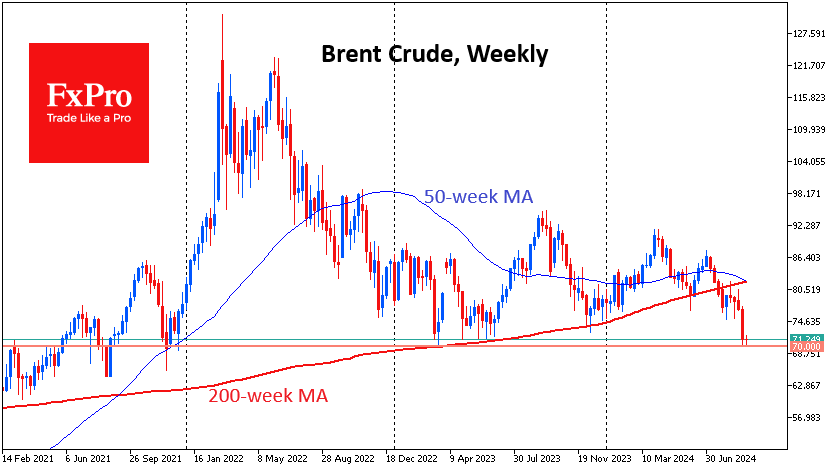

Oil pressure shows no sign of easing, with the price of a barrel of Brent touching lows of $70.50 last Friday and on Monday. The oil price has approached the psychologically important level, as it has traded consistently below $70 for more.

September 9, 2024

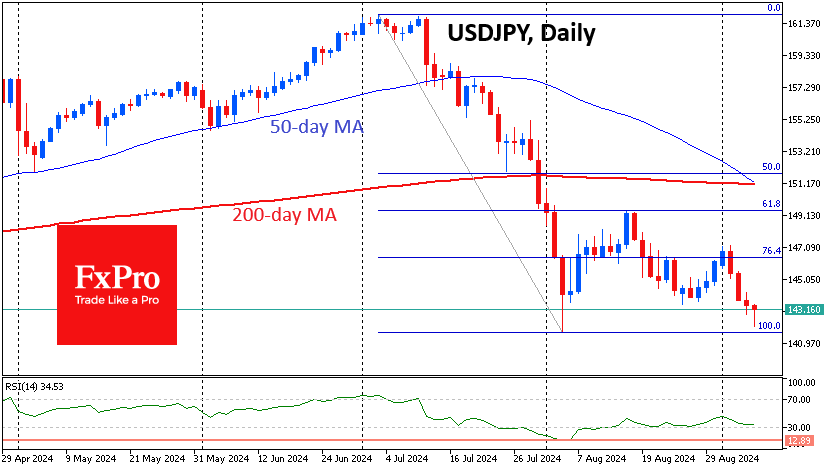

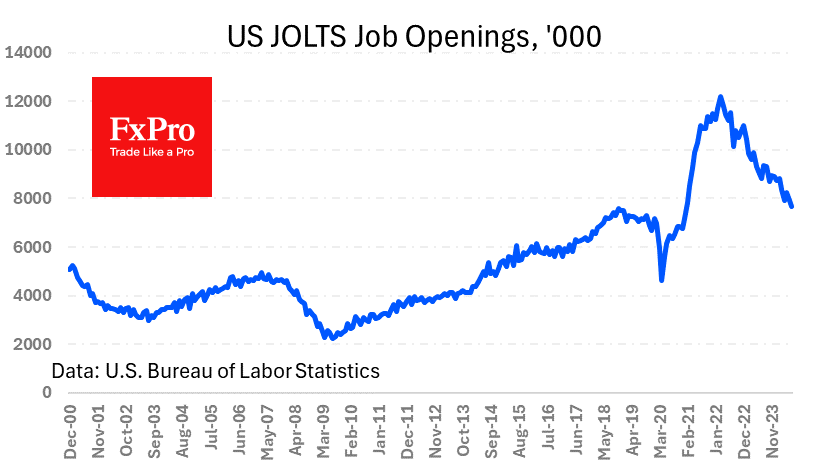

After an initial decline, the USD began to rally on the back of US employment data that dampened expectations of a 50-basis point rate cut by the Fed in September. The US employment data, which triggered a fall in the.

September 6, 2024

The unwinding of the carry trade in the FX market continues, with the major safe havens returning to the extremes seen against the dollar in early August. A new wave of risk aversion has been synchronised across currency and equity.