Market Overview - Page 399

March 16, 2020

One bitcoin trader lost 1,220 BTC on March 12, when the price of the dominant cryptocurrency fell by 50 percent in a single day. As the downtrend of the crypto market worsens, large-scale multi-million dollar liquidations can happen again. Last.

March 16, 2020

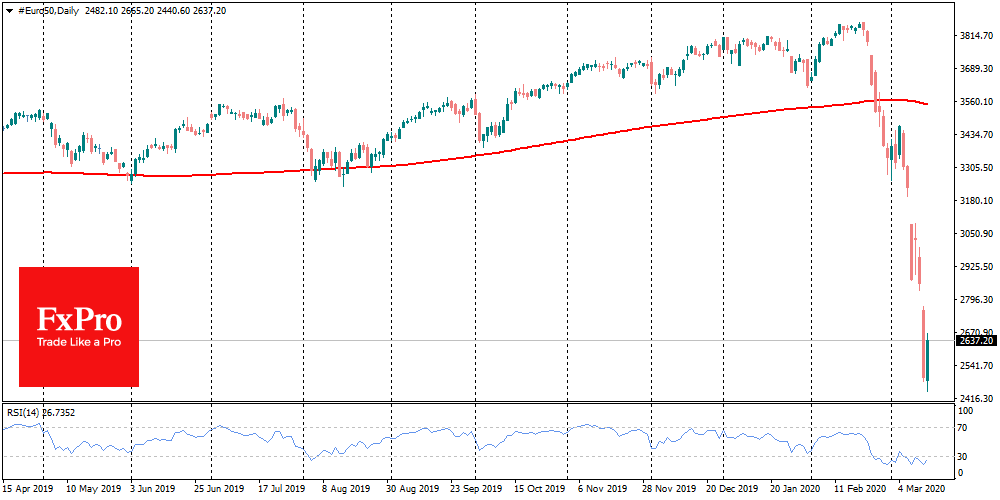

European markets plunged on Monday as much of the region went into shutdown mode to prevent the spread of the new coronavirus. The pan-European Stoxx 600 dropped 8% near the start of trading, travel and leisure stocks plummeting 14.3% to.

March 16, 2020

Oil prices slid more than 6% on Monday as the acceleration in coronavirus cases worldwide, which is bringing travel and business to a standstill, further dents global demand for crude. U.S. West Texas Intermediate crude dropped 6.4%,or $2.05, to trade.

March 16, 2020

The Federal Reserve, saying “the coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” cut interest rates to essentially zero on Sunday and launched a massive $700 billion quantitative easing program to shelter.

March 16, 2020

The Fed emergently cut the rate by 75 points to 0.00%-0.25% on Sunday night. Two hours earlier, RBNZ also cut its rate by 75 points to a historic low of 0.25%. This morning, the Bank of Japan expanded its QE.

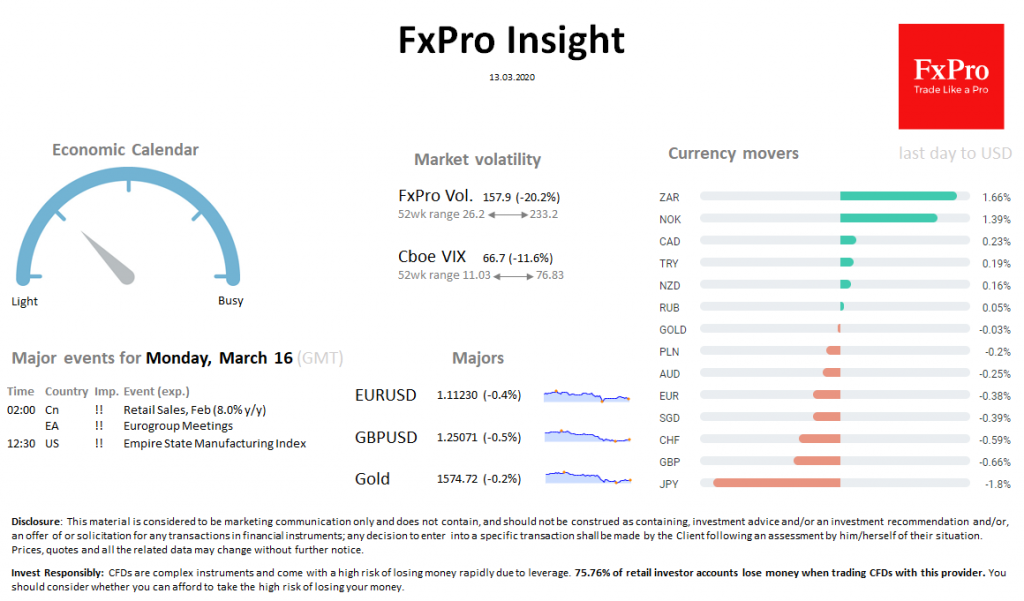

March 13, 2020

Saudi Arabia is flooding markets with oil at prices as low as $25 per barrel, specifically targeting big refiners of Russian oil in Europe and Asia, in an escalation of its fight with Moscow for market share, five trading sources.

March 13, 2020

Europe has become the new epicenter of the COVID-19 pandemic as cases in China slow and the deadly coronavirus runs through Italy and the rest of that continent, World Health Organization officials said Friday. “More cases are now being reported.

March 13, 2020

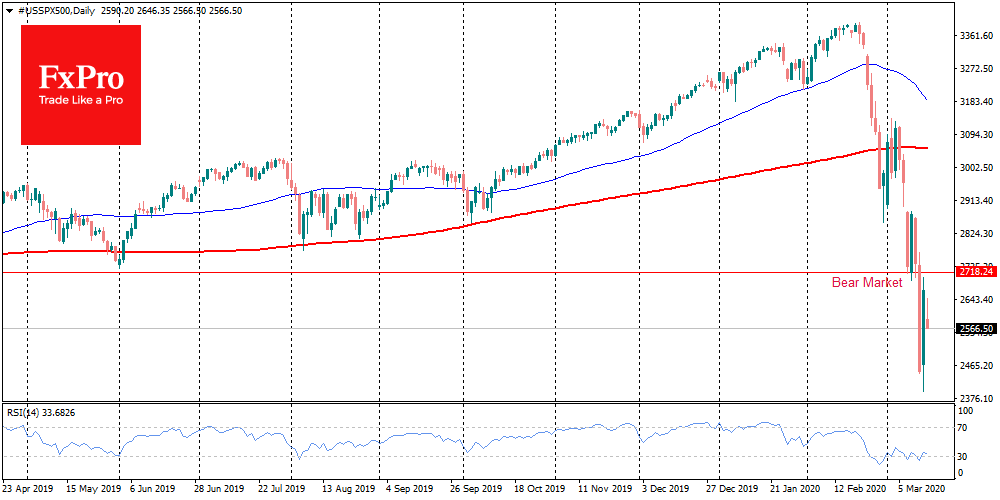

Market overview High volatility of stock markets after yesterday’s collapse remains. S & P500 since the start of trading on Friday added 3.7% after a collapse of 9.9% the day before. EuroStoxx50 grows by 5.5%, FTSE100 – by 4.4%. DXY.

March 13, 2020

Markets on Thursday were experiencing one of the sharpest declines in their history. The fall of the American indices was approaching 10%, becoming the worst since 1987, European markets were losing even more as FTSE100 collapsed by 10.5% by the.

March 13, 2020

World stocks were set on Friday for their worst week since the 2008 financial crisis, with coronavirus panic-selling hitting nearly every asset class and investors fretting that central bank action may not be enough to soothe the pain. European stock.

March 13, 2020

U.S. shale producers are seeking sharp service costs cuts to deal with plummeting prices and shrinking demand, according to executives and a letter sent to top providers, driving home the oil industry’s desperate efforts to cope with a market dive..