Market Overview - Page 38

October 15, 2024

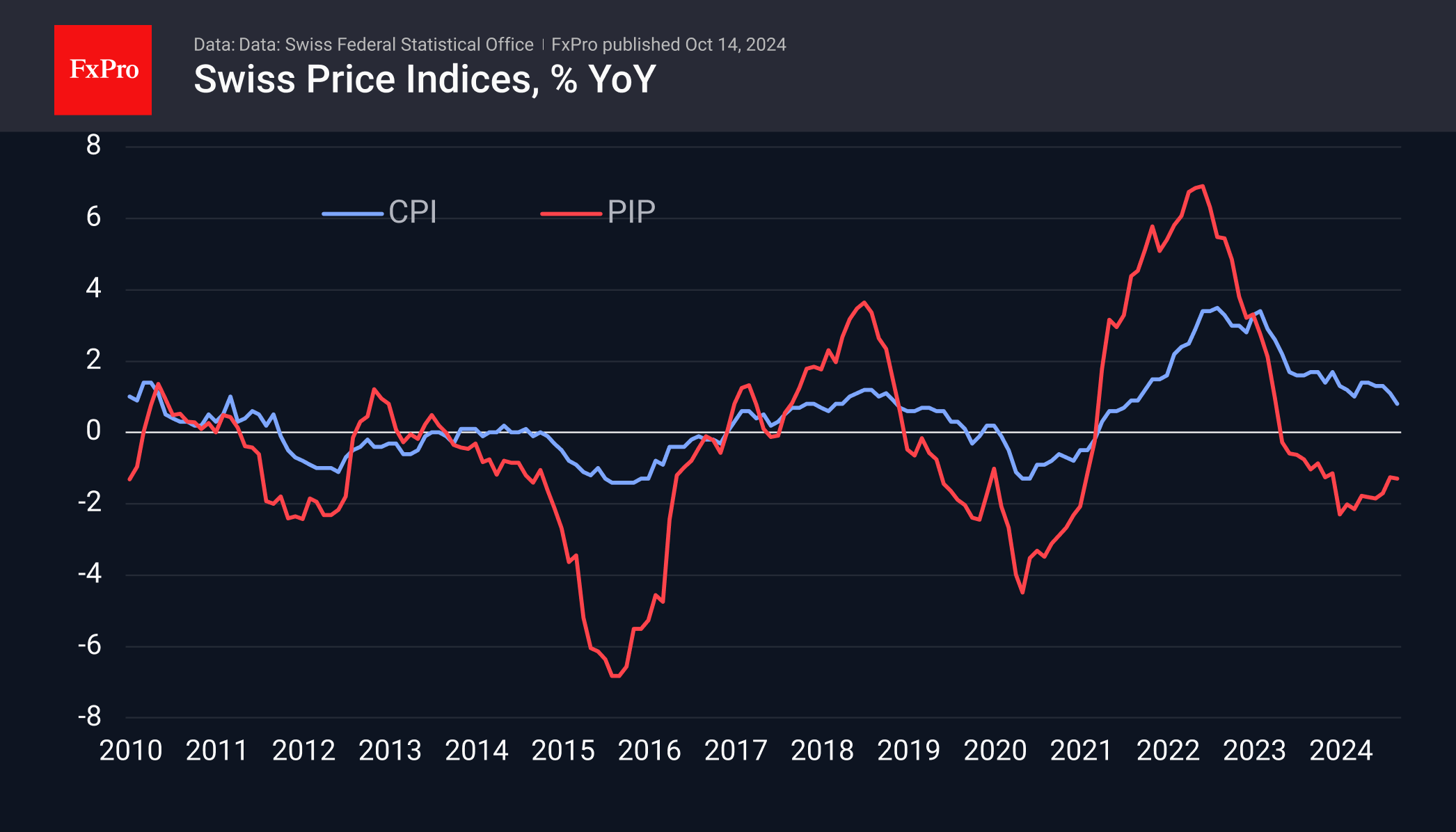

Swiss inflation continues to disappoint, with producer and import prices falling by 0.1% m/m in September, contrary to expectations. This weakness supports the case for further monetary easing by the Swiss central bank. USDCHF rose 0.8%, following the Dollar Index's gains since late September.

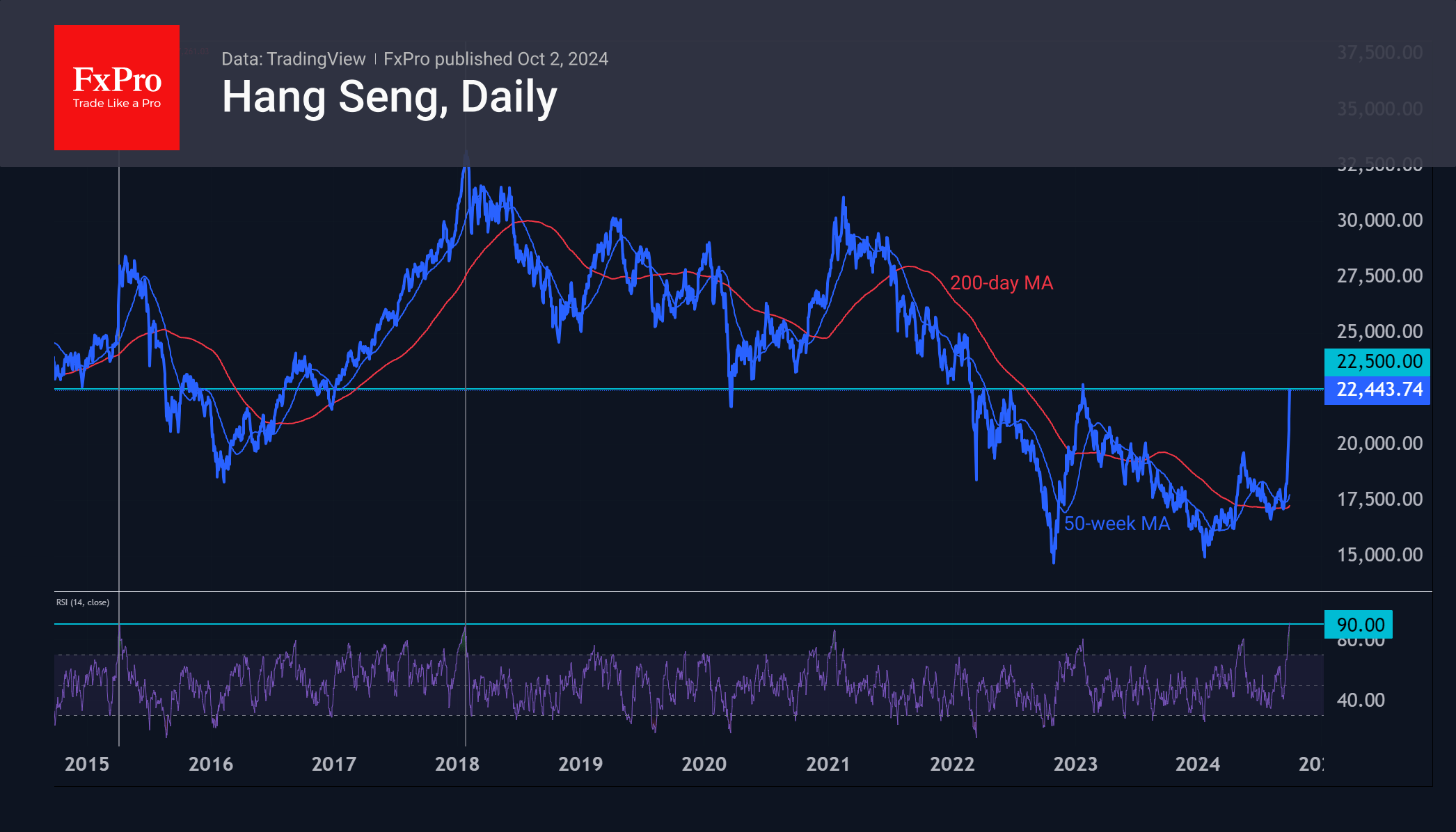

October 14, 2024

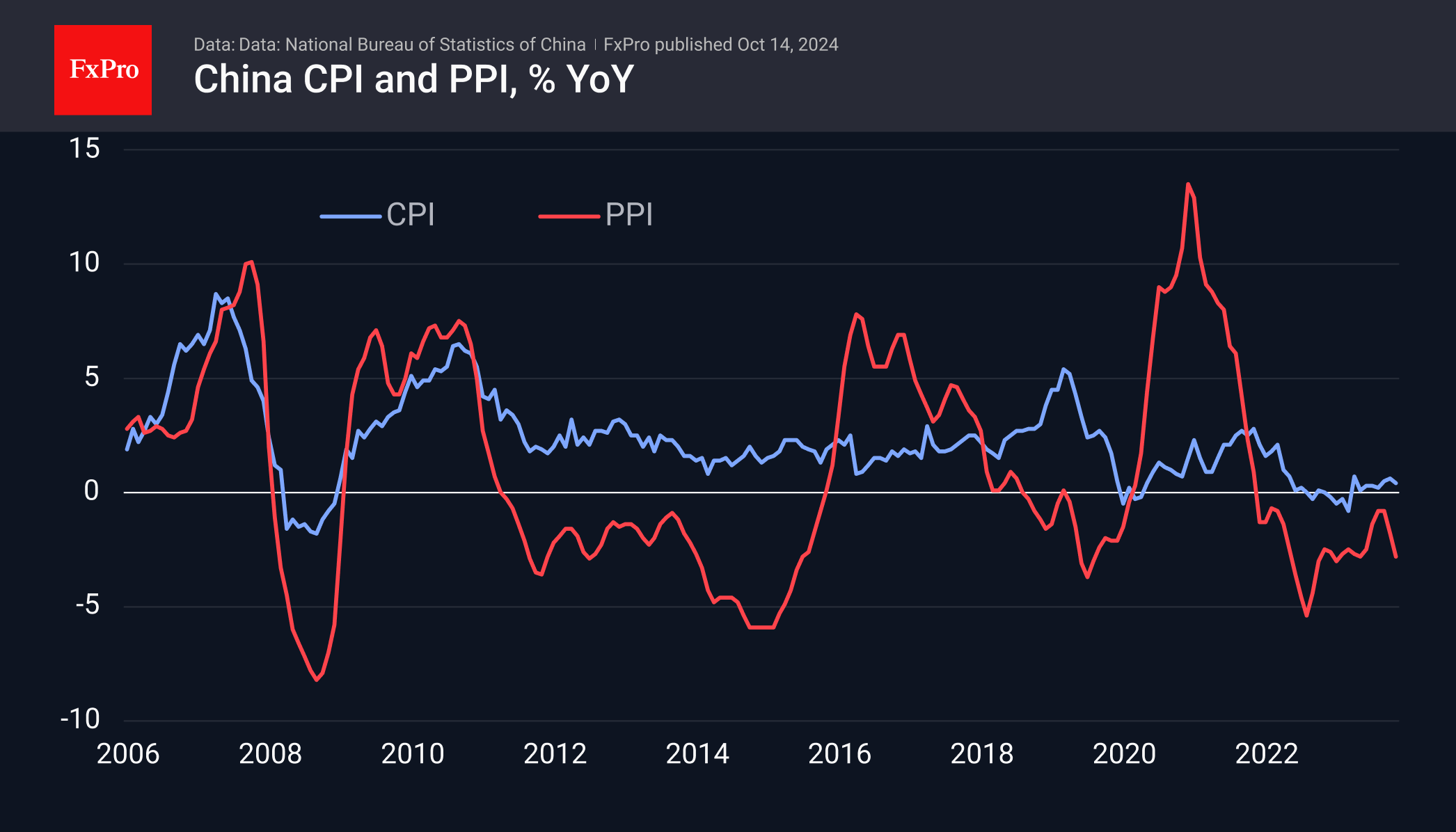

China's latest economic data shows weak growth, with CPI slowing to 0.4% y/y and PPI falling 2.8%. While external trade data signals potential recovery, the overall sentiment remains disappointed. Monetary dynamics indicate some positive movement, with M2 growth at 6.8%.

October 14, 2024

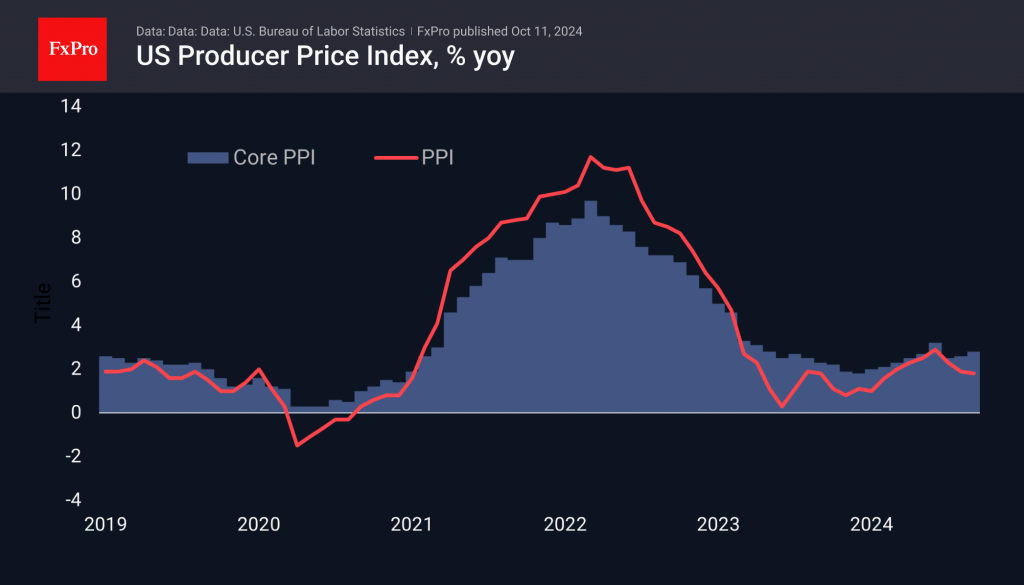

US producer prices rose at a faster pace in September than analysts had forecast. The headline PPI slowed to 1.8% y/y instead of the expected 1.6%. The core price index, which excludes food and energy, accelerated to 2.8%. While this.

October 10, 2024

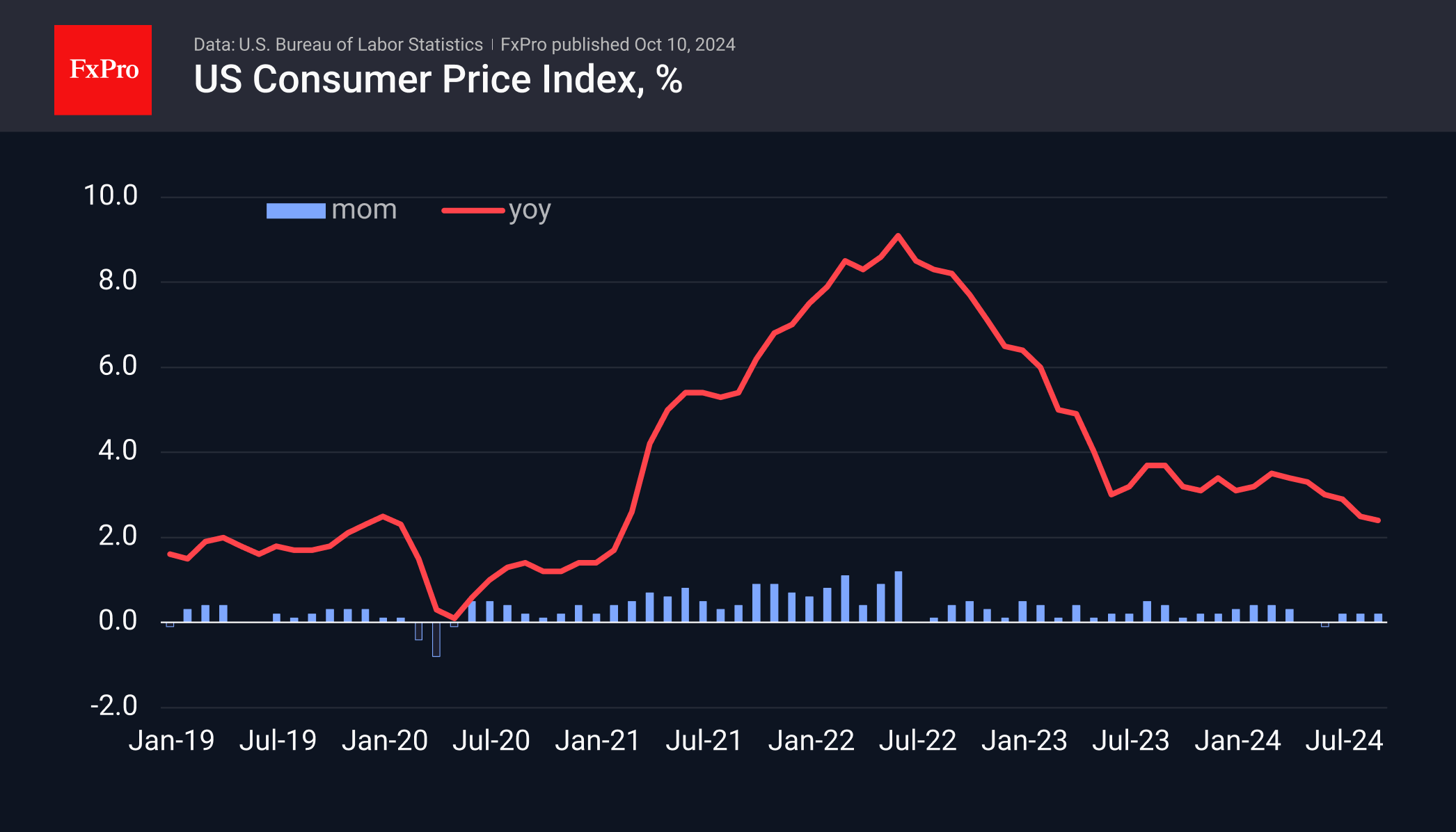

US inflation slightly exceeded expectations, but a surge in jobless claims shifted attention to the need for further policy easing. The dollar remained largely unchanged after conflicting economic data was released.

October 10, 2024

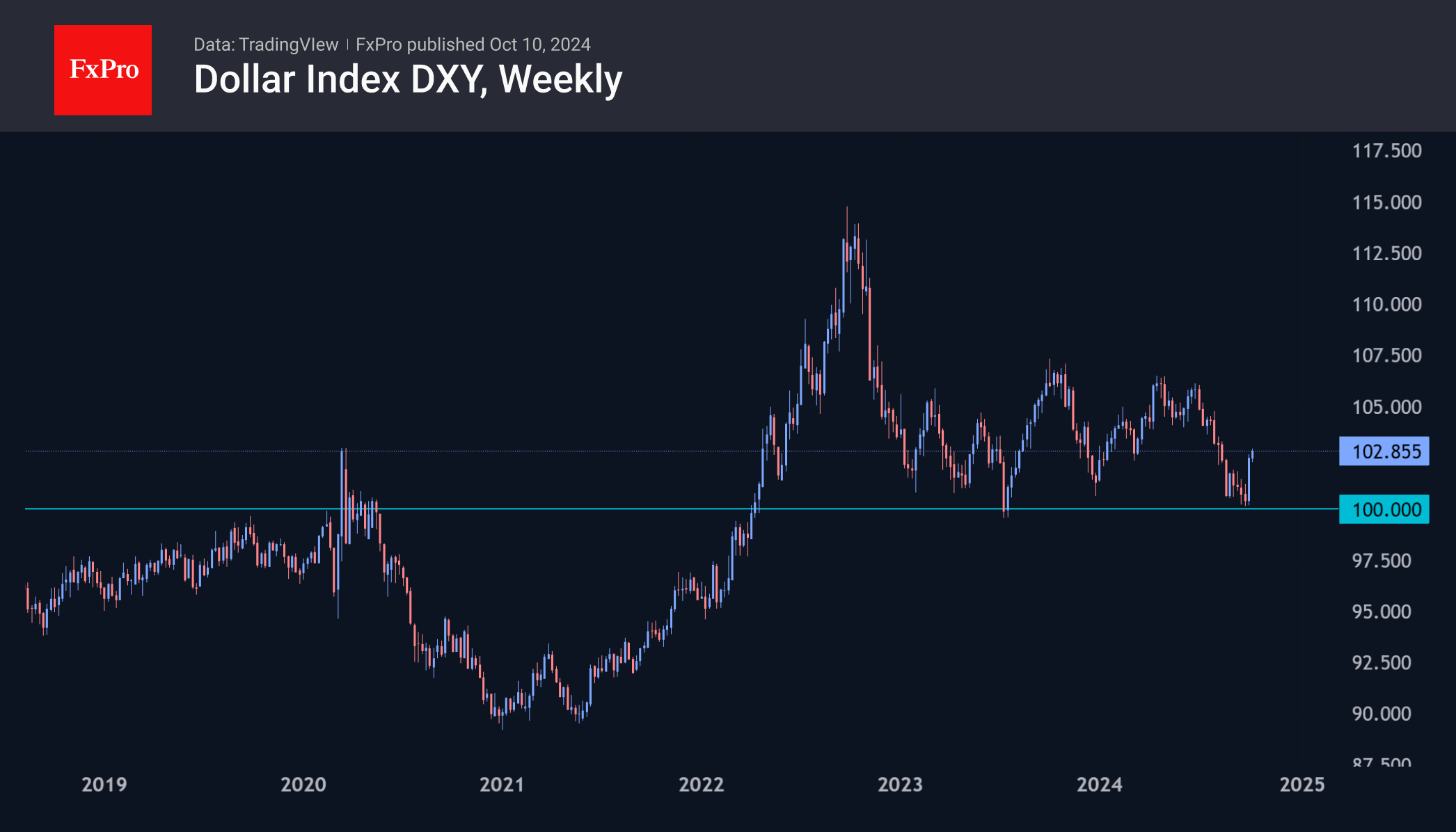

The US dollar is on the rise, gaining almost daily against major currencies, driven by a shift in expectations for the Federal Reserve's key rate. Strong data, including a notable jobs report, has bolstered optimism about the US economy.

October 10, 2024

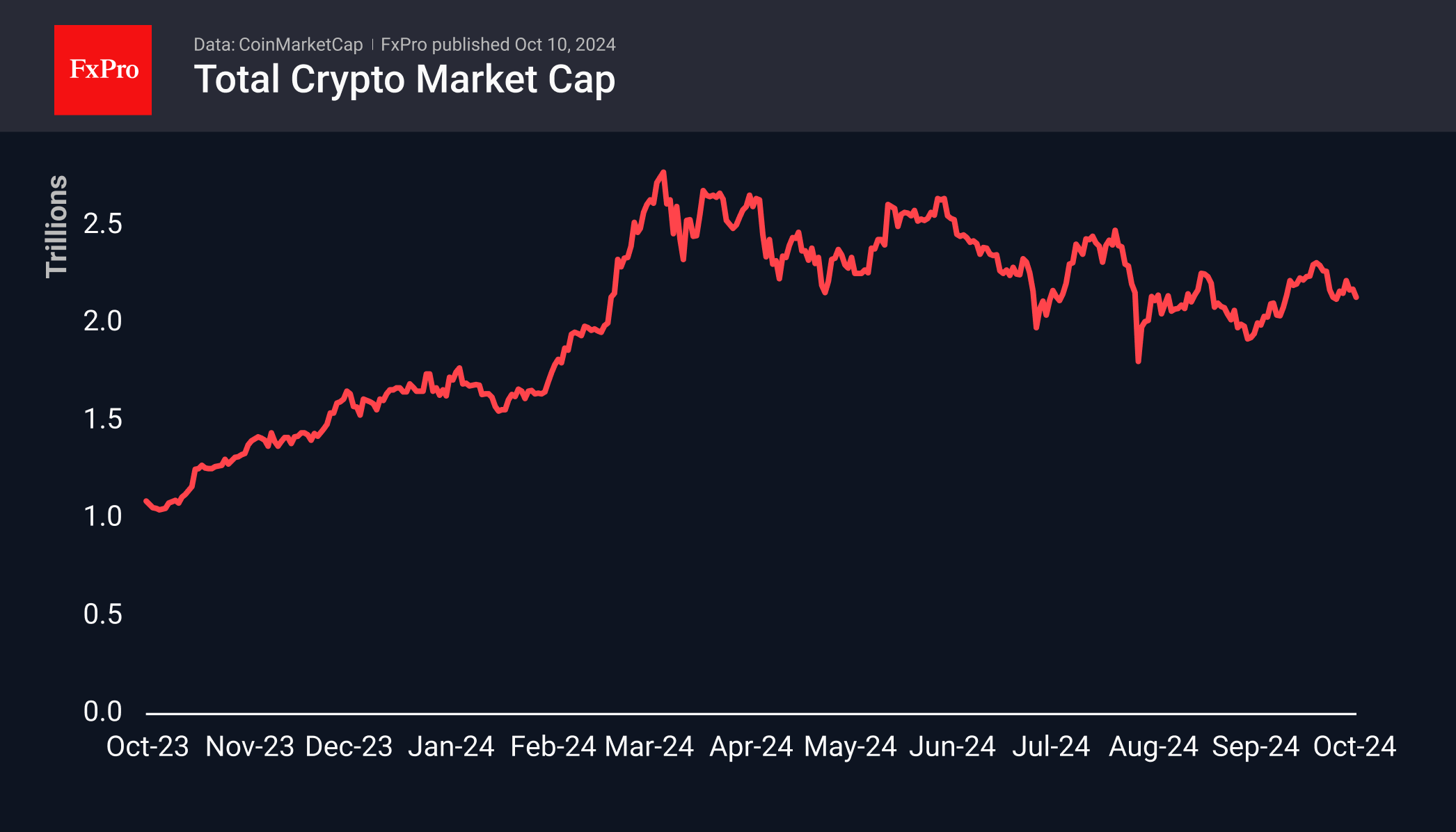

The cryptocurrency market lost 2.2% in 24 hours to $2.13 trillion, continuing to slide despite the S&P500 index making a solid update to all-time highs. Bitcoin lost over 3%, testing support of 50-day MA.

October 9, 2024

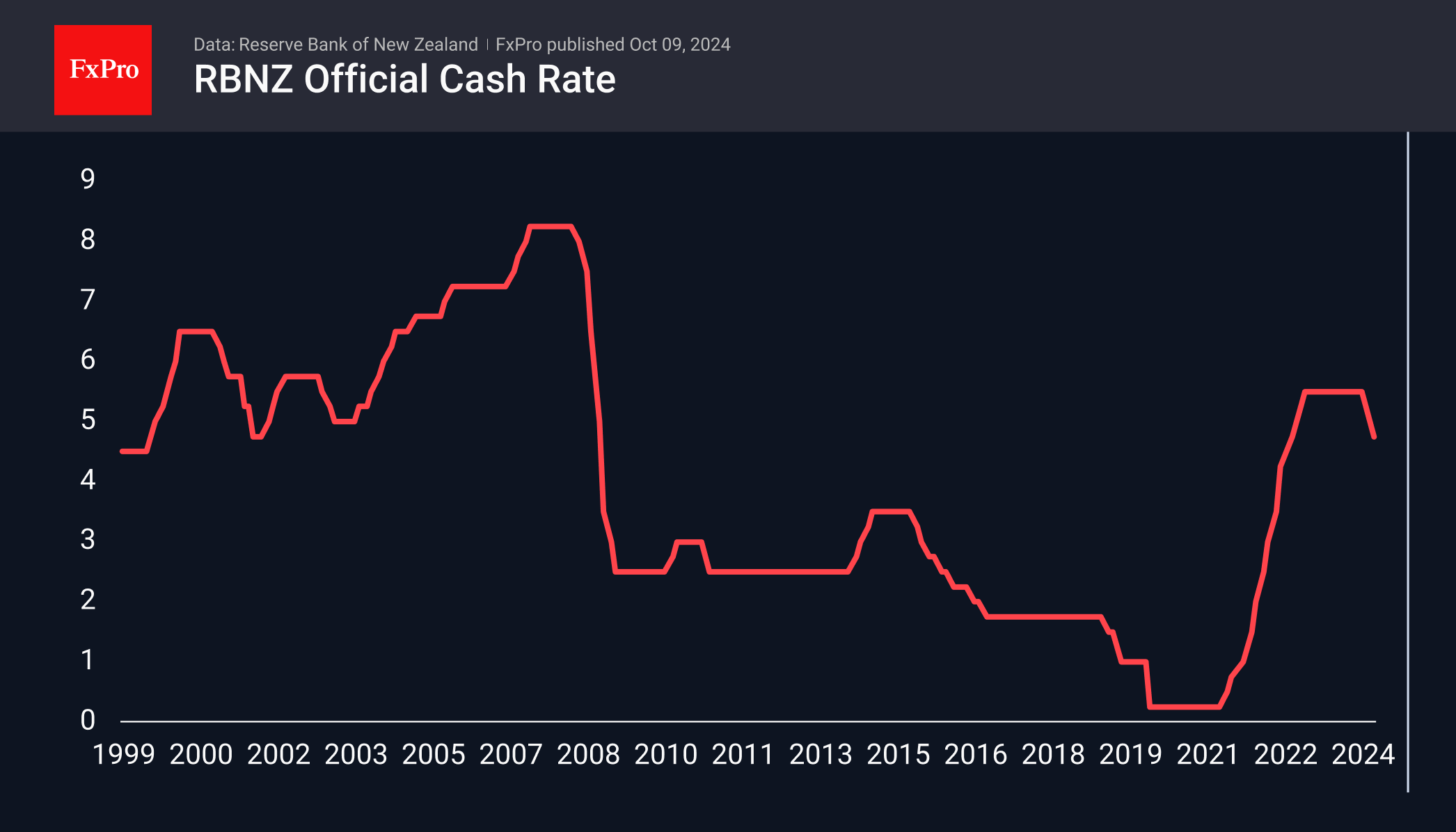

The Reserve Bank of New Zealand cut its key interest rate by 50 basis points to 4.75%, following a 25 basis point cut in August. Explaining its decision, the RBNZ noted that inflation was approaching 2%, the midpoint of the.

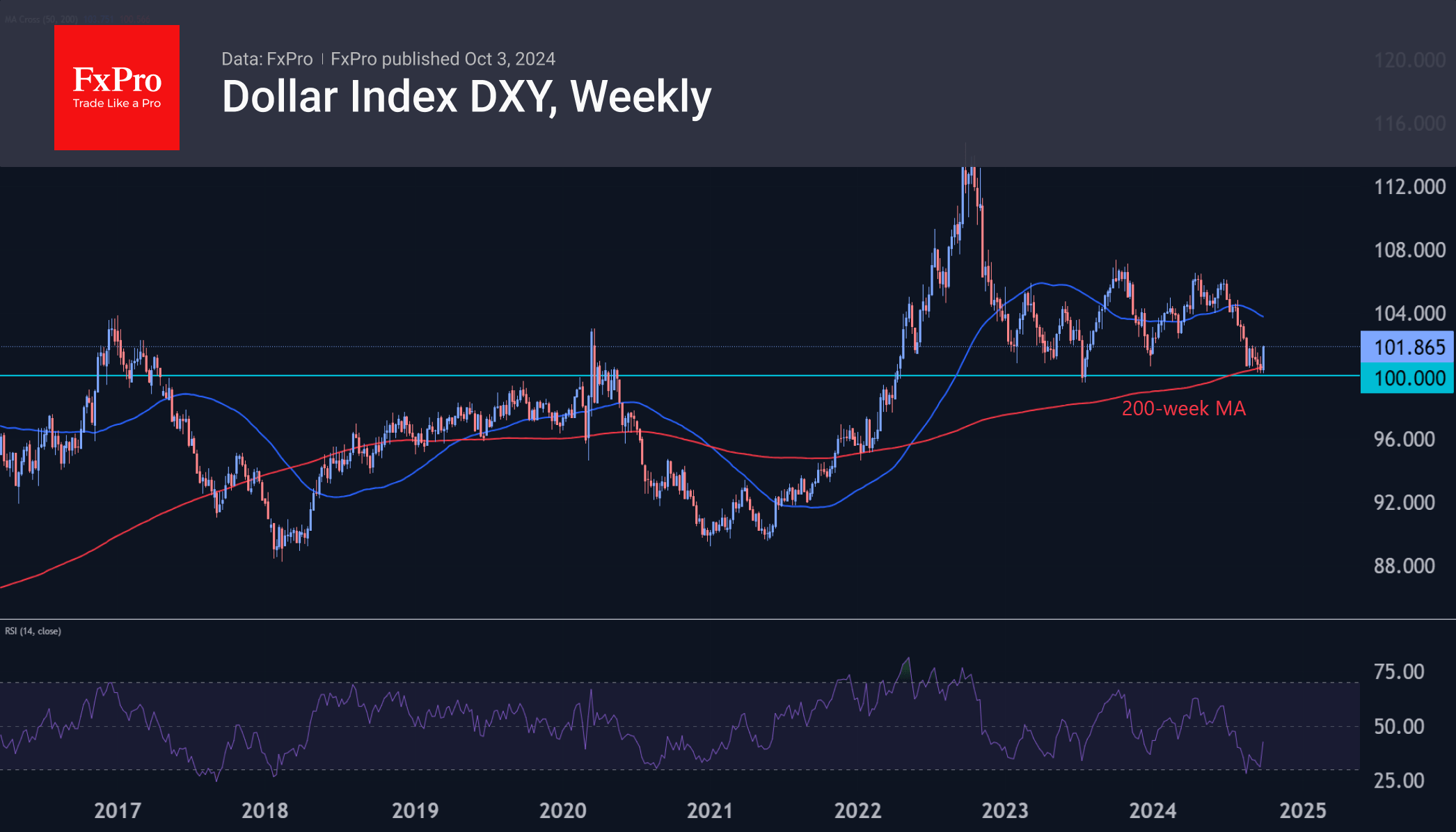

October 8, 2024

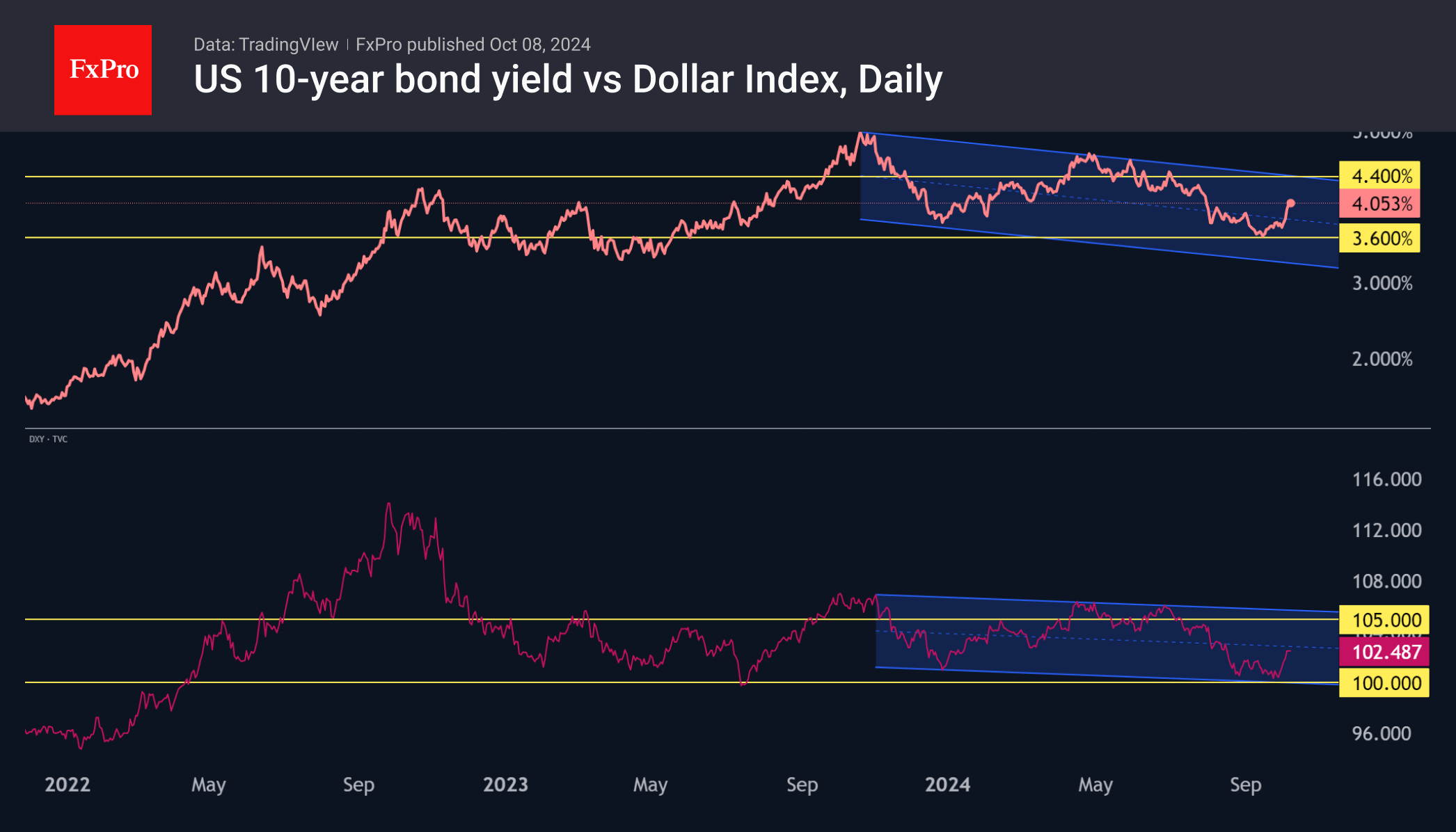

The Dollar Index has been rising since the end of September, tracking US long-term bond yields after the Fed's easing. Although monetary easing is normally a bearish factor, the current dynamic is supportive of the dollar. Rising yields have revived dollar buying, leading to a 2.

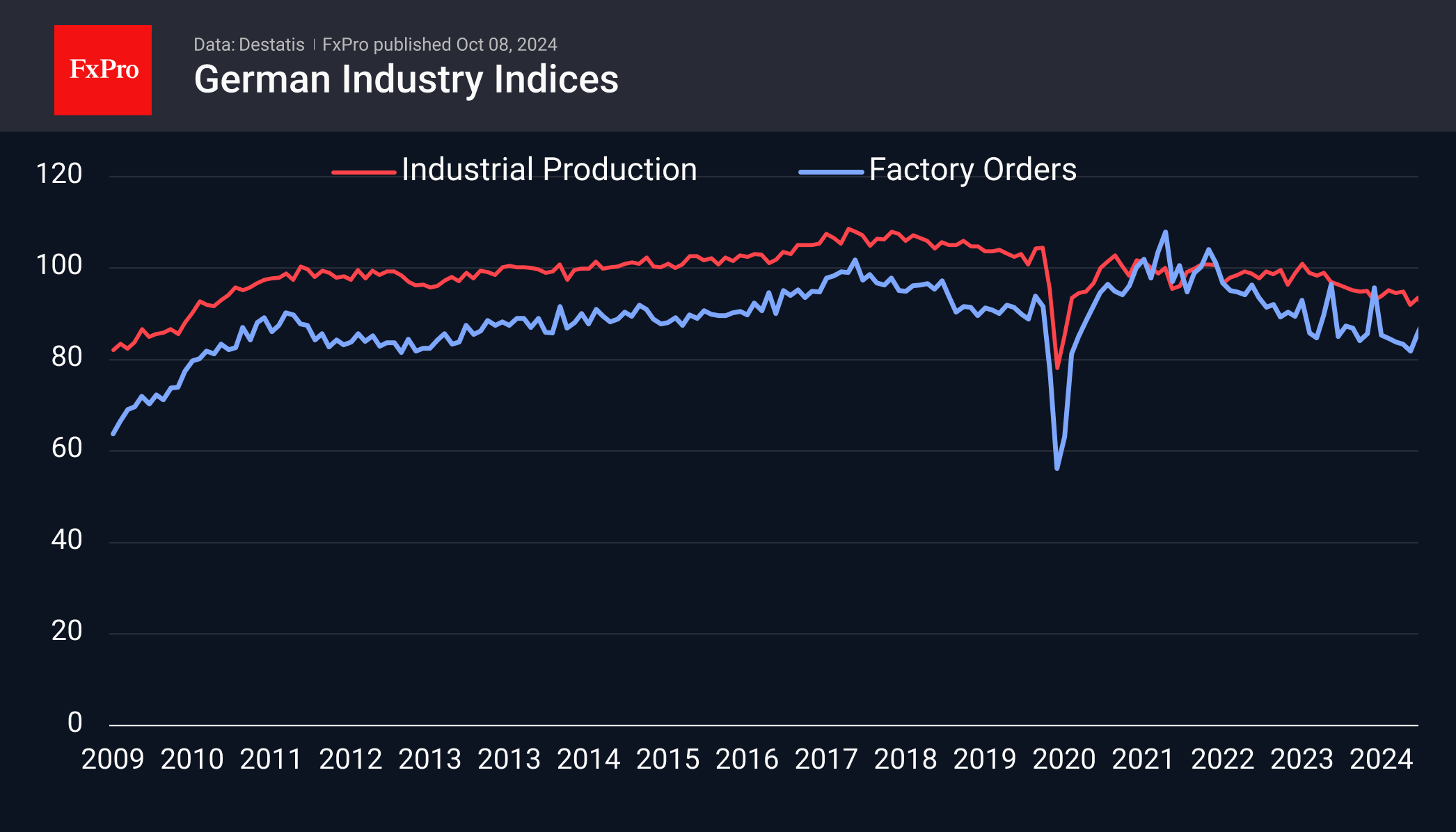

October 8, 2024

Germany's industrial production index jumped 2.9% in August, almost recovering from a similar drop in the previous month. This data, above the expected 0.8% rise, nominally supports the euro-dollar exchange rate on Tuesday, as does the positive surprise in the Sentix index on Monday.

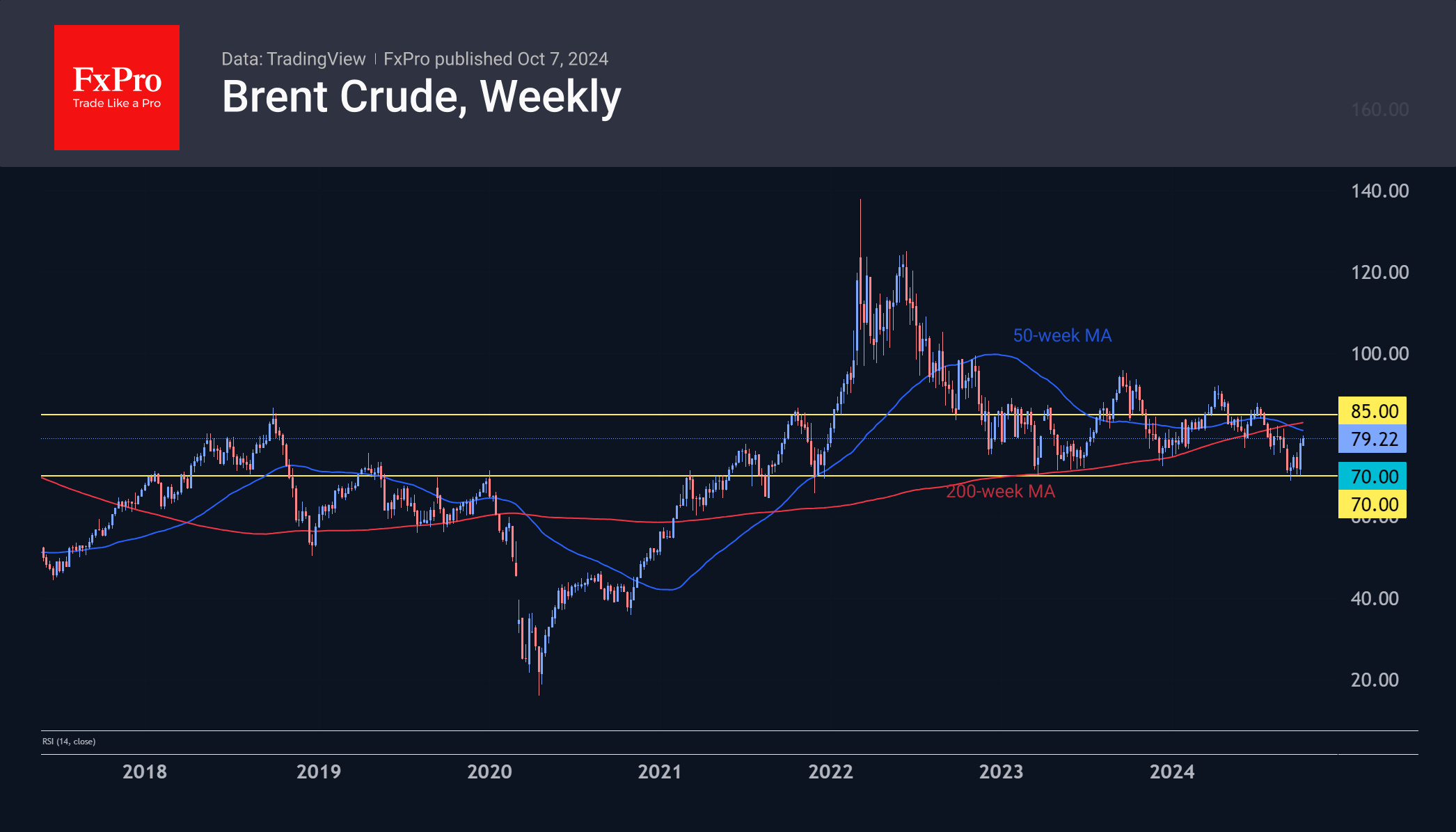

October 7, 2024

Market picture: Oil is on the rise, having turned upwards after a brief dip below $70/bbl Brent. The bullish influence of technical factors, such as a significant round level and accumulated oversold conditions, can only be discussed when we are.

October 3, 2024

The Dollar Index is rising for the fourth consecutive day, gaining over 1.7%, and is about to test its 50-day moving average. The divergence between the price and the RSI indicates that the downward momentum has been exhausted and that there is upside potential towards 104-107.