The US jobs report deepens dollar retreat

November 06, 2023 @ 12:43 +03:00

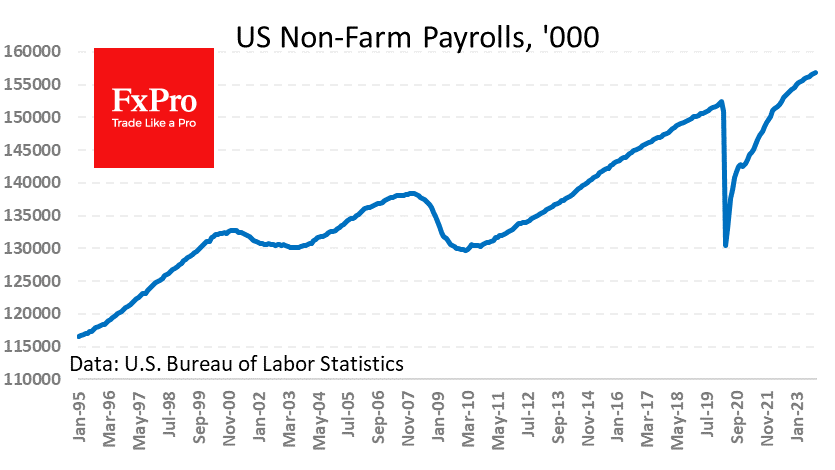

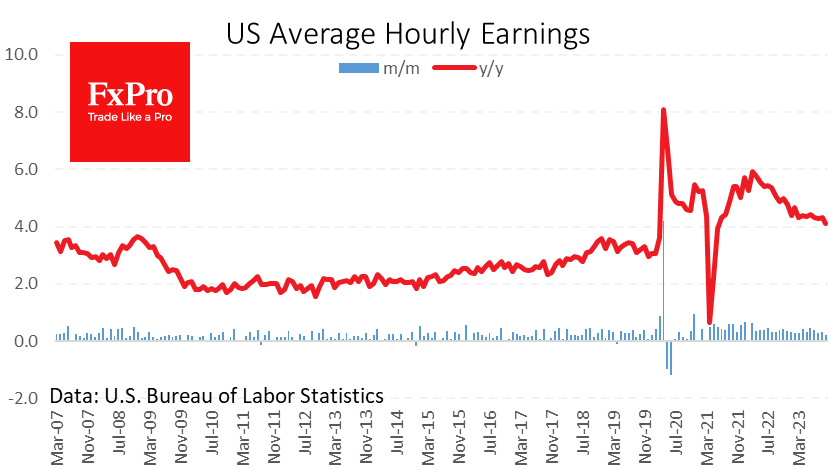

Finally, US data came out so weak that the market could celebrate. The US labour market added 150k jobs in October after 297k (revised from 336k) and expected 180k. The unemployment rate unexpectedly rose from 3.8% to 3.9% despite the share of the economically active population falling from 62.8% to 62.7%. Wage growth slowed from 4.3% to 4.1%, the lowest over two years.

It was the perfect report to confirm that America is slowing down enough to justify a halt in interest rate hikes while not feeling bad enough to say a recession is coming.

This report is the perfect combination for risk demand in the short term. The labour market continues to create jobs at the pace of a healthy economy. At the same time, wage growth is slowing, not accelerating. The rising unemployment rate reflects increased interest in finding a new job.

This combination has reinforced expectations that inflation is on the path to normalisation and that the central bank will not need to tighten policy again. It is only necessary to wait for the effect of the already implemented increases and not to press the pedal of monetary tightening extremely hard.

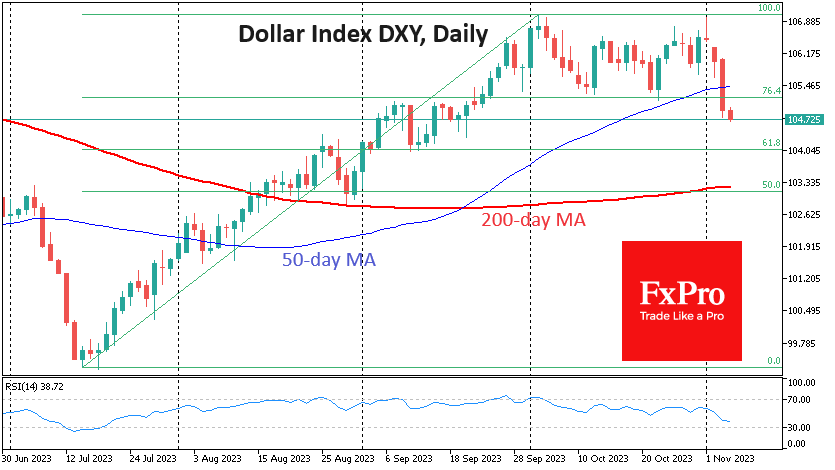

Reduced chances of further rate hikes in December played against the dollar. On Friday, the dollar index fell to its lowest level in six weeks. Friday’s sharp decline sets us up to see a switch to a more classic correction pattern with a pullback to the 61.8% or 104 level from the initial rally from 99 to 107 after a month of staying within the 76.4% correction with support above 105.2.

The FxPro Analyst Team