Market Overview - Page 30

January 31, 2025

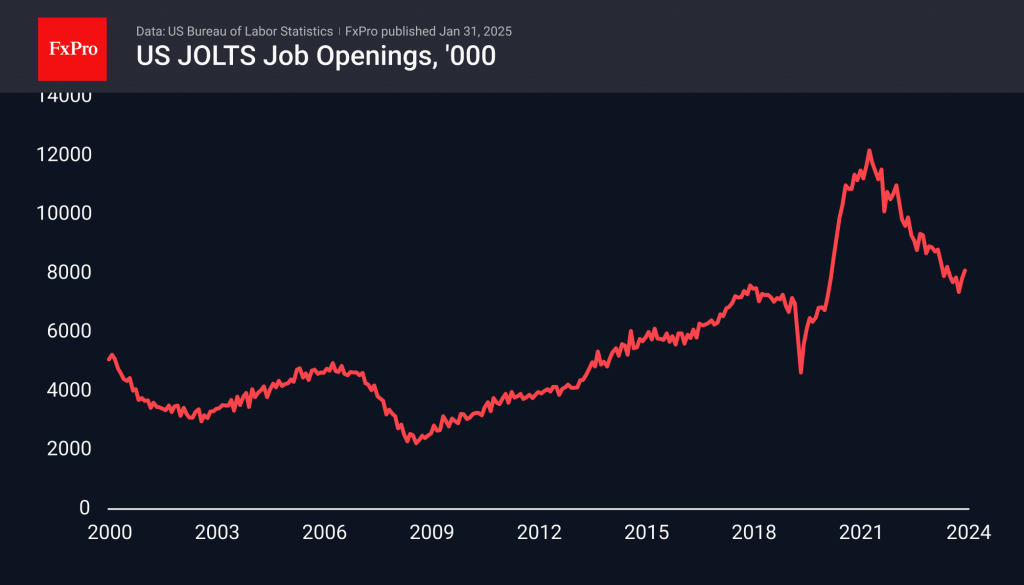

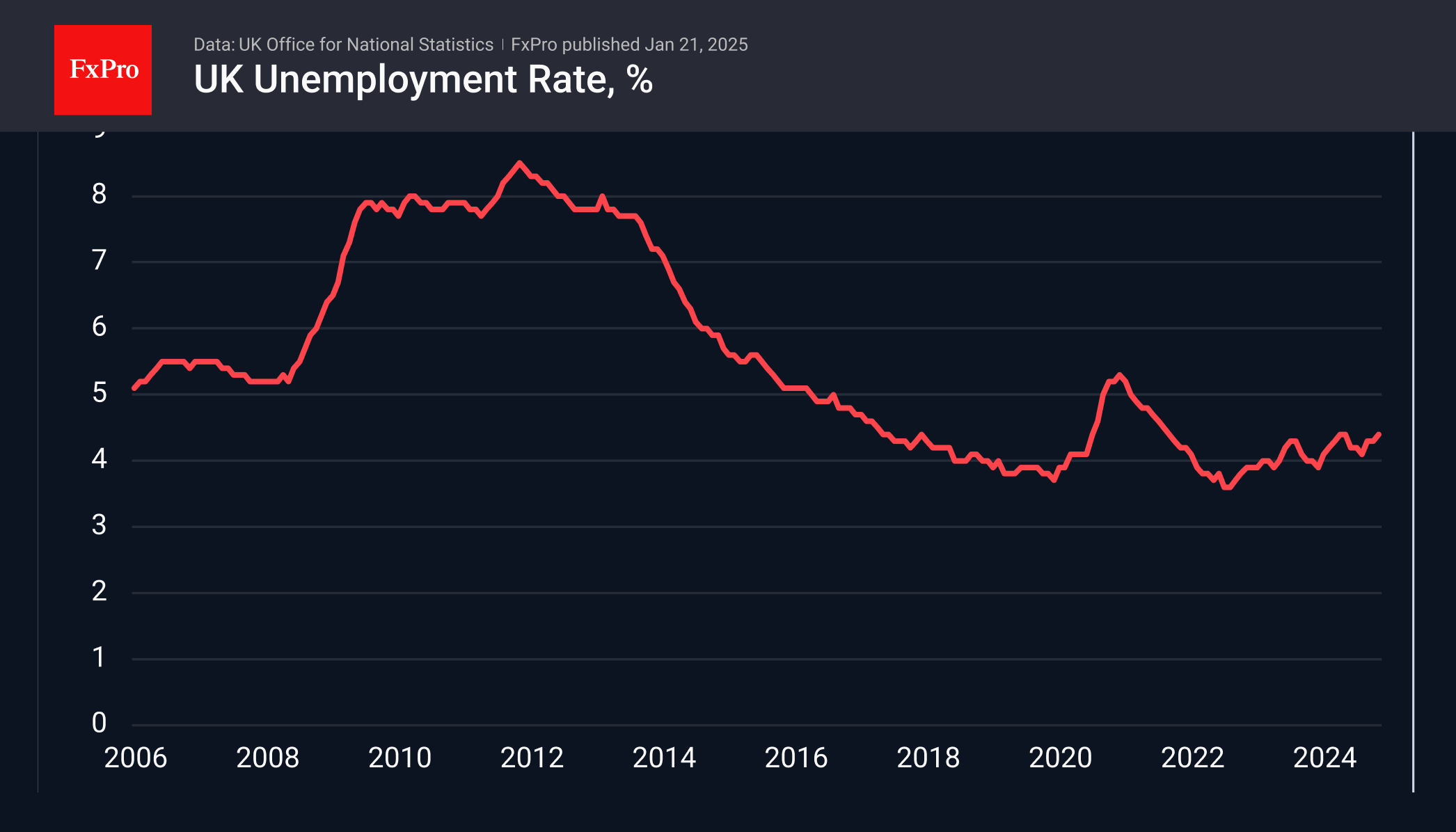

The new week will focus on the US labour market and the UK rate decision. On Tuesday, 4 February, the focus is on the new US job opening statistics. The indicator’s fall over the past two years was viewed with.

January 31, 2025

Gold has hit record highs, moving into territory above 2800. Strong buying following the November-December correction suggests the end of the correction phase and the beginning of a new growth cycle. A breakout to new highs activates a Fibonacci expansion.

January 31, 2025

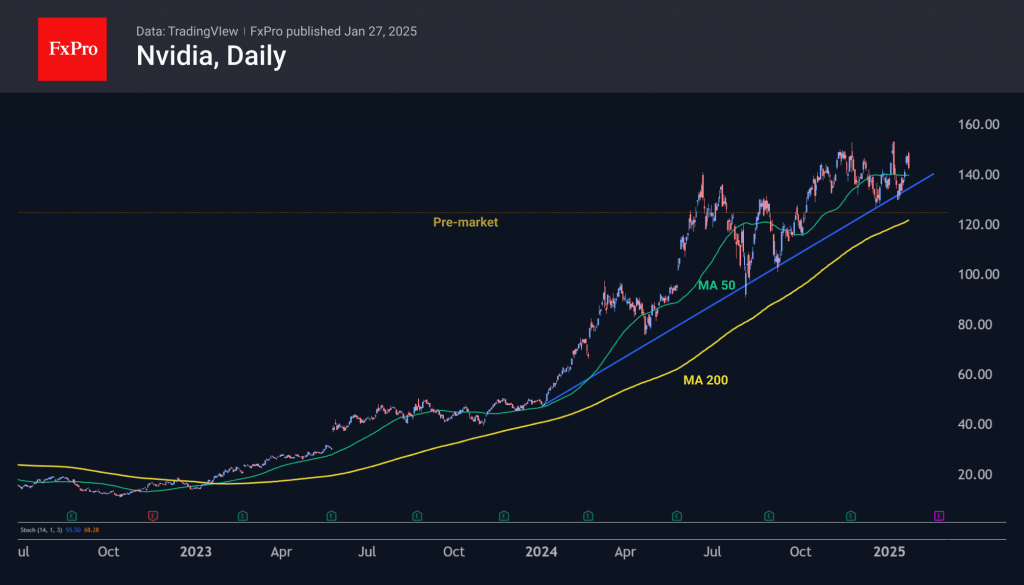

US indices opened the week with a sharp collapse. The news media unanimously attributed this decline to the strong results of DeepSeek, a Chinese competitor of OpenAI’s ChatGPT. The news that a strong network can be trained on obsolete Nvidia.

January 30, 2025

The Federal Reserve left its key rate unchanged in the 4.25%-4.50% range at the end of its January meeting after three consecutive 100 basis point cuts. The markets expected this decision, so their attention was focused on signalling the prospects.

January 29, 2025

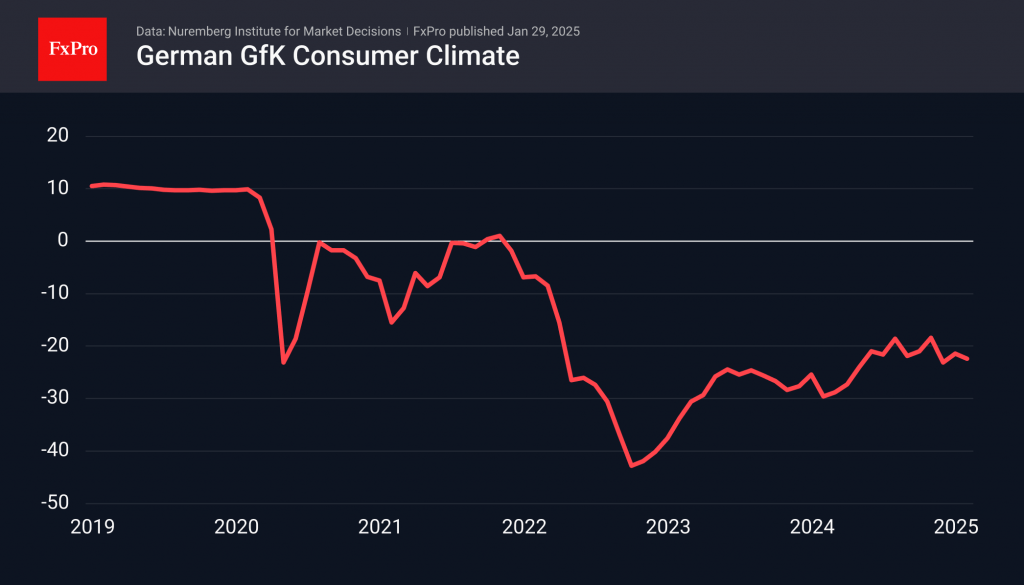

The German Consumer Climate Index declined, reflecting negative trends in income expectations and the desire to buy, which can be attributed to rising inflation.

January 28, 2025

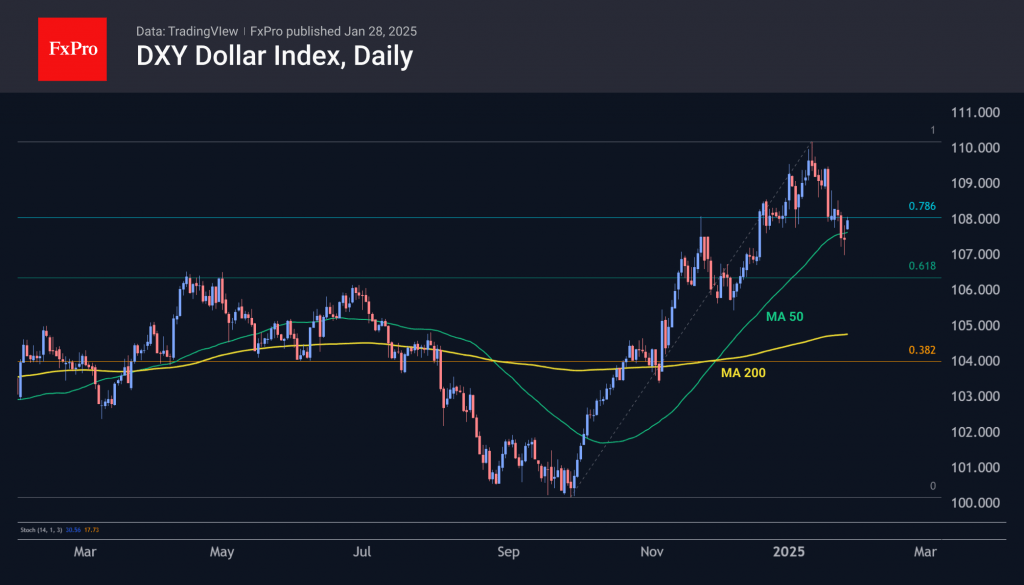

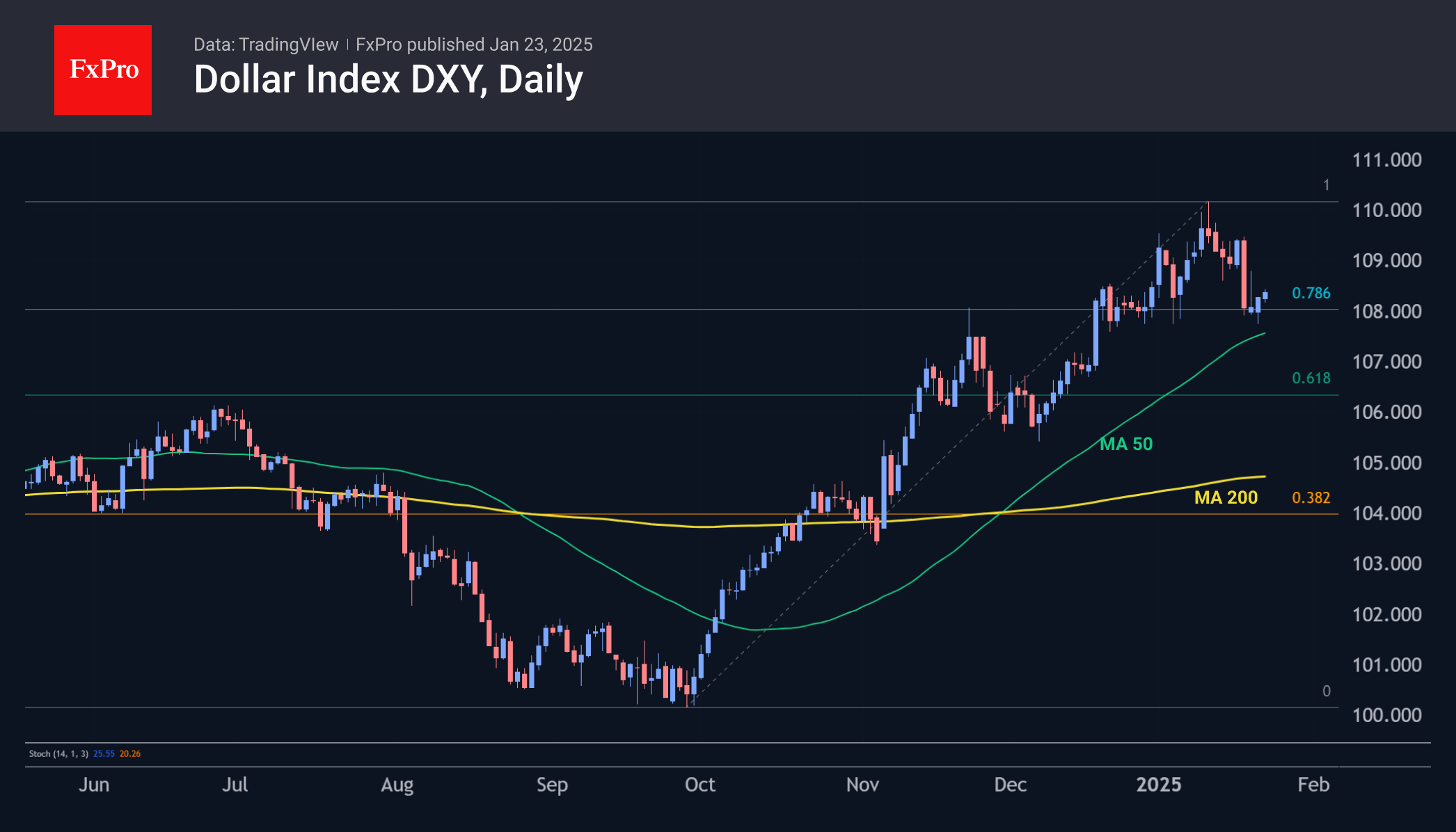

News of potential tariffs on imported goods has sparked speculative interest in the US dollar, leading to a rise in its value. However, there is uncertainty regarding the implementation of these tariffs and how they will affect the economy.

January 27, 2025

The decline in US and European indices was caused by investors exiting AI-related stocks after the release of China's high-quality DeepSeek-R1 AI model. Nvidia shares lost over 10%, putting pressure on the market and potentially leading to a 5-10% reduction in market capitalisation.

January 24, 2025

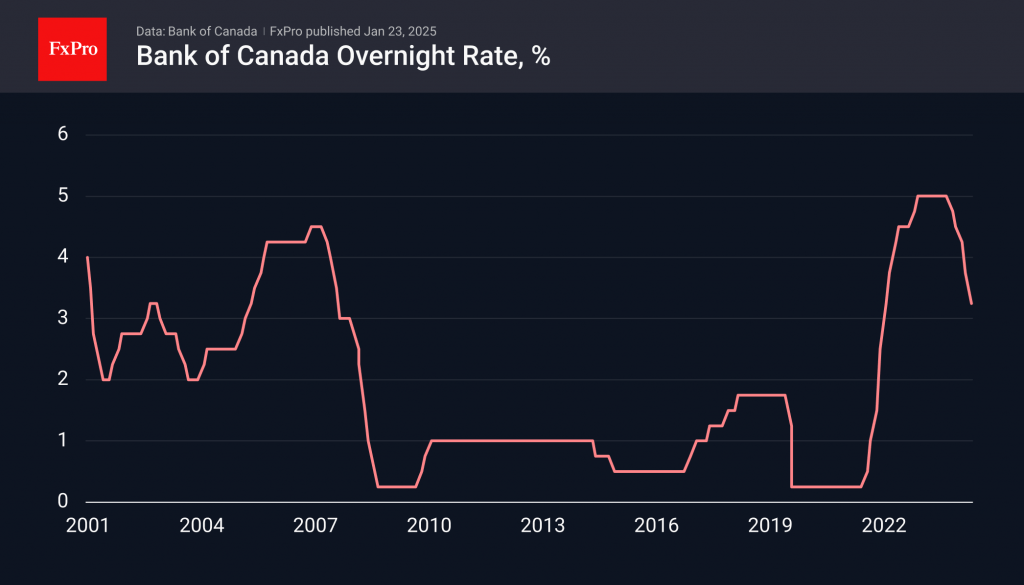

The new week will be packed with monetary policy news. Most observers expect the Bank of Canada to cut its key rate by 25 points to 3.0% on Wednesday, 29 January. The previous two cuts have been 50 pips each,.

January 24, 2025

The price of gold is rising for the fourth week, having added over 3% in the last five days. With the price of an ounce around $2780, the price has reached the area of historical highs at $2790. The dynamics.

January 24, 2025

The US dollar weakened against major currencies due to expectations of a rate cut by the Fed. US indices reached new highs, but concerns remain about the upcoming Fed meeting.

January 24, 2025

This week, we’re breaking down the big moves in the markets: the US dollar’s drop, gold pushing toward record highs, and Bitcoin smashing new milestones. Plus, with the Fed and ECB meetings on the horizon, there’s a lot to keep.