Market Overview - Page 27

March 14, 2025

Despite economic factors working against the dollar, its oversold condition helped it this week or may develop new momentum.

March 13, 2025

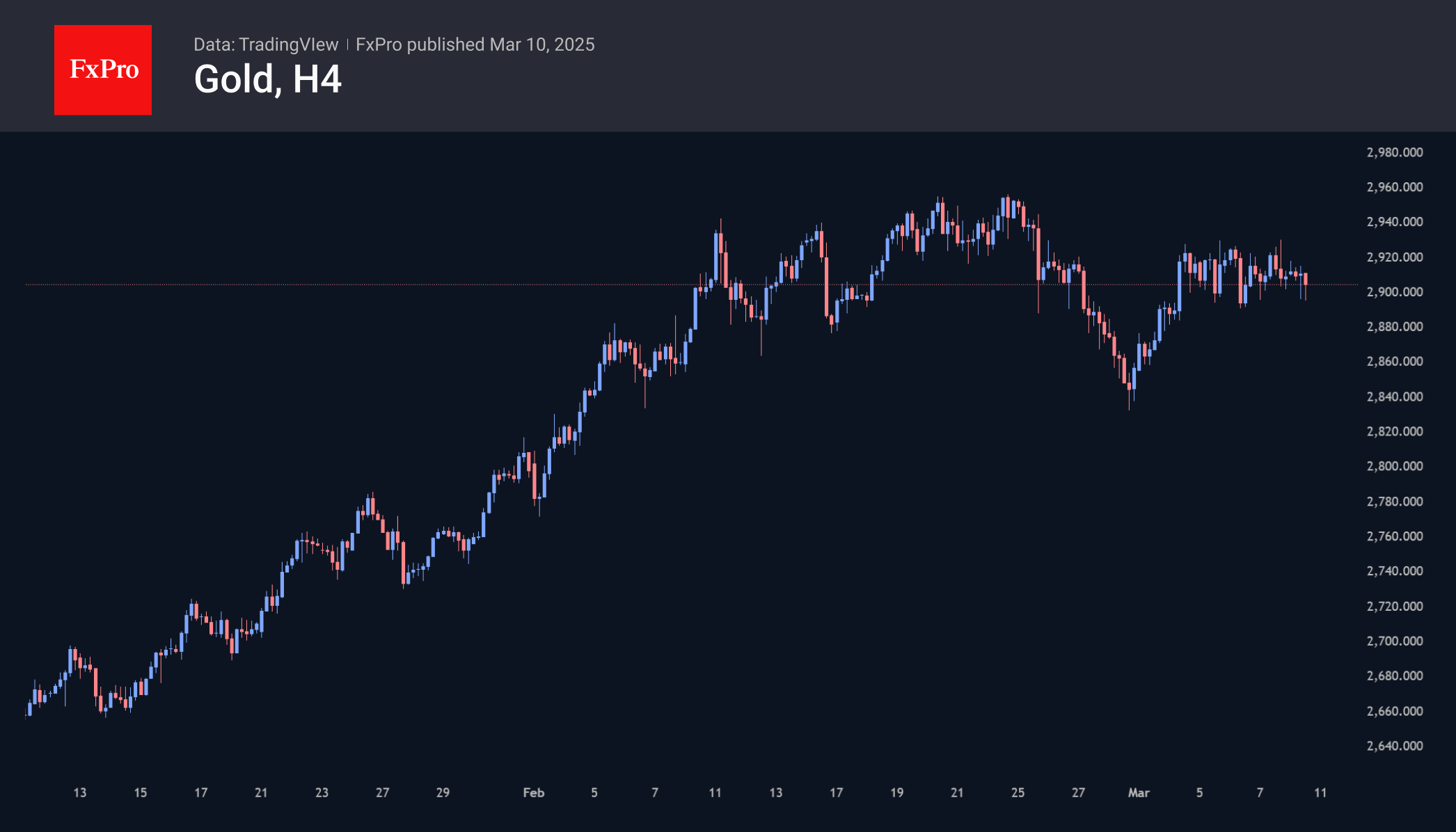

The gold price has resumed updating its all-time highs on the back of speculations around lower rates.

March 13, 2025

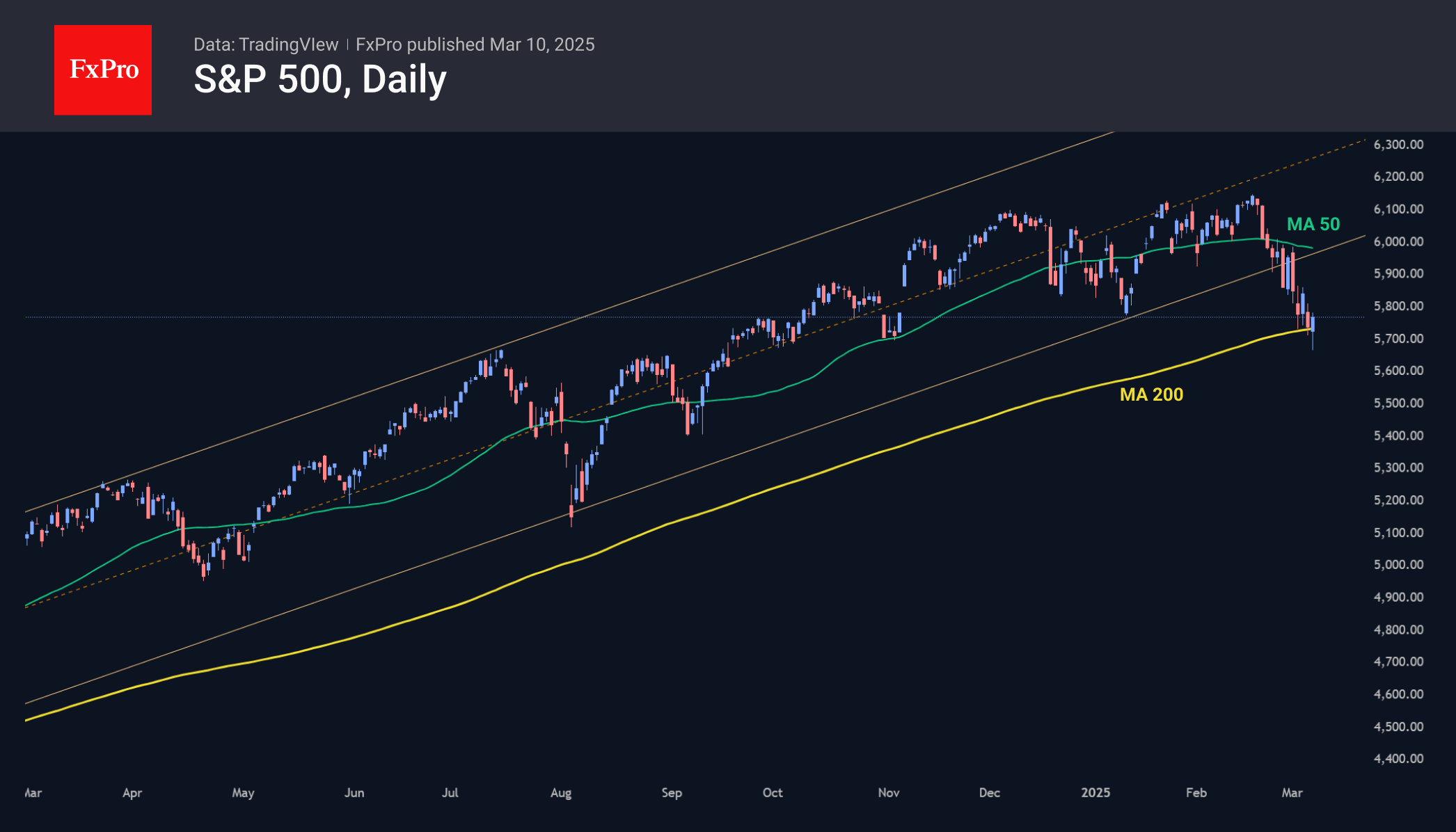

The US indices are under pressure and in a bearish market regime, with the S&P500 and Nasdaq100 closing below their 200-day MA. The sentiment index is at extreme fear levels, but it is uncertain when the bottom will be reached.

March 13, 2025

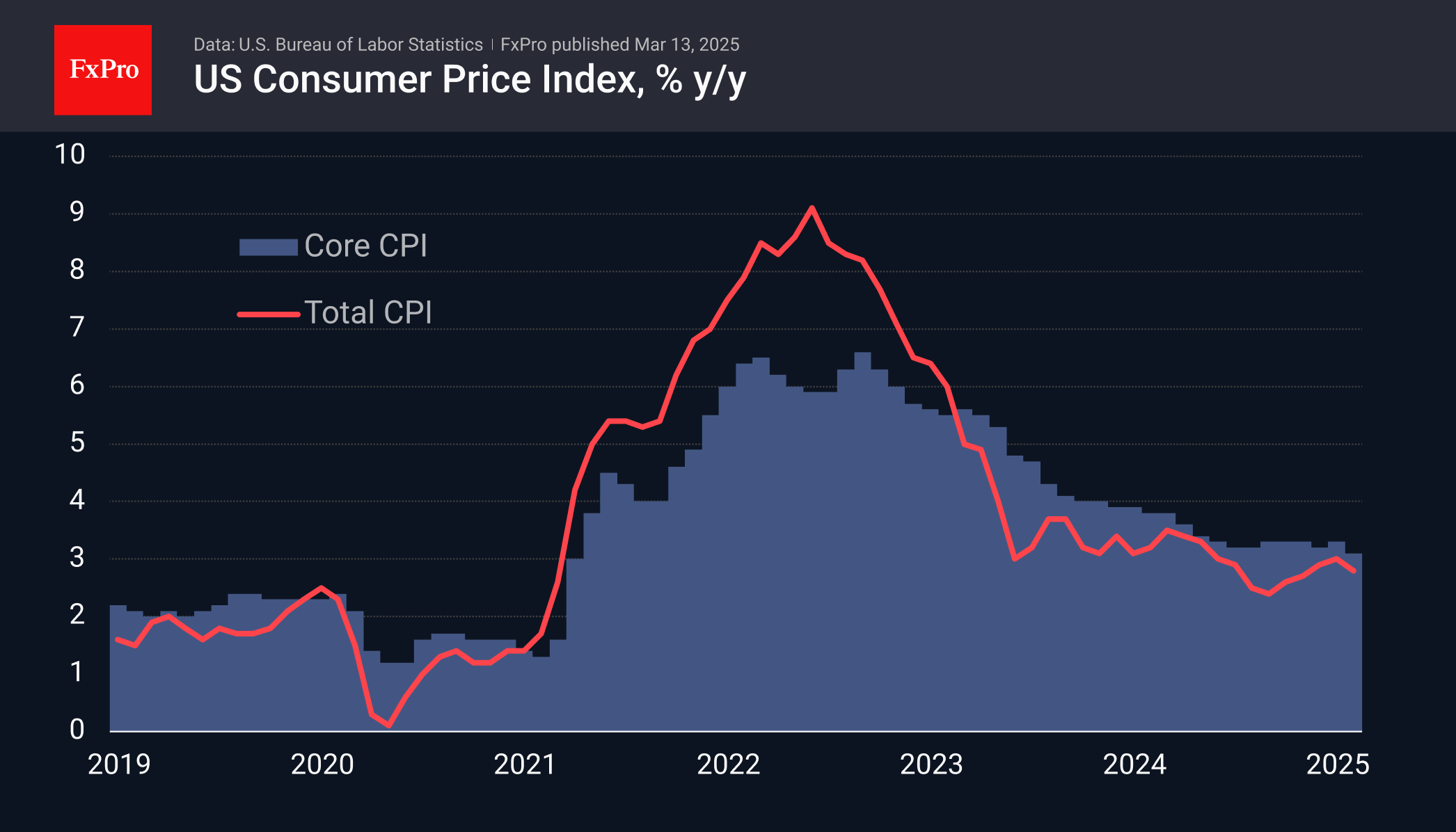

The US CPI slowdown provides a good reason to cut rates, reinforcing the doves' position at the central bank, and potentially bringing a key rate cut closer. The market's focus is on the upcoming Fed meeting on 19 March for signals of the next rate cut.

March 11, 2025

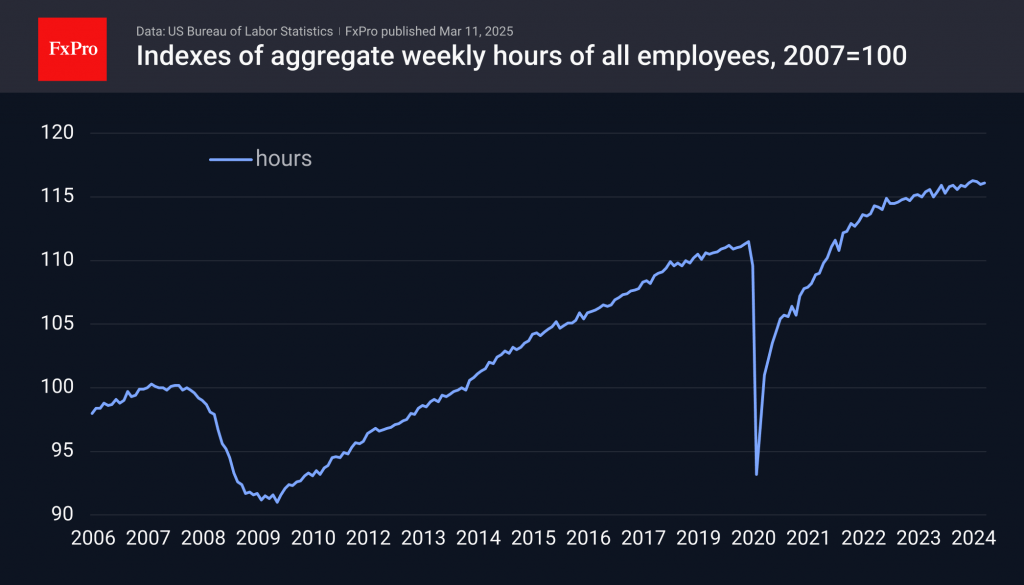

The US labour market is showing stagnation despite an increase in job numbers, as hours worked per week and small business optimism decline. Uncertainty is impacting equity markets and the weakening dollar.

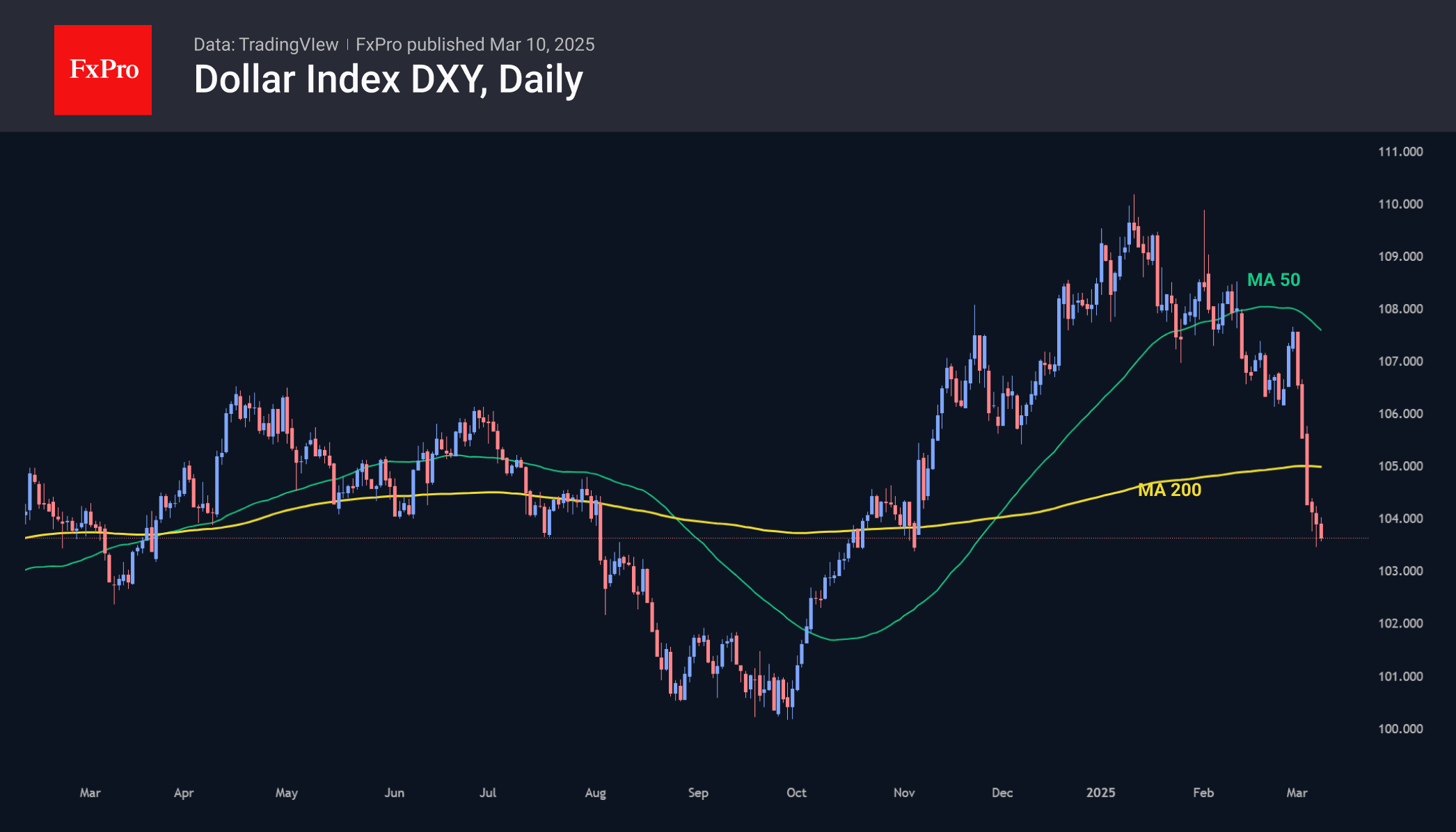

March 10, 2025

S&P500 and Nasdaq100, dipped but found support at their 200-day MA, indicating a possible shift in stock market trends.

March 10, 2025

The US dollar has been actively declining since early February and intensified the decline at the start of this month.

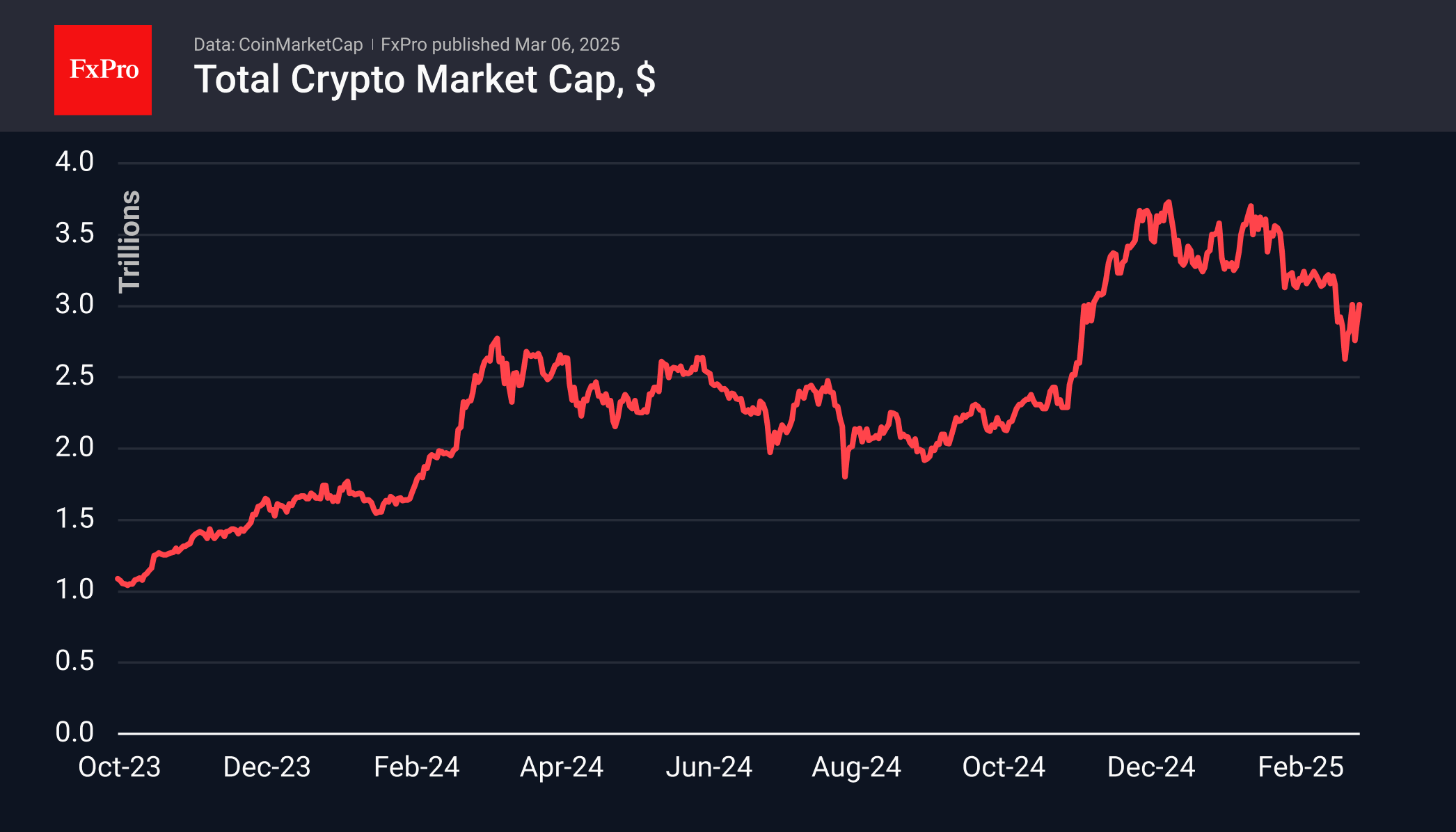

March 6, 2025

The crypto market experienced a recovery but remains cautious. A test of the support level at $3.14 trillion is upcoming, and the market sentiment is still in extreme fear territory. Bitcoin gaining but needs to break the 50-day MA for bullish confirmation.

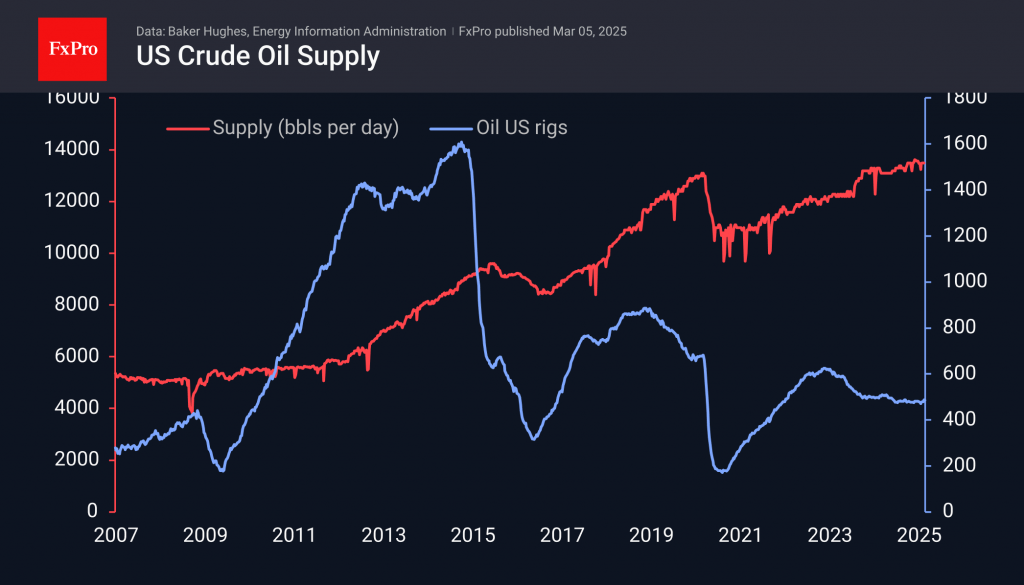

March 5, 2025

Crude oil prices are dropping, nearing the lows of the past four years, as concerns over a global economic slowdown and OPEC's plan to increase production.

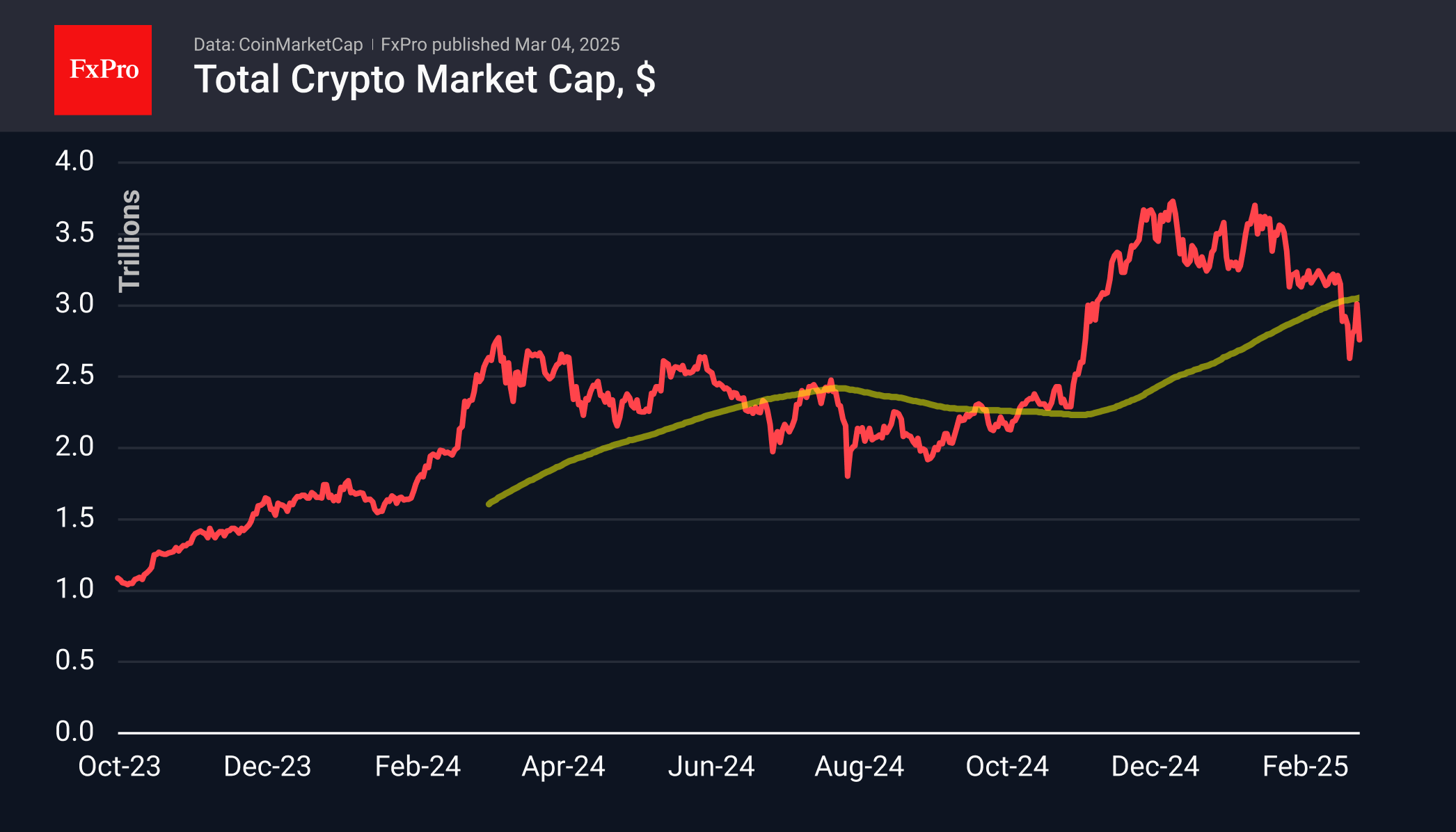

March 4, 2025

Market Picture Pressure in traditional markets has clipped the wings of the crypto market, which is almost back to the point from which Sunday’s rally started. At the start of the day on Tuesday, it was capitalised at $2.76 trillion,.