Market Overview - Page 19

June 23, 2025

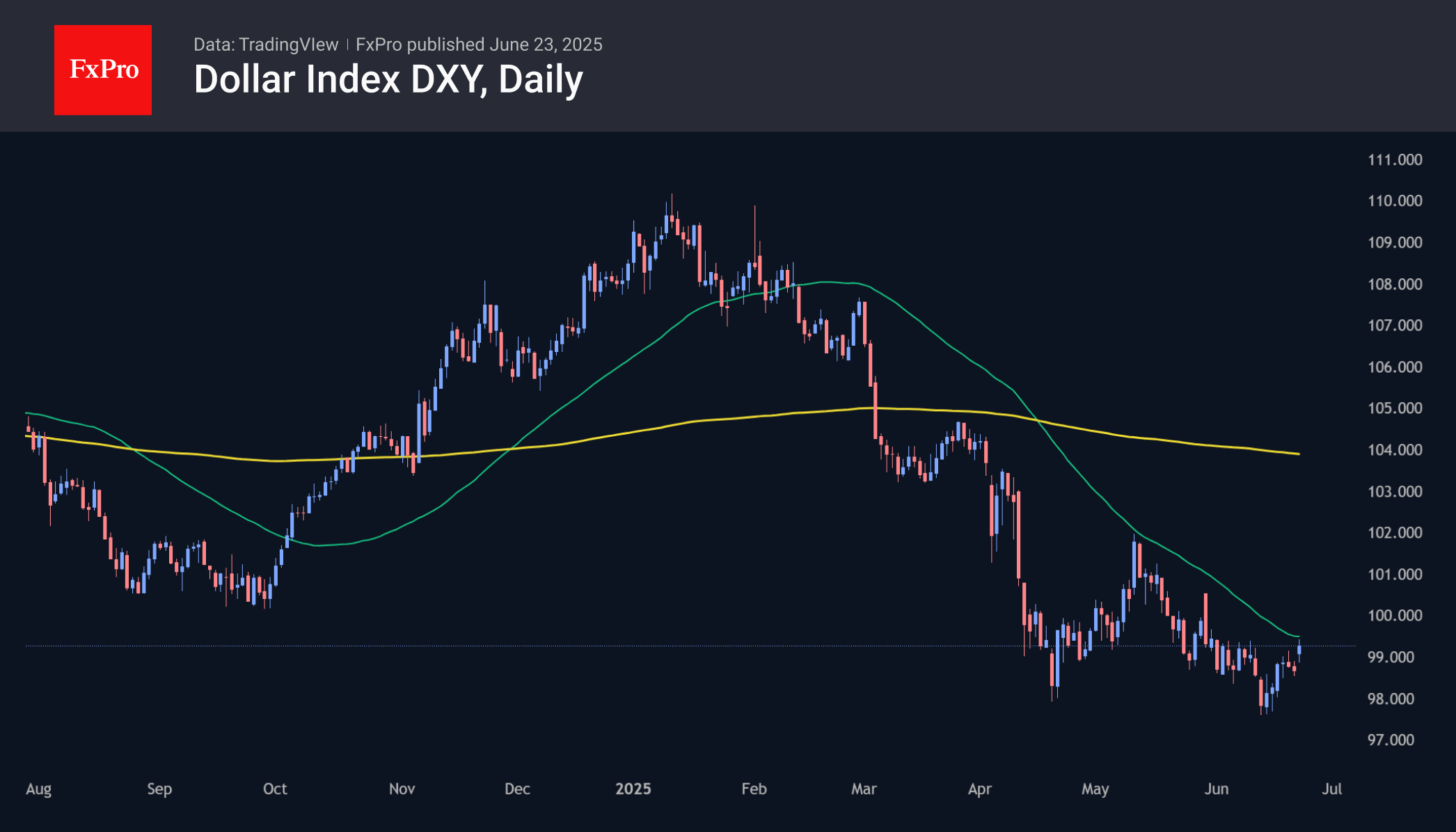

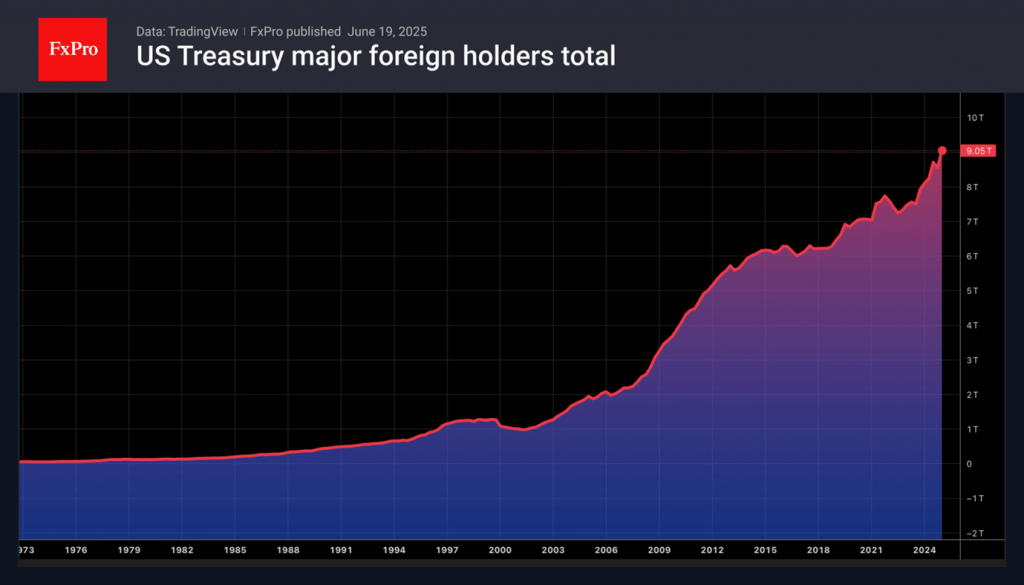

The US dollar has strengthened recently due to Israel's actions towards Iran, reversing the negative sentiment towards US assets. Market outlook and historical patterns suggest a potential shift in trend, affecting inflation and US debt markets.

June 20, 2025

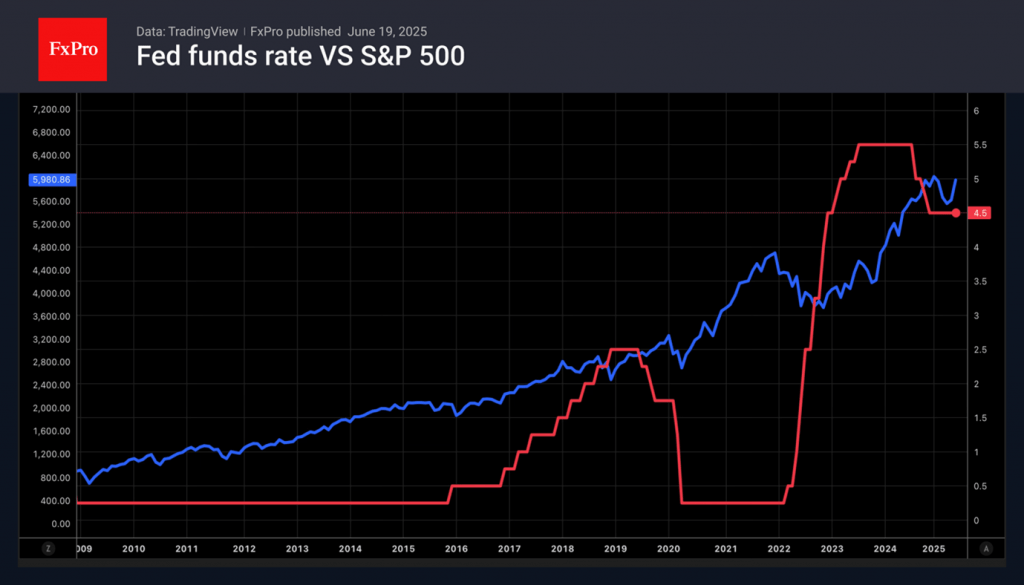

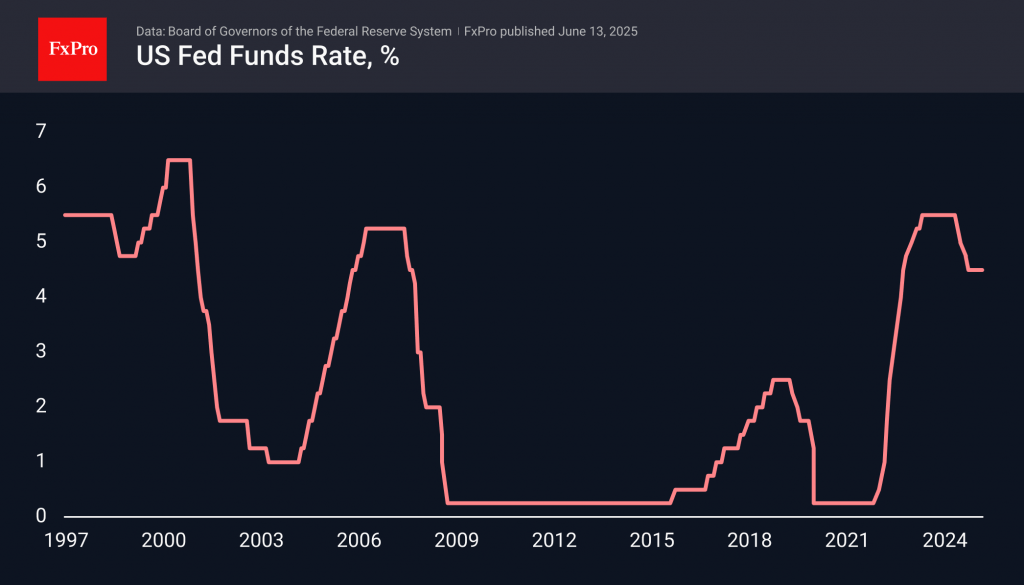

Jerome Powell's speeches to Congress are central this week for insights about the US economy and monetary policy amidst uncertainties like armed conflicts and tariffs.

June 20, 2025

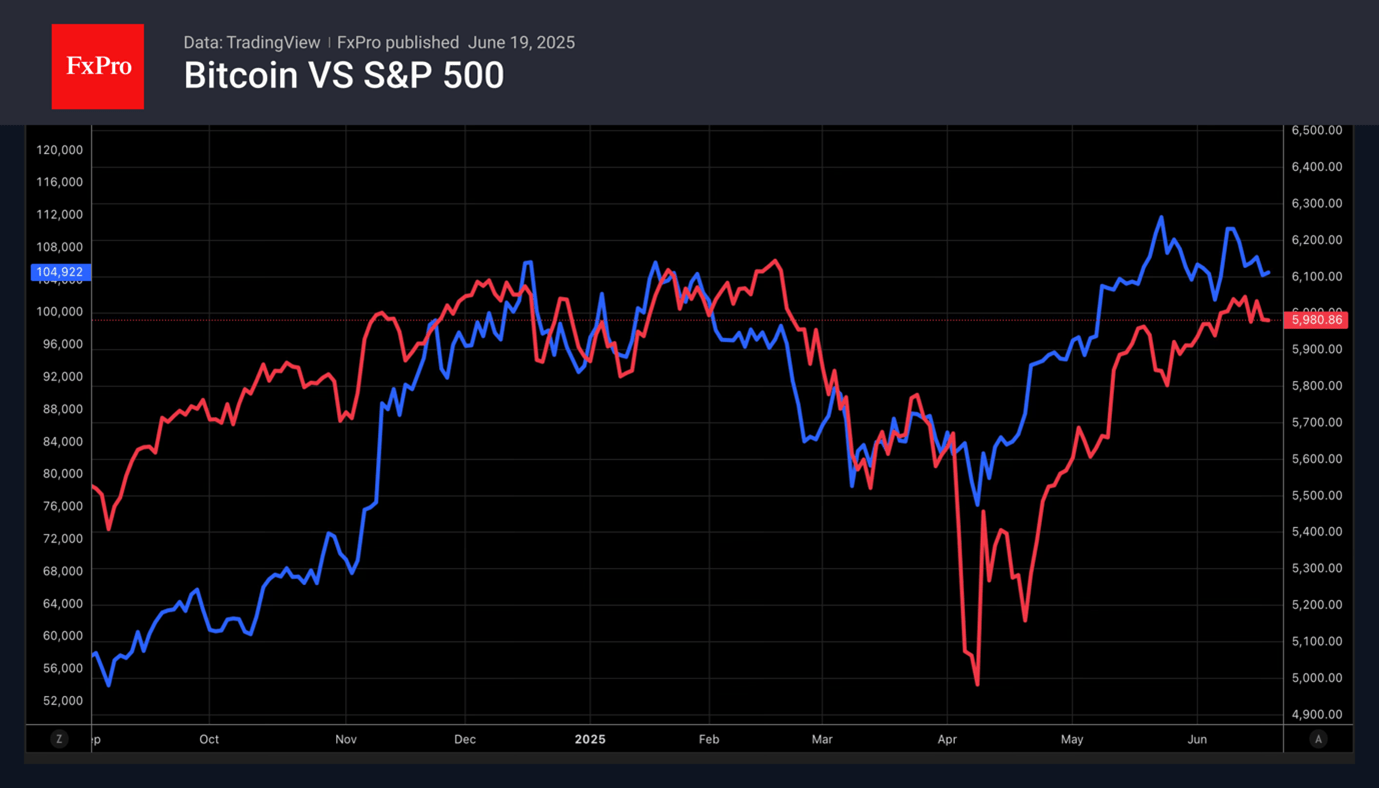

Traders are hedging against a potential BTCUSD correction amidst growing risks and uncertain Fed monetary policy. High demand for protection seen in Bitcoin options

June 20, 2025

The Fed predicts stagflation, affecting stock markets more than war fears. Trump wants lower interest rates to help stocks, but concerns about tariffs and conflicts persist.

June 20, 2025

The US dollar regains its safe haven status due to Middle East conflict, shifting focus from US economic issues.

June 17, 2025

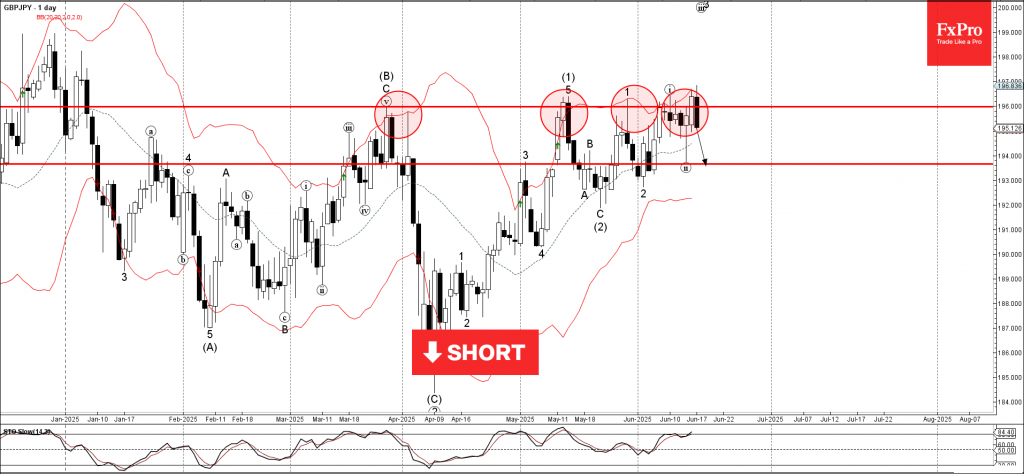

GBPJPY: ⬇️ Sell – GBPJPY reversed from the resistance area – Likely to fall to support level 193.65 GBPJPY currency pair recently reversed down from the resistance area between the pivotal resistance level 196.00 (which has been reversing the price.

June 17, 2025

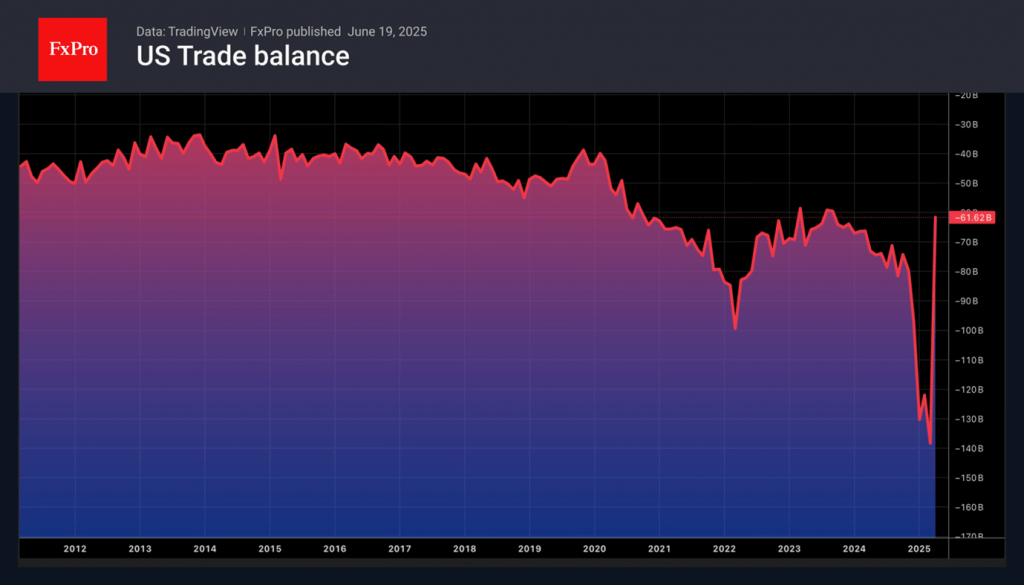

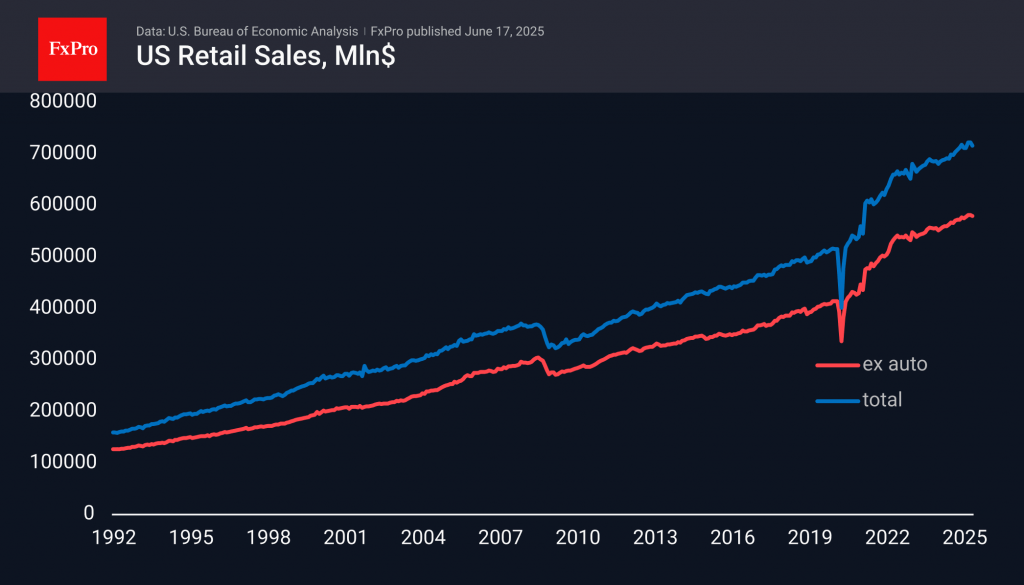

US retail sales fell 0.9% in May, returning to the level of three months ago. Economists on average had forecast a 0.7% contraction, following a 0.1% decline earlier and a 1.5% jump in March. Auto sales and lower fuel prices.

June 17, 2025

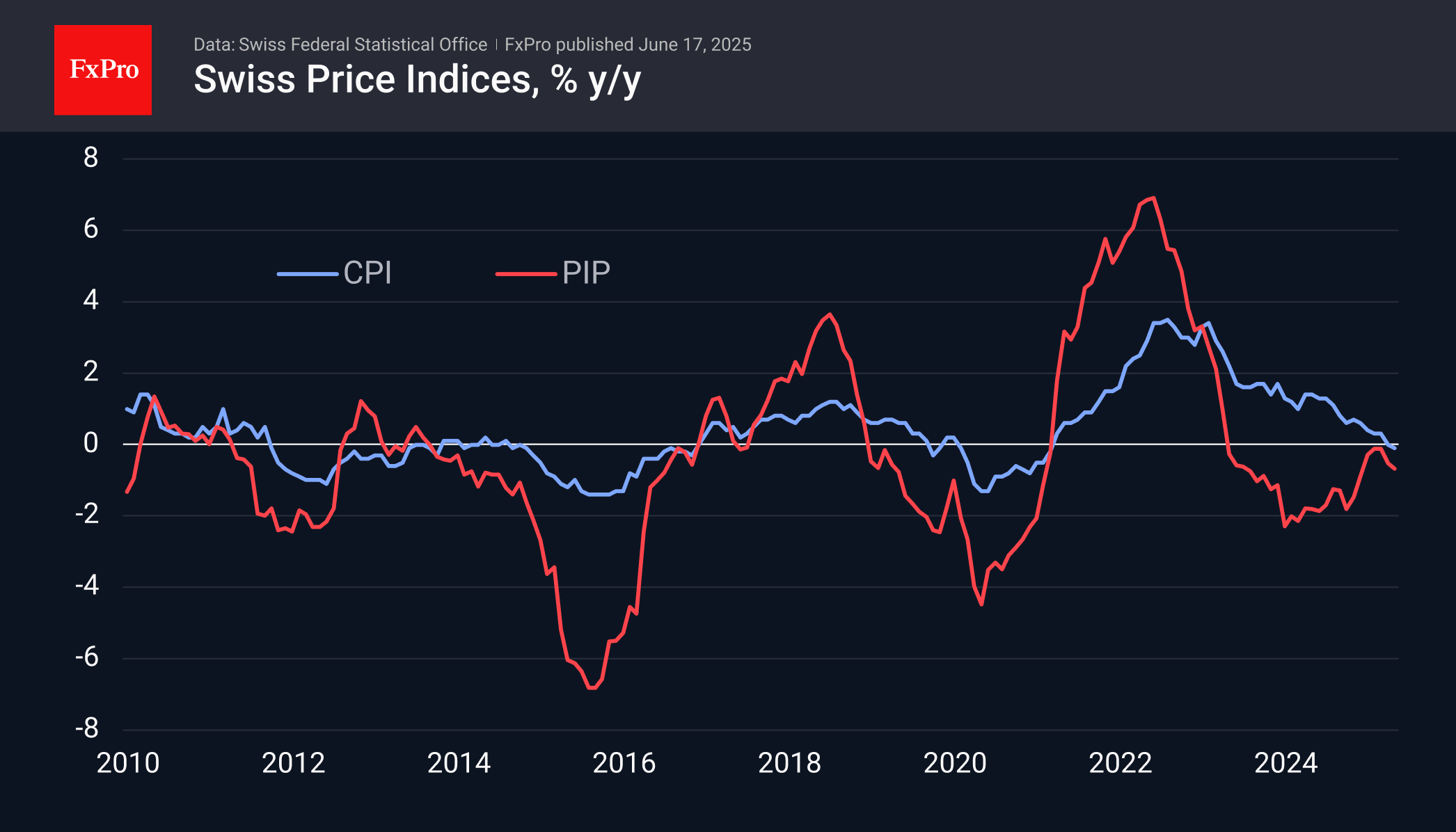

Switzerland may increase pressure on the franc to combat falling inflation, influenced by the currency's strength. The SNB is expected to lower its key rate, potentially leading to a weakening franc over the next quarters.

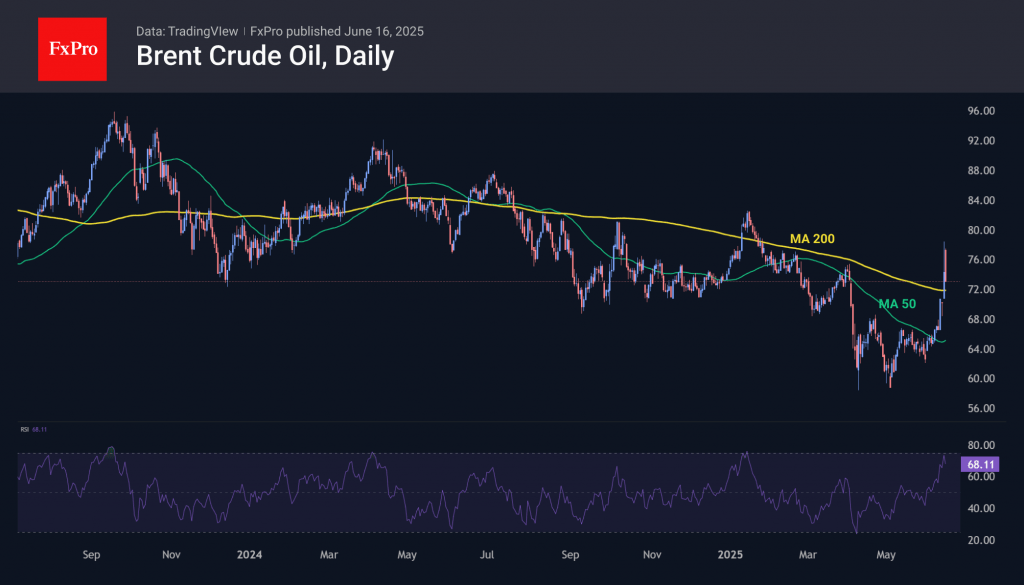

June 16, 2025

Despite bullish news, oil prices are falling, impacted by conflicts in oil-producing regions. Market concerns include threats to supply and geopolitical tensions.

June 13, 2025

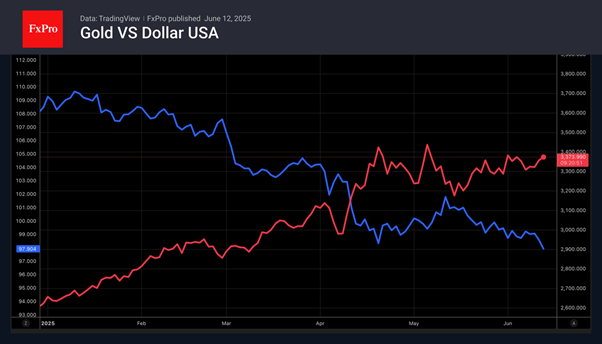

The insatiable appetite of central banks has resulted in an increase in the share of gold value in reserves to 20%. Precious metals have surpassed the euro’s 16% share. Only the US dollar is ahead with 46%. In 2022-2024, regulators.

June 13, 2025

In this episode, we break down the key events currently moving the markets. The US dollar has slipped to its lowest level since 2022, with talk of possible Fed rate cuts gaining momentum. US stocks are pulling back after a.