Market Overview - Page 122

December 17, 2021

• Coca-Cola under the bullish pressure • Likely to rise to resistance level 60.00 Coca-Cola under the bullish pressure after the price broke above the major resistance level 57.35 (previous multi-month high from July) The breakout of the resistance level.

December 15, 2021

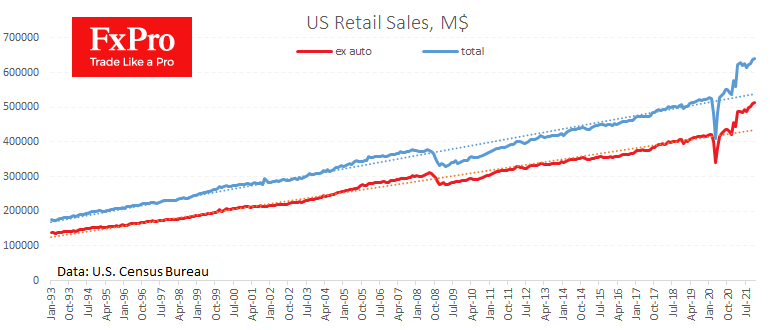

US retail sales showed unexpectedly weak growth, adding only 0.3% for November against expectations of 0.8% and 1.8% a month earlier. This release triggered a strengthening momentum in the dollar, with the DXY rising 0.2% immediately after the release. EURUSD.

December 15, 2021

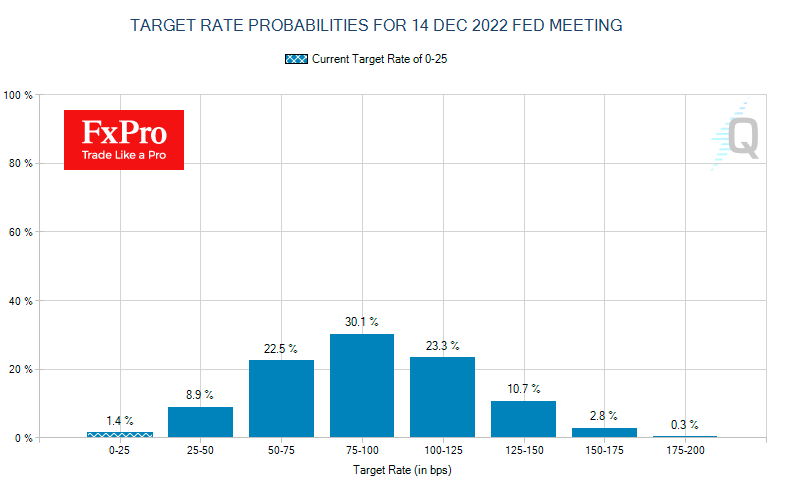

Tonight’s FOMC commentary and Powell’s press conference will kick off a series of outcomes and comments from the world’s biggest central banks. The SNB, Bank of England and ECB will present their decisions on Thursday and the Bank of Japan.

December 15, 2021

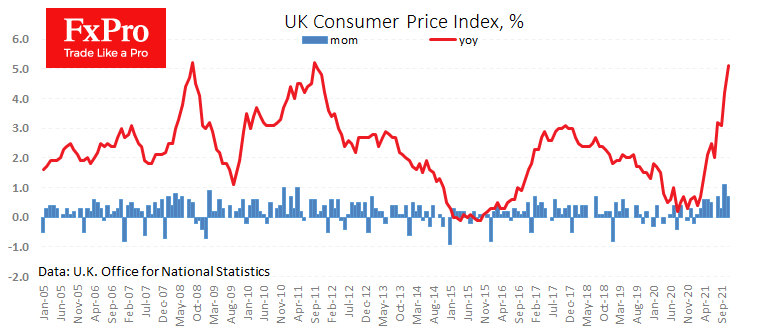

UK consumer inflation accelerated to 5.1% in November, coming close to turning peaks in 2008 and 2014 of 5.2%. Higher levels were last seen in Britain only in the early 1990s. The figures exceeded economists’ average estimates of 4.8%. Overall,.

December 15, 2021

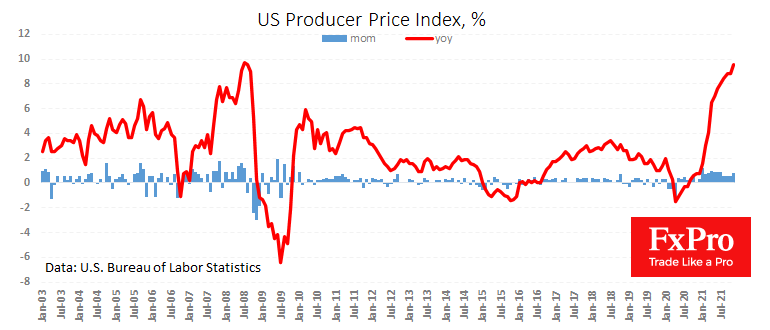

The start of the Fed’s two-day meeting gave new signs of the strength of inflationary pressures in the market, adding to speculation about a tightening of the monetary policy tone. In November, the PPI index was 9.6% y/y, markedly higher.

December 14, 2021

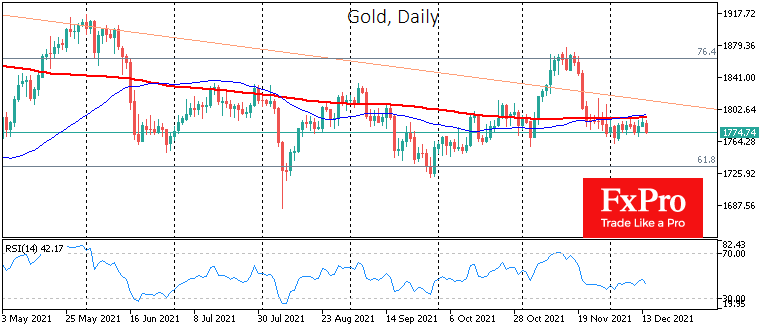

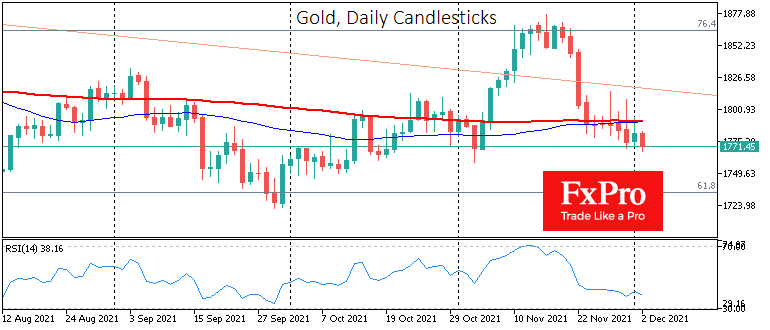

Gold has remained aloof from the main market movements since the beginning of the month, hovering in a range of no more than 1.5% over the last two weeks and alternating between rising and falling. The trend so far this.

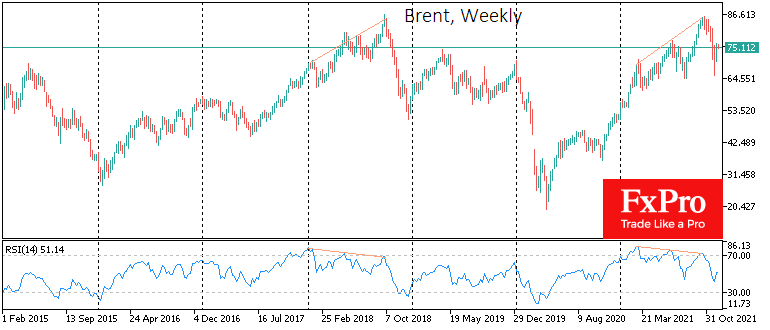

December 13, 2021

Brent crude oil has added more than 8.5% over the past week. We have seen an impressive increase in buying on a temporary decline below the 50-week moving average. From the tech analysis side, Crude oil has so far managed.

December 10, 2021

Financial markets are waiting with increased attention to US inflation data. Analysts, on average, expect year-over-year price growth acceleration from 6.2% to 6.8%. Traders in the markets will be looking for answers to whether the peak of inflationary pressures has.

December 7, 2021

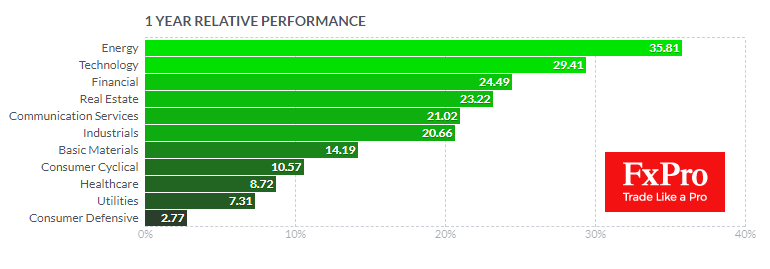

About 13 months ago, in early November 2020, we saw a shift in the previous months’ investment idea thanks to Biden’s presidential election victory and the emergence of effective and affordable vaccines. Then we saw a investors’ shift from so-called.

December 3, 2021

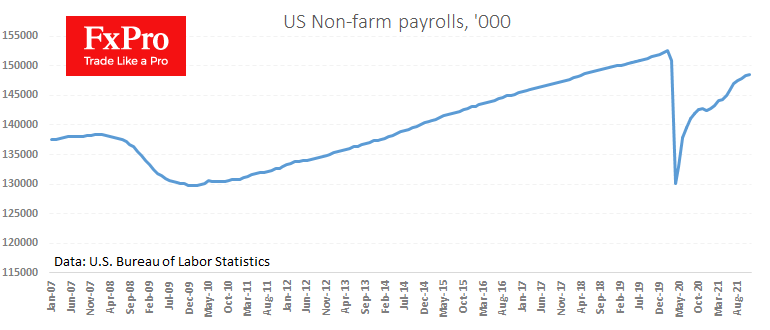

In November, The US economy created 210K jobs, a shockingly low number compared with the expected 550K. And this is the weakest increase since January. This indicator noted a close correlation with the dynamics of new coronavirus cases, which are.

December 3, 2021

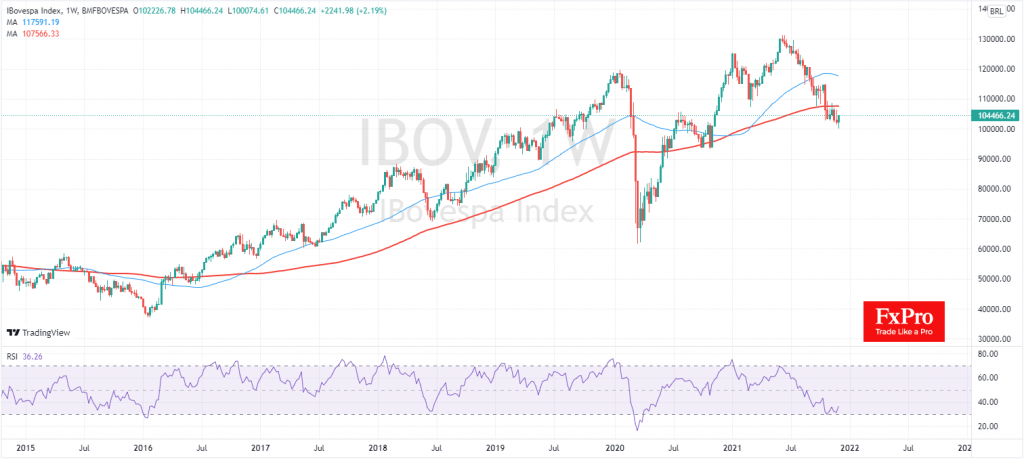

Brazilian market index Bovespa earlier this week came close to the psychologically crucial round level 100,000, having lost around 23% from its peak six months ago. Despite this backdrop, the Brazilian market looks too depressed and is already showing some.