The UK post mixed data, but not bad for Pound

February 11, 2022 @ 15:17 +03:00

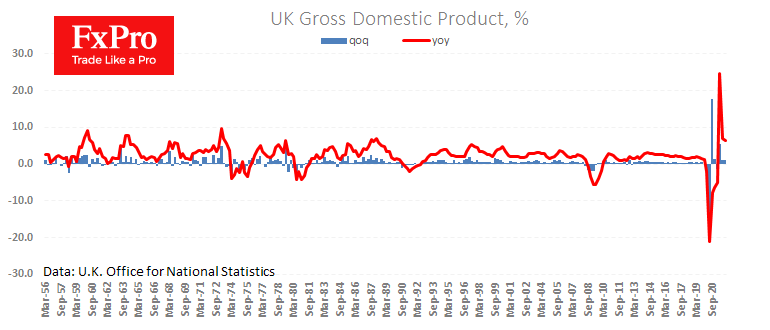

The UK economy added 1% in the fourth quarter last year and is 6.5% higher than a year ago. The annual growth rate is declining as the low base effect fades away.

In December, industrial production added 0.3% and moved into growth territory compared to the same month a year earlier. These are signs that the Bank of England’s interest rate hike cycle has met the UK economy in pretty good shape.

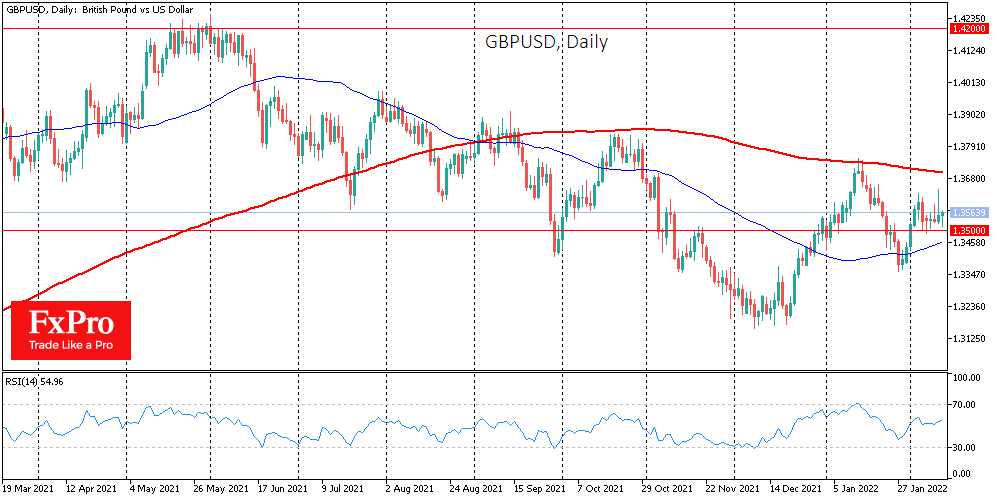

The British pound has been gaining support in the last two days on the declines in the area of 1.35 GBPUSD despite the impressive upward thrust of the dollar. This dynamic is explained by the fact that the Bank of England has as much potential to tighten policy. Locally the pound looks like a decent competitor to the dollar.

The markets are pricing in that the Bank of England may raise the rate by 50 points at one of the following meetings, keeping the policy tightening gap with the Fed. And this is good news for the pound, which could also help reduce inflationary pressures.

The FxPro Analyst Team