Market Overview - Page 12

September 30, 2025

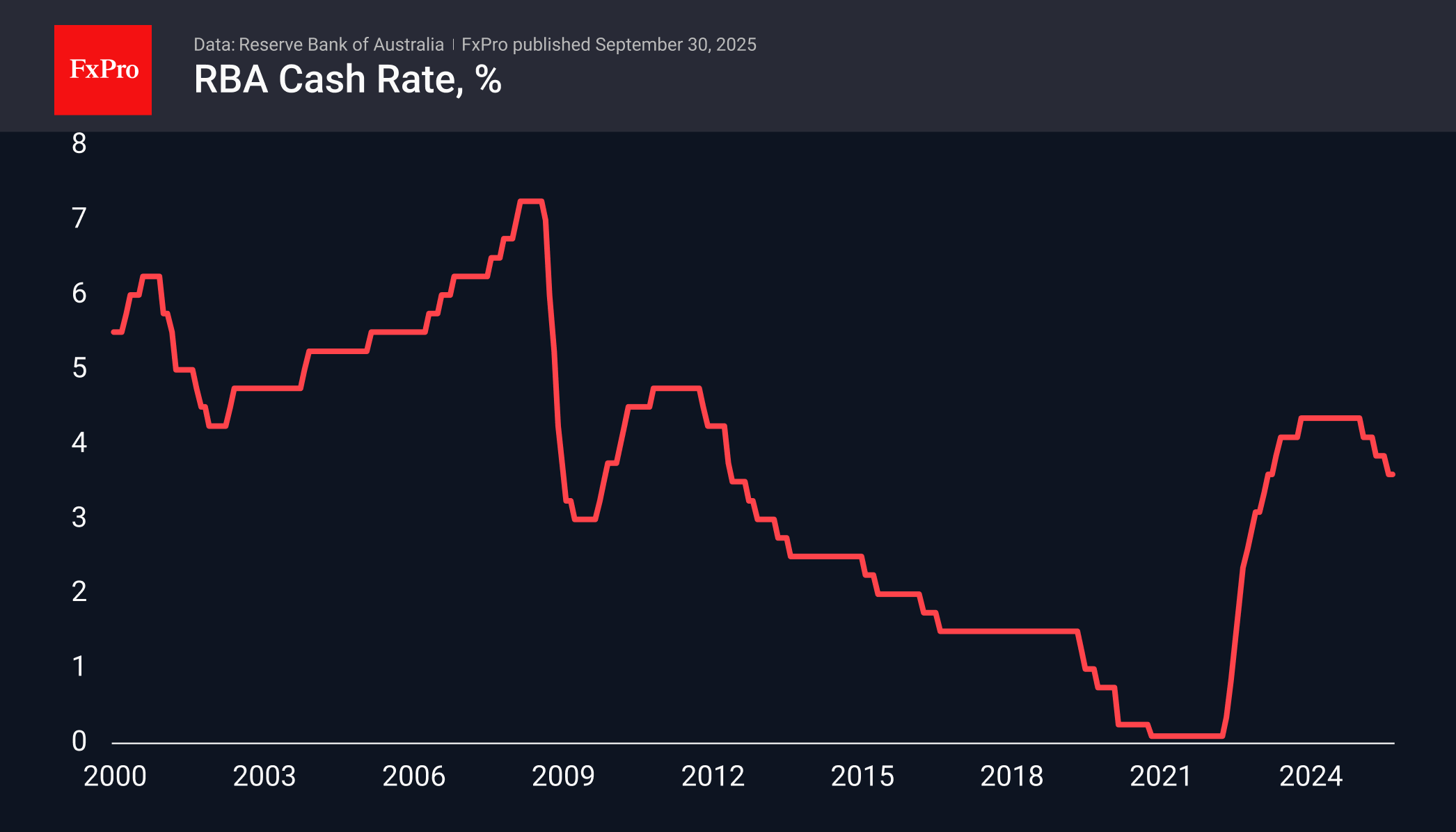

AUD rises amid RBA's hawkish stance, while US policy uncertainty and shutdown fears weaken USD, sustaining AUD's upward trend.

September 29, 2025

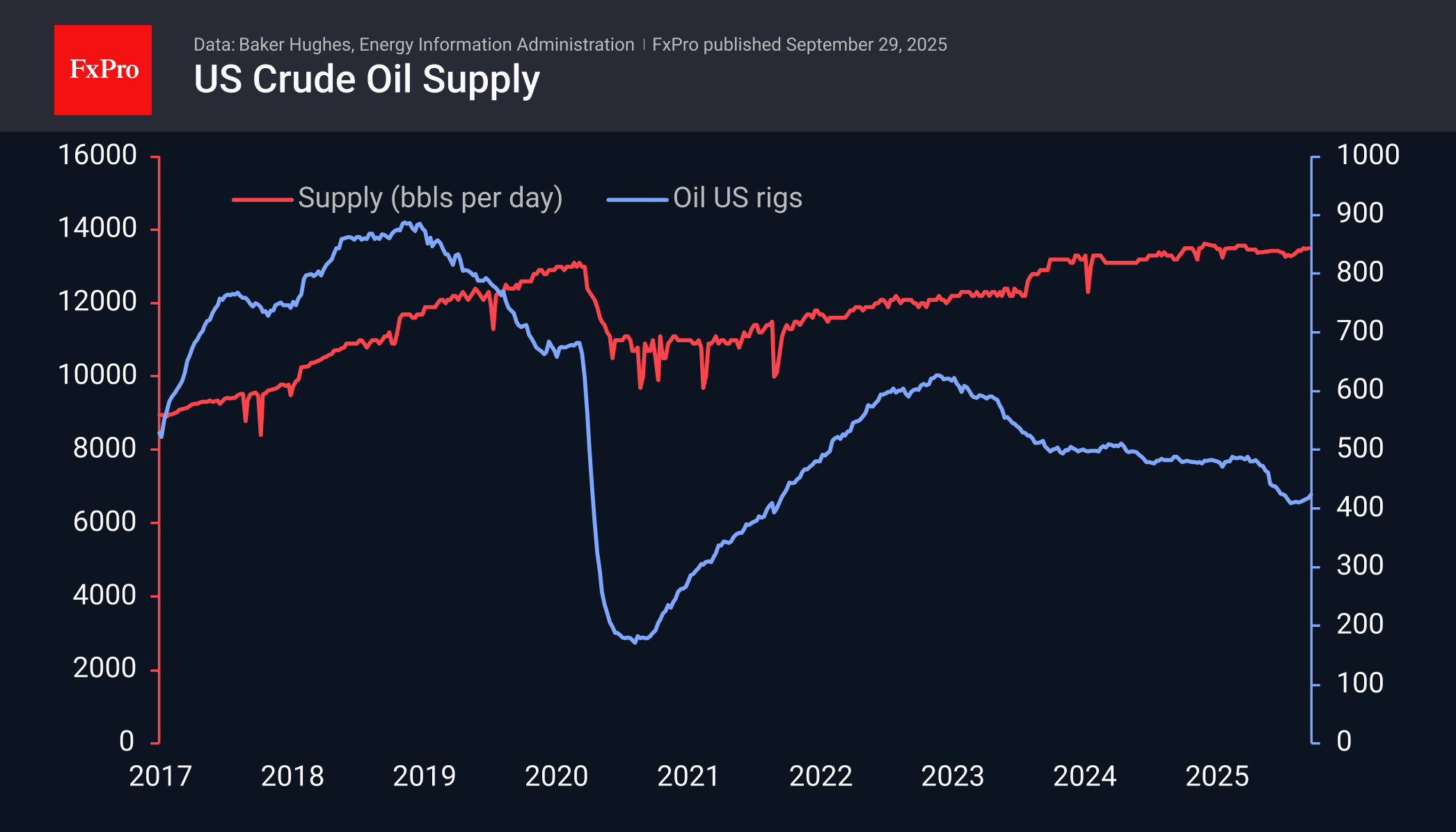

US and OPEC Crude oil producers ramp up output, increasing competition for market share; prices face downward pressure despite stocks and commodities growth.

September 26, 2025

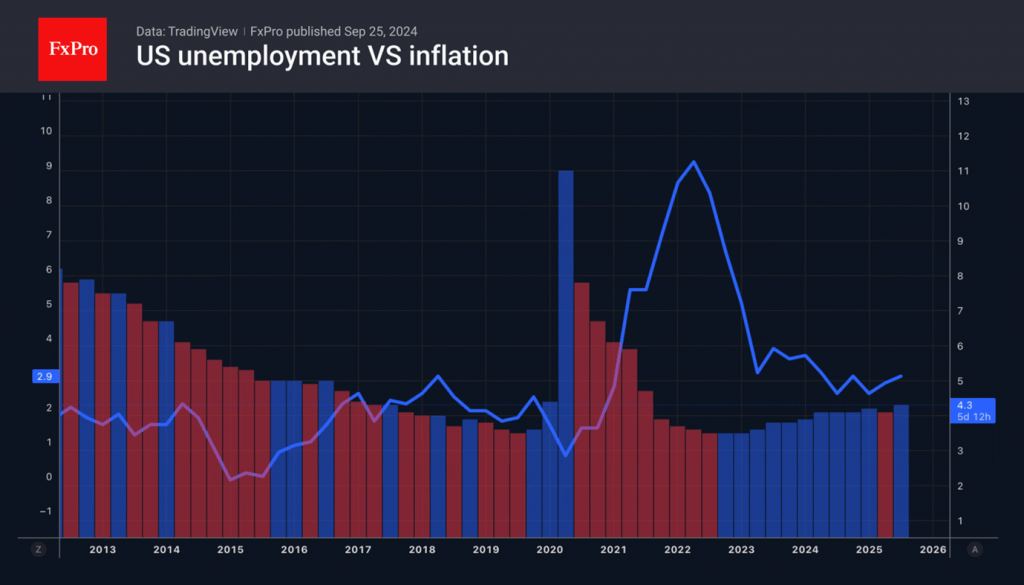

The US jobs report for September is becoming the key event of the week to October 3rd

September 26, 2025

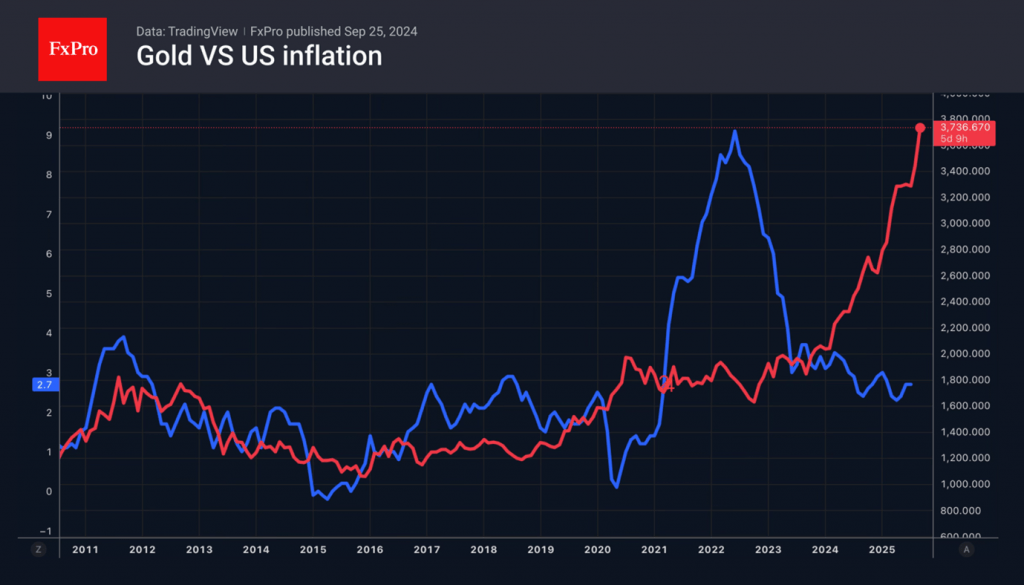

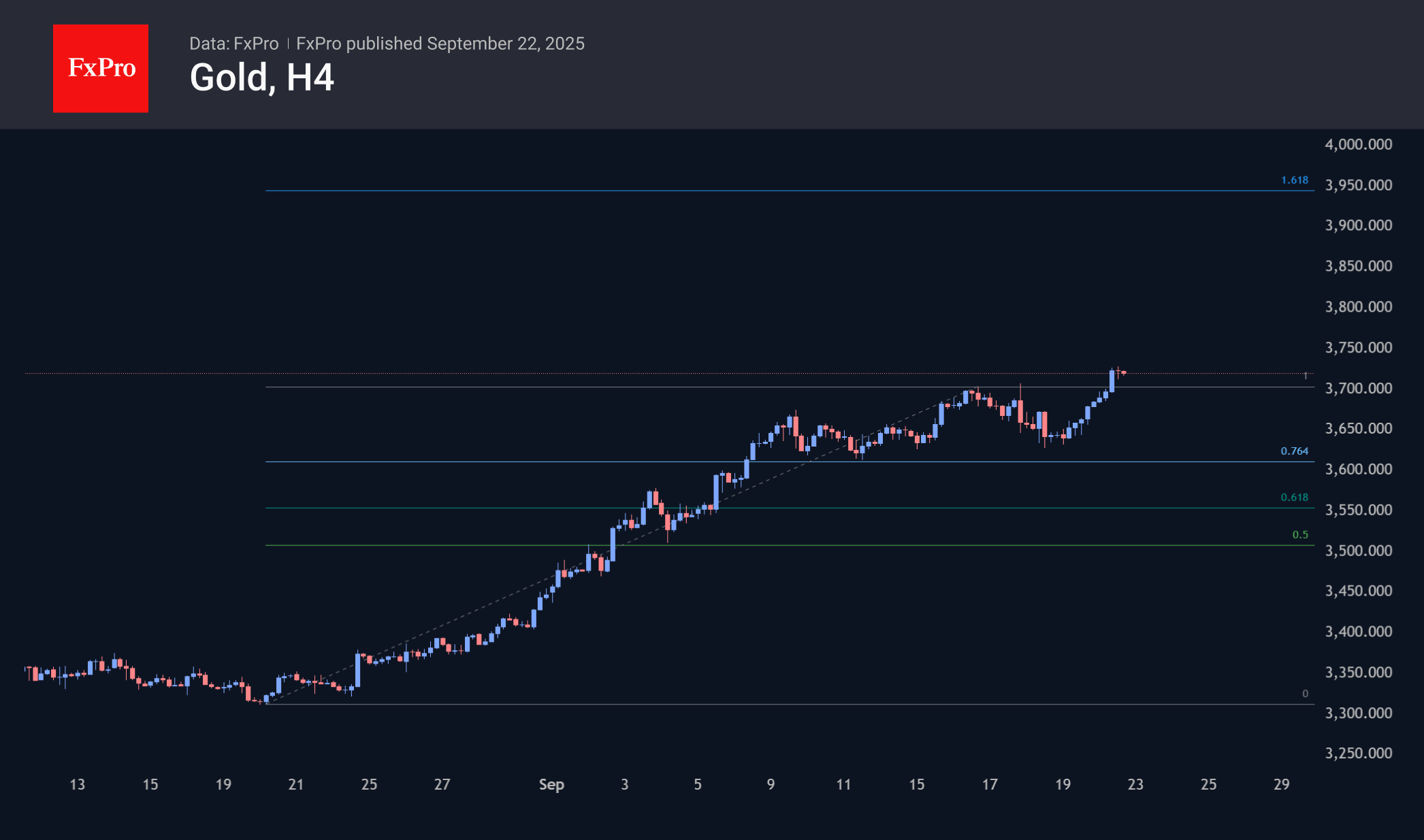

Gold is trading near record highs, while price pullbacks are attracting new buyers

September 26, 2025

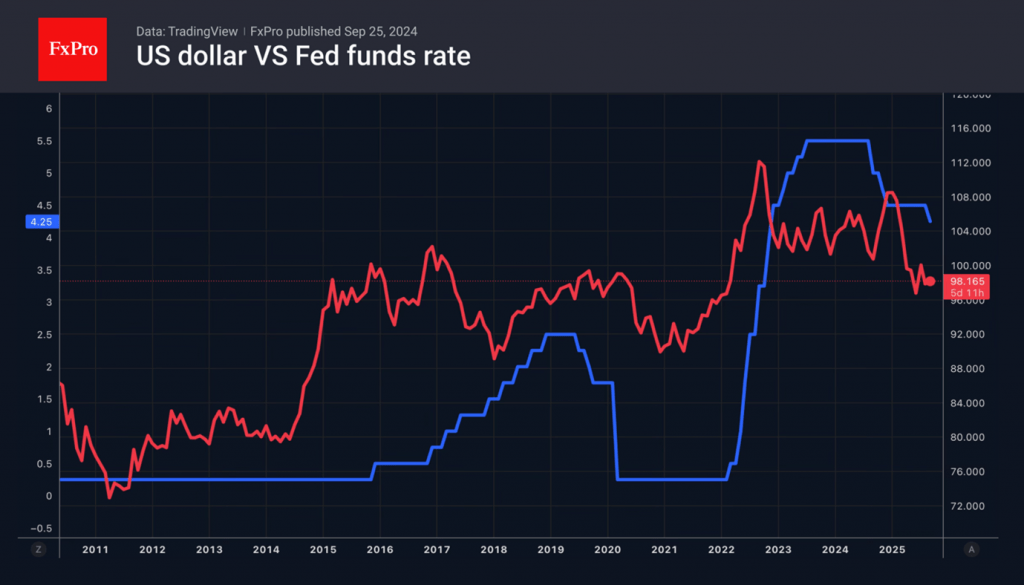

The US dollar has recovered thanks to the Fed chair's reluctance to signal a rate cut in October, while US stocks overheated in 19 out of 20 valuations

September 25, 2025

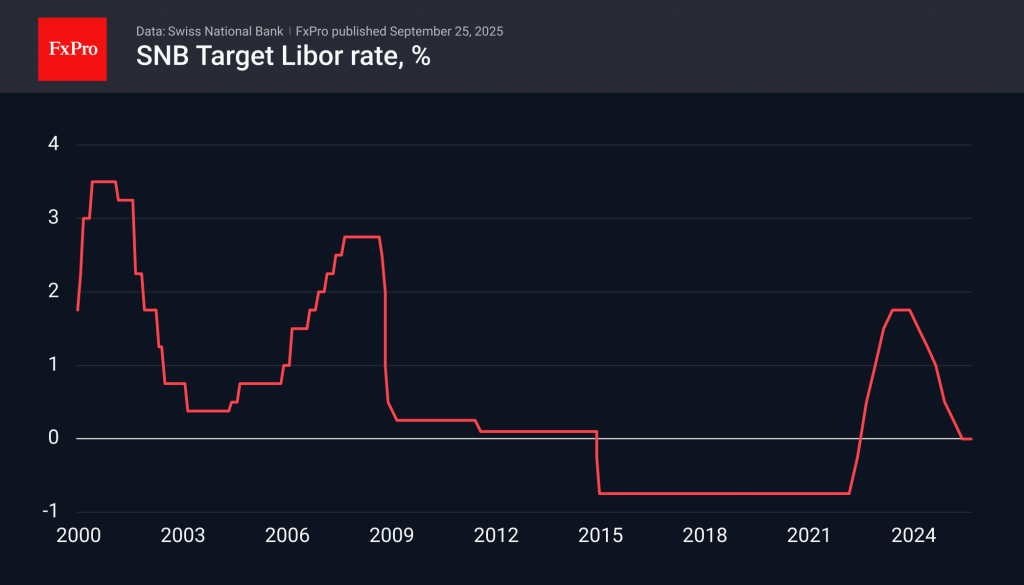

The SNB kept its key rate at 0.0% but ready to intervene as CHF continue its long-term uptrend.

September 24, 2025

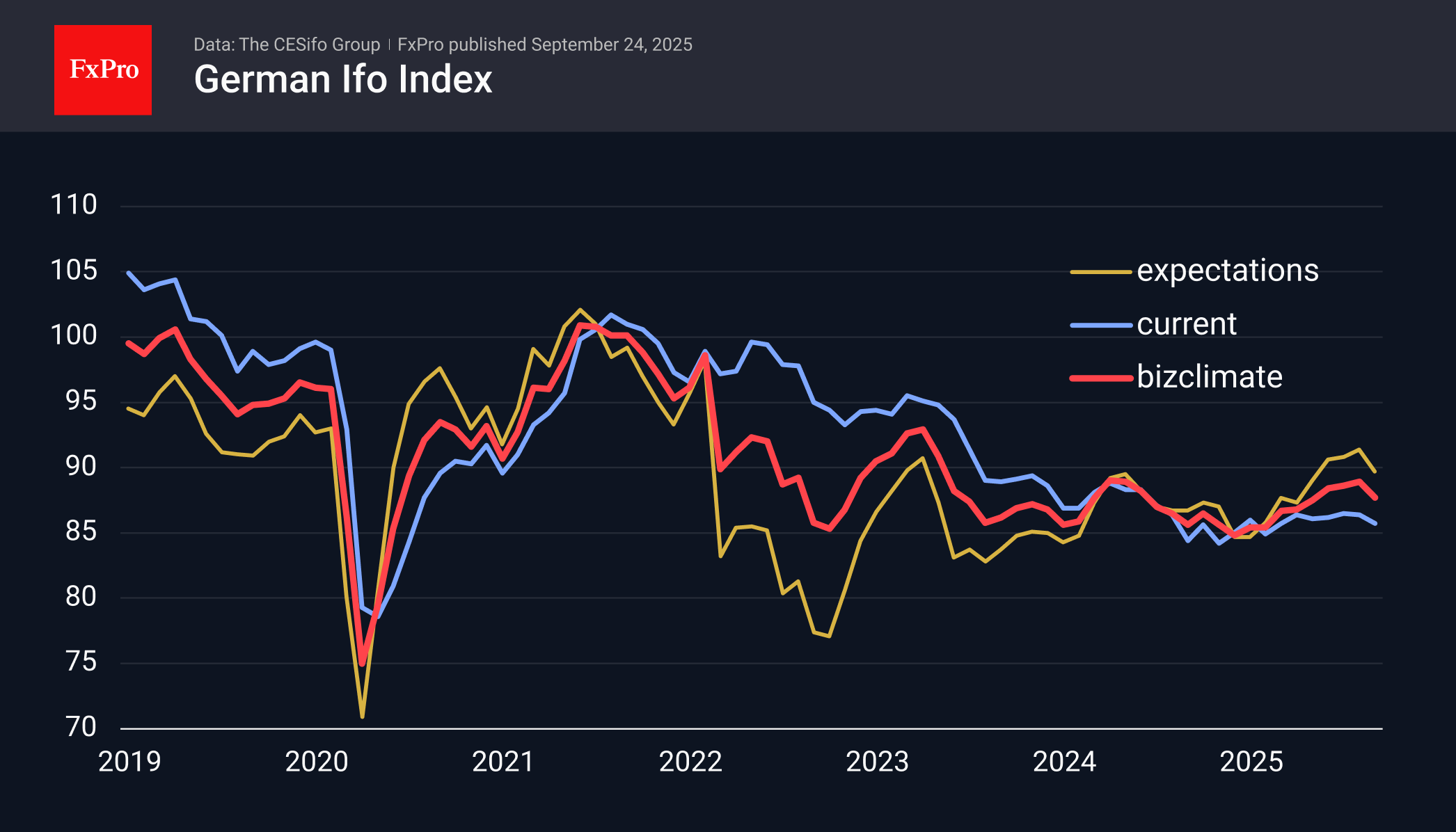

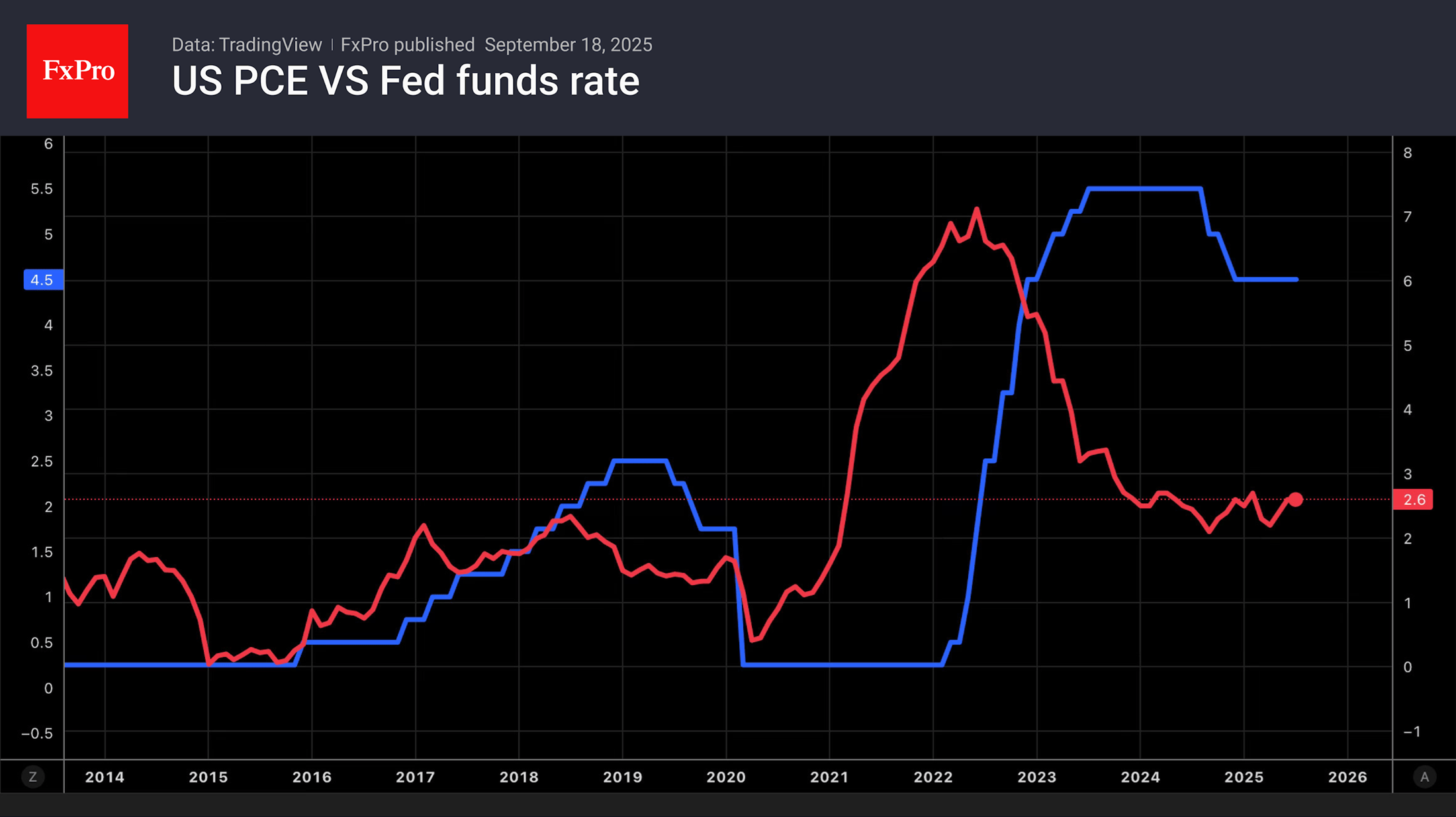

The euro weakens as US dollar strengthens, driven by Germany's slowdown and robust US growth, with further dollar gains expected.

September 24, 2025

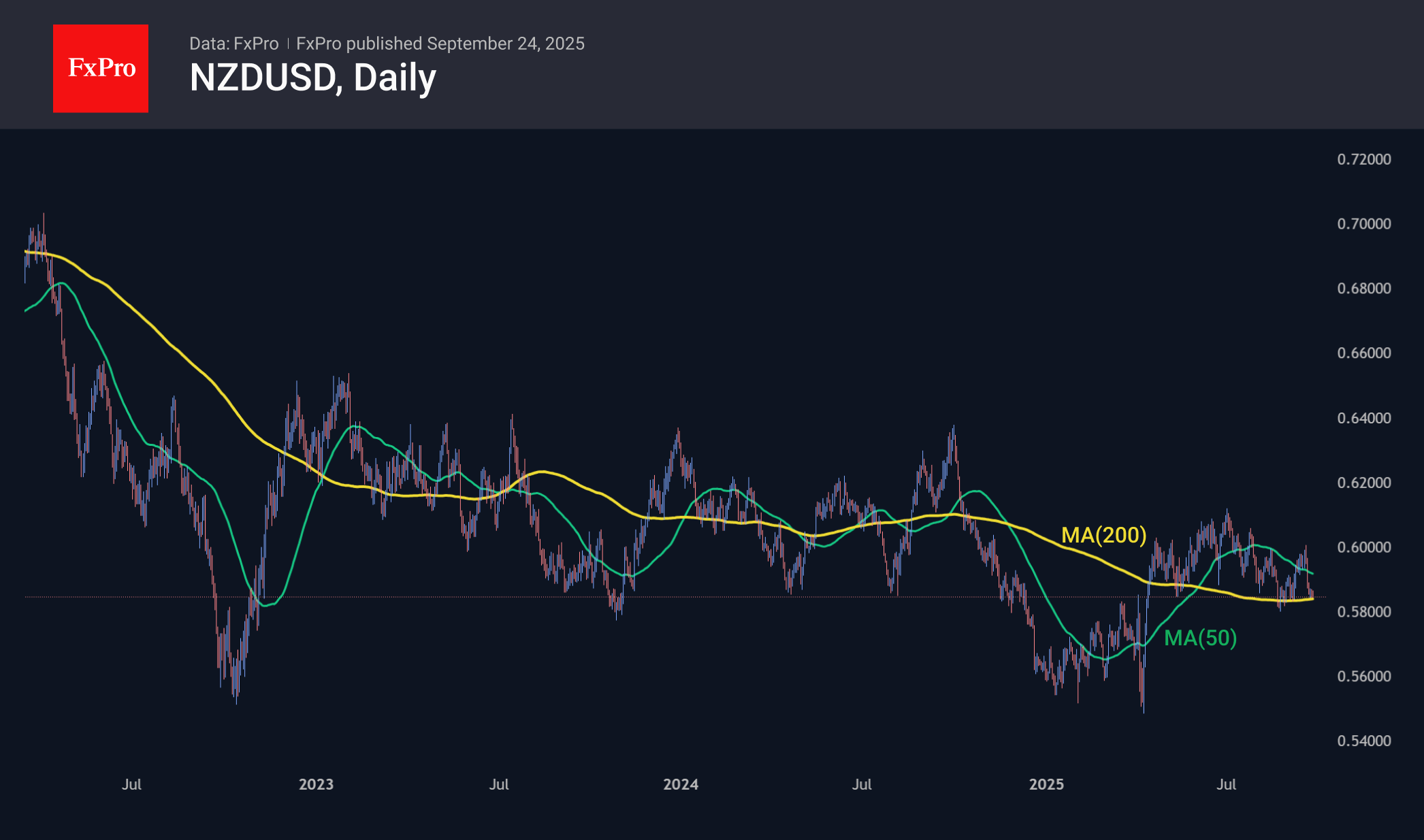

The Fed's easing, contrary to the news, boosted the dollar, driving NZD, CAD, and JPY to multi-month lows, while the pound, euro, and franc reversed from extremes.

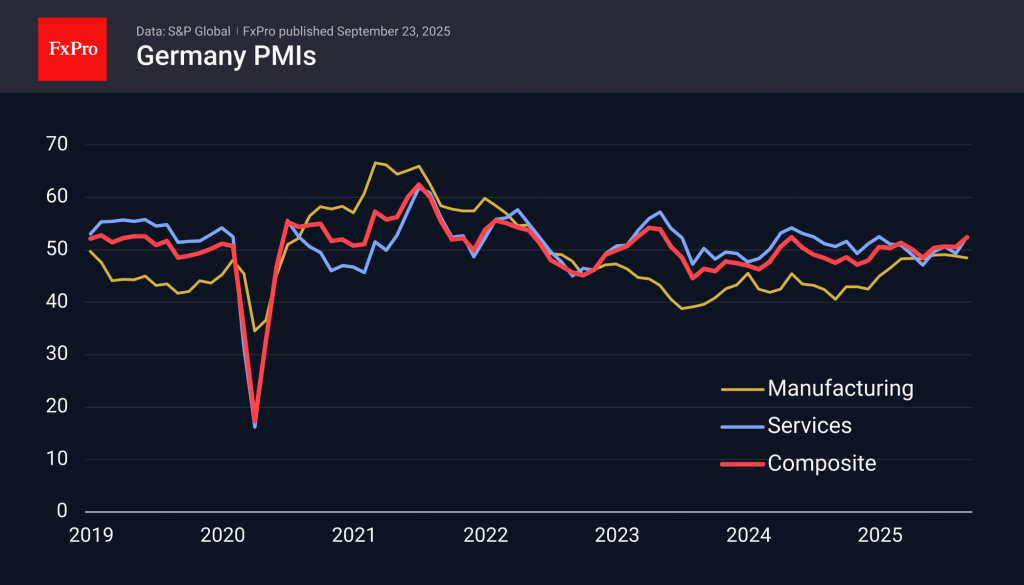

September 23, 2025

Eurozone PMI beats forecasts, led by German services, but improvements are too slight for the euro to break key resistance levels for EURUSD and EURGBP.

September 23, 2025

Gold’s surge to record highs signals strong demand amid global tensions, but rapid growth raises correction risks. Investors are advised to exercise caution.

September 19, 2025

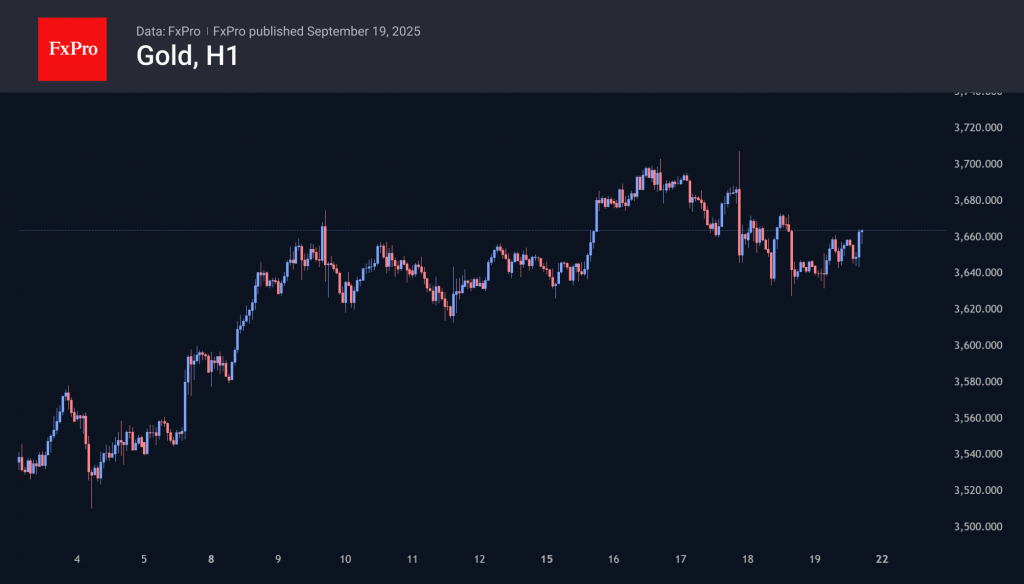

Gold set records in 2025, up 40% YTD, driven by central bank buying and a weak dollar. However, recent Fed moves have led to a gold pullback as investors buy stocks and dollars.