Market Overview - Page 119

February 7, 2022

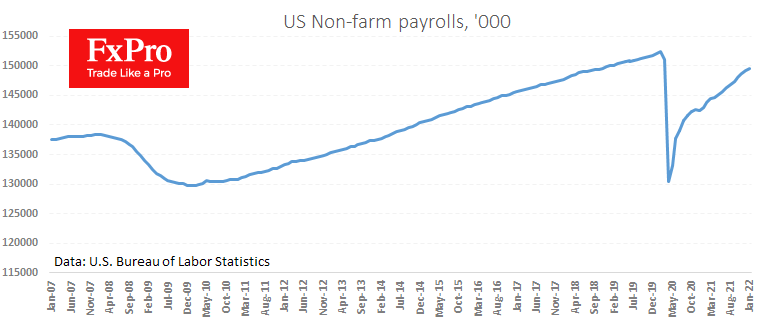

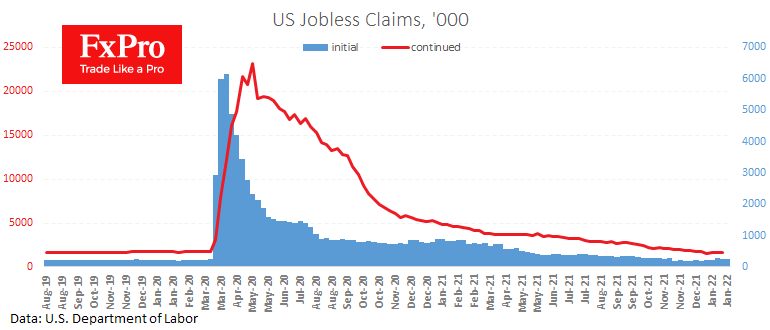

Employment growth of 467K in January was well above forecasts. In addition, there was a noticeable upward revision to the job gains of the previous couple of months. Furthermore, wage growth accelerated to 5.7% y/y, marking the unwinding of the.

February 4, 2022

A positive surprise on US employment. The official BLS report showed a jobs increase of 467K, markedly better than the expected 110-165K. Moreover, the previous data was seriously revised upwards and now reports employment growth of 510K in December compared.

February 4, 2022

US jobs data will be released today, which promises to attract increased market attention and could cause a surge of volatility in the dollar and equities. In the January employment estimates, investors and traders will be looking for answers as.

February 4, 2022

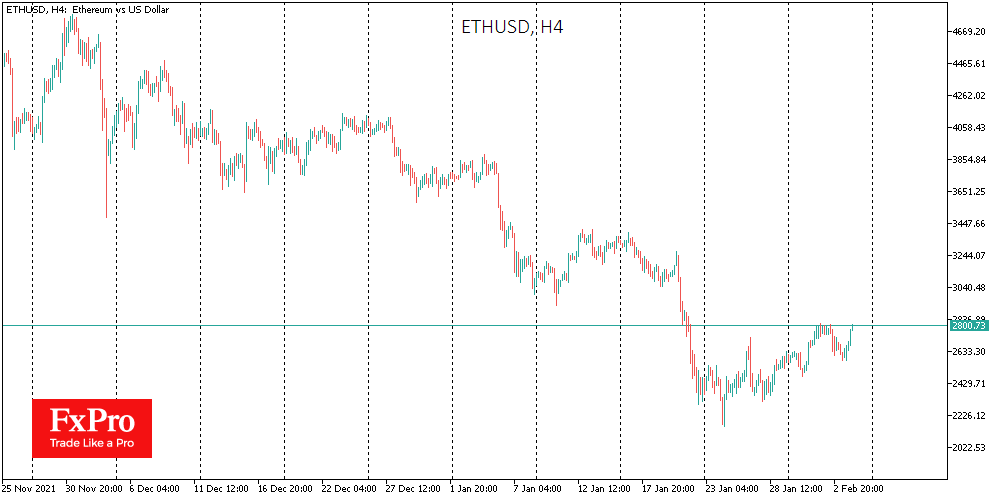

Down the chain, US stock market dynamics now determine corporate investor sentiment towards Bitcoin and Ether. From the top-down, this sentiment then spreads down to altcoins. But since late last year, there has been a continuing trend that even bitcoin’s.

February 3, 2022

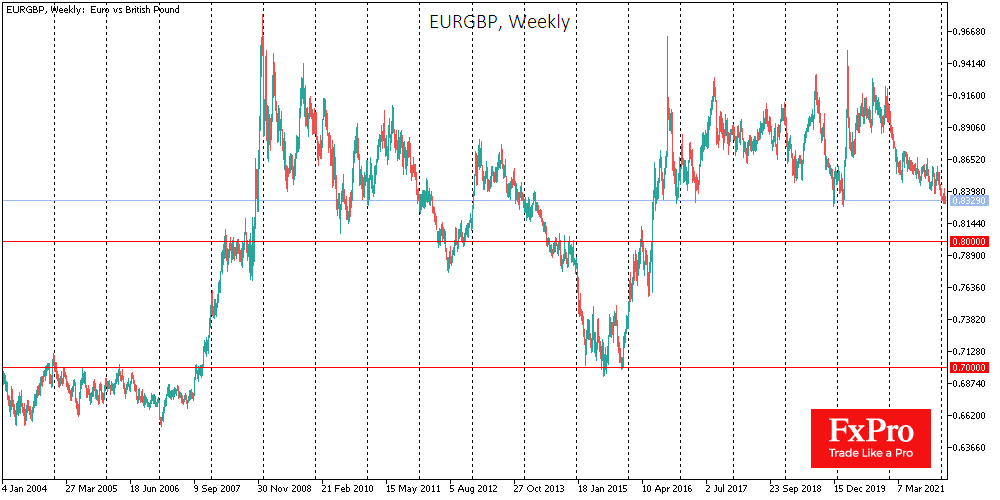

The Bank of England and the ECB will announce their monetary policy decisions today. They could reinforce the contrast in policy between these central banks and trigger a significant reassessment in the FX market. The ECB is expected to confirm.

February 2, 2022

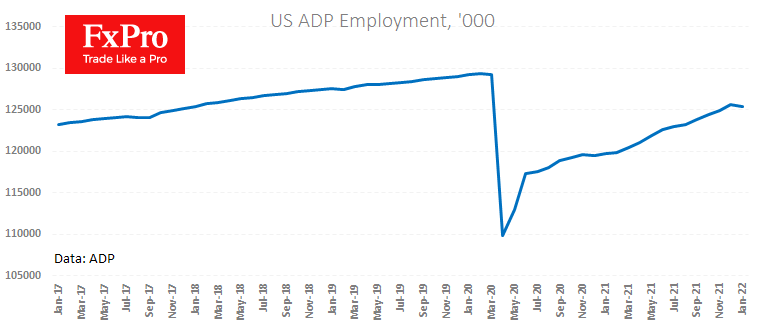

According to the latest ADP data, employment in the USA fell by 301K in January. This is sharply weaker than the expected gain of 185K after a rise of 776K in December. The shocking dip is caused by both the.

February 2, 2022

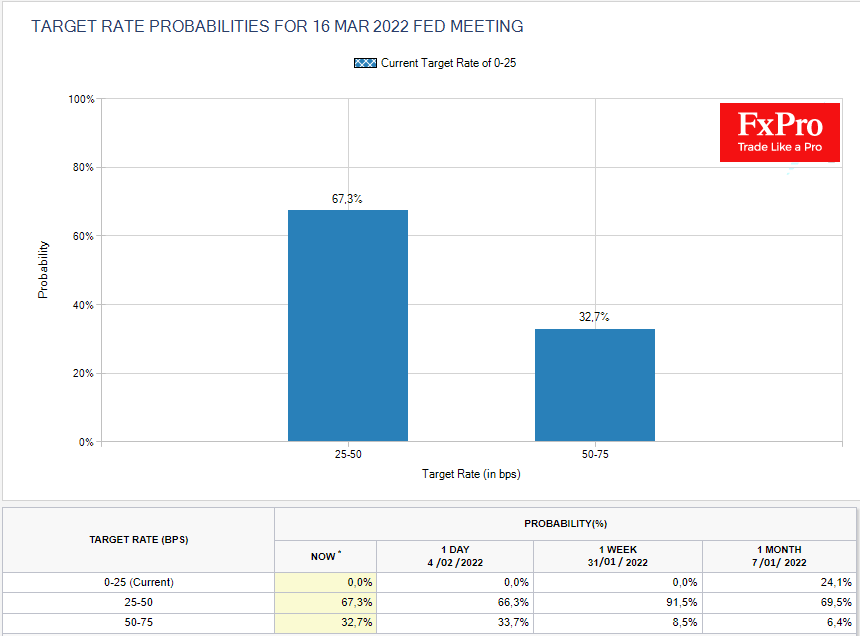

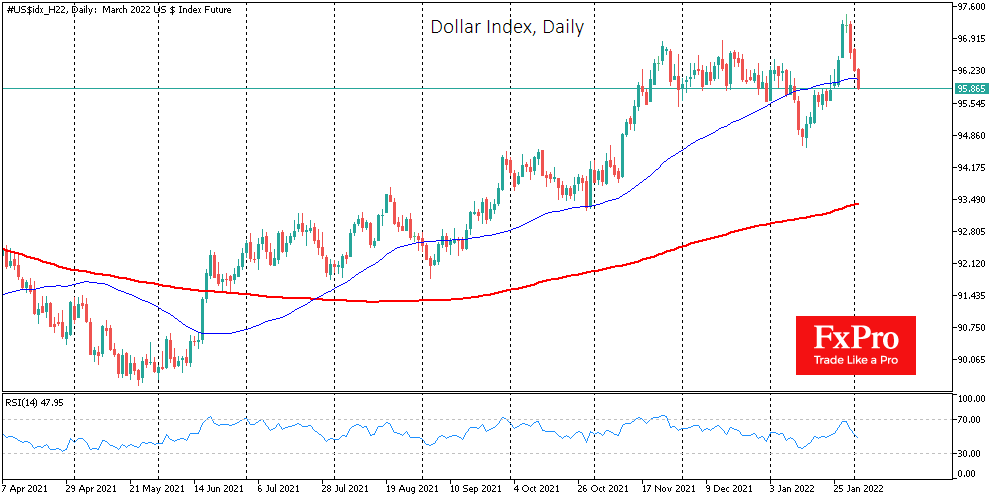

At the end of last month, the dollar index renewed 1.5-year highs after confirmation of the Fed’s plans to tighten monetary policy quickly. Since then, the US currency has given up some ground, but for now, there are visible chances.

February 2, 2022

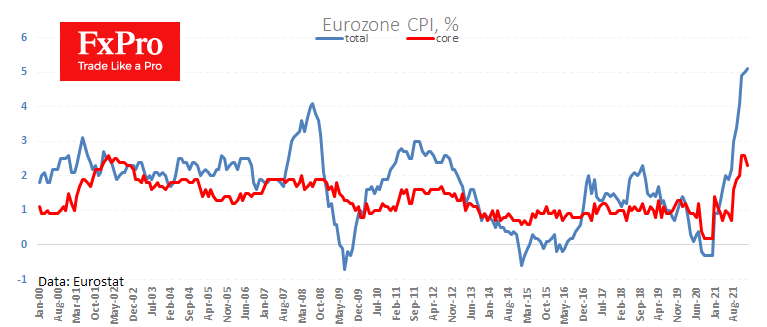

In Europe, inflation accelerates, contrary to forecasts that the peak has passed. First estimates just released noted an acceleration in CPI from 5.0% to 5.1% y/y against average estimates of a slowdown to 4.4%. An inflation rate creeping above 5%.

February 2, 2022

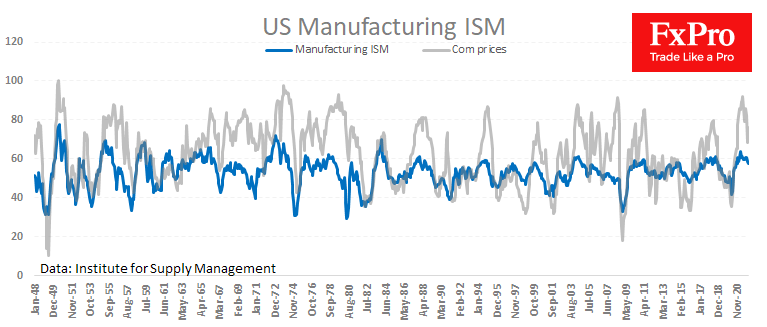

The US manufacturing ISM, an essential indicator for America’s business cycle, recorded a significant slowdown in January but managed to beat expectations. It had declined from 58.7 to 57.6 against expectations of 57.4. The manufacturing ISM has slipped in the.

February 1, 2022

• AUDUSD reversed from support zone • Likely to rise to resistance level 0.7150 AUDUSD currency pair recently reversed up with the daily Bullish Engulfing the support zone lying between the round support level 0.7000 (previous monthly low from the start.

February 1, 2022

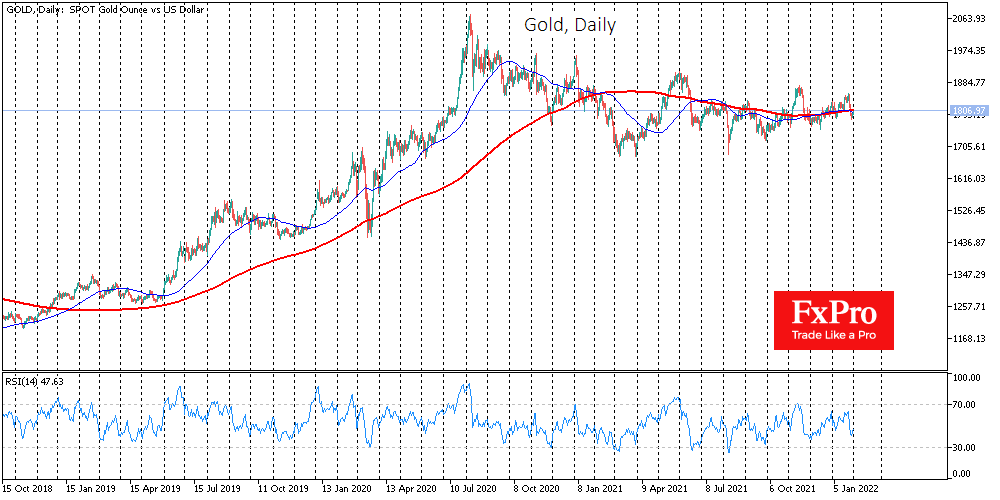

Gold is attempting to return to the $1800 area on Tuesday. The bulls do not want the price fixing below this round level, as they want to avoid the markets starting a wider liquidation of long positions in the metal..