The Russian-Ukrainian crisis may push Oil prices up further

March 08, 2022 @ 15:12 +03:00

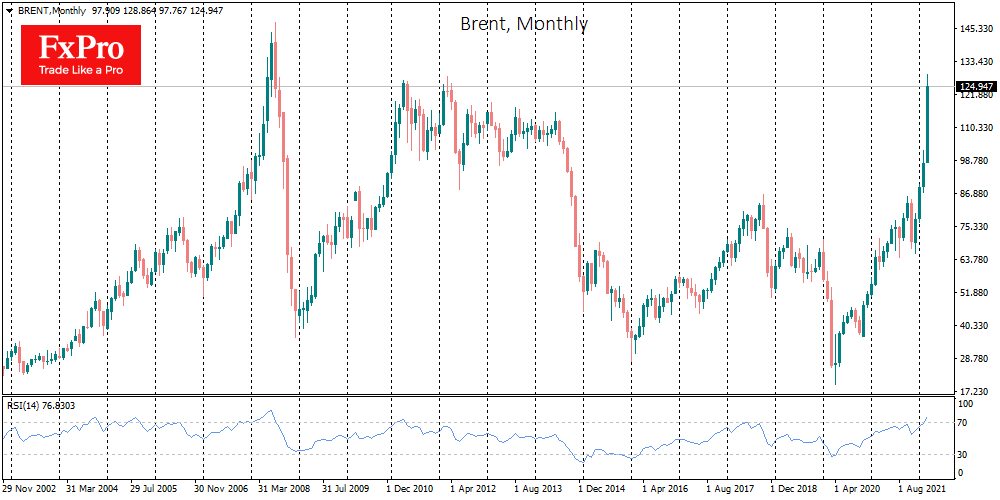

Brent oil is trading near $125 – in the 2011 and 2012 highs area. The market continues to receive bullish comments from politicians and officials. However, traders seemed set to pause to digest current price levels after a frightening rally to $129 at one point on Monday, reacting to reports that the US and allies are weighing a ban on Russian oil and gas imports.

In Russia, Novak (a former energy minister and co-founder of OPEC+ deals) points out that the oil embargo will push prices into the $300 a barrel area. Probably, this forecast is based on a comparison of the current situation with the OPEC embargo in late 1972, when the price soared 3-4 times within a few weeks.

The International Energy Agency’s executive director said the Oil can still move higher from current levels.

Officially, Russia is not refusing to export Oil and Gas, but local companies have recently failed to sell Oil because of a buyers’ boycott or fears of being hit by US and EU sanctions.

Shell’s just-announced refusal to buy all Russian Oil is doing little to bring down the commodity price.

With this news backdrop, Oil is getting support on the downside in the $115 area, where last week’s highs were located. It will take a lot more political will to reverse the trend in Oil.

Also, the chances of Oil from Iran to make up for the drop-offs are somewhat thawed, as the president has said that Tehran will not give up its red lines.

Iran would logically be expected to use the situation to bargain for better terms on a deal with the West. The same applies to Venezuela, where US representatives have headed to secure a rise in global production.

Will the countries previously most disadvantaged by US sanctions use the momentum to ramp up production? That question is not yet answered. Likely, we should expect price rises to accelerate in the coming days before the situation reverses into a constructive direction and prices head for a correction.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks