Market Overview - Page 113

March 30, 2022

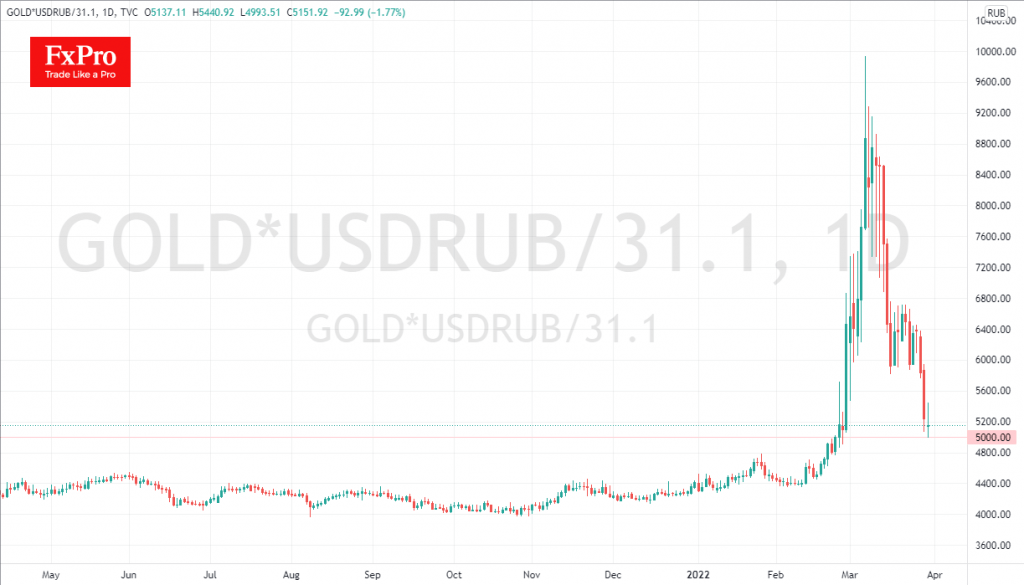

The Bank of Russia last week fixed the purchase price of Gold from banks at 5,000 roubles per gram. At the time of the announcement, on the 25th of March, the Dollar was hovering around 100 roubles, and the price.

March 30, 2022

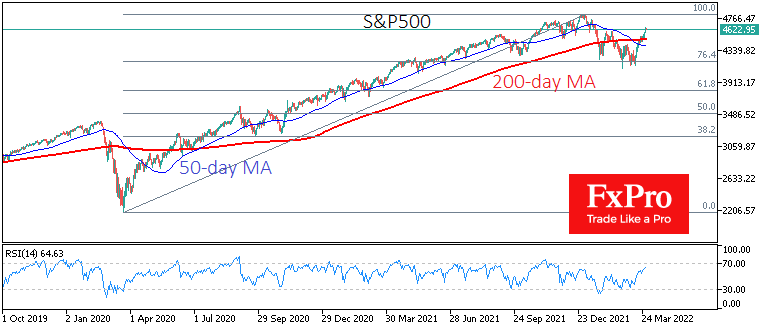

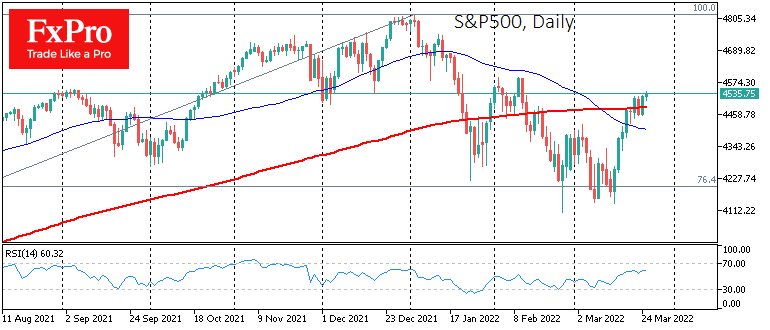

The Russia-Ukraine peace talks have revived momentum in risk-sensitive assets. The market reaction to the outcome of the peace negotiations brought the indices back to where they had last been before the last days of February. The S&P500 reached its.

March 29, 2022

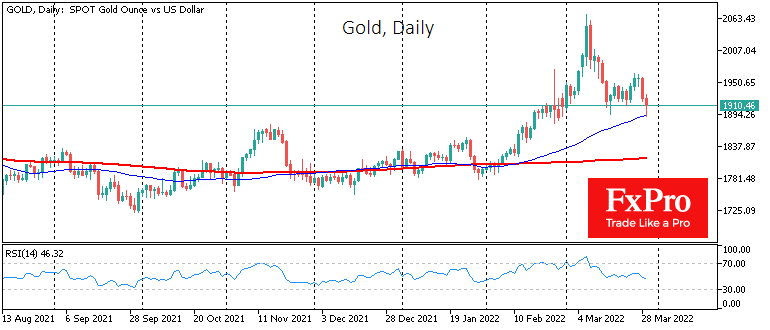

The price of a troy ounce of gold fell to $1890, its lowest level since late February, on reports of significant progress in negotiations between Russia and Ukraine. Gold retreated 8.5% from the 8th of March peak, returning to the.

March 29, 2022

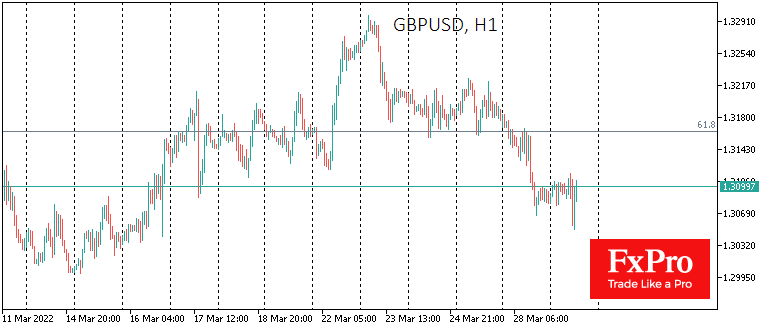

The British pound is often closely linked to risk demand in global markets due to London’s position as a significant financial hub. However, the UK and European stocks have performed well since last Wednesday, while the pound and the euro.

March 29, 2022

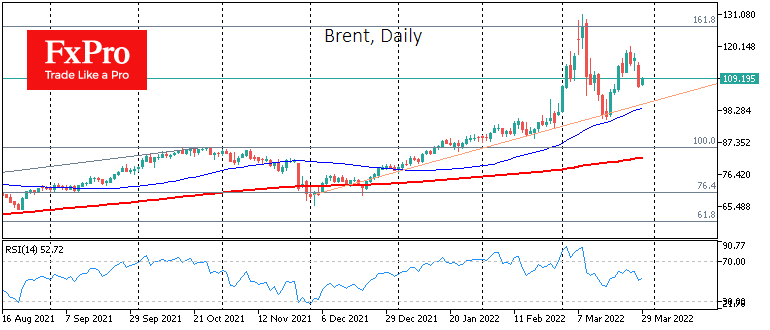

Brent lost 7.7% to $106.4 on Monday on fears of a drop in demand due to a lockdown in Shanghai, China’s financial hub. In addition, the Saudi and Yemeni cease-fire and the upcoming Ukraine-Russia talks in Turkey helped reduce the.

March 29, 2022

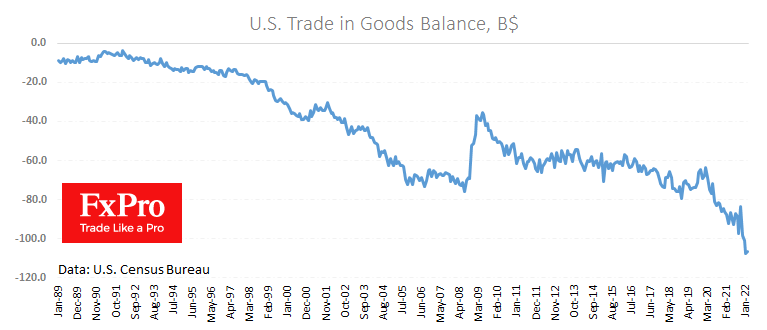

According to preliminary data from the US Bureau of Economic Analysis, the US trade deficit stalled last month. Imports exceeded exports by 106.6bn in February, down slightly from 107.6bn a month earlier, offering little consolation. The US has remained a.

March 28, 2022

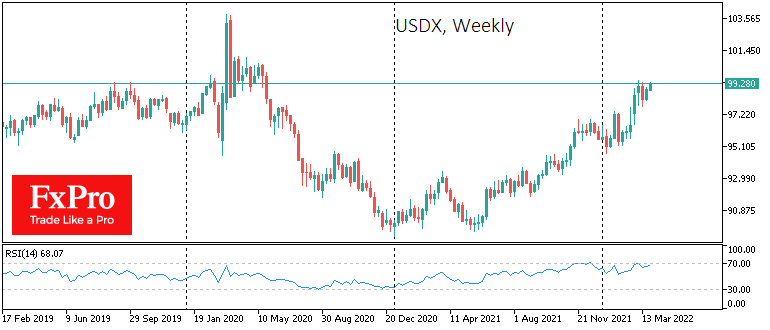

There has been a lot of talk lately about the decline of the US dollar’s reserve status. However, investors and traders should separate long-term trends from short-term market impulses. Reserve fund managers often prefer to refrain from active selling so.

March 25, 2022

The S&P500 is consolidating above important technical and psychological levels, which could herald further gains in stock markets. The peak of fear in the markets due to the military action in Ukraine came on March 7-8. After that date, we.

March 25, 2022

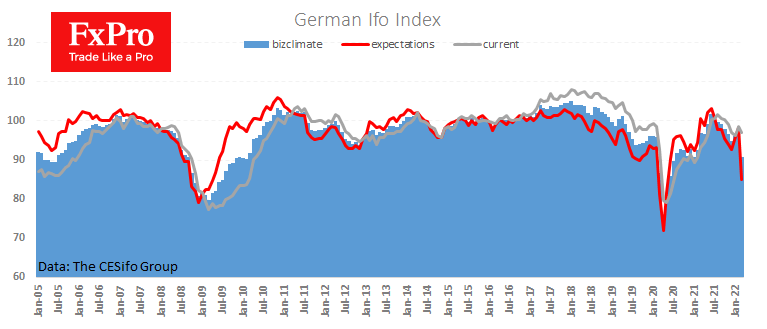

According to fresh Ifo estimates, business sentiment in Germany fell in March to its lowest level since January 2021. The business climate index fell from 98.5 to 90.8 following a collapse in business expectations amid war in Ukraine and the.

March 25, 2022

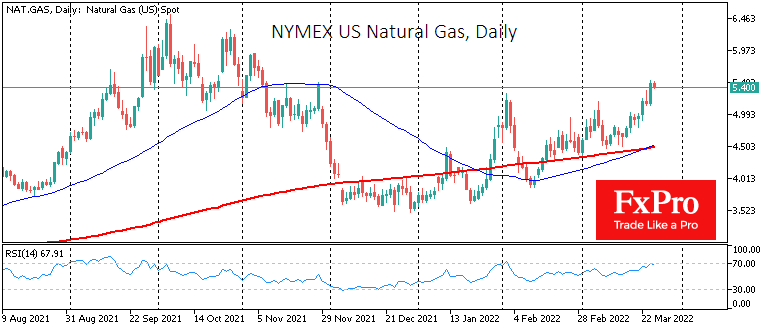

Oil and gas remain hot topics in the markets. Although these energy prices have corrected from their recent highs, the uptrend promised to be with us if there are no signs of de-escalation in Ukraine. Moreover, high energy prices are.

March 24, 2022

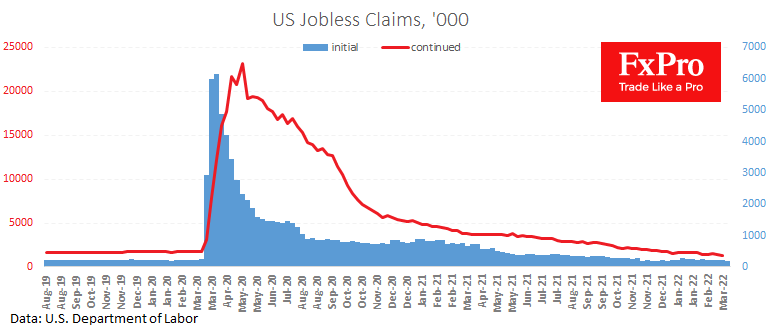

The number of initial jobless claims in the US collapsed to 187K last week, the lowest since 1969. Before the pandemic, the number was hovering around 220K, and we saw a complete recovery to these levels in the previous four.