Renewing Natural gas growth momentum

April 26, 2022 @ 16:22 +03:00

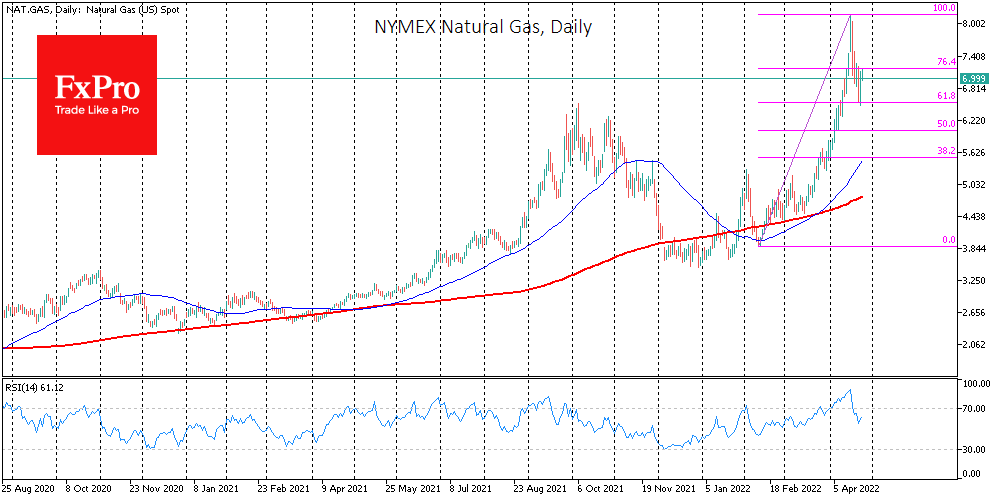

NYMEX Natural gas price has again surpassed $7 and may well have completed a corrective pullback from the February-April momentum and may soon be preparing to go to a multi-year high above $8.2.

It spiked 110% from the Feb lows of $3.9 to a peak on April 18th, and its momentum is clearly in line with its Fibonacci retracement pattern touching 61.8% of the rally.

Additionally, the bottom of the latest correction coincided with the previous price peak in October. This transformation of former strong resistance into support is frequent in the markets.

In support of a bullish scenario for gas, its price showed a more than 7% jump on Monday, despite the decline in oil.

There is a fundamental reason for this ability to resist gravity: Europe is still looking for alternatives to Russian gas, and the first alternative is gas from the USA.

Against the bullish momentum in gas, as in other commodities, a wave of selloffs of risk assets and deleveraging could play out. Already we are seeing the first signs of this in more robust demand for the yen and falling Gold while stock indices are falling.

The FxPro Analyst Team