Market Overview - Page 111

April 14, 2022

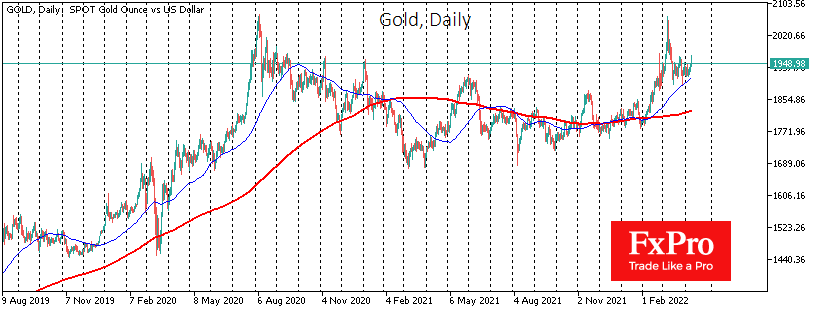

The Dollar is correcting on Thursday morning, losing around 1% from Wednesday’s peak, when the dollar index rose to its highest since May 2020. It has caught our attention that Gold and the Dollar have been moving in tandem since.

April 13, 2022

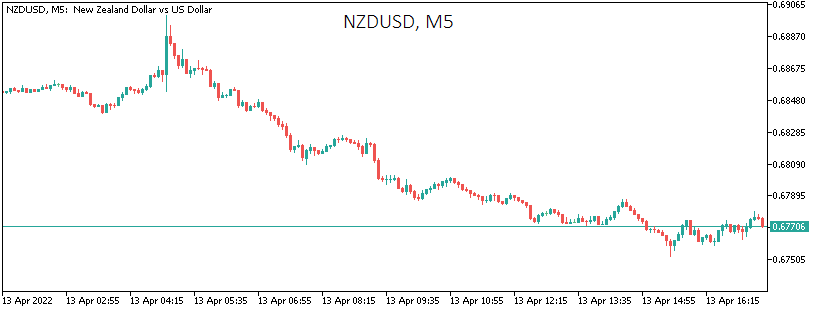

Today the central banks of Canada and New Zealand raised their key rates by 50 points at once. New Zealand was not expected to rise sharply, but that did not save the NZD from the ensuing sell-off. A heavy downturn.

April 13, 2022

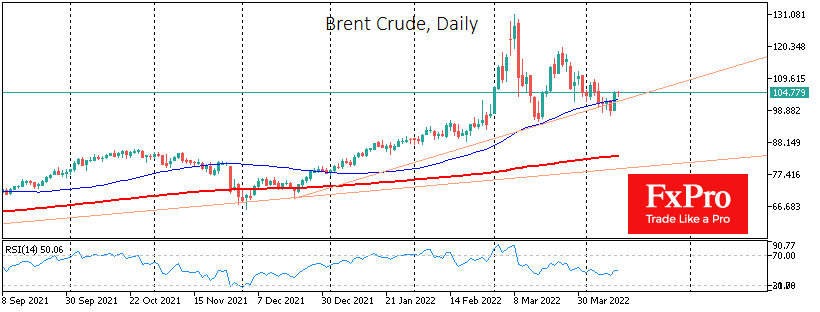

The price of oil rose more than 6% on Tuesday, with the main driver being news that Russia is sharply cutting its oil production. Reuters sources report a fall in production in the first days of April to 10.32m BPD,.

April 13, 2022

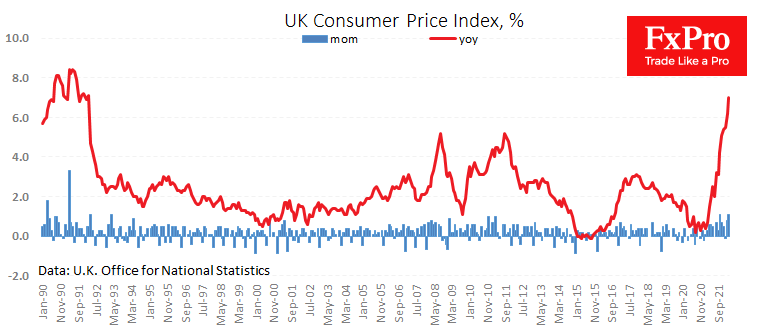

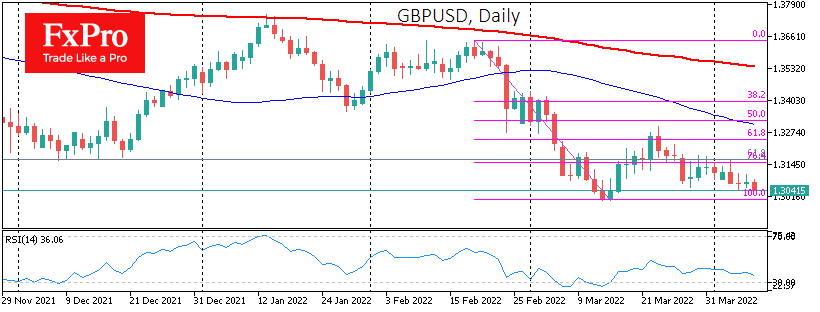

Inflation in the UK is developing an acceleration stronger than expected. Estimates for March marked a 1.1% CPI gain for the month, above the 0.8% a month earlier and rebutting analysts’ hopes that the monthly price growth would slow to.

April 12, 2022

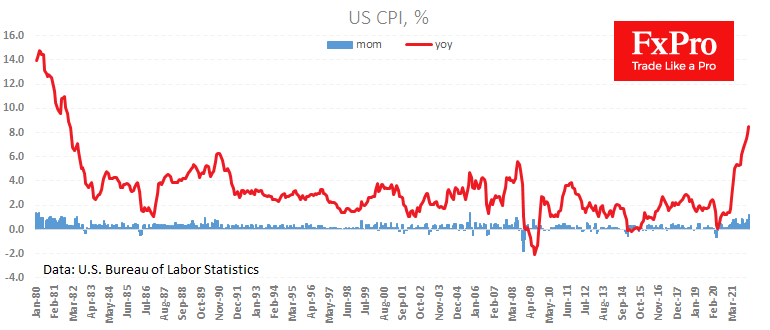

The US consumer price index has updated its record since 1981, accelerating to 8.5% y/y from 7.9% a month earlier and slightly stronger than the 8.4% average analysts forecast. However, yesterday’s White House warning of “extraordinarily elevated” inflation data set.

April 12, 2022

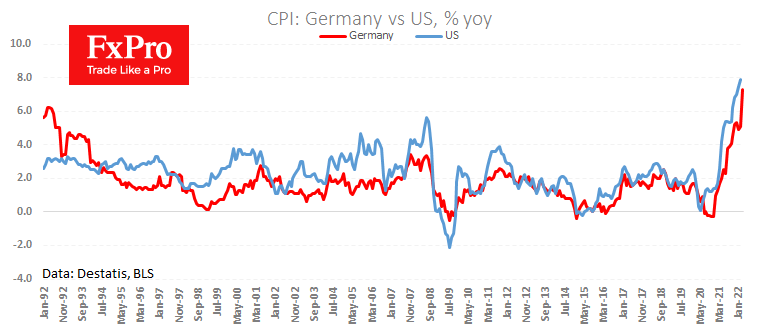

In Germany, the final consumer price index data confirmed that inflation reached 7.3% y/y in March – the highest since 1981. This is a worrying reading, but it is already priced in as it coincided with the preliminary estimates released.

April 12, 2022

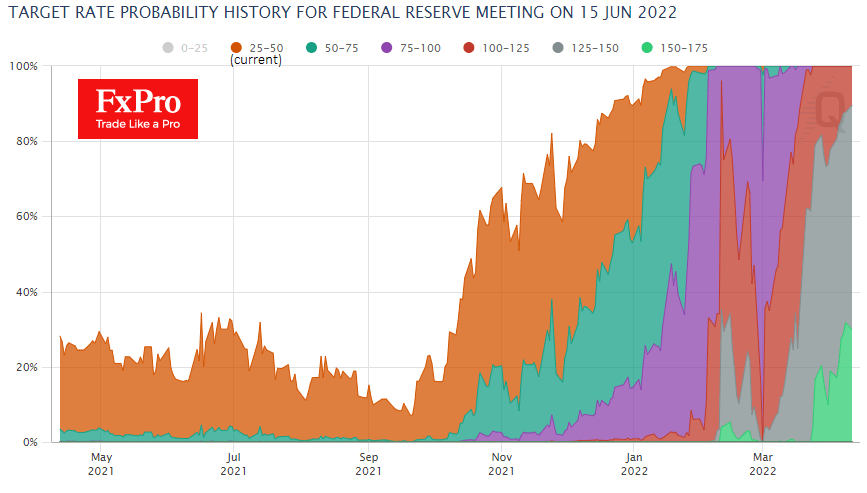

Expectations for further moves by the Fed have an increasing impact on markets, pushing the dollar up to extreme highs and pressuring stocks. Futures are laying on an 84% chance of a 50-point rate hike in early May and a.

April 11, 2022

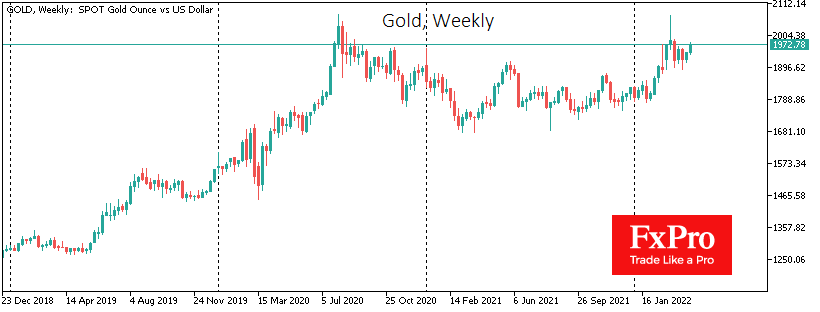

Gold rose for the third trading session in a row, gaining more than 0.8% since the beginning of the day and reaching five-week highs earlier today at $1969. Previously, for almost a month, gold gained strong support on declines below.

April 11, 2022

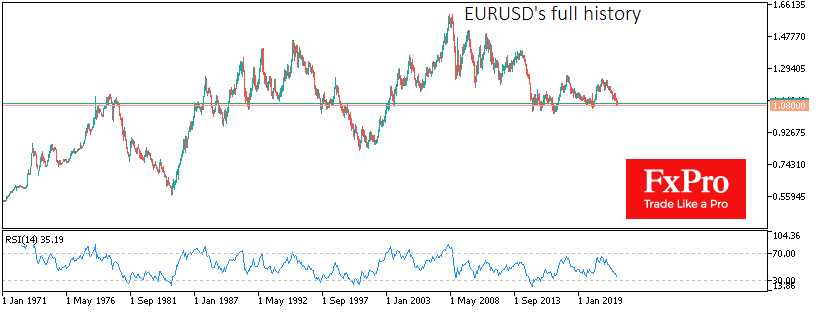

Politics is once again temporarily becoming the main driver for the single currency. EURUSD returned to 1.0925 on Monday, gaining 0.8% from Friday’s lows on reports that incumbent Macron is ahead of far-right Le Pen and will potentially get even.

April 11, 2022

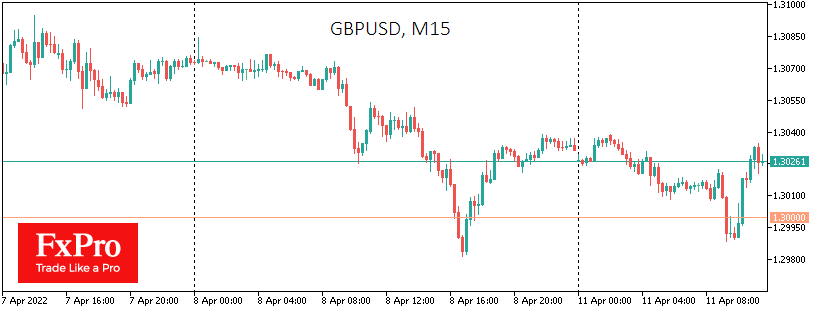

The British pound returned to the $1.3000 area, a significant circular level from which the British currency bounced in the middle of last month. The bulls continue to hold for the second consecutive trading session. The intraday charts clearly show.

April 8, 2022

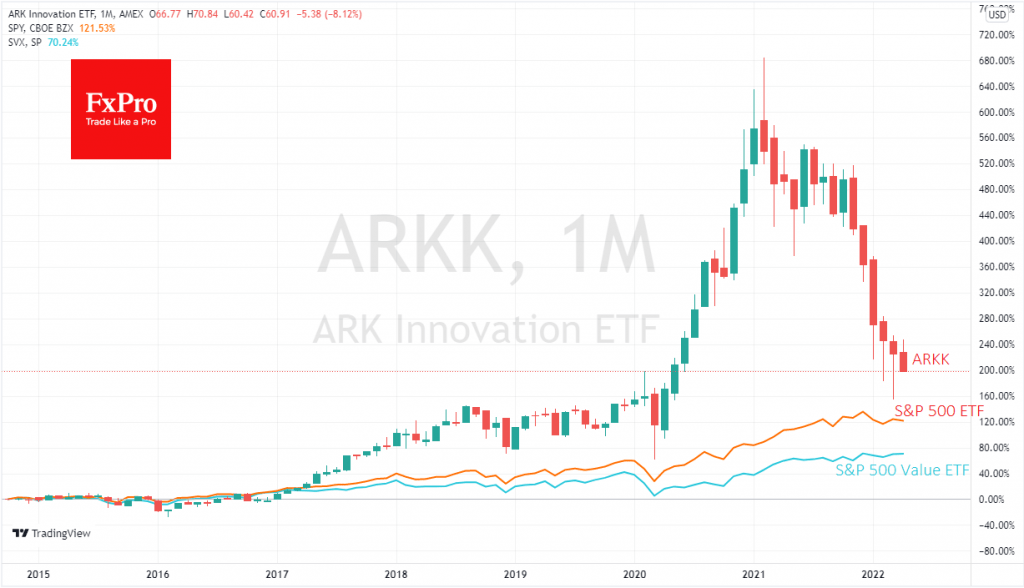

While one hears in the markets several times a year that “the world will never be the same”, it is easy to see market cyclicality, if not in individual stock names, then in sectors. Over the past 14 months, Katie.