Market Overview - Page 108

May 11, 2022

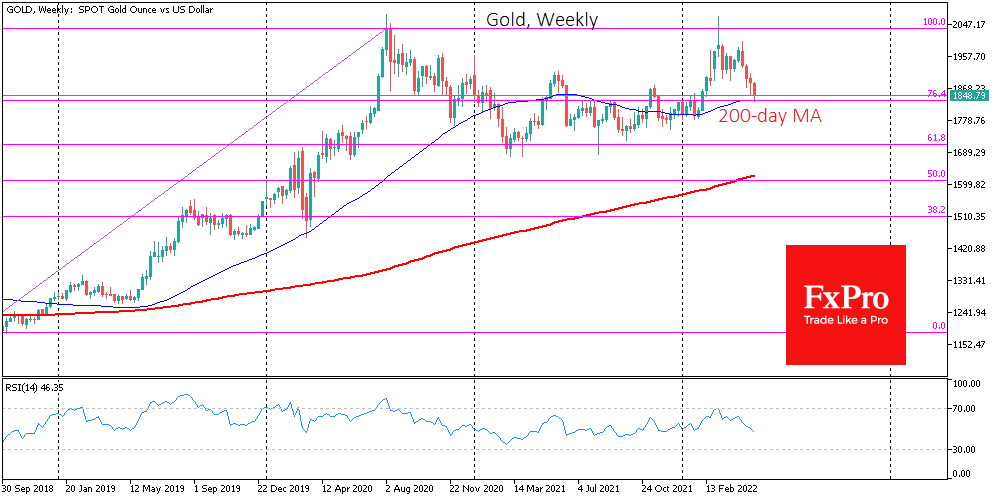

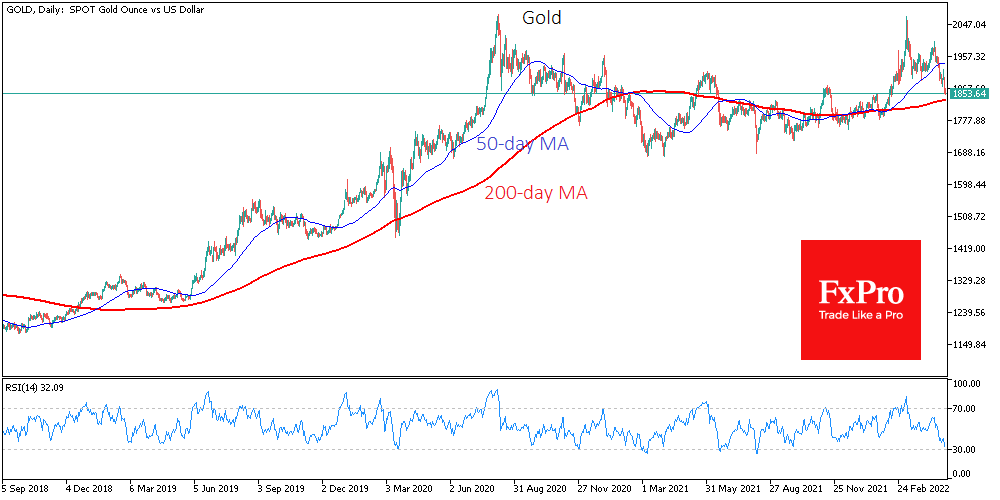

Gold dipped to $1832 on Wednesday morning, pulling back to a critical support line in the form of the 200-day moving average, losing more than 11% from the peak levels reached in early March. Gold has been under systematic pressure.

May 10, 2022

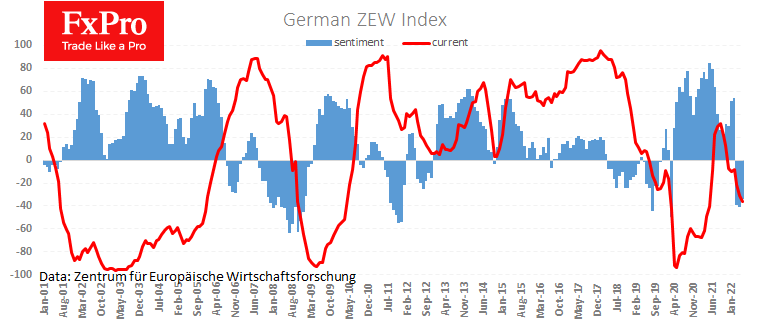

Economic Sentiment in Germany rose unexpectedly, according to the latest May assessment. The corresponding ZEW indicator rose to -34.3 in May from -41.0 a month earlier, against expectations of a dip to -43.0. Meanwhile, the current assessment of the economic.

May 10, 2022

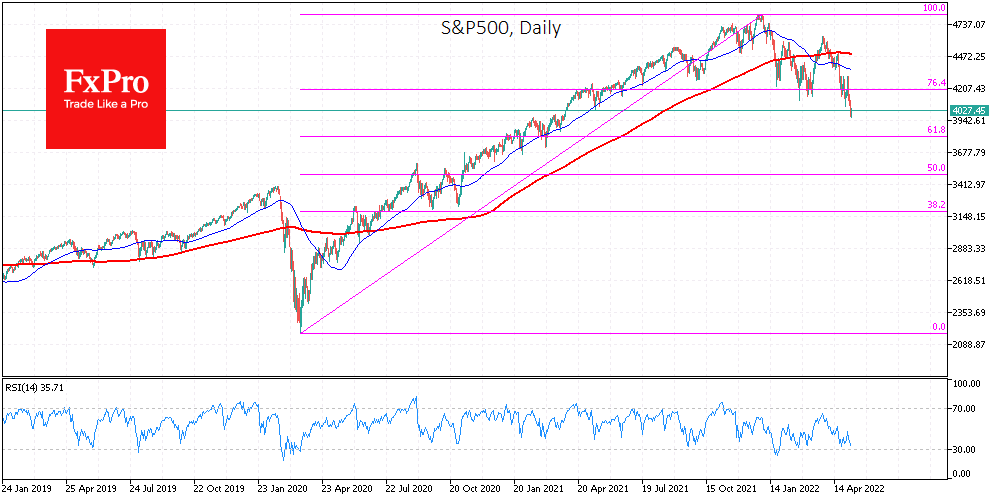

The S&P500 index lost about 3.2% Monday, closing below 4,000, a significant round level. The performance of S&P futures on Tuesday morning is feeding us with cautious optimism, pointing to buyers’ dominance at the start of trading in Europe. The.

May 9, 2022

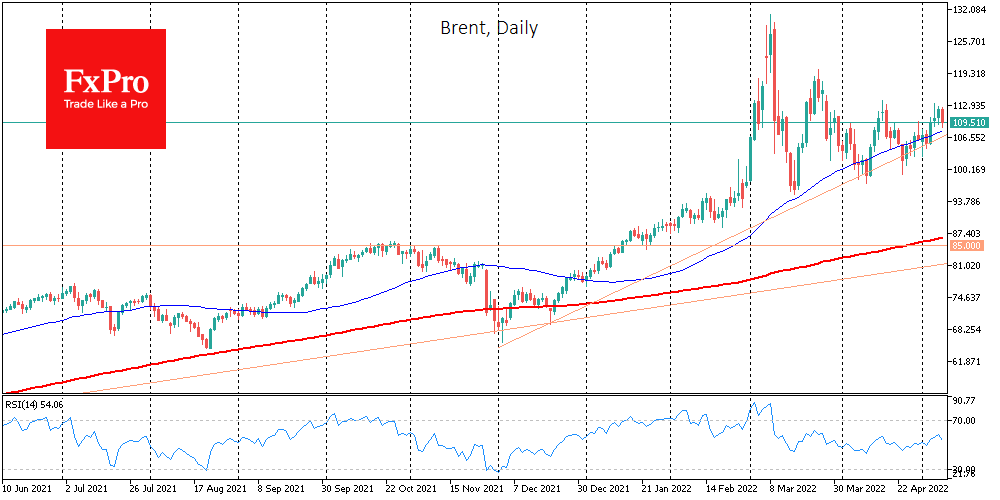

Brent crude is back below $110/bbl, losing 2% since the start of the day on Monday. At the beginning of May, oil largely remained within the trends of previous months. There are still accumulating risks that oil will break down.

May 6, 2022

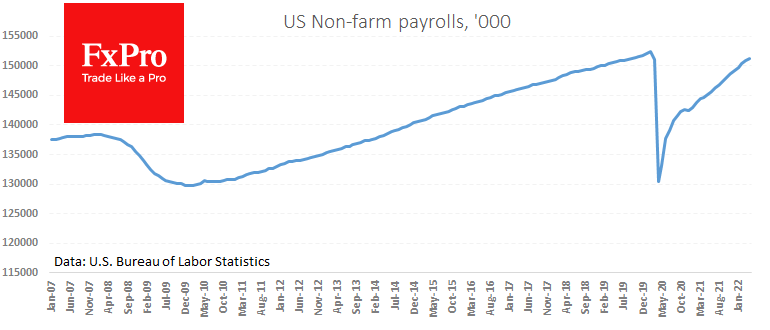

In April, the US labour market maintained its impressive growth rate with 428K new jobs. This is higher than the expected 390K and in line with the increase a month earlier. The current employment rate was 1.2 million below its.

May 6, 2022

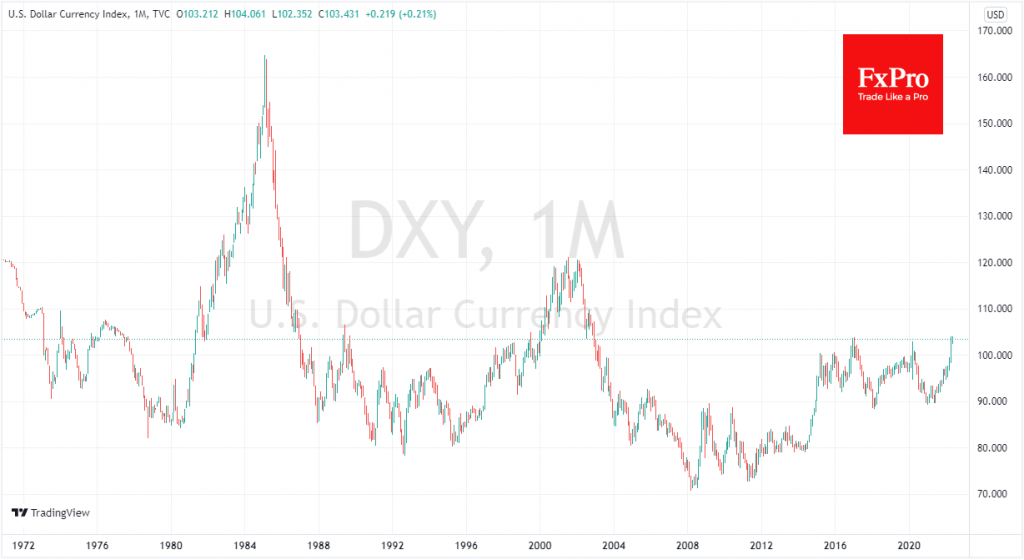

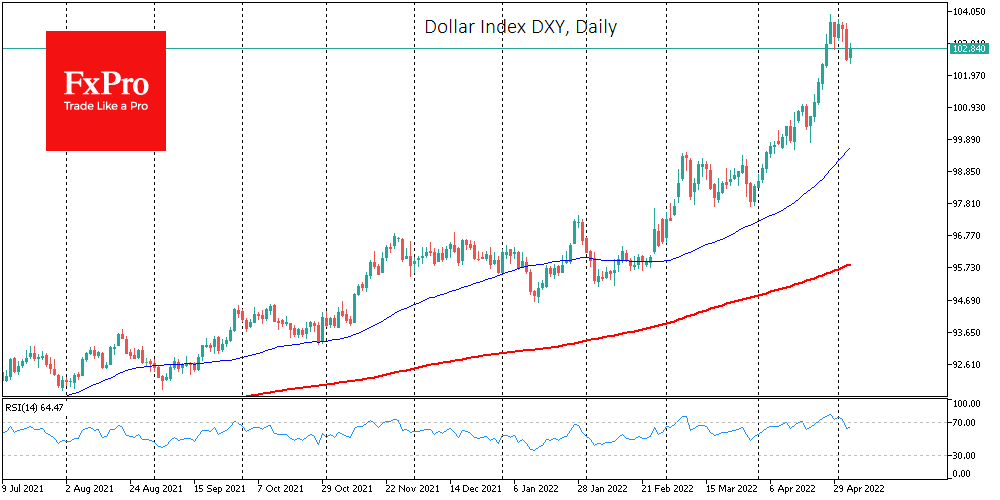

The dollar index renewed its highs in almost 20 years, surpassing 104, as crucial US currency rivals one by one lost buyer support. Suddenly the dollar was a safe haven of last resort. In 2018 and 2020, the dollar was.

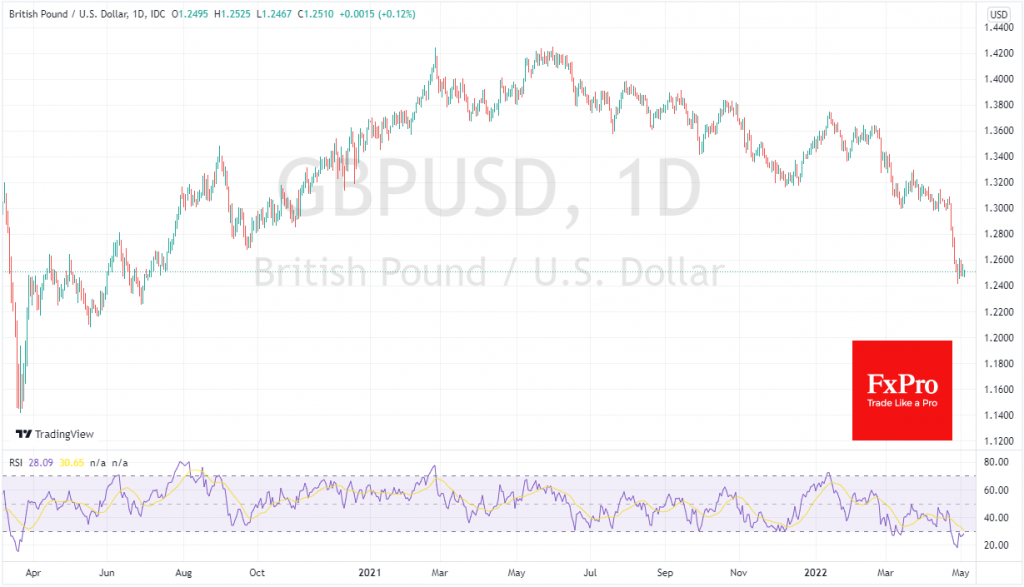

May 5, 2022

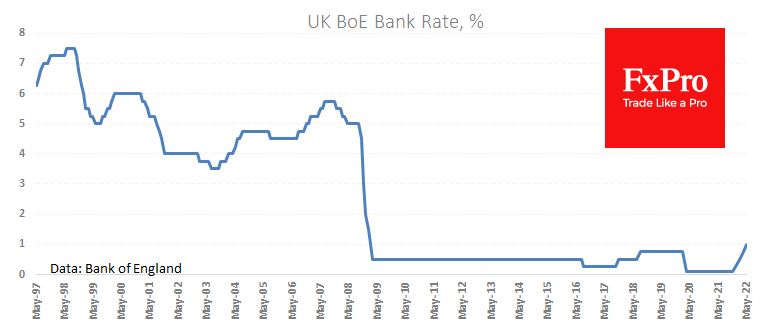

GBPUSD collapsed to 1.2380 by 2% or more than 230 pips from the start of the day on Thursday, with pressure intensifying after the Bank of England’s bank rate decision announcement. As analysts had expected, the Bank of England raised.

May 5, 2022

Last night the US Fed raised its rate by 50 bp and announced the looming start of asset sales from its balance sheet. The market expected these things, but the details and forecasts were a little less hawkish, which played.

May 4, 2022

GBPUSD is hovering around 1.2500 for the sixth consecutive trading session. But this stabilisation is more like the calm before the storm than a new balance point. The Pound enjoys a fragile equilibrium as investors and traders choose to take.

May 4, 2022

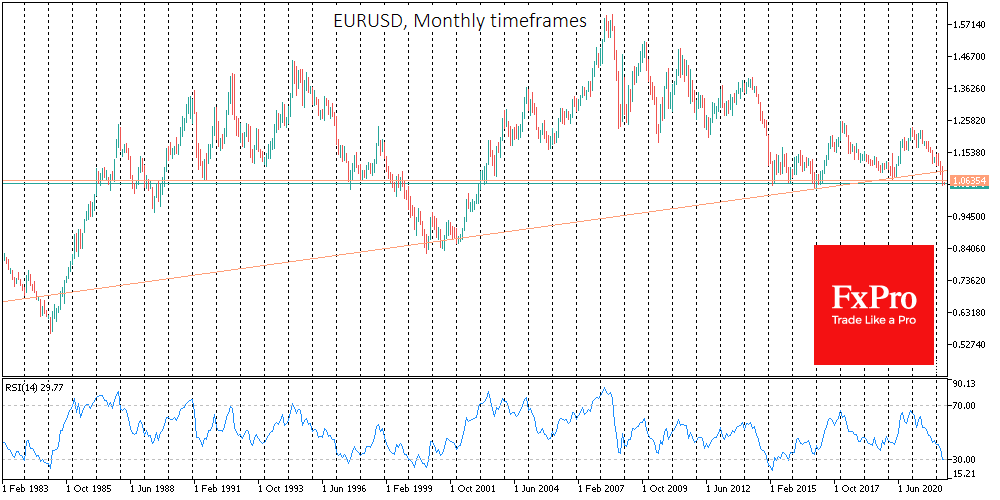

The dollar is near the extremes of the world’s most popular currencies. The dollar index is near the peaks of March 2020 and January 2017. Investors and traders have pushed the dollar to a vital turning point over the past.

May 3, 2022

The EURUSD has been hovering around 1.05 for the fourth day in a row, which is the last round level point before moving towards parity. This lull could be interpreted as an attempt by the bears to gain strength before.