Market Overview - Page 104

June 15, 2022

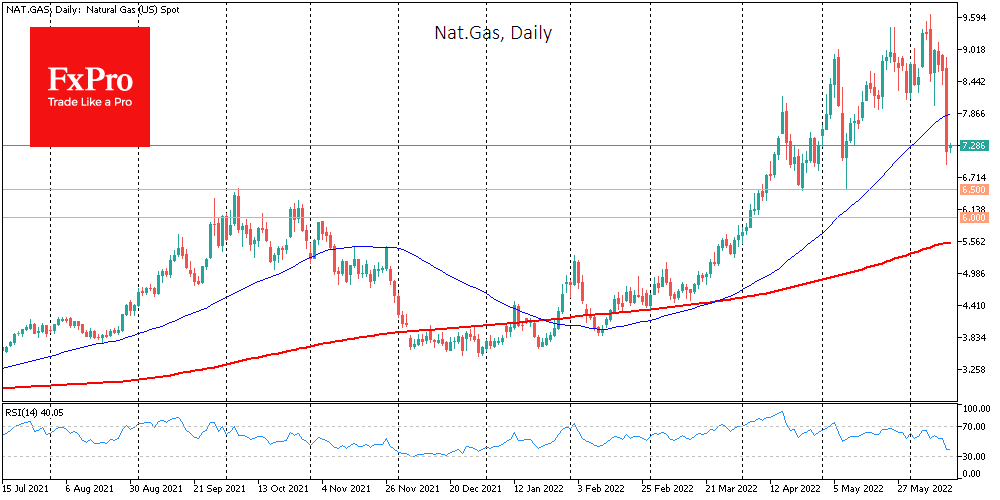

Oil and gas took a massive hit during the New York trading session. Oil and gas fell sharply for different reasons, but in both cases, we could witness a bearish energy reversal after more than fivefold price gains from the.

June 14, 2022

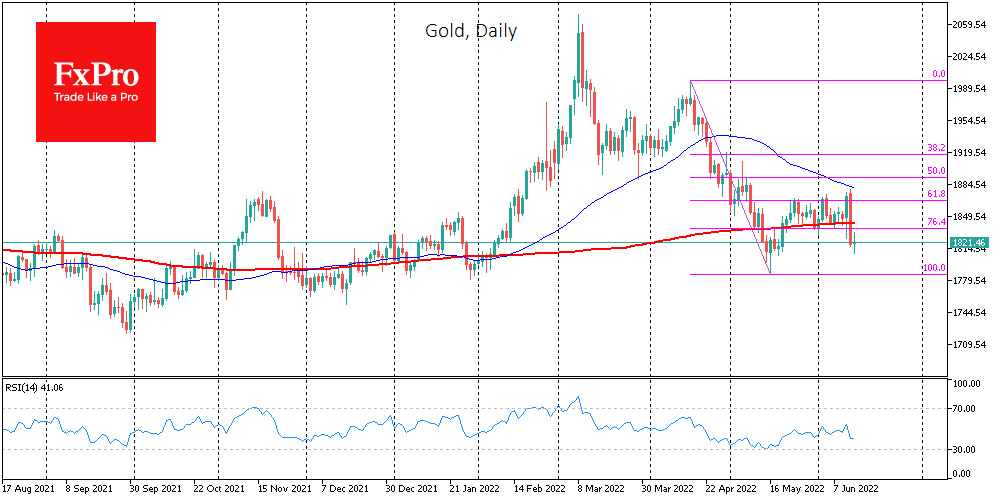

Gold lost about 3% on Monday alone and touched $1809 at the start of trading on Tuesday. Yesterday’s sell-off provided us with four medium-term bearish signals on the daily timeframes. First, the daily candlestick completely absorbed Friday’s bullish momentum, clearly.

June 14, 2022

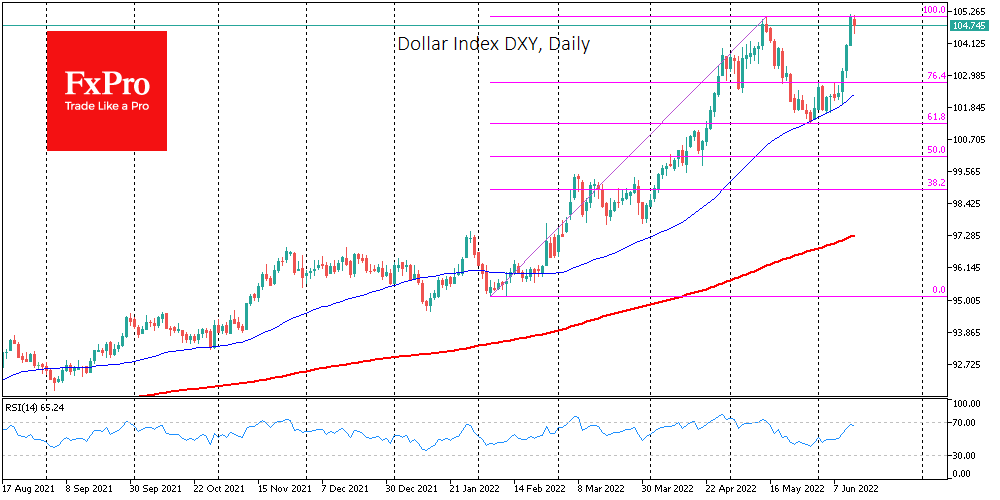

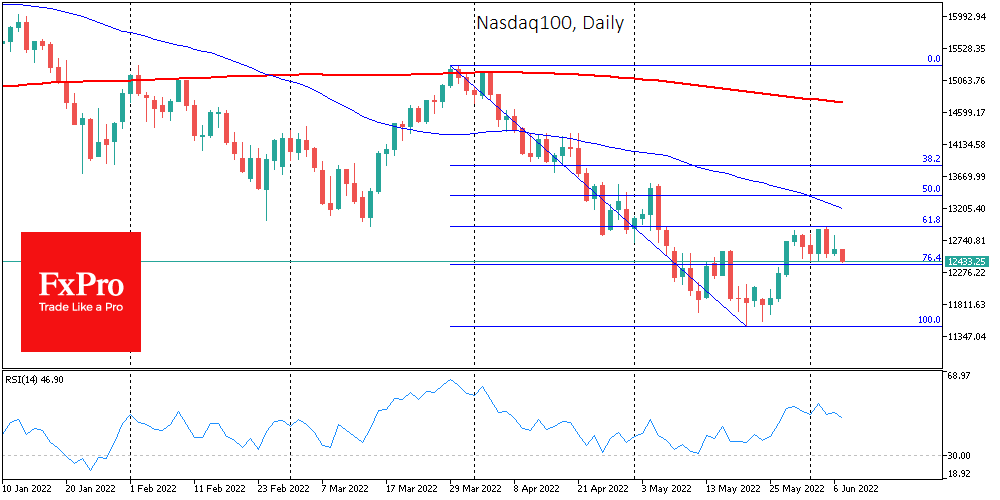

The S&P500 index fell 3.9% intraday on Monday, closing the index in the bear market territory. The Nasdaq collapsed more than 4.6%, losing a third of its all-time high in November last year. The dollar index closed above 105 on.

June 13, 2022

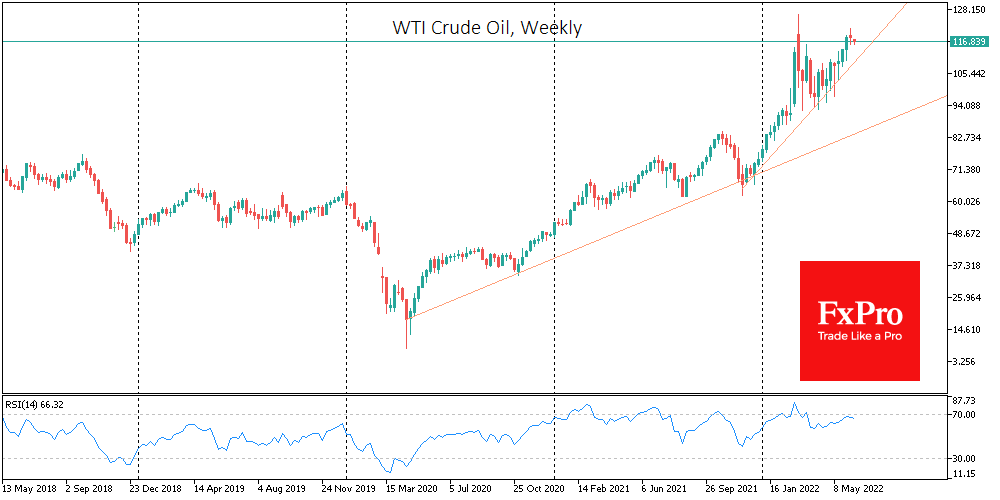

Oil fell symbolically over the past week, losing 1.3% to $116.3 a barrel of WTI amid trading in Europe on Monday. Locally oil looks like a solid defensive asset, with oil companies such as Exxon Mobil renewing record highs, attracting.

June 13, 2022

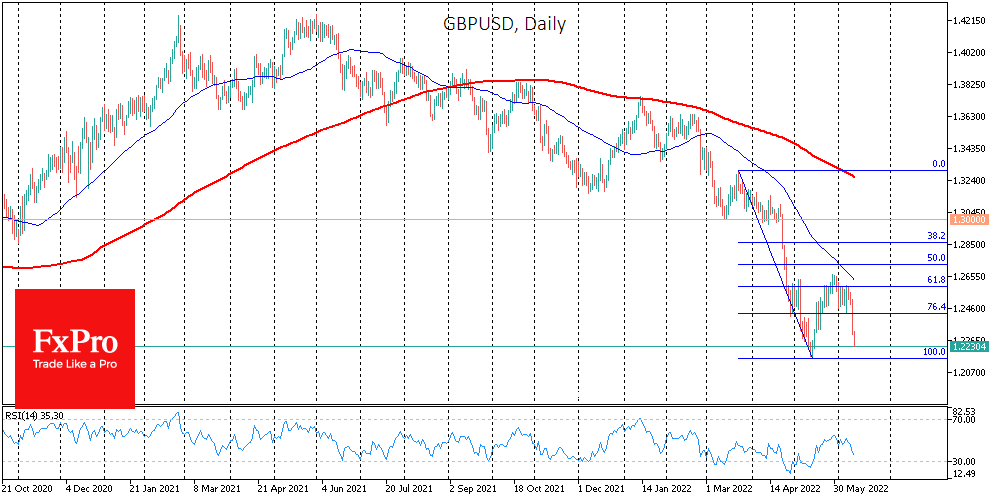

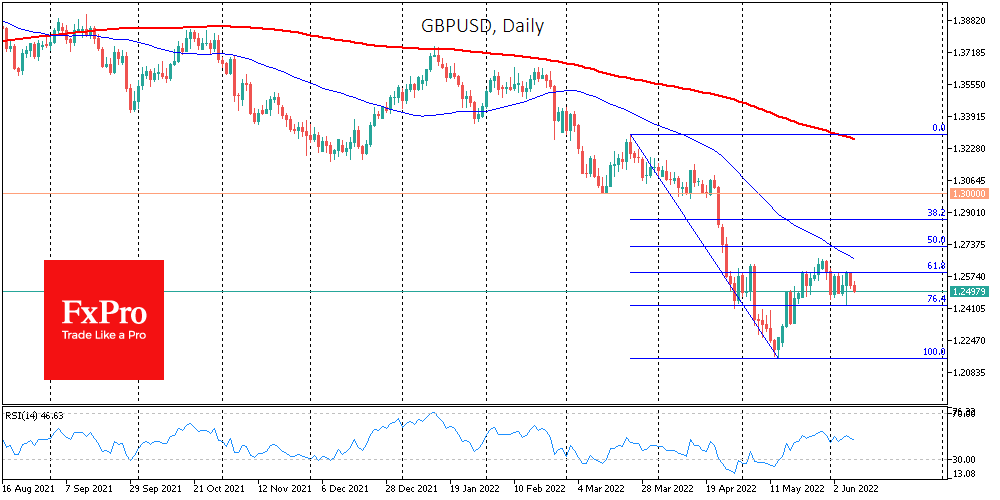

GBPUSD is trading near 1.2250, losing about 3% in the last four trading sessions. Pressure on the pound intensified on Monday, releasing a disappointing set of statistics. Monthly estimates showed the economy shrinking by 0.3% for April, contrary to expectations.

June 10, 2022

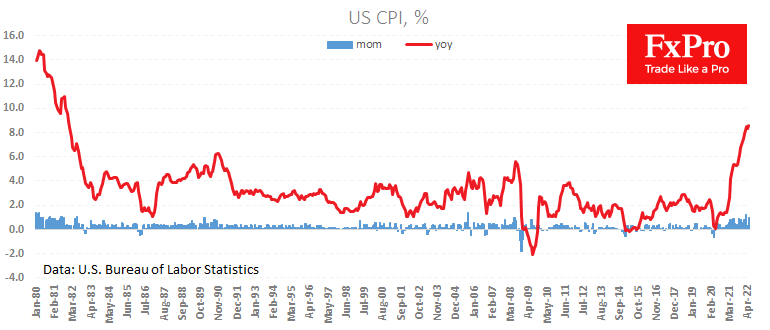

The US consumer price index accelerated by 8.6% in May from 8.3% a month earlier. The new data exceeded expectations, rebutting hopes that US inflation is already slowing. Today’s inflation report is the last big release before the Fed meeting.

June 10, 2022

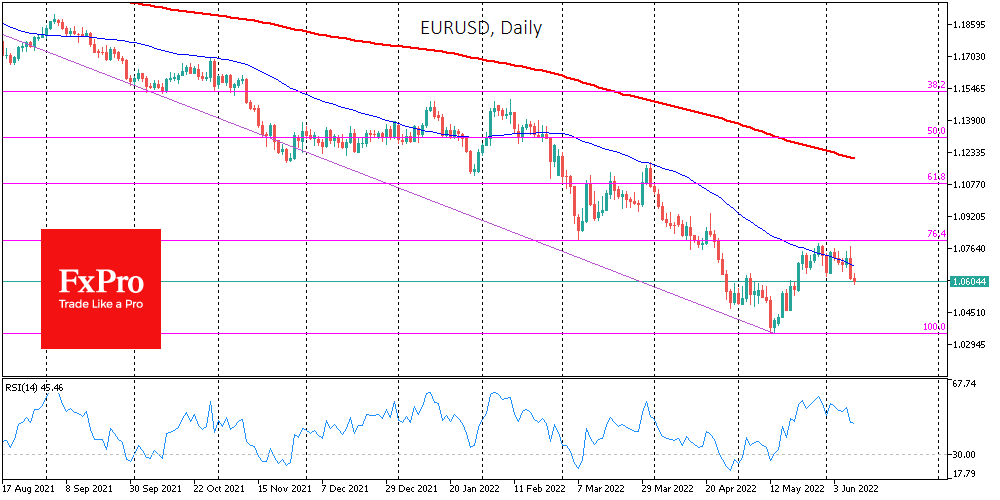

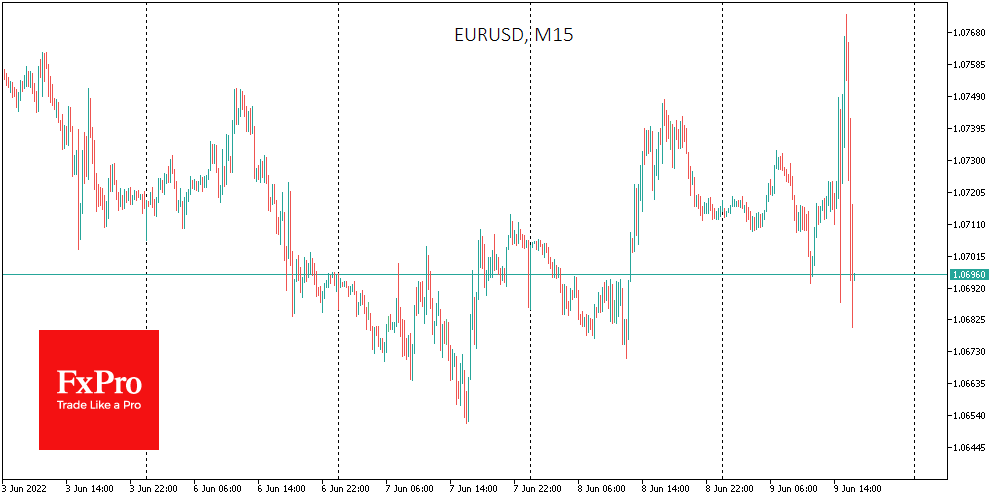

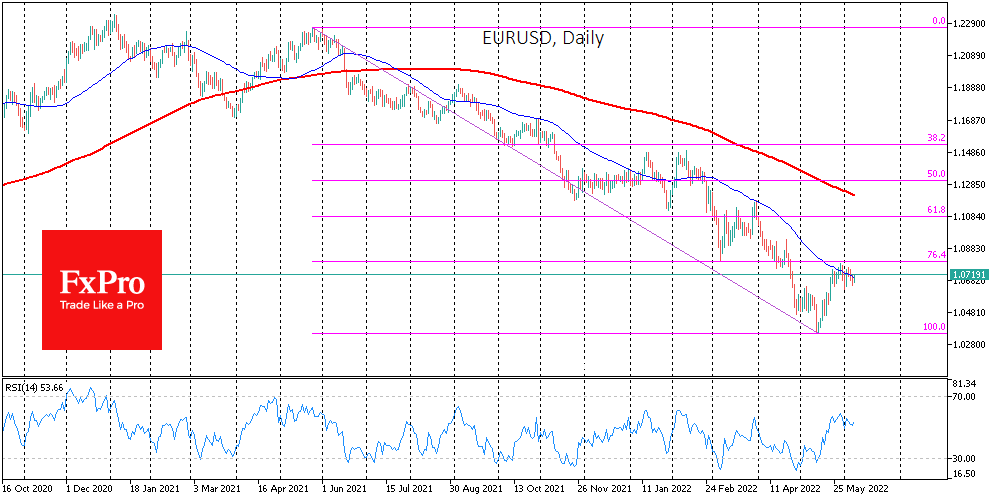

As expected, euro buyers’ optimism faded immediately after the ECB press conference began, returning EURUSD back below 1.0600. Shortly after the initial surge in reports of an actual reversal in ECB policy, investors and traders delved into assessments of how.

June 9, 2022

The European Central Bank has kept its key rate unchanged and officially announced that it will stop buying as part of its asset purchase programme from July 1. In an accompanying commentary, the ECB explicitly indicated that it intends to.

June 9, 2022

The British Pound is retreating for a second day, returning below the 1.25 level, failing to build on the positive momentum at the start of the week. The pressure appears to be driven by rising government bond yields in global.

June 8, 2022

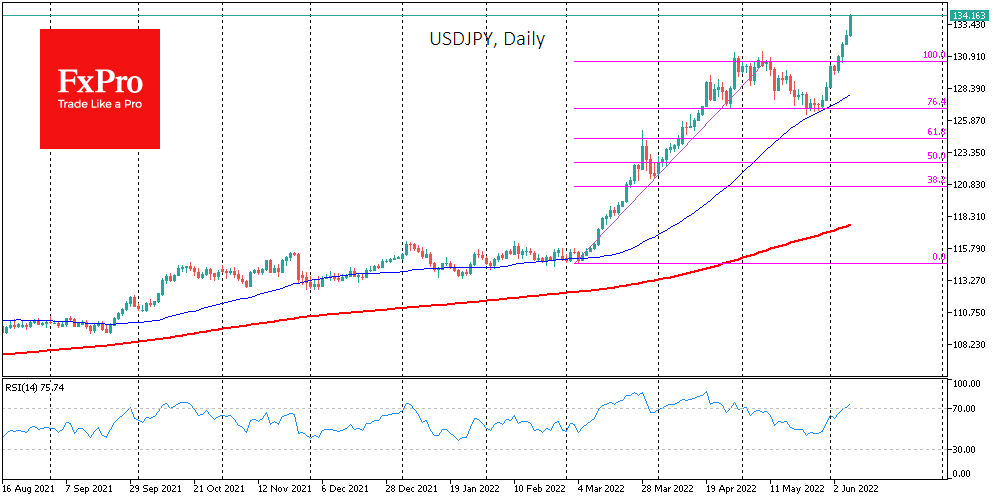

The USDJPY has added for the sixth trading session out of the last seven, this week renewing 20-year highs. The pair reached 134, getting very close to the extremes of January 2001, near 135. We see that this new momentum.

June 8, 2022

The single currency returned under 1.0700 after three days of decline. Late last month, EURUSD failed to consolidate above the 50-day moving average, confirming the prevalence of the downtrend. The bounce in the pair in the second half of last.