Market Overview - Page 102

July 6, 2022

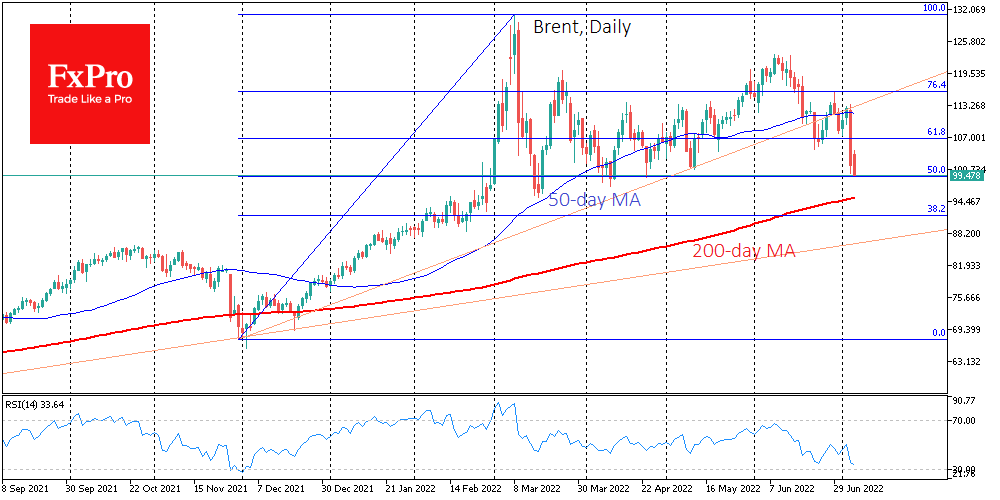

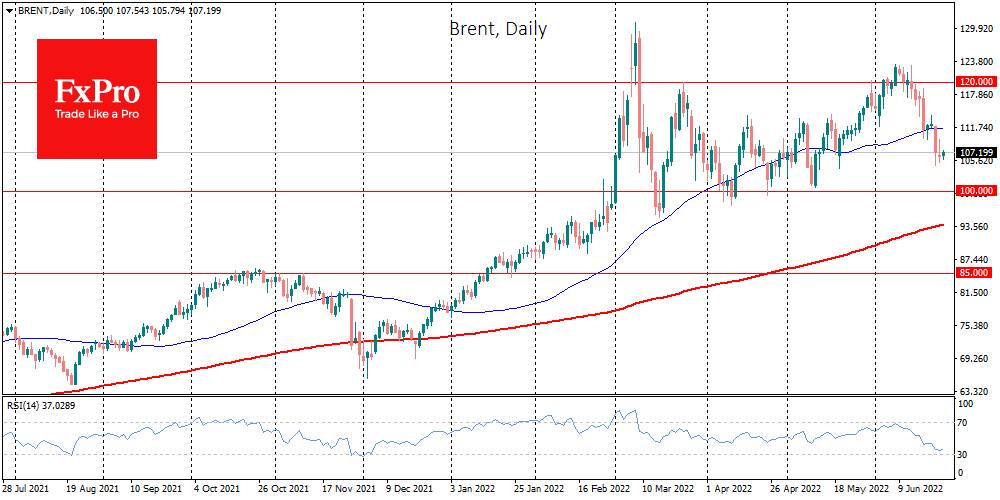

Brent crude is losing more than 10% in just over a day to $100, repeating the lows of early May and raising the question of breaking the uptrend since last December. In our view, the trend break occurred when the.

July 5, 2022

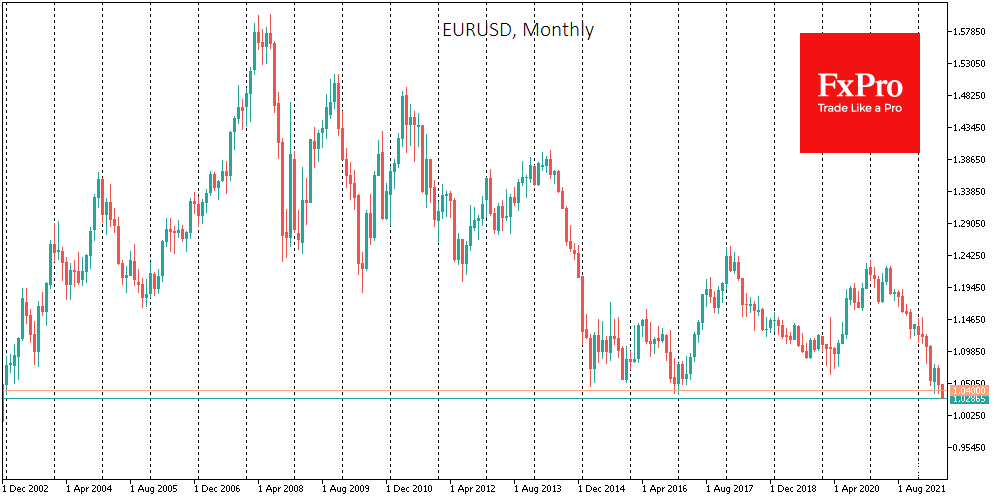

The single currency collapsed below 1.03 for the first time since December 2002. The 1.0350 area euro buyers have managed to defend three times in the last month and a half and at the end of 2016. In our view,.

July 5, 2022

The Turkish lira has been losing more than 1% over the last 24 hours following the release of another batch of inflation statistics which show no sign of easing and trades near 17.0. Consumer prices rose by 5% during June,.

July 4, 2022

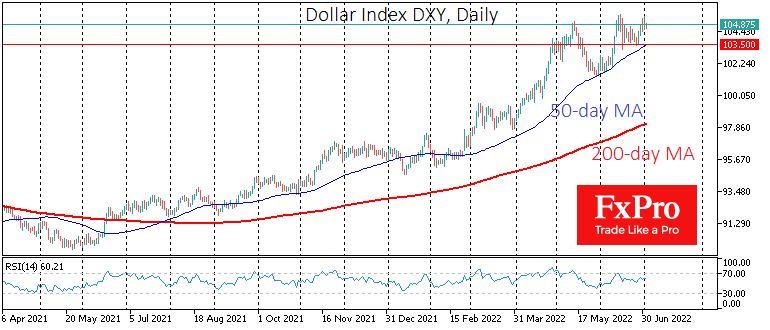

While the calendar’s second half of the year started last Friday, it will probably not begin in the markets until the upcoming US jobs data is released this Friday. It is worth sorting out where the US currency currently stands.

July 4, 2022

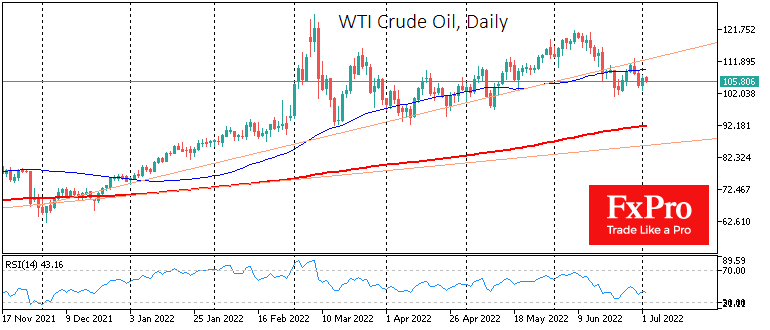

WTI closed last week with minor changes, close to $107. The dynamics of the previous two weeks indicate a timid attempt to return to the bullish trend after the correction. However, there are more signs of an end to the.

July 4, 2022

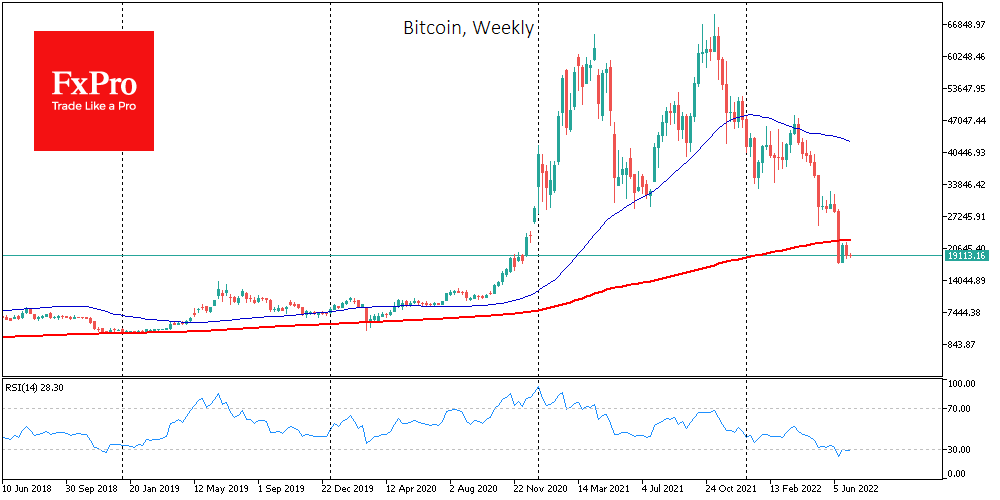

Bitcoin is down 9.2% over the past week, finishing around $19,400 and trading near 19,000 on Monday morning. Ethereum has lost 13.3% in the last seven days, while other top altcoins in the top 10 have fallen from 8.6% (BNB).

July 1, 2022

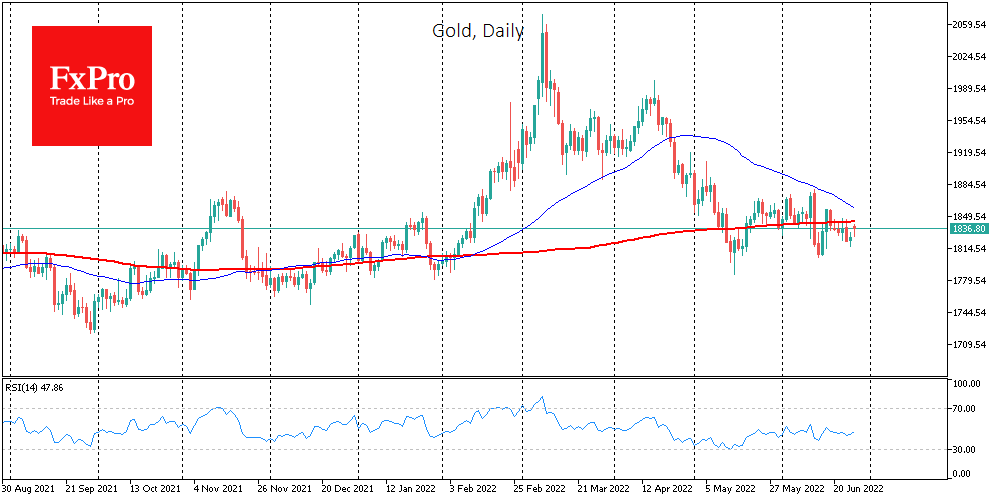

Gold dived below $1800 on Friday morning, testing this year’s low at $1790. It has managed to get support from buyers on a dip below the important round level in the last six months, but this time buyers may come.

June 29, 2022

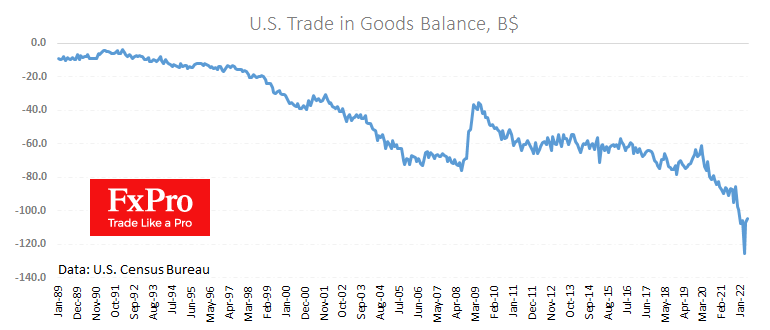

The US merchandise deficit narrowed to its lowest since the end of last year at 104.3bn compared to 106.7bn in April and 125.7bn in March. The record deficit in March was triggered by panic buying a wide range of goods.

June 29, 2022

The rebound in financial markets that we have seen since the beginning of last week seems to have stalled. Various key market indices are showing signs of growth fatigue. The rebound is mainly related to the depth of the previous.

June 28, 2022

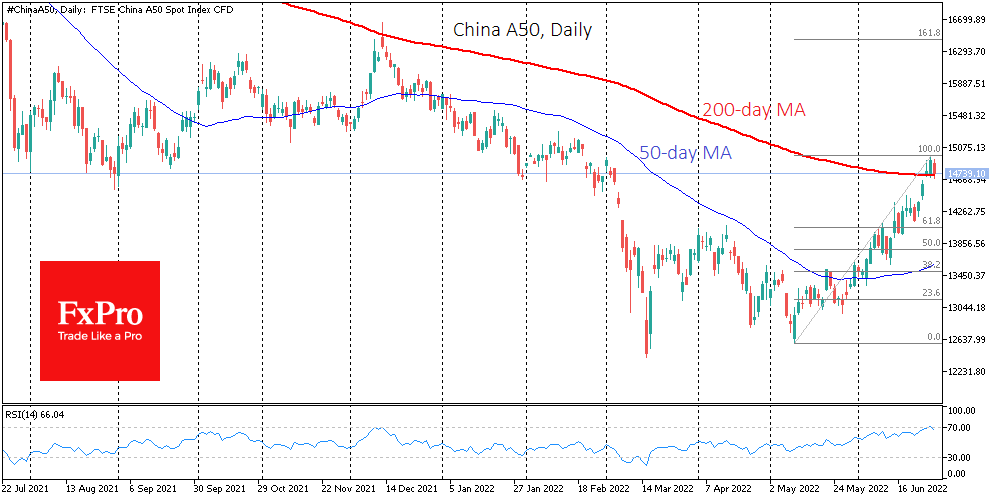

In the financial markets, the demand for risky assets has done its baby steps in recovery. The currency market recently has been moving in small increments, but straightforwardly, selling off the dollar against most developed country rivals. Interestingly, this retreat.

June 27, 2022

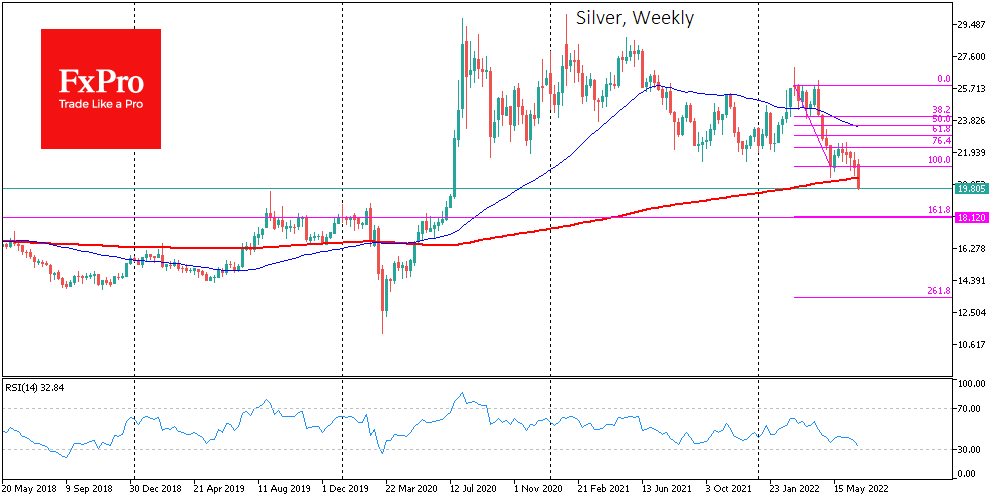

G7 countries are discussing refusing to import gold from Russia – another attempt to limit the country’s export earnings. However, this news is more about headlines than the potential to become an actual market mover. The price of the troy.