Market Overview - Page 101

July 13, 2022

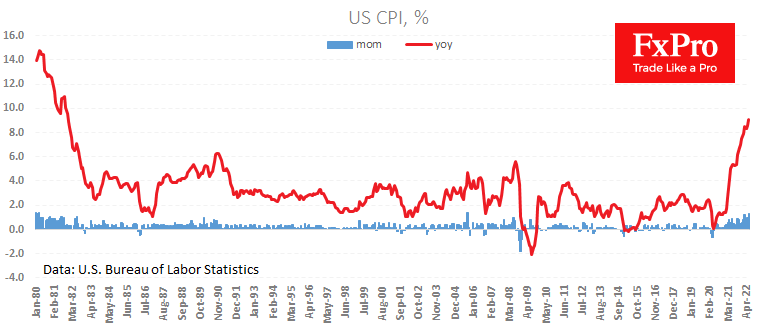

US consumer inflation hit a 41-year high and beat forecasts, reaching 9.1% y/y in June against 8.6% a month earlier and expected an increase to 8.8%. The data above expectations triggered a jump in the dollar and renewed pressure on.

July 13, 2022

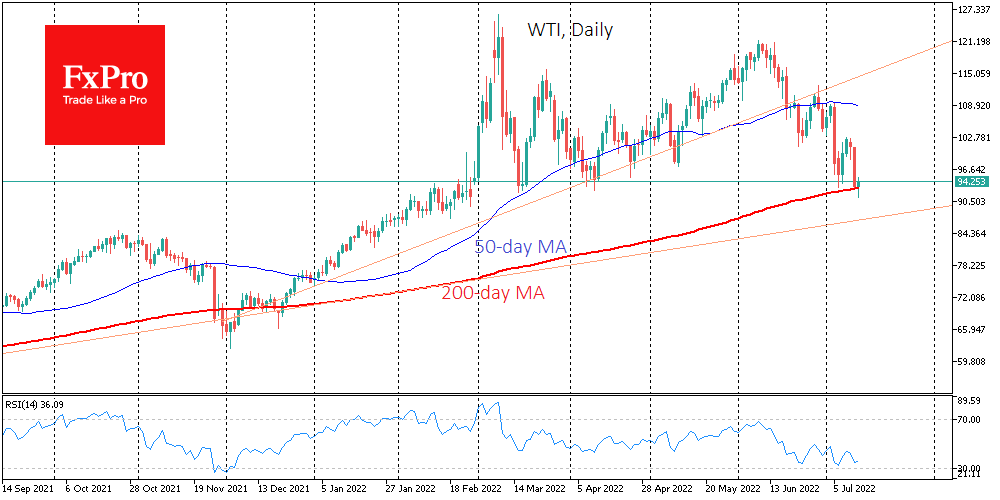

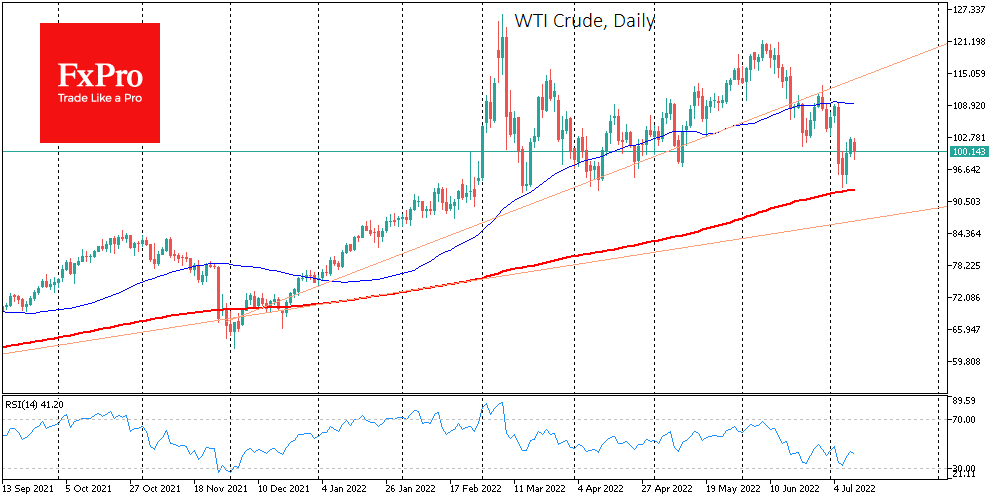

Oil lost more than 10% in just over 24 hours, starting to decline late in the day on Monday. WTI crude fell to $91.30 as it sold off. Having lied on the way down stop orders, oil at one point.

July 13, 2022

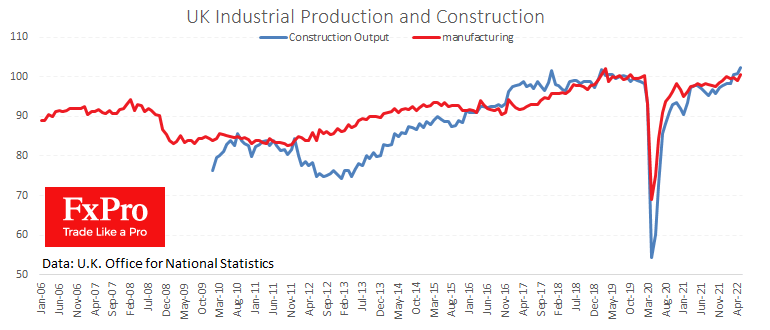

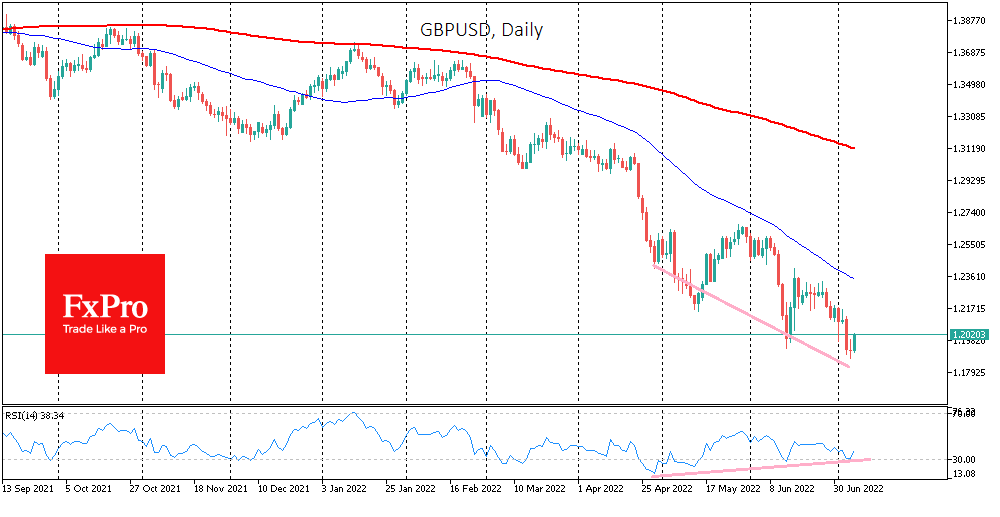

A new package of UK macro statistics showed some recovery and exceeded expectations, supporting pound buying, although it did not help the stock market. The monthly economic growth is estimated at 0.5% in May after a decline of 0.2% in.

July 12, 2022

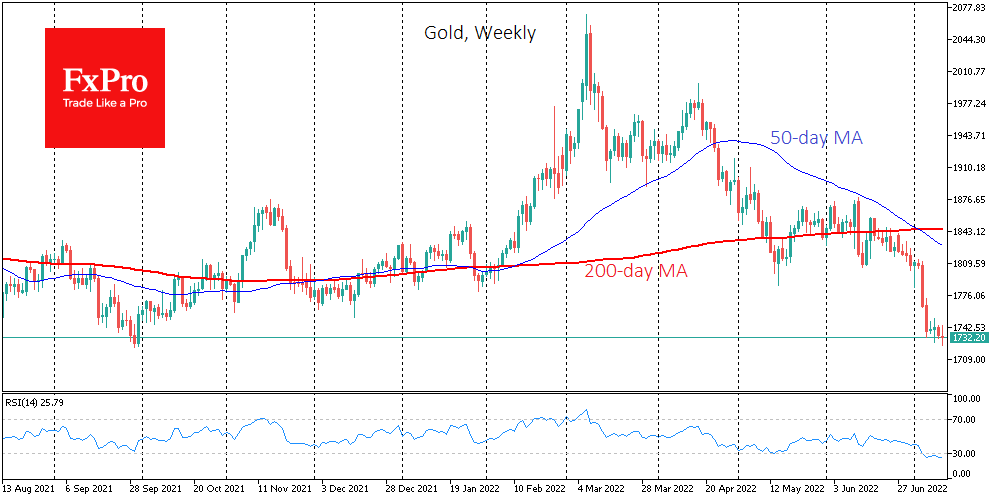

The price of gold fell to a new nine-month low on Tuesday, at one point falling below $1725. In the region of $1720-1740, gold has been finding support in the declines of the last 15 months, and the daily charts.

July 12, 2022

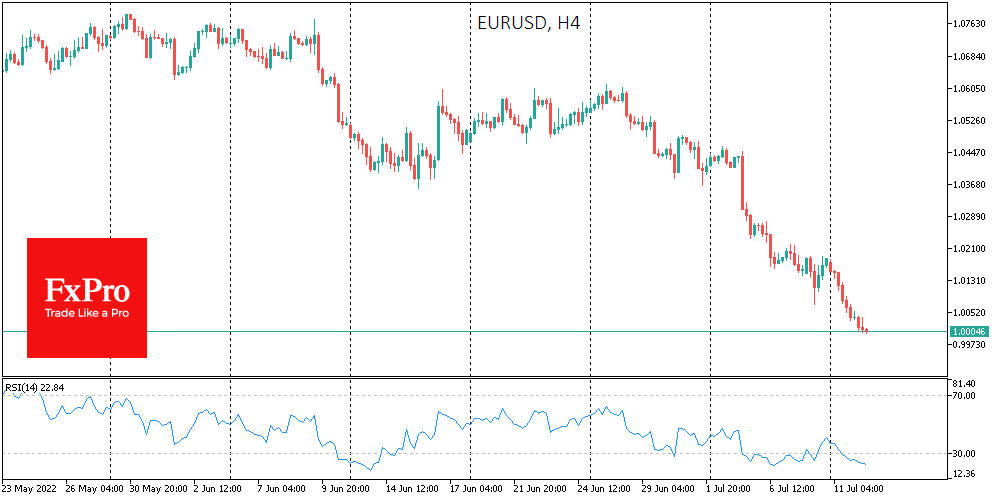

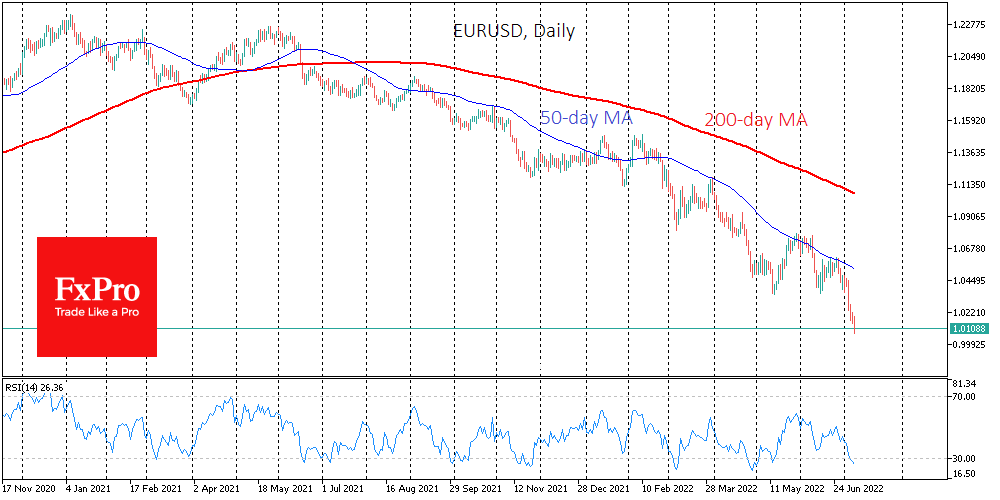

The euro is one hair from parity with the dollar, a psychologically important line above which the single currency has been trading for the last generation. After losing more than 4% over the week, the EURUSD looks excessively and emotionally.

July 12, 2022

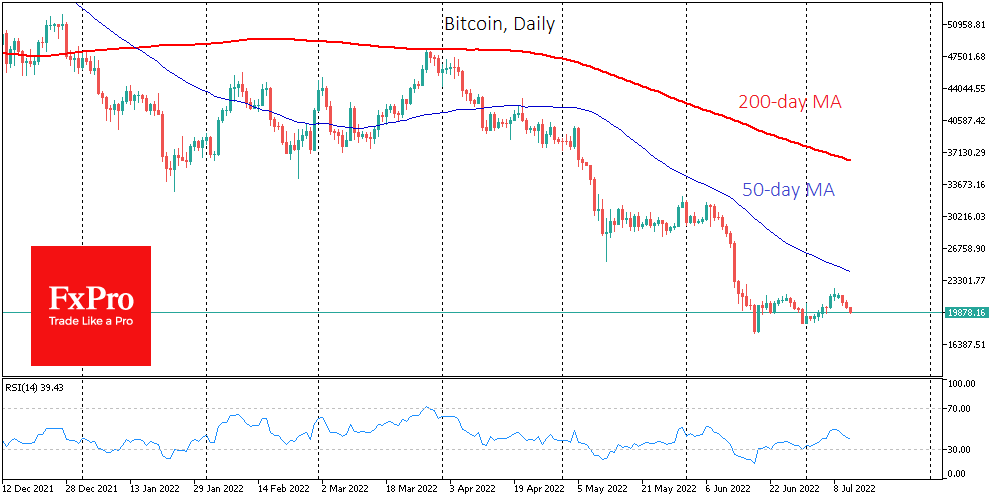

Bitcoin was down 2.5% on Monday and, continuing its decline on Tuesday morning, was back at $20,000. Ethereum has lost 5.2% in the past 24 hours to $1090. Altcoins in the top 10 fell from 1.1% (XRP) to 5.2% (Solana)..

July 11, 2022

WTI crude oil has been losing 3.5% since trading on Monday, bouncing back below $100 after rebounding late last week. A stronger dollar and the return of a cautious tone to financial markets as the week begins indicate that downside.

July 11, 2022

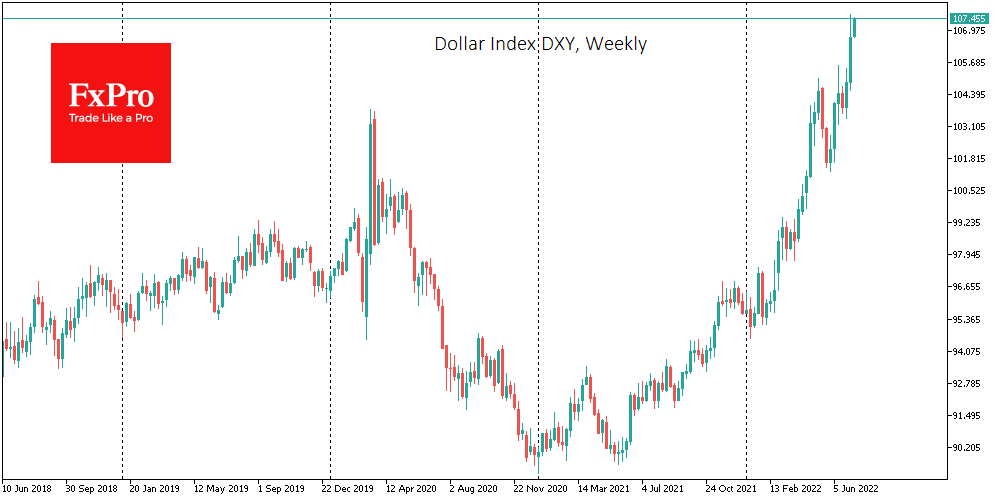

The dollar index is making new highs, rising to 107.6 on Friday afternoon, and by the start of active trading in Europe, trading at 107.45. This is the highest rate since October 2002. The dollar index has added about 20%.

July 8, 2022

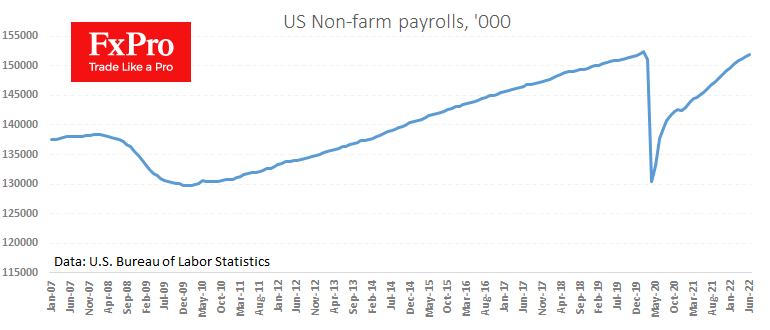

The US labour market created 372K new jobs in June, close to the rate of growth in the previous three months when growth was 398K, 368K and 384K. The data came out better than expectations, which suggested a slowdown to.

July 8, 2022

The single currency fell to 1.0071 in the early European session on Friday. For EURUSD, it is a new low since December 2002 and a continuation of the massive sell-off that started last Tuesday. Looking solely at the technical picture,.

July 7, 2022

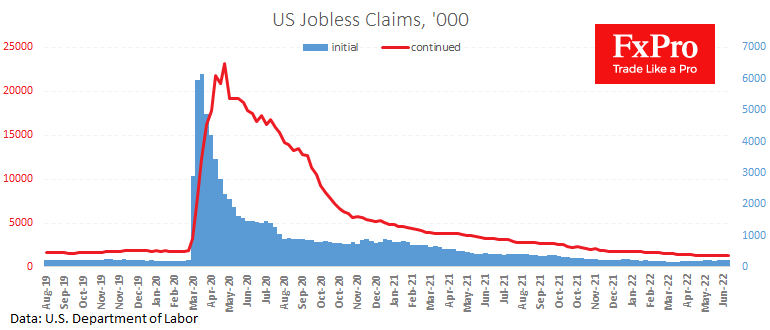

The US labour market seems to be letting off steam. Indicators ahead of official employment statistics point to a cooling of the market. New weekly jobless claims data showed an increase to 235K against expectations of 230K and 231K a.