Crypto Review - Page 104

April 17, 2020

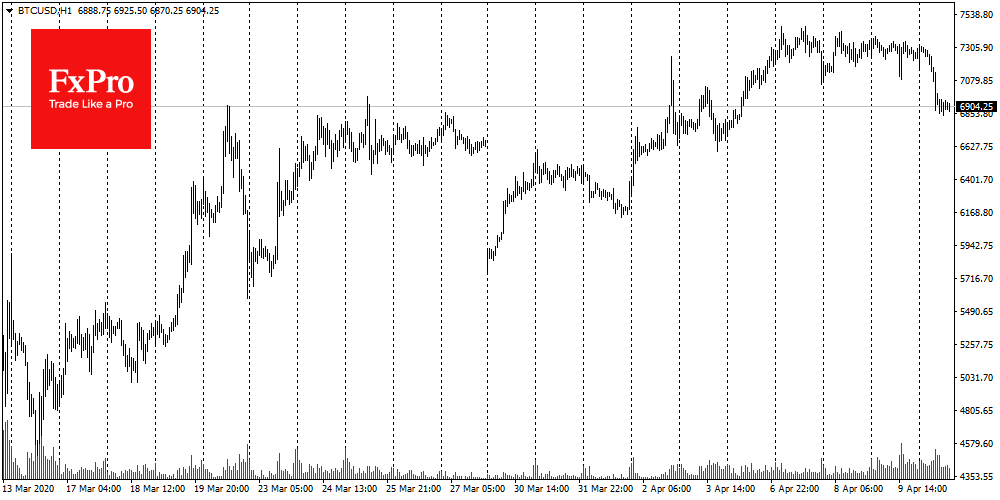

Bitcoin keeps its gain yesterday and changes hands around $7,100. According to CoinMarketCap, trading volumes in the Bitcoin network are stably above $40 billion. However, bitcoin cannot grow above $7,100 so far. The more impressive growth was shown by Ethereum.

April 16, 2020

Bitcoin retains its superior feature – volatility. After a decline to $6,500 earlier today, bitcoin showed a sharp rebound to levels above $7,100. Strengthening of the first cryptocurrency is accompanied by increased trading volumes, confirming the strength of the positive.

April 15, 2020

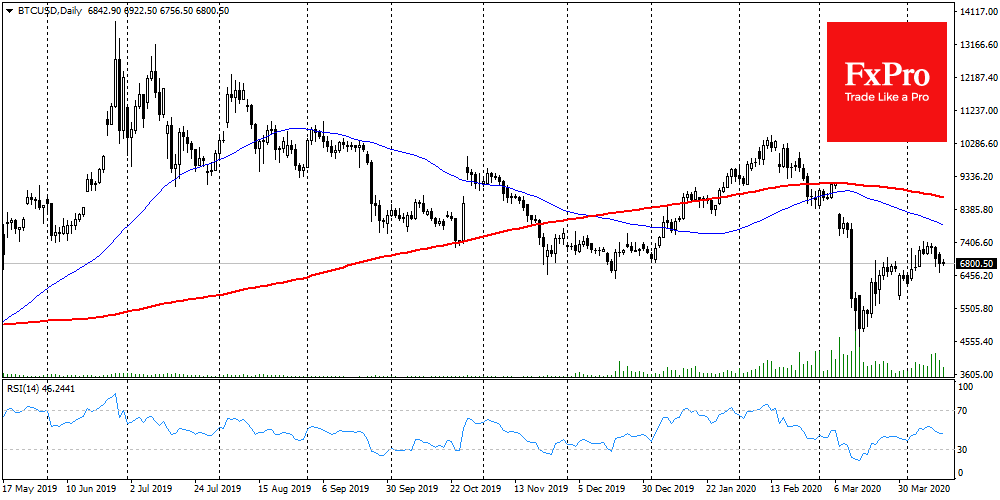

During the last day, bitcoin has been holding positions around $6,900, almost unchanged in the price for the day. Сrypto market participants believe that bitcoin may still attempt to attack a $7K level. However, the longer the cryptocurrency is in.

April 14, 2020

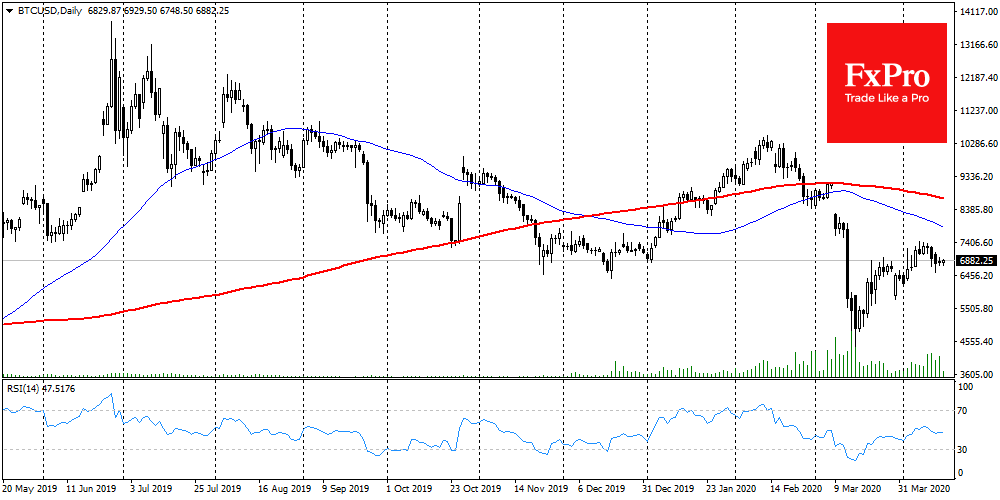

Bitcoin grew more than 2% over the last 24 hours to $6,900. But the daily candlesticks reflect the downward trend since last week, and the mini-rebound of the previous few hours takes place along with lower trading volumes. The Crypto.

April 10, 2020

Bitcoin lost more than 4% in one day, pulling down the rest of the crypto market. As is often the case, the sideway price trend ends with a sale for bitcoin. At the moment, the benchmark cryptocurrency has rolled back.

April 9, 2020

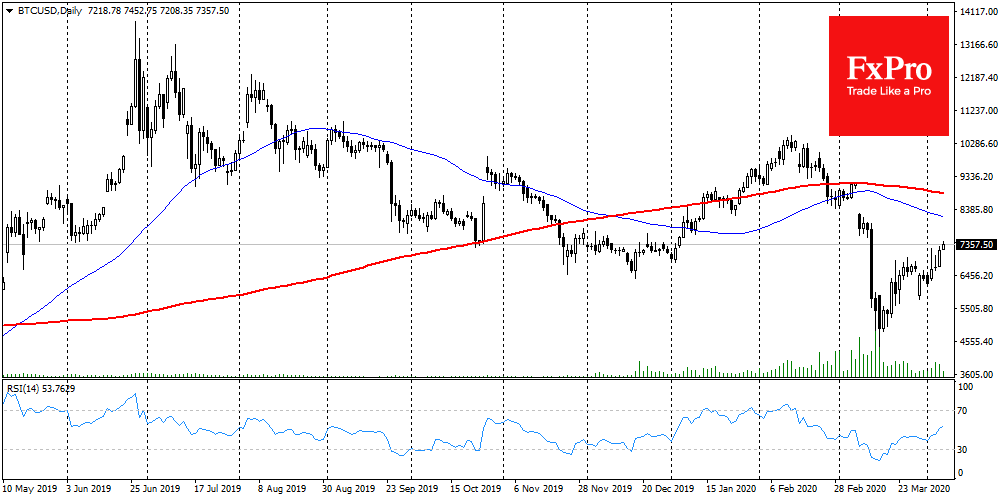

Over the past few days, bitcoin stood at around $7,300, which is good news after a collapse a month ago. The first cryptocurrency recovered to levels at the start of the year that now seems like a century ago. Because.

April 8, 2020

In the last 24 hours Bitcoin faced pressure around $7,400, dipping to $7,150, but soon returned above $7,300. BTCUSD got support at reduced trading volumes, which may indicate that the recovery is fragile. The Bitcoin Greed and Fear index grew.

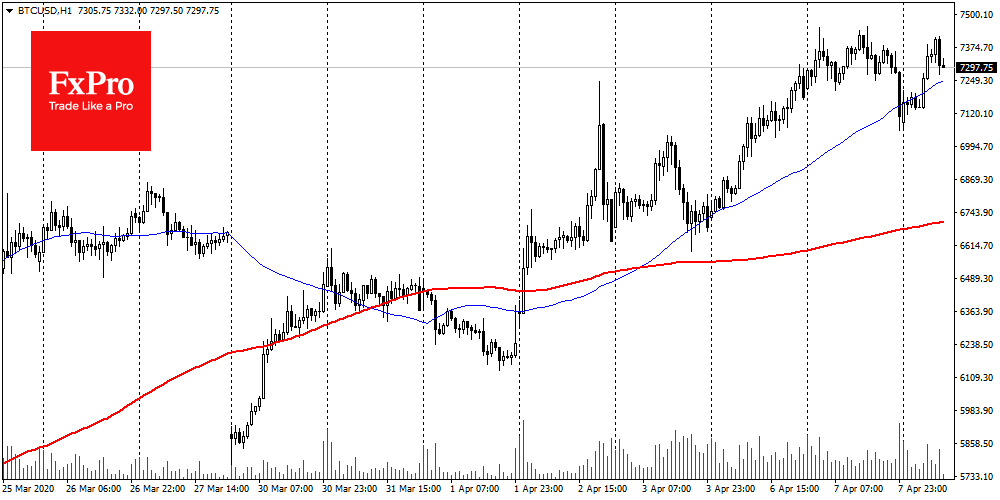

April 7, 2020

On Tuesday morning, Bitcoin showed 4.5% growth and traded around $7,300. At some point, bitcoin climbed to $7,400 but attracted sellers. According to CoinMarketCap, in the last 24 hours, trading volumes in the Bitcoin network increased by 45%. Markets believe.

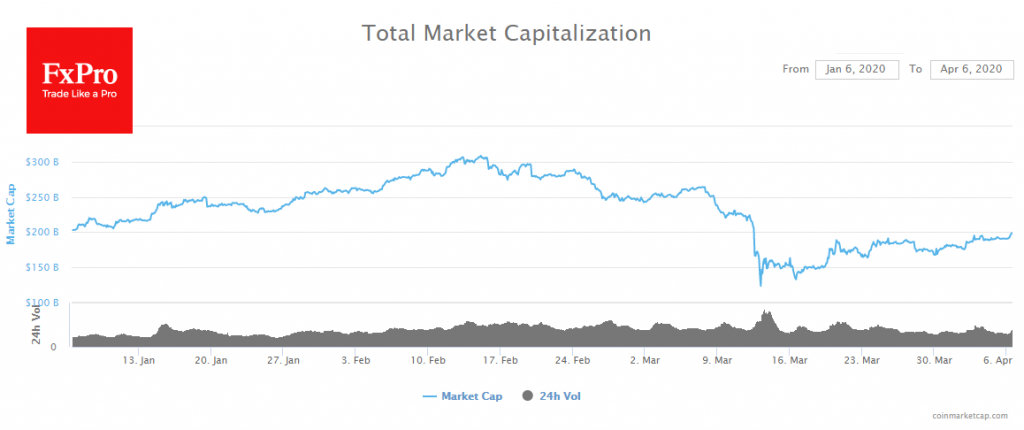

April 6, 2020

Bitcoin and the overall crypto market started the week on a positive note. In the last 24 hours, the benchmark cryptocurrency has added almost 4% and managed to exceed $7K. Along with the price, the growth of trading volumes is.

April 3, 2020

During the last 24 hours, Bitcoin bounced to $7,100 and then declined to $6,800 by Friday morning. The growth of the cryptocurrency took place against the background of growing trade volumes, which is an additional positive impulse. Despite the growth.

April 2, 2020

Bitcoin climbed by 5% in the last 24 hours and is trading at around $6,650. Yesterday, the benchmark coin was clinging to $6,200, but it started to grow sharply late at night. As for technical analysis, this price jump closed.