Technical analysis - Page 7

January 15, 2026

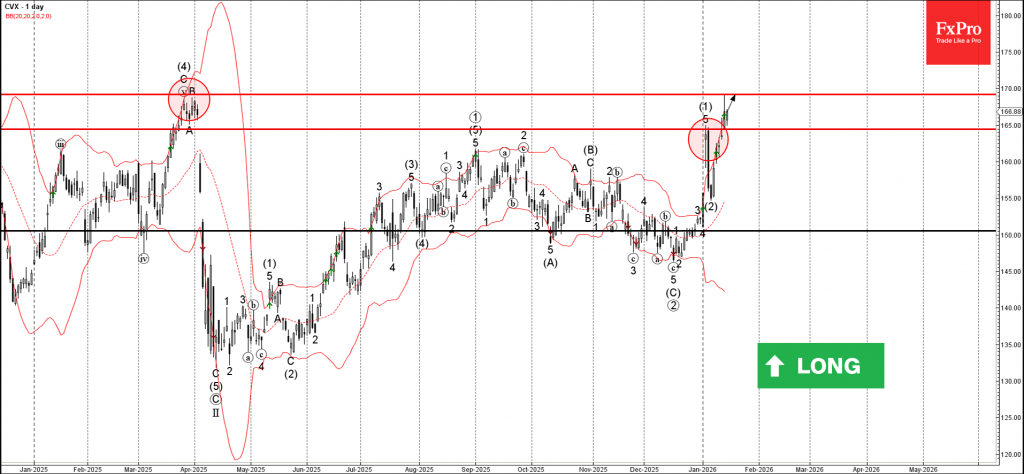

Chevron: ⬆️ Buy – Chevron broke strong resistance level 165.00 – Likely to rise to resistance level 168.90 Chevron recently broke above the strong resistance level 165.00 (which stopped the previous impulse wave (1) at the start of January). The breakout of.

January 15, 2026

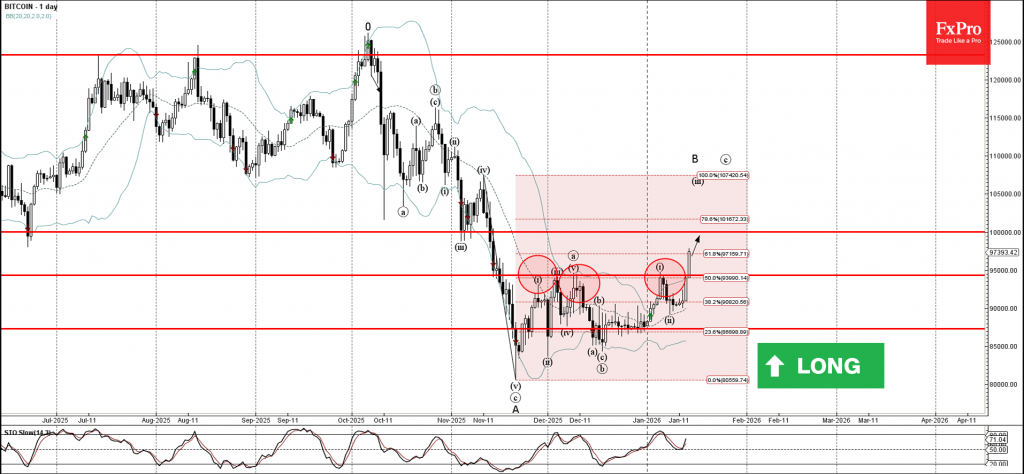

Bitcoin: ⬆️ Buy – Bitcoin broke resistance area – Likely to rise to resistance level 100000.00 Bitcoin cryptocurrency recently broke the resistance area between the pivotal resistance level 95000.00 (which has been reversing the price from November) and the 50%.

January 15, 2026

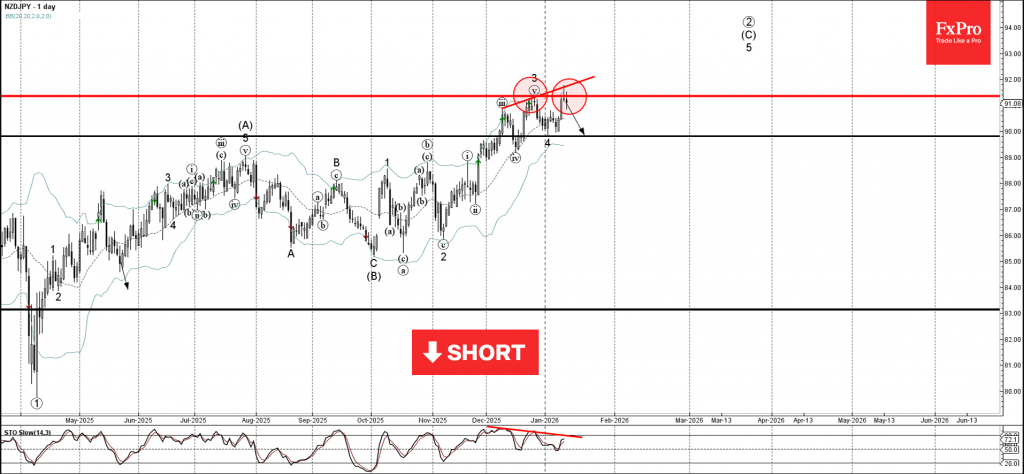

NZDJPY: ⬇️ Sell – NZDJPY reversed down from the resistance area – Likely to fall to support level 90.00 NZDJPY currency pair recently reversed down from the resistance area between the pivotal resistance level 91.35 (which stopped the previous impulse.

January 13, 2026

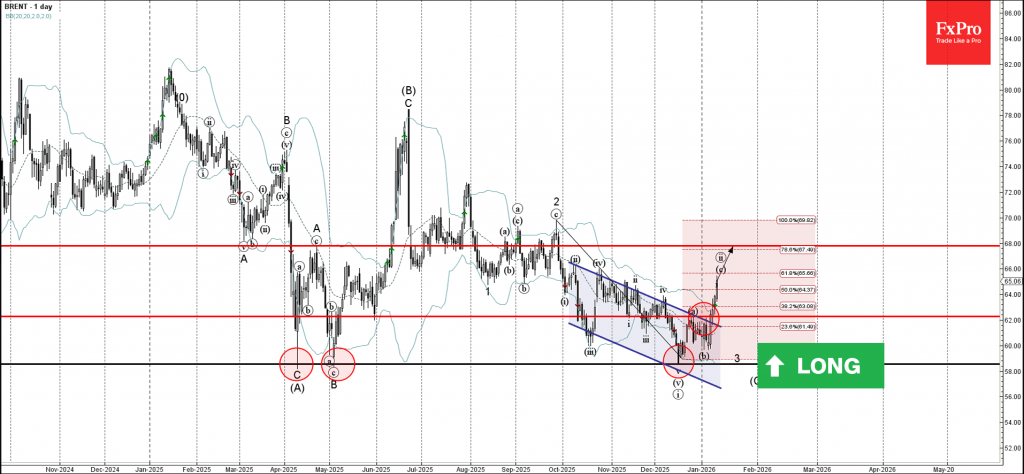

Brent Crude oil ⬆️ Buy – Brent Crude oil rising inside impulse wave c – Likely to rise to resistance level 68.00 Brent Crude oil recently broke the resistance area between the resistance level 62.00, resistance trendline of the daily.

January 13, 2026

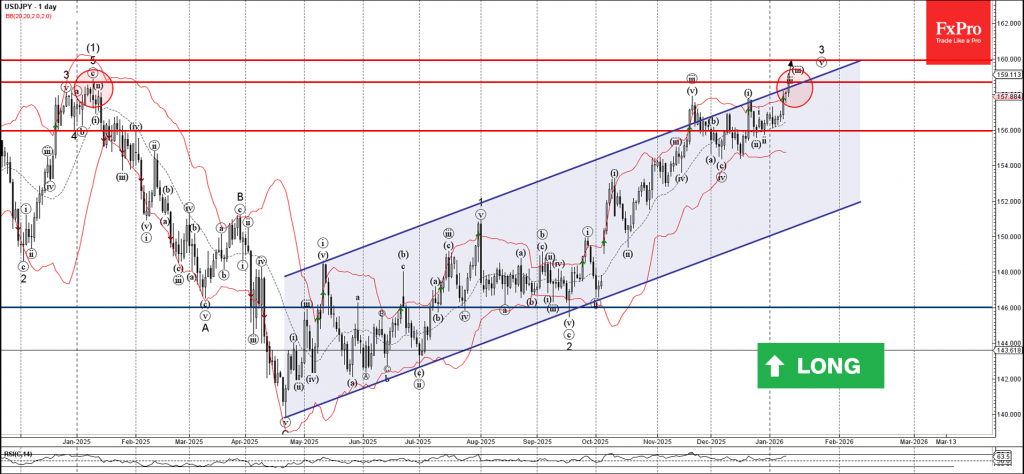

USDJPY ⬆️ Buy – USDJPY broke resistance area – Likely to rise to resistance level 160.00 USDJPY currency pair recently broke the resistance area between the long-term resistance level 158.70 (which started the sharp downtrend in January) and the resistance.

January 13, 2026

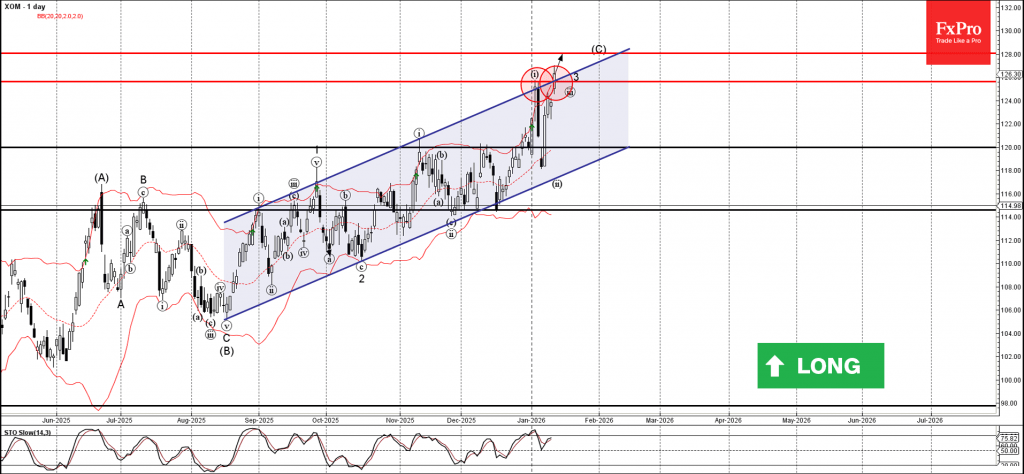

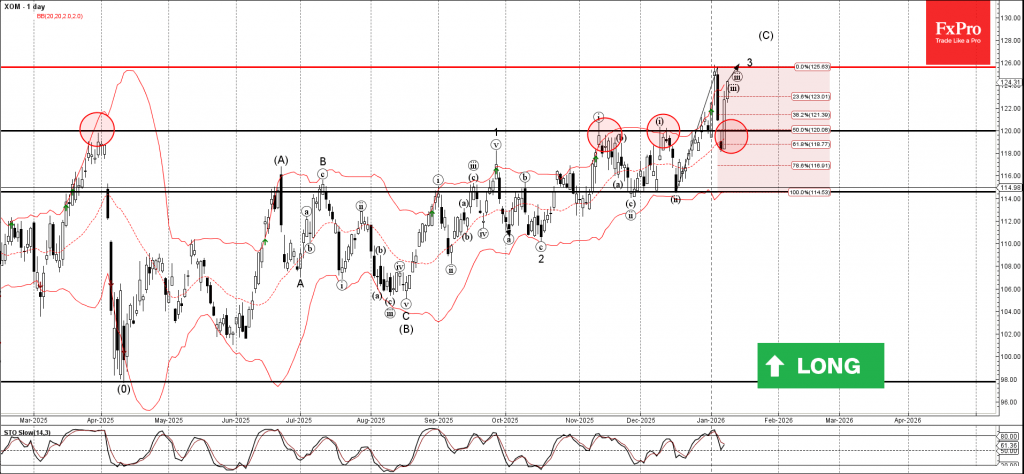

Exxon Mobil ⬆️ Buy – Exxon Mobil broke resistance level 125.60 – Likely to rise to resistance level 128.00 Exxon Mobil recently broke the resistance area between the key resistance level 125.60 (which stopped the previous impulse wave i) and.

January 13, 2026

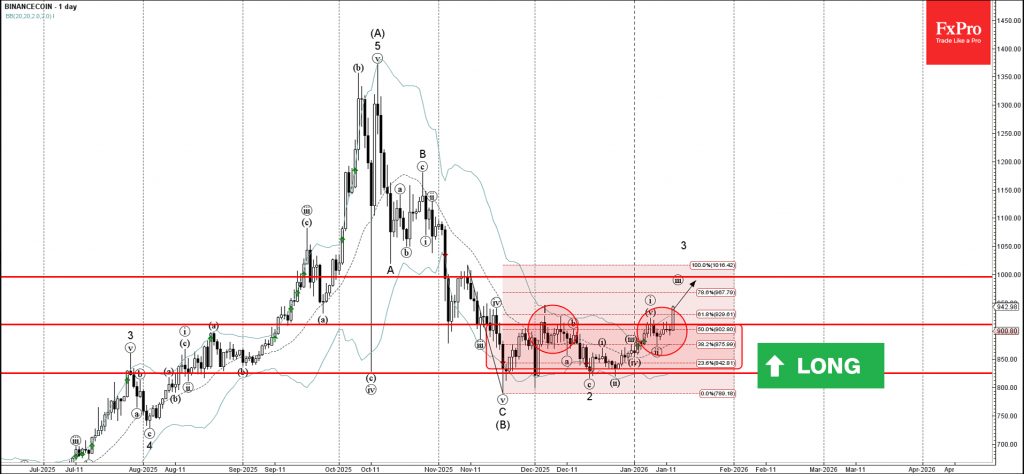

Brent Crude oil ⬆️ Buy – BNB broke out of sideways price range – Likely to rise to resistance level 1000.00 BNB recently broke the resistance area between the resistance level 910.00 (upper border of the sideways price range from.

January 13, 2026

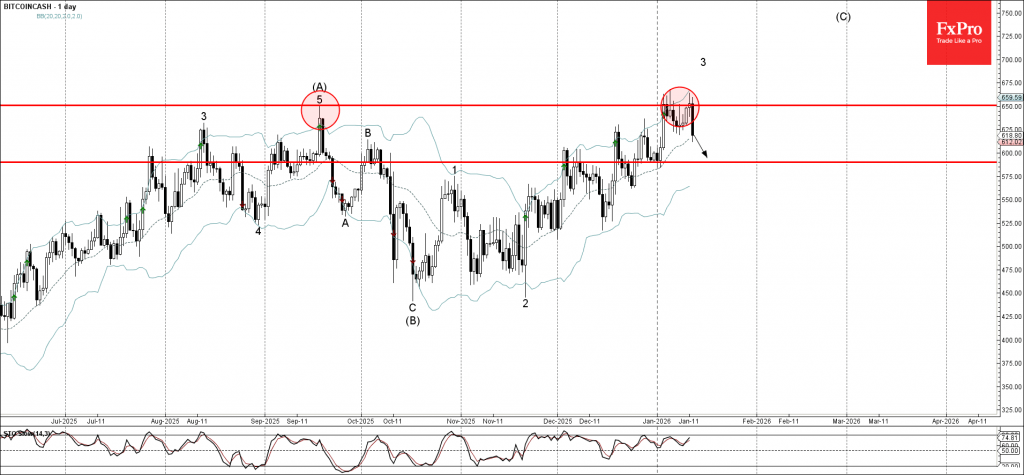

Bitcoin Cash: ⬇️ Sell – Bitcoin Cash reversed from resistance area – Likely to fall to support level 590.00 Bitcoin Cash cryptocurrency recently reversed from the resistance area between the long-term resistance level 650.00 (which stopped the sharp uptrend in.

January 13, 2026

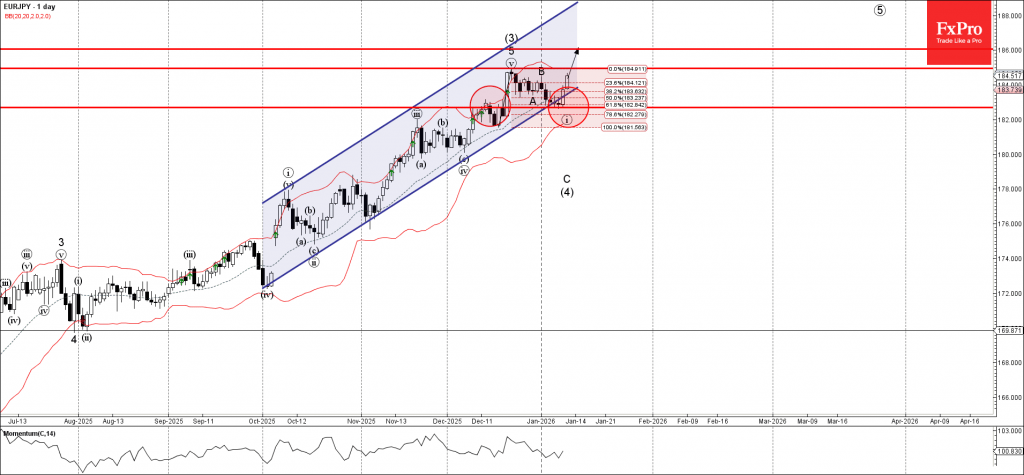

EURJPY: ⬆️ Buy – EURJPY reversed from support area – Likely to rise to resistance level 184.90 EURJPY currency pair recently reversed from the support area between the key support level 182.70(former resistance from December) and the 61,8% Fibonacci correction.

January 12, 2026

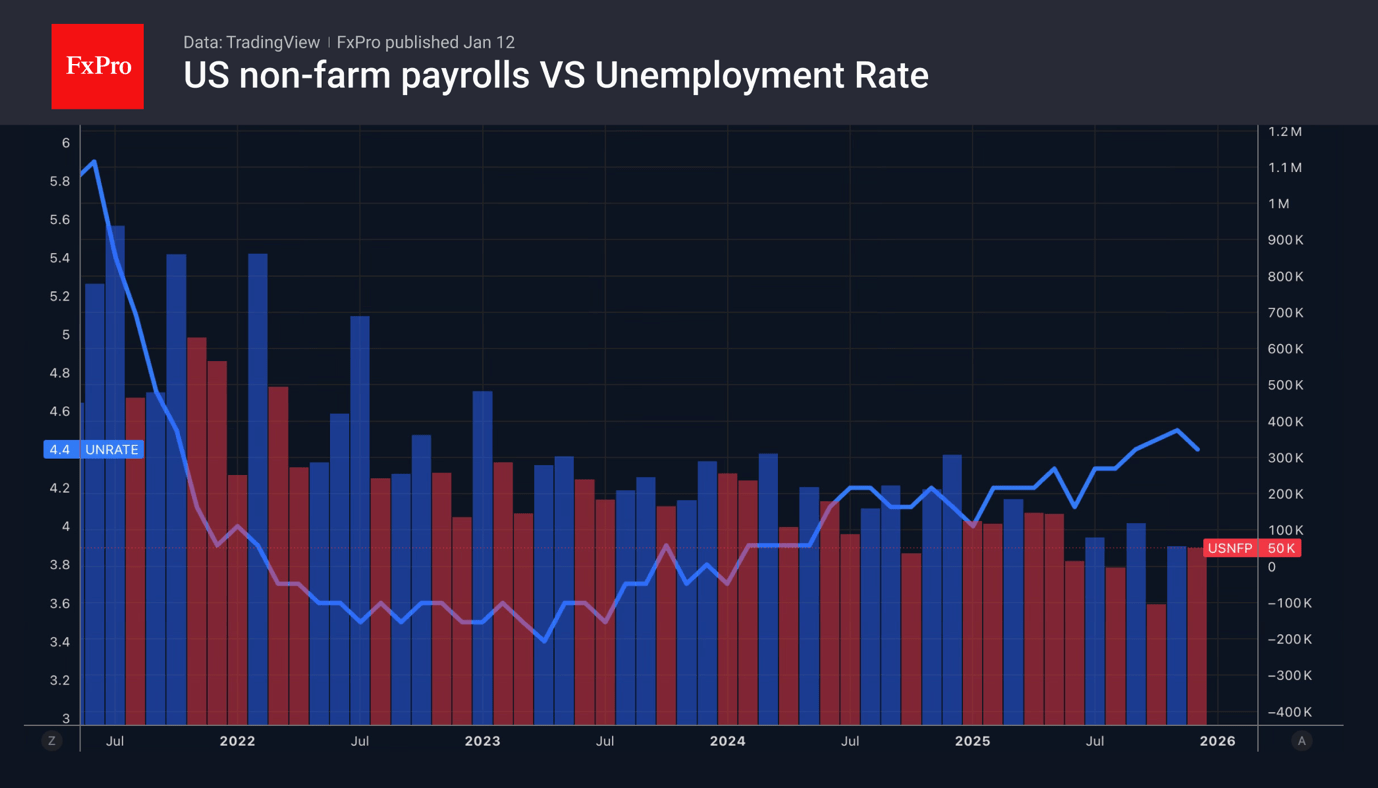

The dollar suffered due to threats to the Fed’s independence. Gold managed to renew its record highs.

January 9, 2026

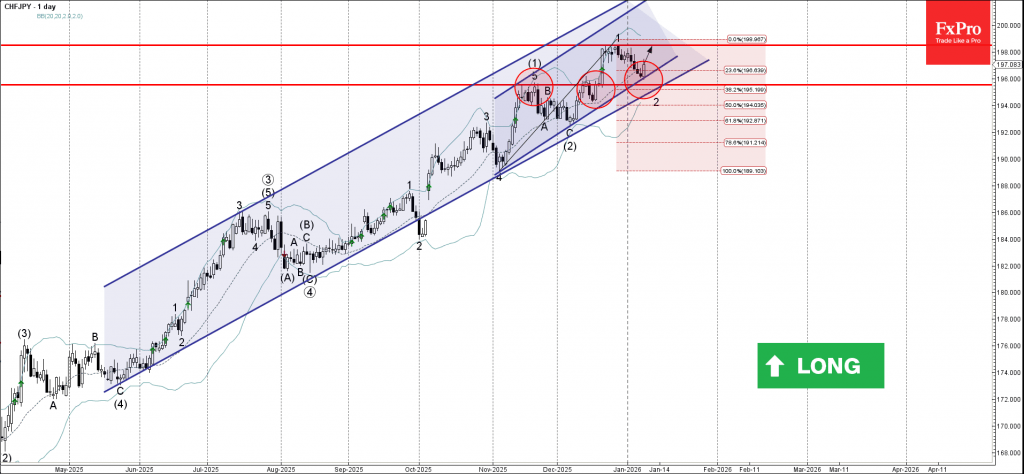

CHFJPY: ⬆️ Buy – CHFJPY reversed from support area – Likely to rise to resistance level 198.50 CHFJPY currency pair recently reversed from the support area between the pivotal support level 196.00 (former resistance from November and December) and the.