Technical analysis - Page 5

January 28, 2026

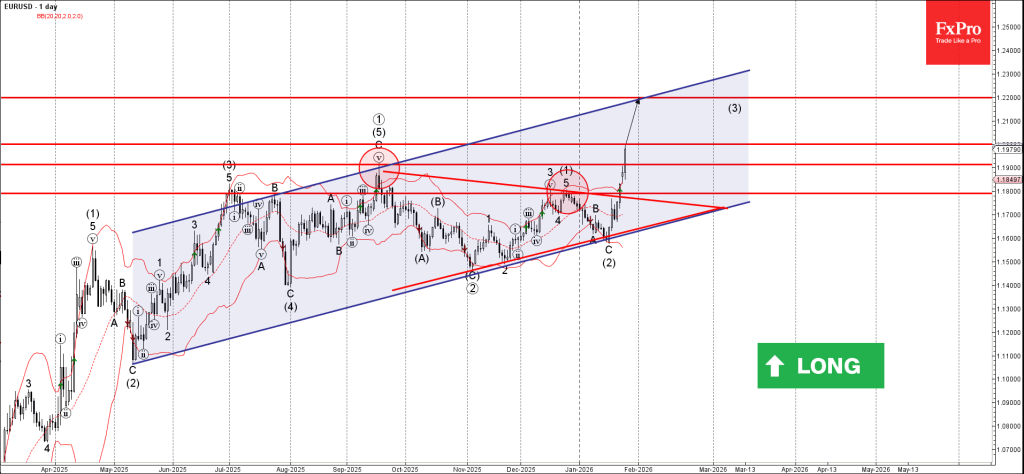

EURUSD: ⬆️ Buy – EURUSD broke key resistance level 1.1900 – Likely to rise to resistance level 1.2200 EURUSD currency pair recently broke through the key resistance level 1.1900 (which stopped the sharp daily impulse wave (5) in last September)..

January 27, 2026

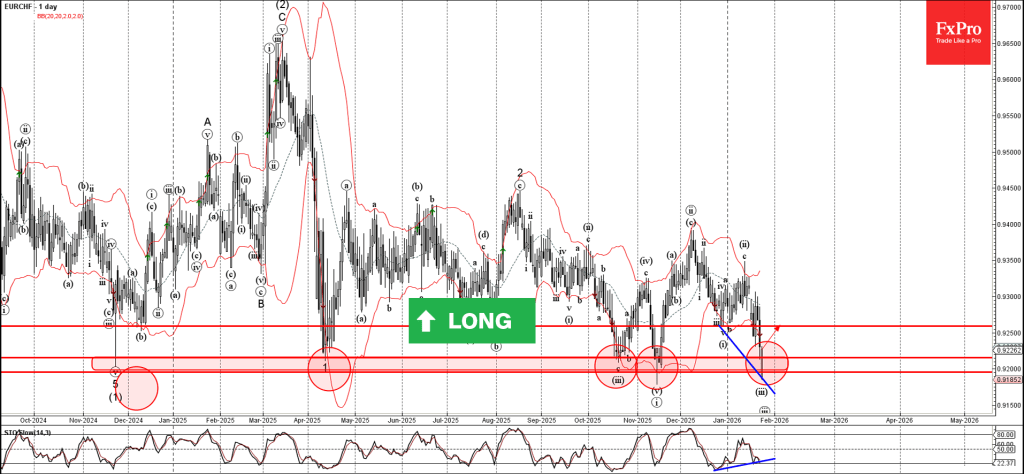

EURCHF: ⬆️ Buy – EURCHF reversed from support zone – Likely to rise to resistance level 0.9260 EURCHF currency pair recently reversed up from the strong support area between the support levels 0.9195 and 0.9215 (which has been reversing the.

January 27, 2026

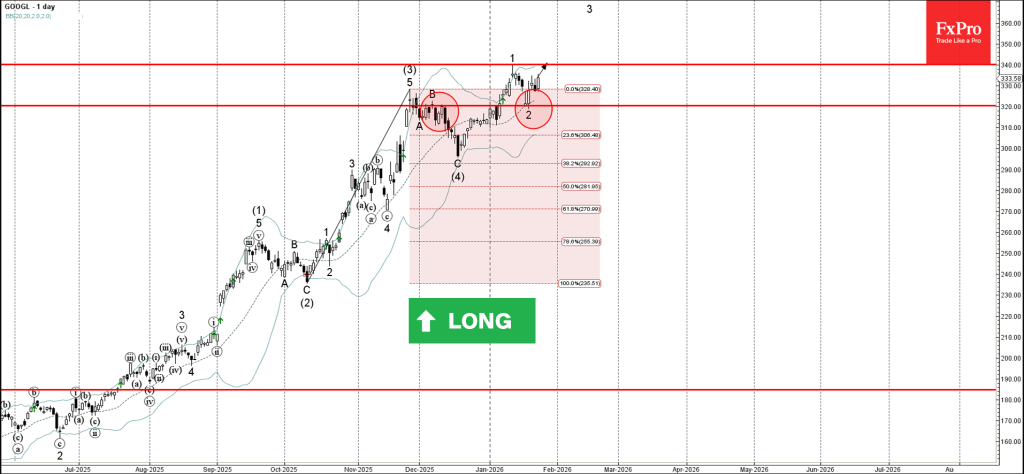

Google: ⬆️ Buy – Google reversed from support level 320.00 – Likely to rise to resistance level 340.00 Google recently reversed up from the support area between the pivotal support level 320.00 (former resistance from December) and the 20-day moving.

January 27, 2026

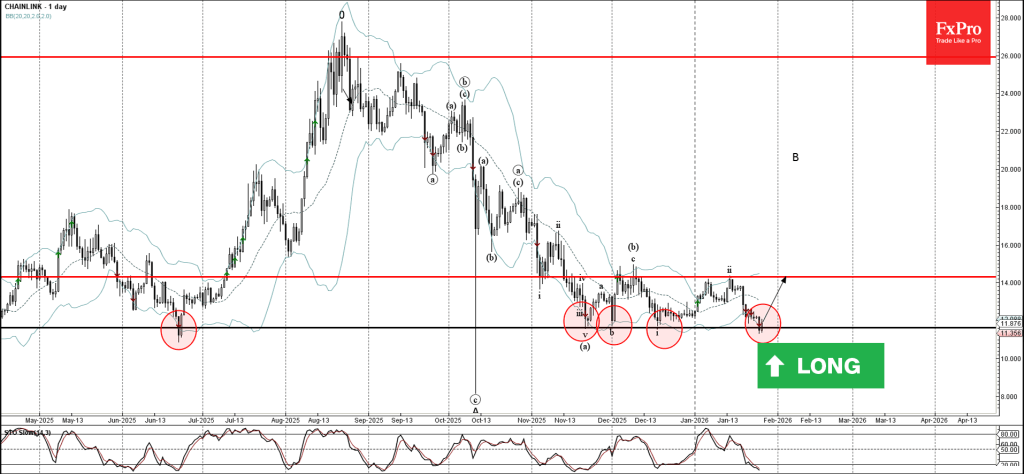

Chainlink: ⬆️ Buy – Chainlink reversed from support zone – Likely to rise to resistance level 14.00 Chainlink cryptocurrency recently reversed up from the support zone between the long-term support level 11.60 (which has been reversing the price from June).

January 27, 2026

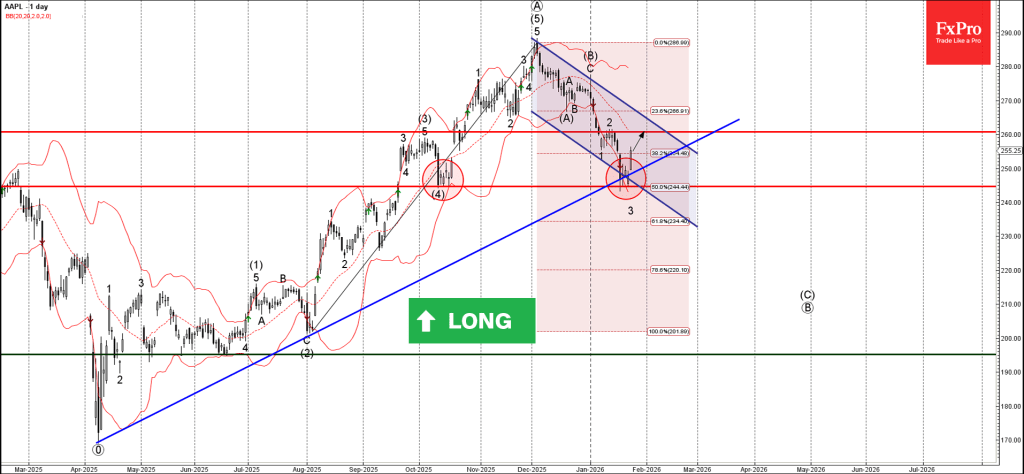

Apple: ⬆️ Buy – Apple reversed from strong support level 245.00 – Likely to rise to resistance level 260.00 Apple recently reversed up from the support area between the strong support level 245.00 (which reversed the price at the start.

January 24, 2026

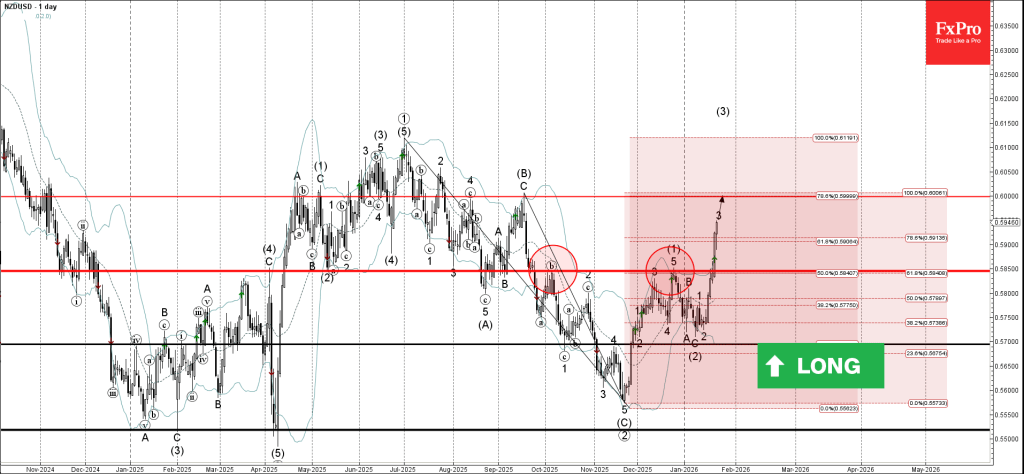

NZDUSD: ⬆️ Buy – NZDUSD broke resistance level 0.5850 – Likely to rise to resistance level 0.6000 NZDUSD currency pair recently broke the resistance level 0.5850 (which stopped the previous waves (b) and (1), as can be seen below). The.

January 24, 2026

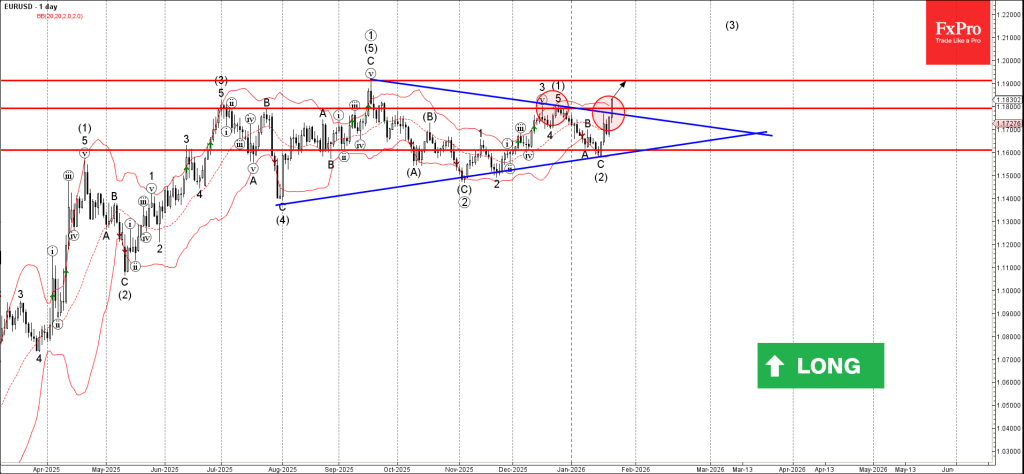

EURUSD: ⬆️ Buy – EURUSD broke key resistance level 1.1800 – Likely to rise to resistance level 1.1900 EURUSD currency pair recently broke the key resistance level 1.1800 (which reversed the price in December, as can be seen below) interacting.

January 23, 2026

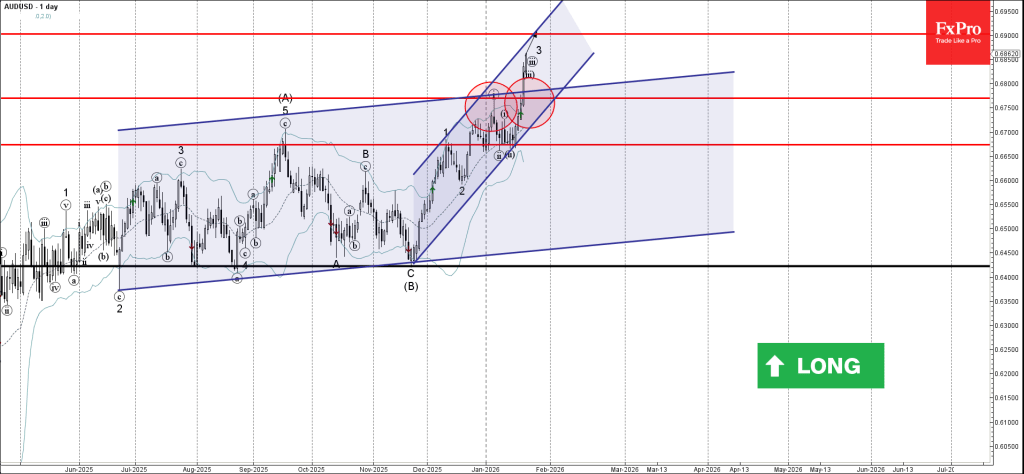

AUDUSD: ⬆️ Buy – AUDUSD broke the strong resistance level 0.6770 – Likely to rise to resistance level 0.6900 AUDUSD currency pair recently broke the strong resistance level 0.6770 (which stopped earlier impulse wave i) interacting with the resistance trendline.

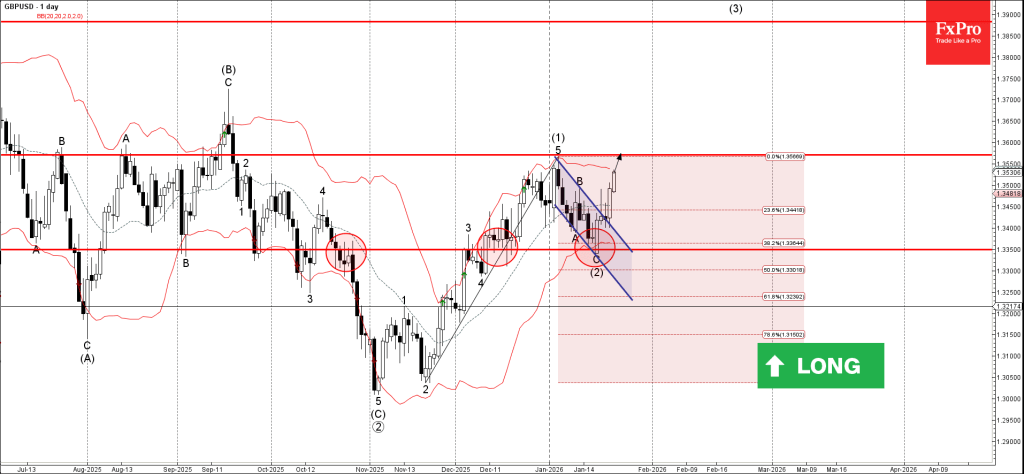

January 23, 2026

GBPUSD: ⬆️ Buy – GBPUSD broke daily down channel – Likely to rise to resistance level 1.3570 GBPUSD currency pair recently broke the daily down channel from the start of January (which encloses the previous medium-term ABC correction (2)). The.

January 23, 2026

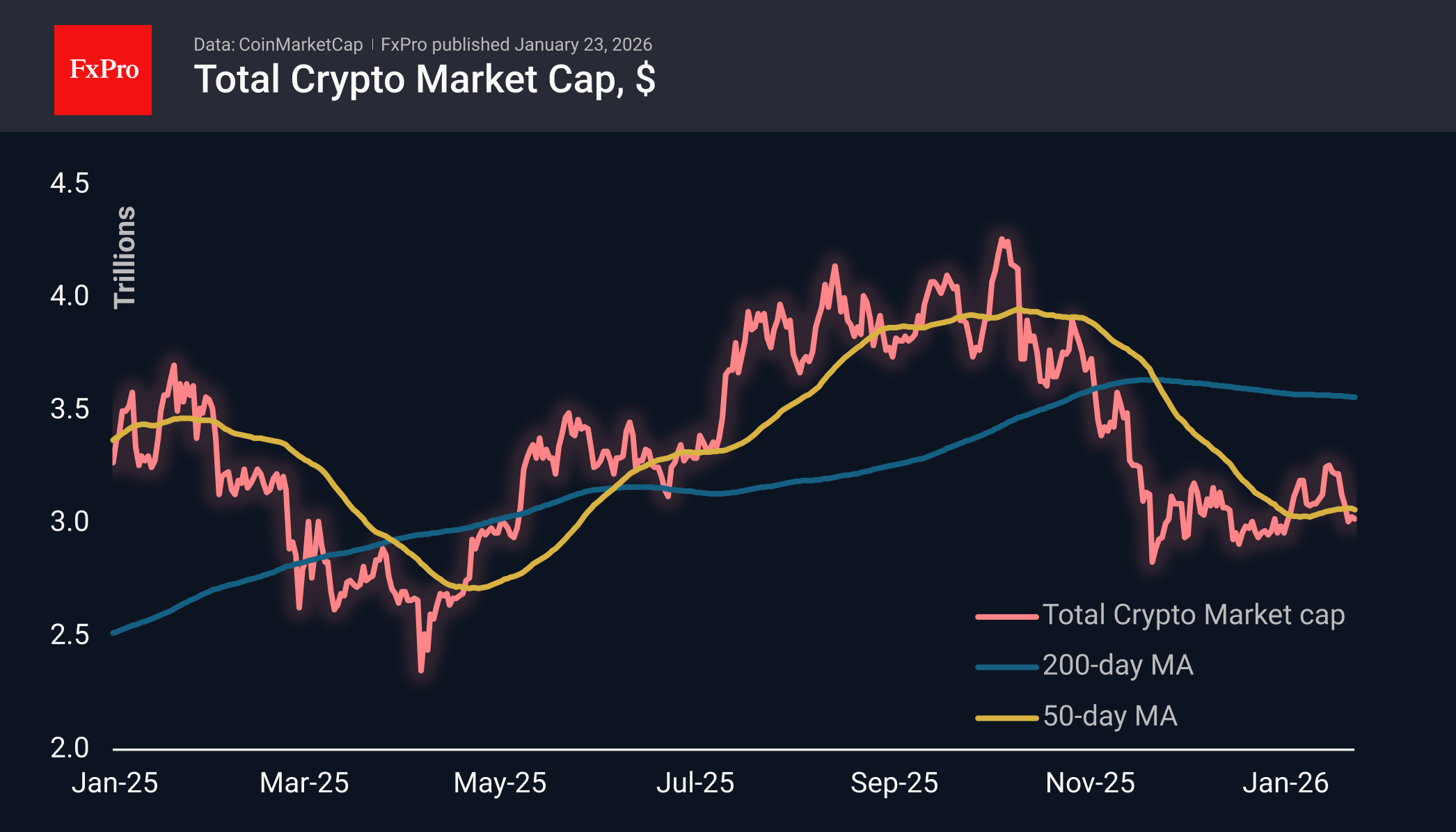

Crypto markets remain subdued despite positive trends elsewhere; Bitcoin faces resistance, while long-term holders drive capital rotation.

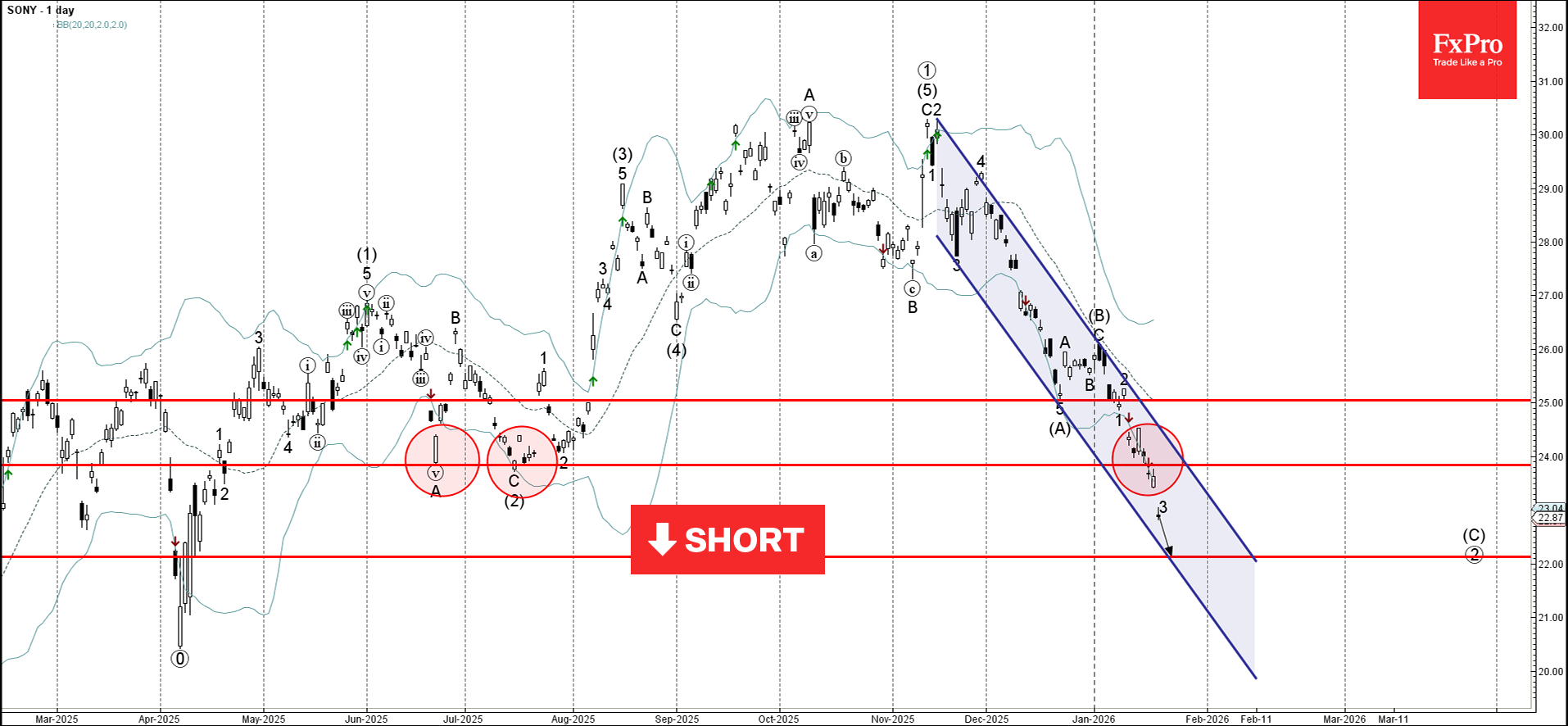

January 23, 2026

Sony: ⬇️ Sell – Sony broke long-term support level 24.00 – Likely to fall to support level 22.00 Sony reopened today with the sharp downward gap – after the price broke below the strong long-term support level 24.00 (former monthly.