Technical analysis - Page 449

September 27, 2018

Copper reversed from resistance area Copper losses are likely Copper recently reversed down from the resistance area lying between the resistance level 285.00 (top of wave 4 from July), upper daily Bollinger Band, 100-day moving average and the 38.2% Fibonacci.

September 26, 2018

Sugar broke the key support level 10.50 Further losses are likely Sugar recently broke through the key support level 10.50 (which stopped the previous sharp impulse wave (i) at the start of September, as can be seen below). The breakout.

September 26, 2018

USDCHF rising inside impulse wave (3) Further gains are likely USDCHF has been rising in the last few trading sessions inside the medium-term impulse wave (3), which started earlier from the support level 0.9550 (which stopped the previous short-term correction.

September 25, 2018

EURNZD reversed from support zone Further gains are likely EURNZD continues to rise after the recent upward reversal from the support zone lying between the key support level 1.7550, support trendline of the daily up channel from June and the.

September 25, 2018

Natural Gas approached resistance zone Downward correction likely Natural Gas is currently trading close to the resistance zone lying between the long-term resistance level 3.0450 (which reversed the price with the daily Evening Star in June) and the upper daily.

September 24, 2018

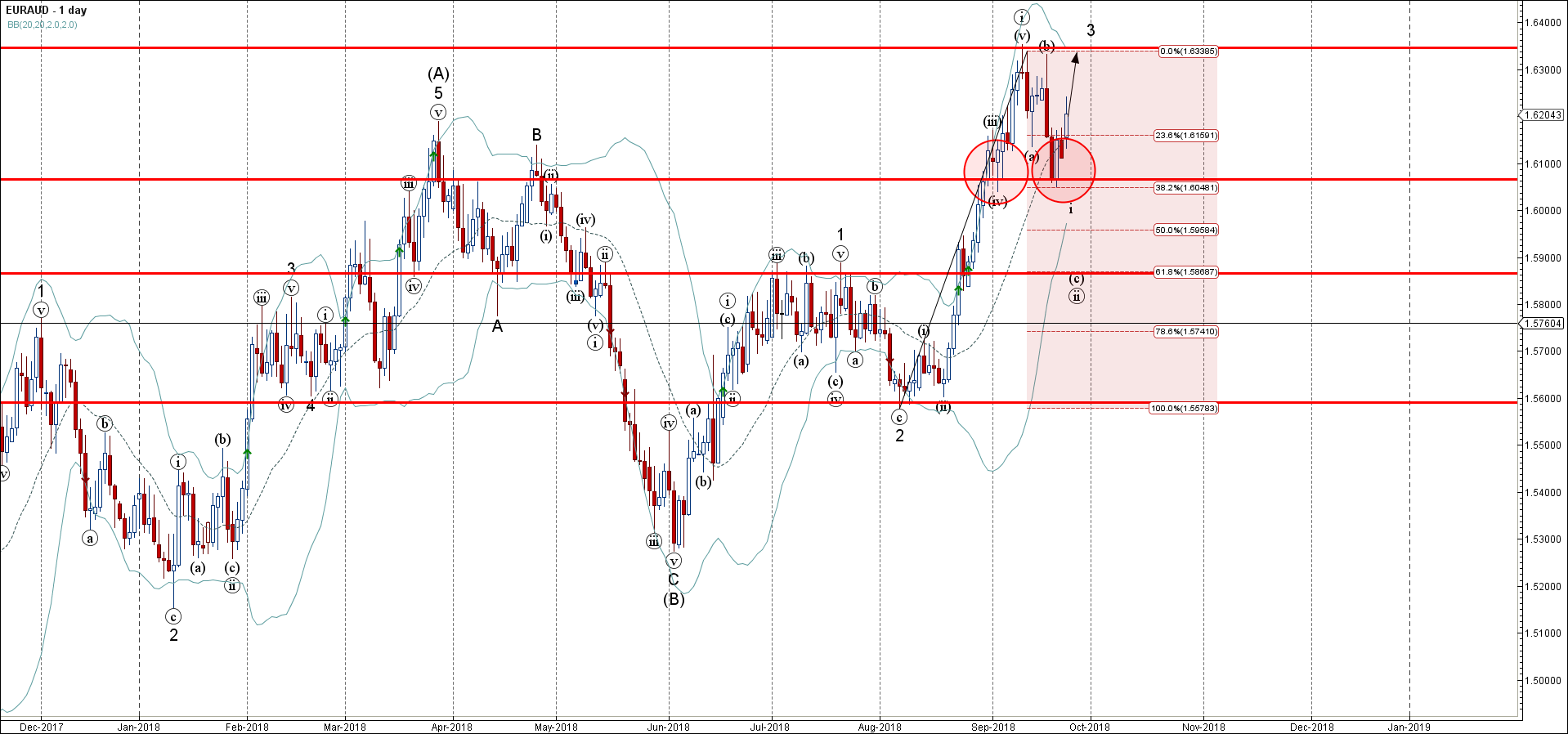

EURAUD reversed from support zone Further gains are likely EURAUD recently reversed up from the support zone lying between the key support level 1.6060 (low of the previous wave (iv)) and the 38.2% Fibonacci correction of the previous sharp upward.

September 24, 2018

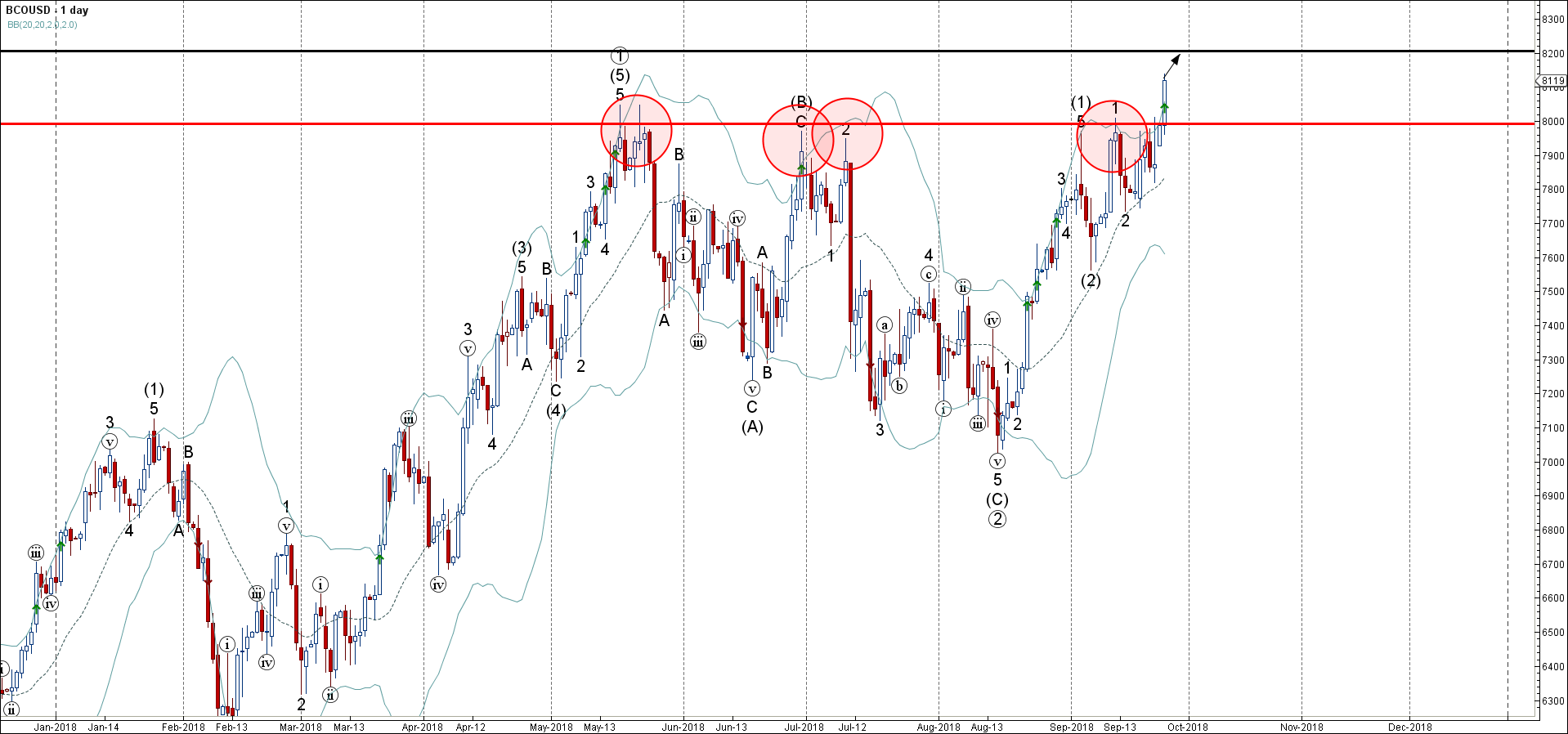

Brent Crude Oil broke resistance level 80.00 Further gains are likely Brent Crude Oil recently broke through the strong, multi-month resistance level 80.00 – which has been reversing the price from the middle of May (as can be seen below)..

September 19, 2018

Despite the expansion of tariffs between China and the United States, global markets remain positive. MSCI Asia ex Japan adds 0.7% this morning; Hong Kong’s Heng Seng increases by 1.1%, although China announced the introduction of 5-10%-tariffs for the U.S..

August 20, 2018

EURUSD EURUSD is trading near 1.1420, losing 0.2% from the beginning of the day after an impressive growth on Friday from 1.1370 to 1.1440. The growth on Friday was largely associated with upward correction after a strong decline. According to.

July 26, 2018

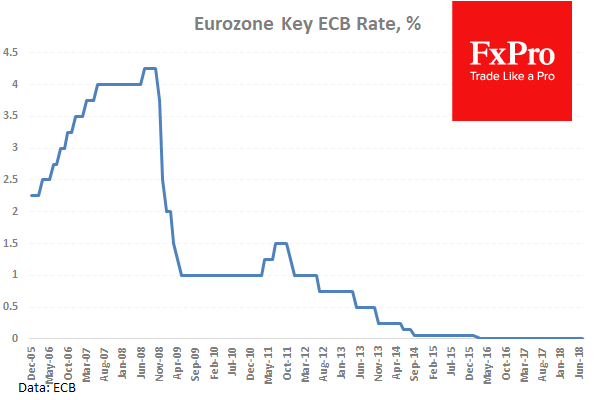

ECB keeps interest rates, QE parameters, and forward guidance unchanged, reiterating the intention to keep rates at this level at least until summer 2019. During the press conference, ECB President noted the “steady and wide” economic growth of the euro.

July 13, 2018

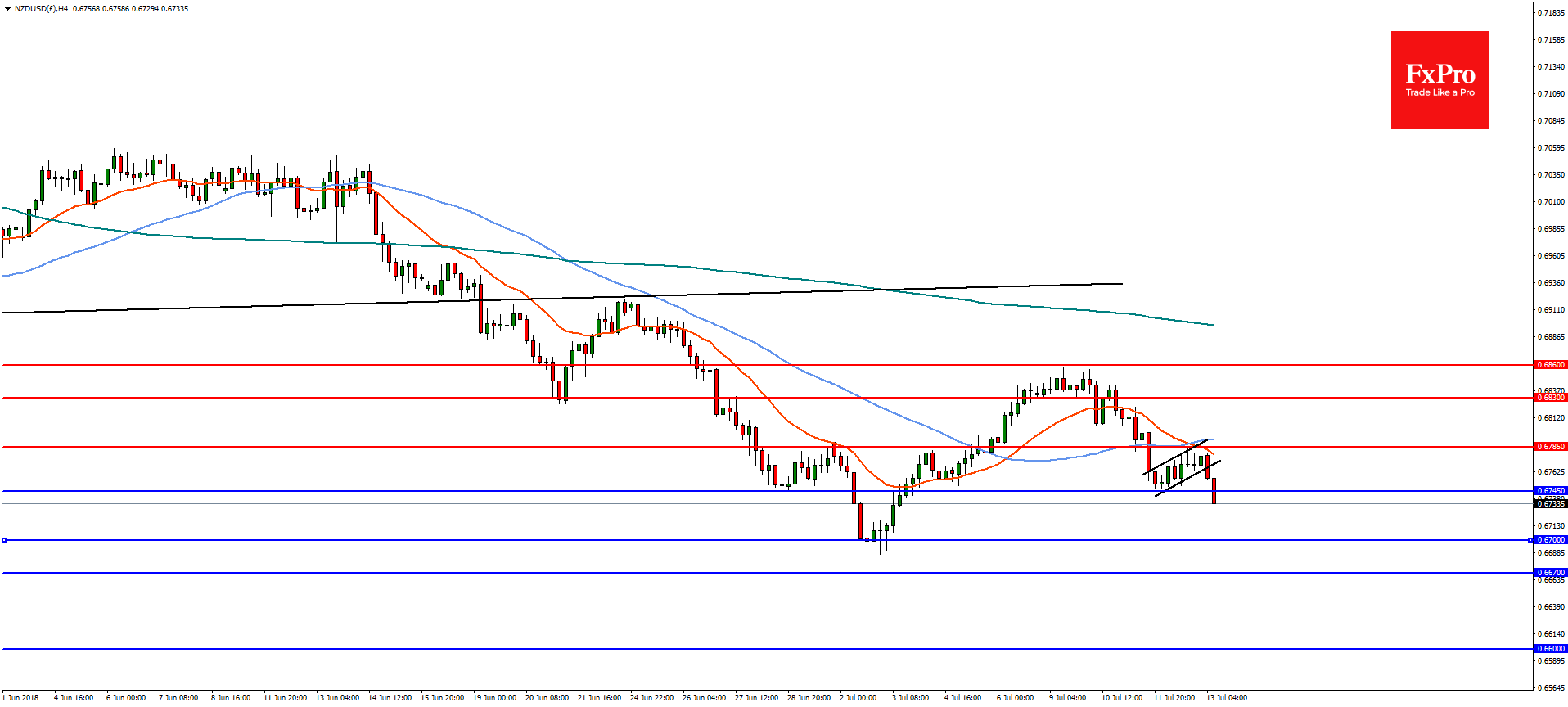

The New Zealand Dollar (NZD) remains under pressure this week with the resumption of the US-China trade war headlines. The NZD did put in a recovery as China refrained from retaliating immediately to the latest round of US tariffs of.