Technical analysis - Page 447

October 16, 2018

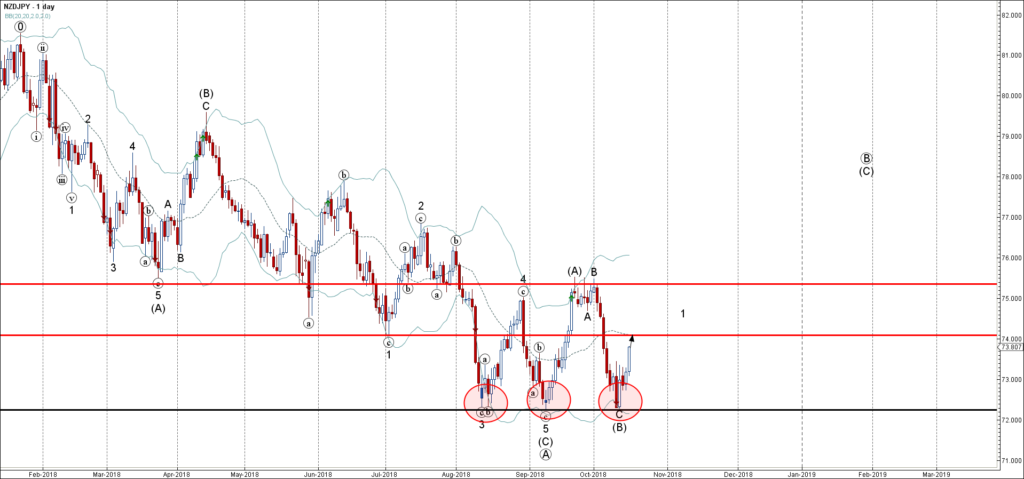

NZDJPY rising inside medium-term impulse wave (C) Further gains are likely NZDJPY continues to rise inside the strong medium-term impulse wave (C), which started earlier from the combined support area lying between the major support level 72.30 (which also reversed.

October 15, 2018

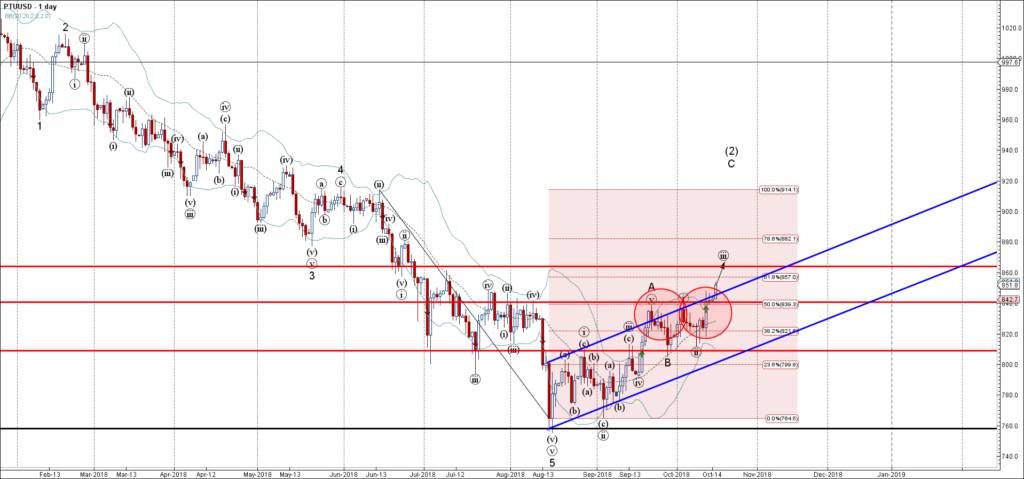

Platinum broke key resistance area Further gains are likely Platinum recently broke through the key resistance area lying between the pivotal resistance level 840.00 (which has been reversing the price from August), 50% Fibonacci correction of the earlier downward impulse.

October 15, 2018

USDJPY falling inside impulse wave ③ Further losses are likely USDJPY continues to fall impulse the sharp primary impulse wave ③, which started earlier from the powerful resistance area lying between the long-term resistance level 114.60, upper daily Bollinger Band.

October 12, 2018

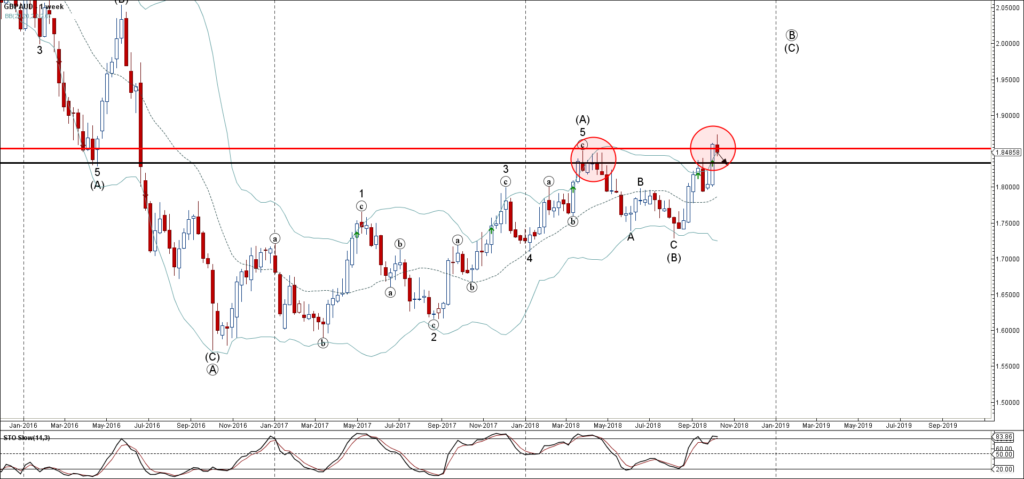

GBPAUD reversed from major resistance area Further losses are likely GBPAUD today reversed down from the major resistance area lying between the long-term resistance level 1.8540 (which also stopped the previous uptrend at the start of 2018) and the upper.

October 12, 2018

Sugar broke multi-month resistance level 13.00 Further gains are likely Sugar continues to rise after the earlier breakout of the multi-month resistance level 13.00 (which stopped the previous short-term corrective wave A at the start of June, as can be.

October 11, 2018

Gold broke resistance area Further gains are likely Gold today broke through the resistance area lying between the pivotal resistance level 1210.00 (which has been reversing the price from the end of August) and the resistance trendline of the extended.

October 11, 2018

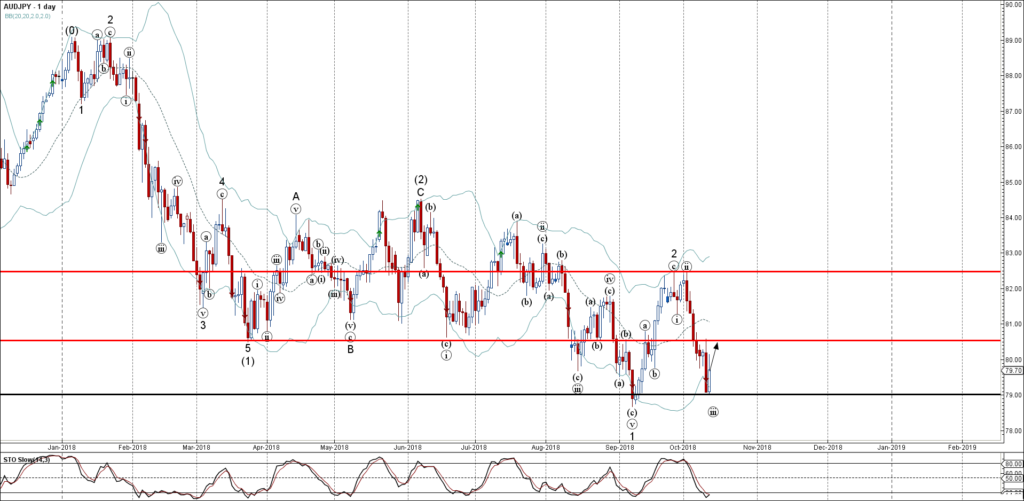

AUDJPY reversed from support area Further gains are likely AUDJPY continues to rise after the earlier upward reversal from the support area lying between the key support level 79.00 (which stopped the previous short-term impulse wave 1 at the start.

October 10, 2018

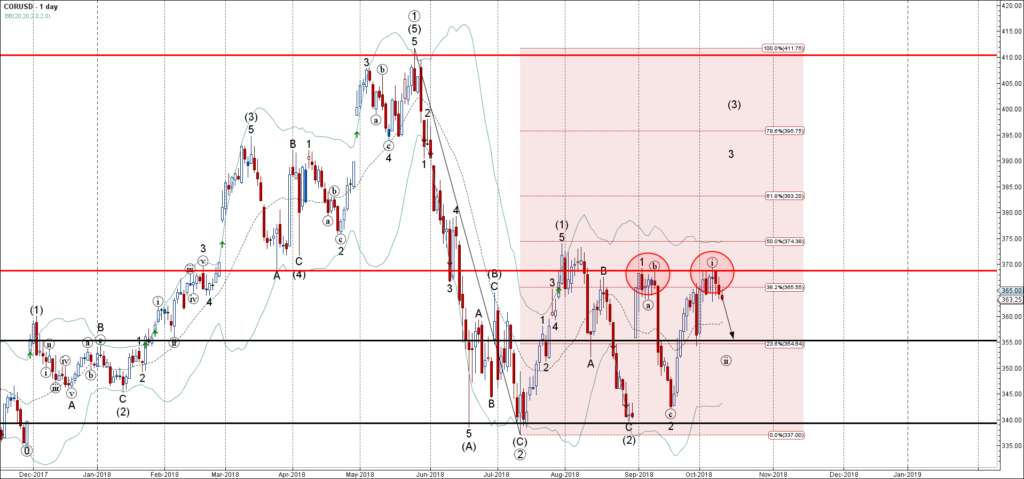

Corn reversed from resistance zone Further losses are likely Corn recently reversed down from the resistance zone lying between the resistance level 370.00 (top of the previous impulse wave 1 from August) and the 38.2% Fibonacci correction of the previous.

October 10, 2018

GBPCAD rising inside impulse wave (3) Further gains are likely GBPCAD continues to rise inside the medium-term impulse wave (3) which stared earlier from the support area lying between the strong support level 1.6600 (monthly low from August) and the.

October 9, 2018

Silver reversed from resistance area Further losses are likely Silver recently reversed down from the resistance area lying between the key resistance level 14.90 (top of the previous correction (ii) from August), upper daily Bollinger Band and the 61.8% Fibonacci.

October 9, 2018

EURGBP broke support area Further losses are likely EURGBP continues to fall after the earlier breakout ofthe support area lying between the key support level 0.8800 (monthly low from July) and the 61.8% Fibonacci correction of the previous sharp upward.