Technical analysis - Page 446

October 24, 2018

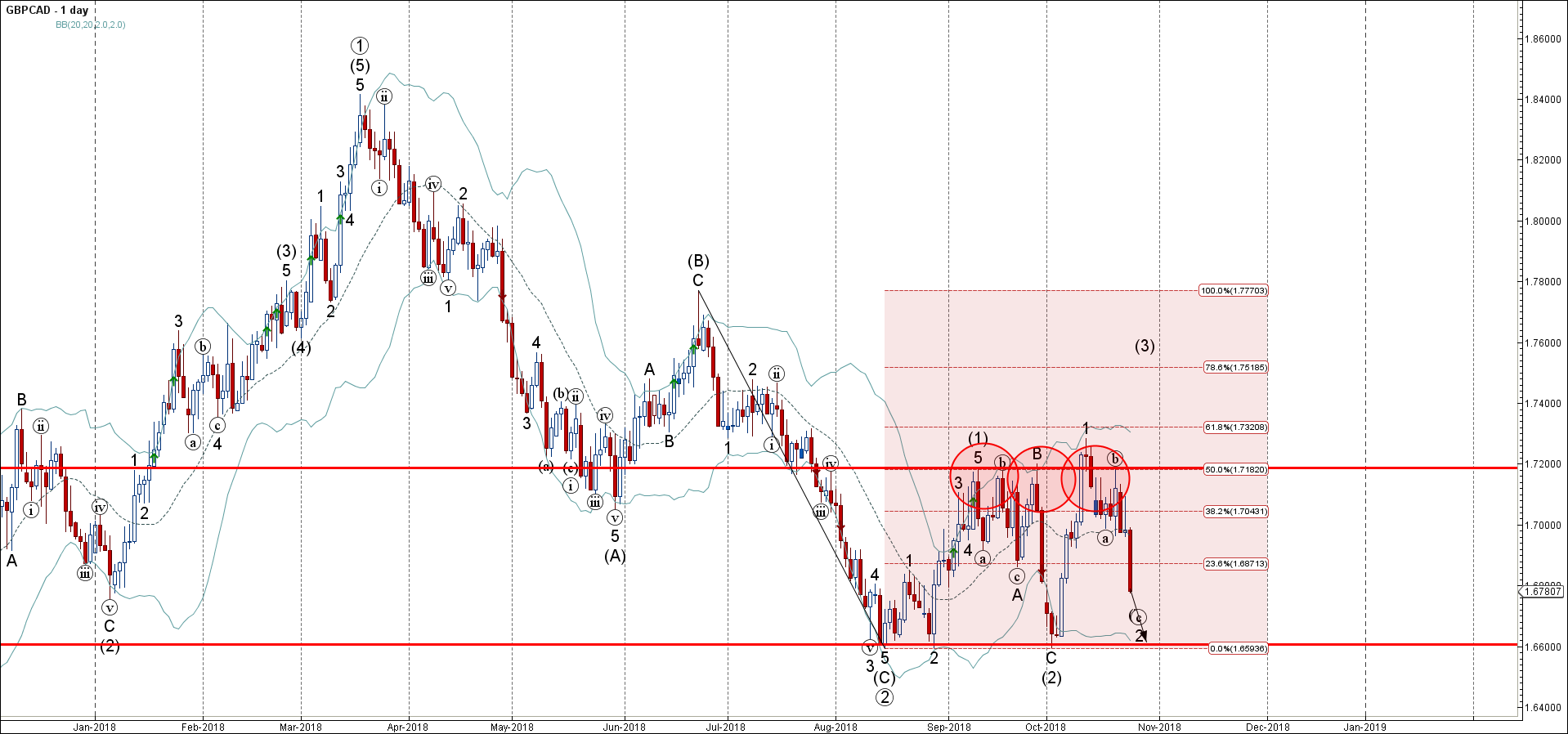

GBPCAD falling inside short-term impulse wave C Further losses are likely GBPCAD continues to fall inside the short-term impulse wave C, which started recently from the resstance area lying at the intersection of the key resistance level 1.7200 (which has.

October 23, 2018

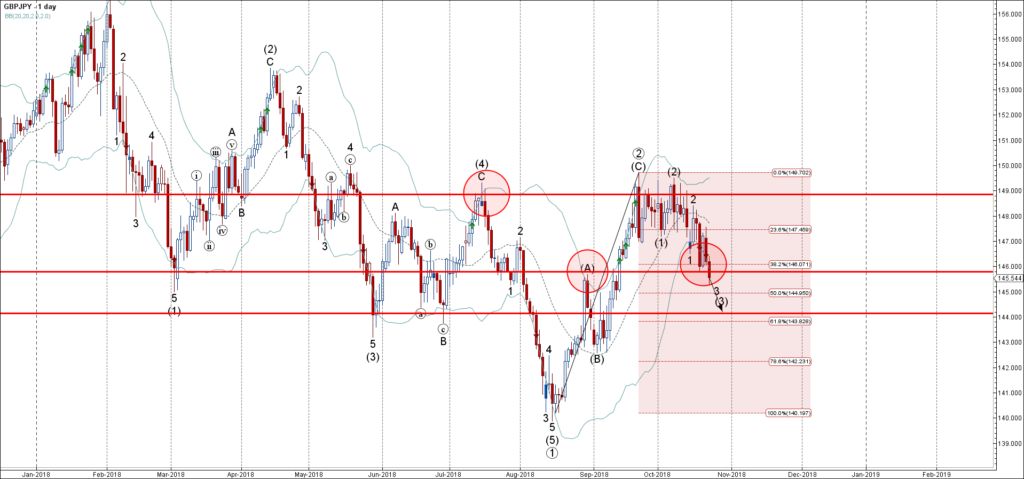

GBPJPY broke support area Further losses are likely GBPJPY recently broke through the support area lying between the key support level 145.80 (former resistance from August, which reversed the price earlier this month) and the 38.2% Fibonacci correction of the.

October 23, 2018

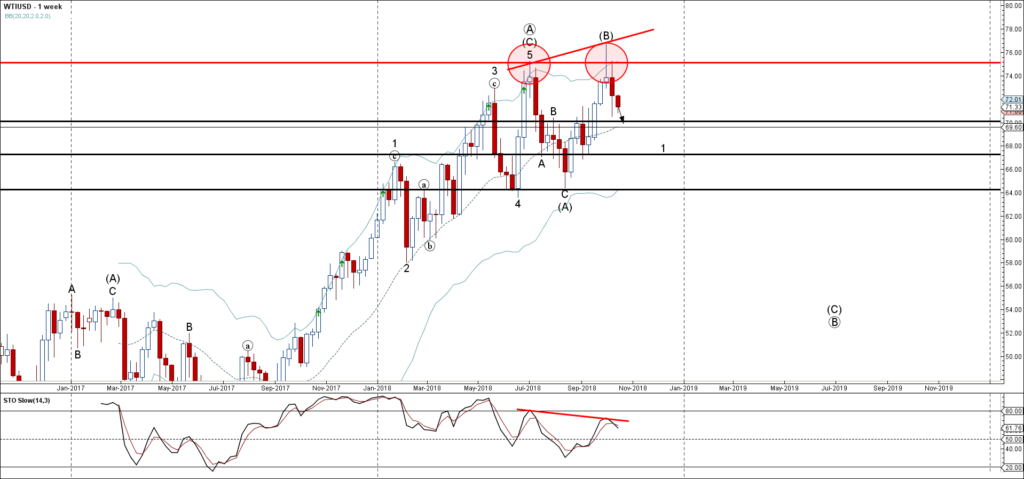

• Brent Crude Oil broke support area • Further losses are likely Brent Crude Oil recently broke through the support area lying at the intersection of the key support level 67.60 (which also reversed the price sharply in September) and.

October 22, 2018

Palladium broke key resistance level 1085.00 Further gains are likely Palladium continues to rise inside the short-term impulse wave 3, which broke earlier through the key resistance level 1085.00 (which stopped the previous impulse waves (3) and 1 – as.

October 22, 2018

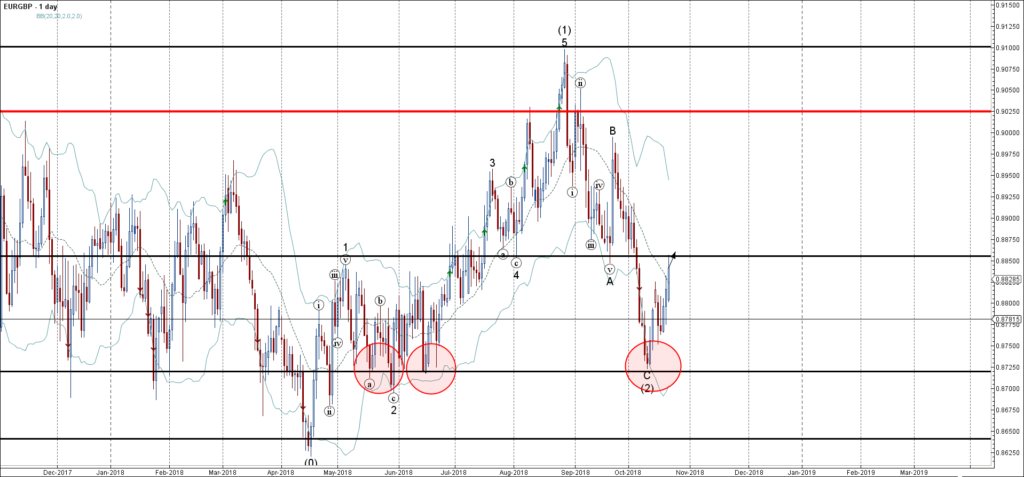

EURGBP rising inside medium-term impulse wave (3) Further gains are likely EURGBP continues to rise inside the medium-term impulse wave (3), which started earlier from the support area lying between the key support level 0.8725 (which has been reversing the.

October 19, 2018

Natural Gas reversed from resistance area Further losses are likely Natural Gas recently reversed down from the resistance area lying between the resistance level 3.330 (which reversed the previous impulse wave (i)) and the upper daily Bollinger Band. The downward.

October 19, 2018

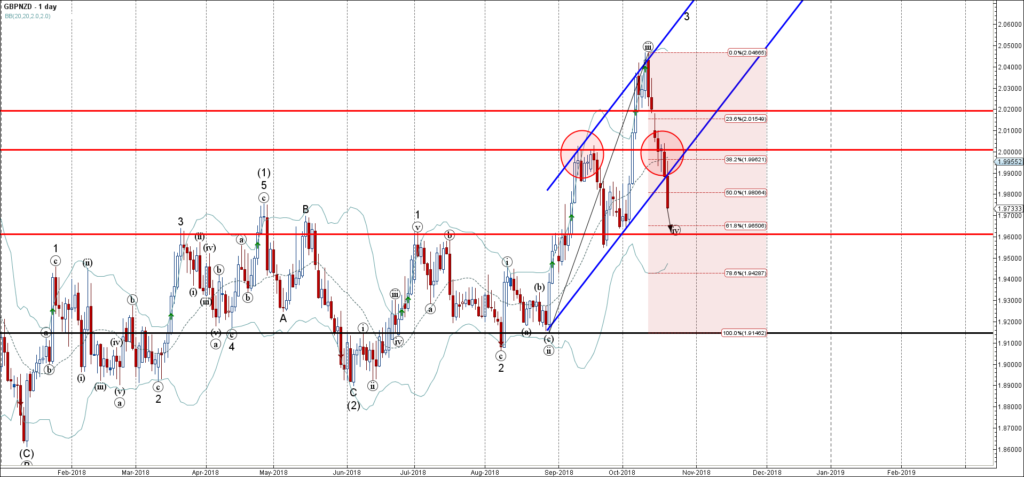

GBPNZD broke support area Further losses are likely GBPNZD recently broke through the support area lying between the key round support level 2.000 (former powerful resistance from September), support trendline of the daily up channel from August and the 38.2%.

October 18, 2018

EURAUD falling inside short-term corrective wave (ii) Further losses are likely EURAUD continues to fall inside the short-term corrective wave (ii), which started earlier from the powerful resistance area lying between the strong resistance level 1.6340 (top of the Evening.

October 18, 2018

Copper falling inside medium-term impulse wave (3) Further losses are likely Copper continues to fall inside the medium-term impulse wave (3), which started earlier from the resistance area lying between the key resistance level 285.00 (which has been reversing the.

October 17, 2018

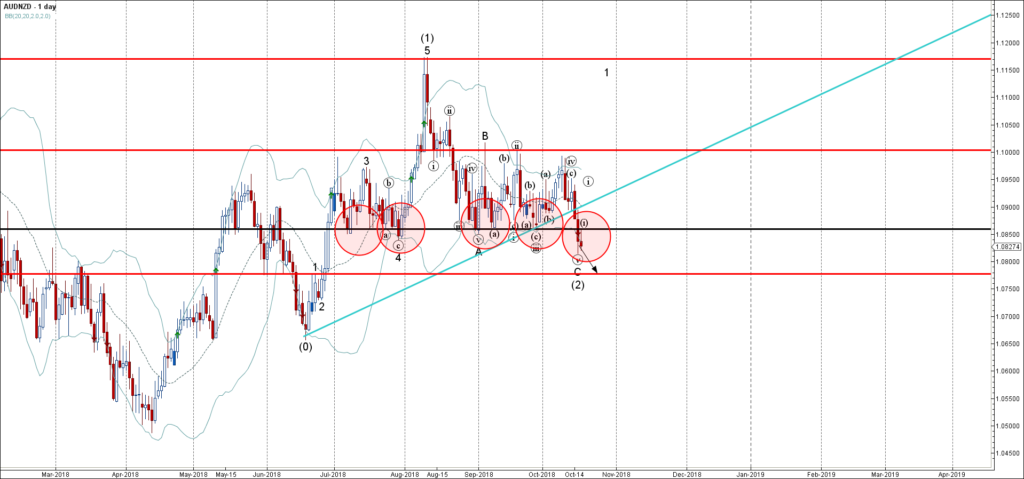

AUDNZD broke support area Further losses are likely AUDNZD recently broke through the support area located between the strong support level 1.0860 (which has been steadily reversing the price from July) and the ascending support trendline from June. The breakout.

October 17, 2018

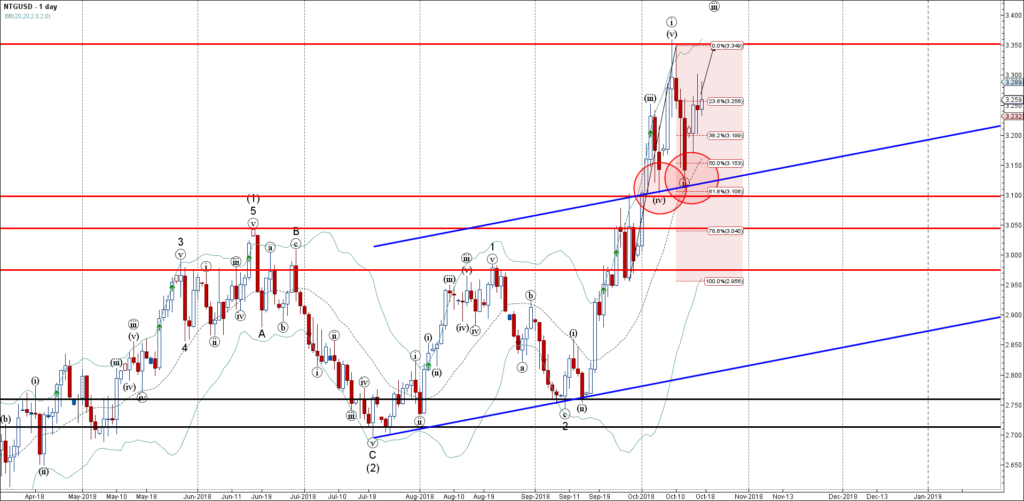

Natural Gas rising inside impulse wave (iii) Further gains are likely Natural Gas continues to rise inside the short-term impulse wave (iii), which started earlier from the support area located between the key support level 3.100 (which also reversed the.