Technical analysis - Page 435

January 25, 2019

Platinum reversed from support area Further gains are likely Platinum recently reversed up from the support area located between the key support level 785.00 (which has been reversing the price from December), lower daily Bollinger Band and the support trendline.

January 25, 2019

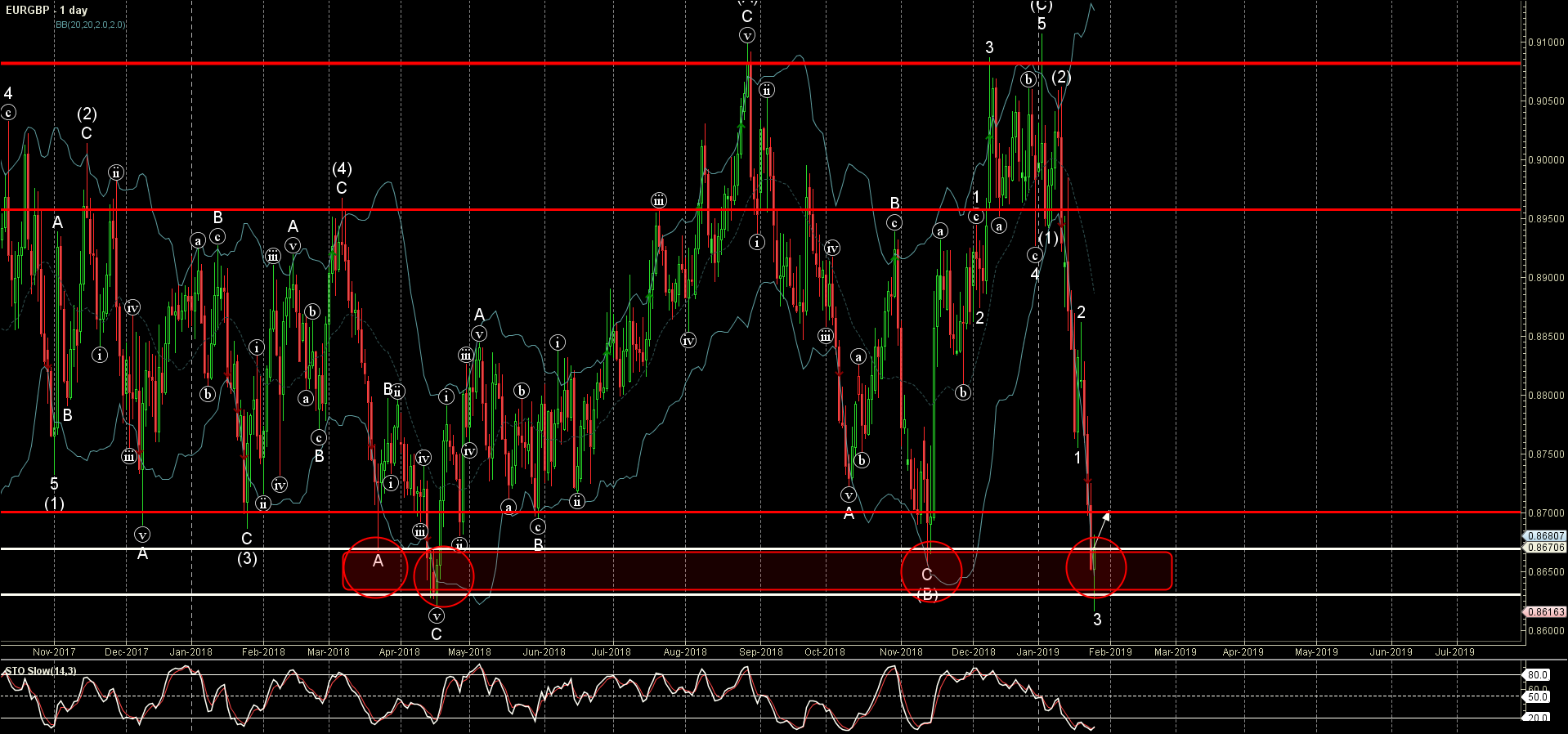

EURGBP reversed from support area Further gains are likely EURGBP recently reversed up from the support area located between the support levels 0.8630 and 0.8670 -, strengthened by the lower daily Bollinger Band. The upward reversal from this support area.

January 24, 2019

Brent Crude Oil reversed from resistance area Further losses are likely Brent Crude Oil recently reversed down from the resistance area lying at the intersection of the resistance level 63.00 (which also reversed the price at the end of 2018),.

January 24, 2019

AUDUSD reversed from resistance area Further losses are likely AUDUSD recently reversed down from the resistance area located between the resistance level 0.7200, 100-day moving average, upper daily Bollinger Band and the resistance trendline of the daily down channel from.

January 23, 2019

Wheat broke key resistance level 520.00 Further gains are likely Wheat recently broke above the key resistance level 520.00 – which has been steadily reversing the price from the start of January. The breakout of this resistance level is aligned.

January 23, 2019

GBPUSD broke resistance area Further gains are likely GBPUSD recently broke though the resistance area located between the round resistance level 1.3000 and the resistance trendline of the daily down channel from September. The breakout of this resistance area accelerated.

January 22, 2019

WTI reversed from resistance zone Further losses are likely WTI recently reversed down from the resistance area lying between the pivotal resistance level 54.50 (which stopped the previous correction (4) in December), upper daily Bollinger Band and the 38.2% Fibonacci.

January 22, 2019

USDJPY reversed from resistance area Further losses are likely USDJPY recently reversed down from the resistance area located between the key resistance level 109.80 (former multi-month support from August) and the 50% Fibonacci correction of the previous sharp downward impulse.

January 21, 2019

Soy reversed from support zone Further gains are likely Soy recently reversed up with the daily Morning Star from the support zone lying at the intersection of the round support level 900.00, 50-day moving average and the 50% Fibonacci correction.

January 21, 2019

USDCHF rising inside short-term impulse wave 3 Further gains are likely USDCHF continues to rise inside the short-term impulse wave 3, which previously broke through the resistance trendline of the daily down channel from November. The active impulse wave 3.

January 18, 2019

Corn reversed from support area Further gains are likely Corn recently reversed up from the support area lying between the key support level 372.30 (which stopped the previous wave (a) in December), lower daily Bollinger Band and the 50% Fibonacci.