Technical analysis - Page 434

February 4, 2019

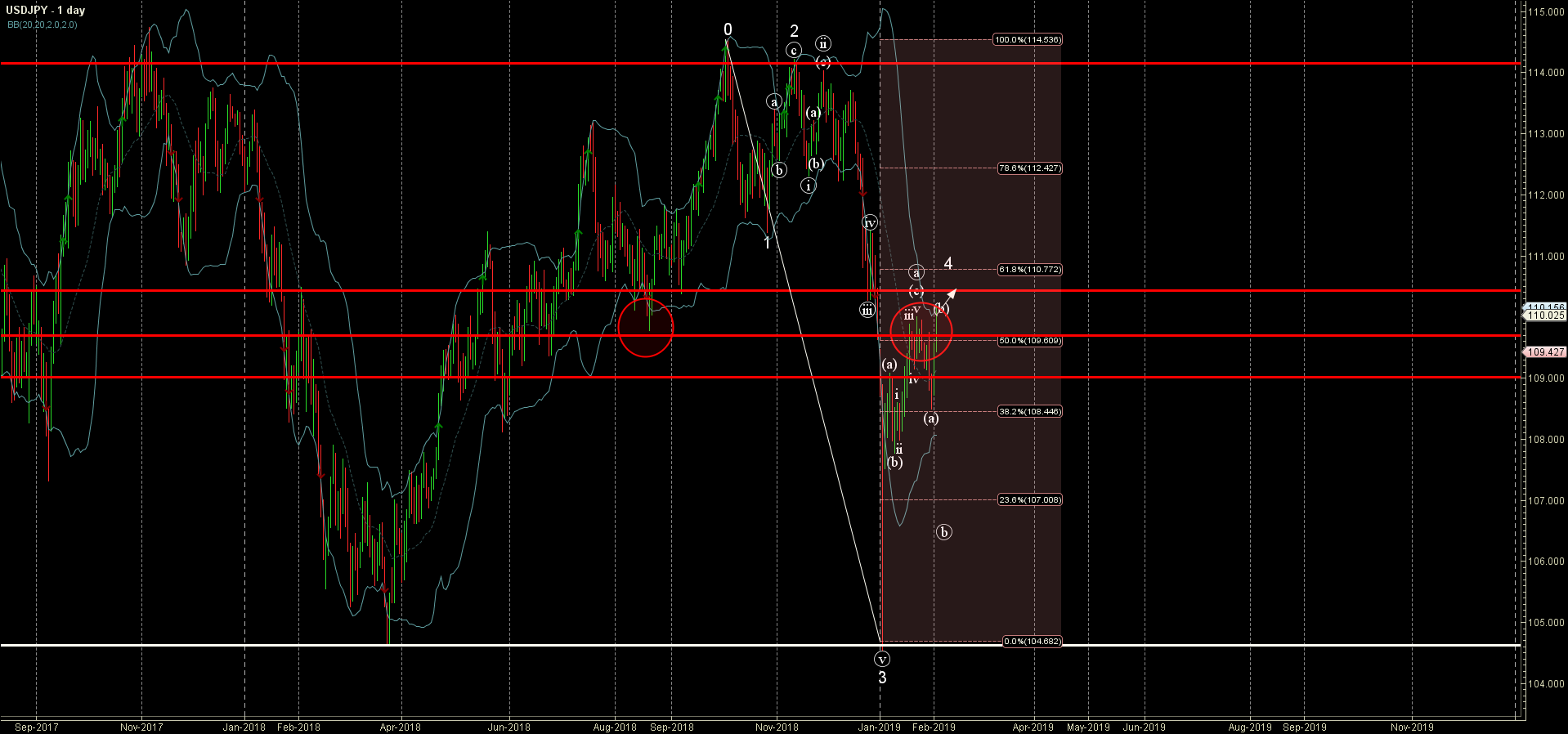

USDJPY broke through resistance area Further gains are likely USDJPY today broke through the resistance area located between the resistance level 109.70 (which reversed the price multiples times in January) and the 50% Fibonacci correction of the previous downward impulse.

February 4, 2019

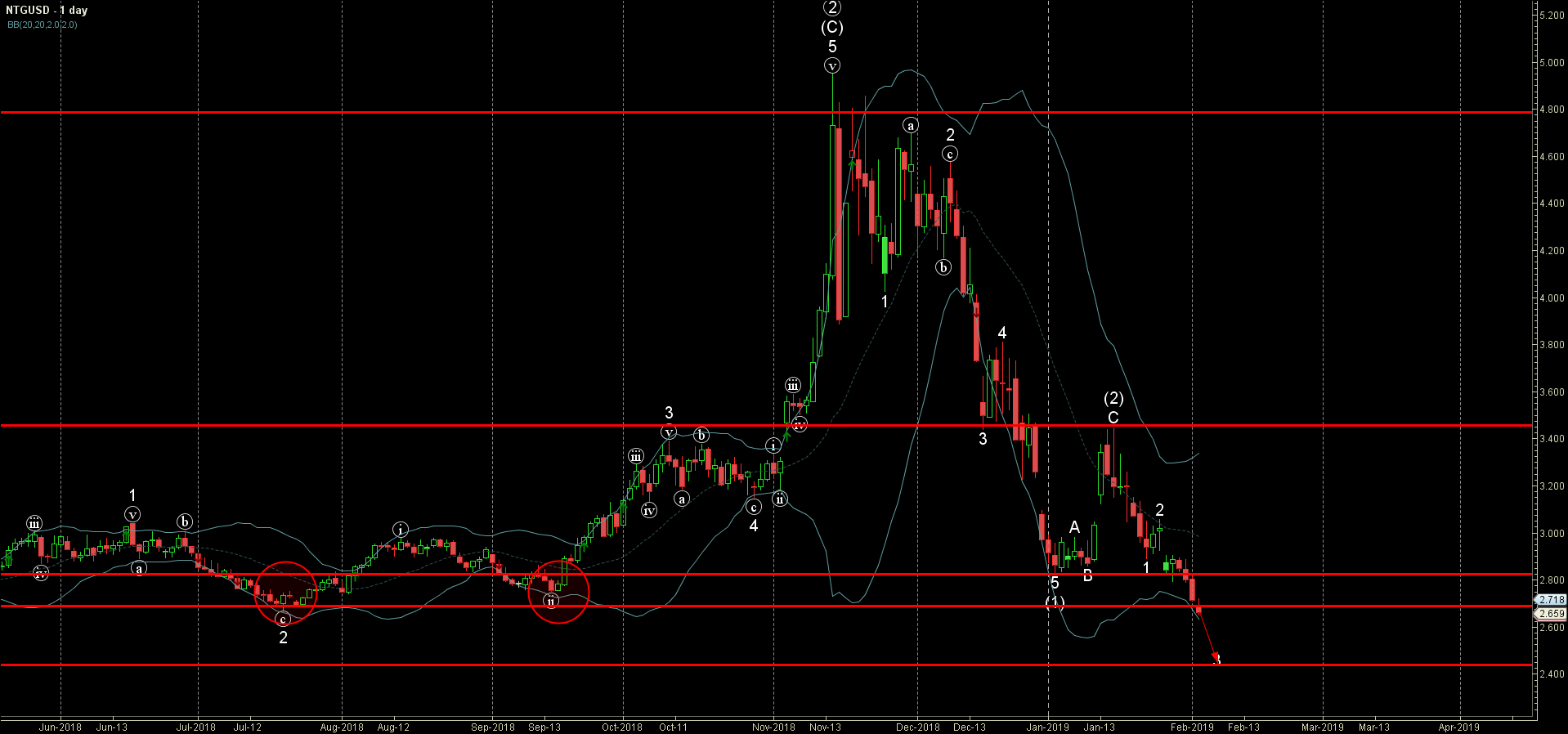

Natural Gas broke support area Further losses are likely Natural Gas recently broke through the support area lying between the support levels 2.820 (monthly low from January) and 2.690 (which reversed the price in last July and September). The breakout.

February 1, 2019

GBPCAD reversed from resistance area Further losses are likely GBPCAD recently reversed down from the resistance area lying between the resistance level 1.7500 (which has been reversing the price from July), resistance trendline of the wide daily up channel from.

February 1, 2019

Platinum resumed sharp uptrend Further gains are likely Platinum recently reversed up with the daily Bullish Engulfing from the support area lying between the support level 1275.00, support trendline of the accelerated daily up channel from August and the 38.2%.

January 31, 2019

Copper rising inside impulse wave (3) Further gains are likely Copper recently broke above below the resistance level 273.00(which has been reversing the price from the end of December) – which accelerated the active impulse wave (3). Impulse wave (3).

January 31, 2019

CHFJPY broke key support level 109.50 Further losses are likely CHFJPY recently broke below the key support level 109.50 (which stopped the (a)-wave of the active short-term ABC correction 2 from the start of January). The breakout of the support.

January 30, 2019

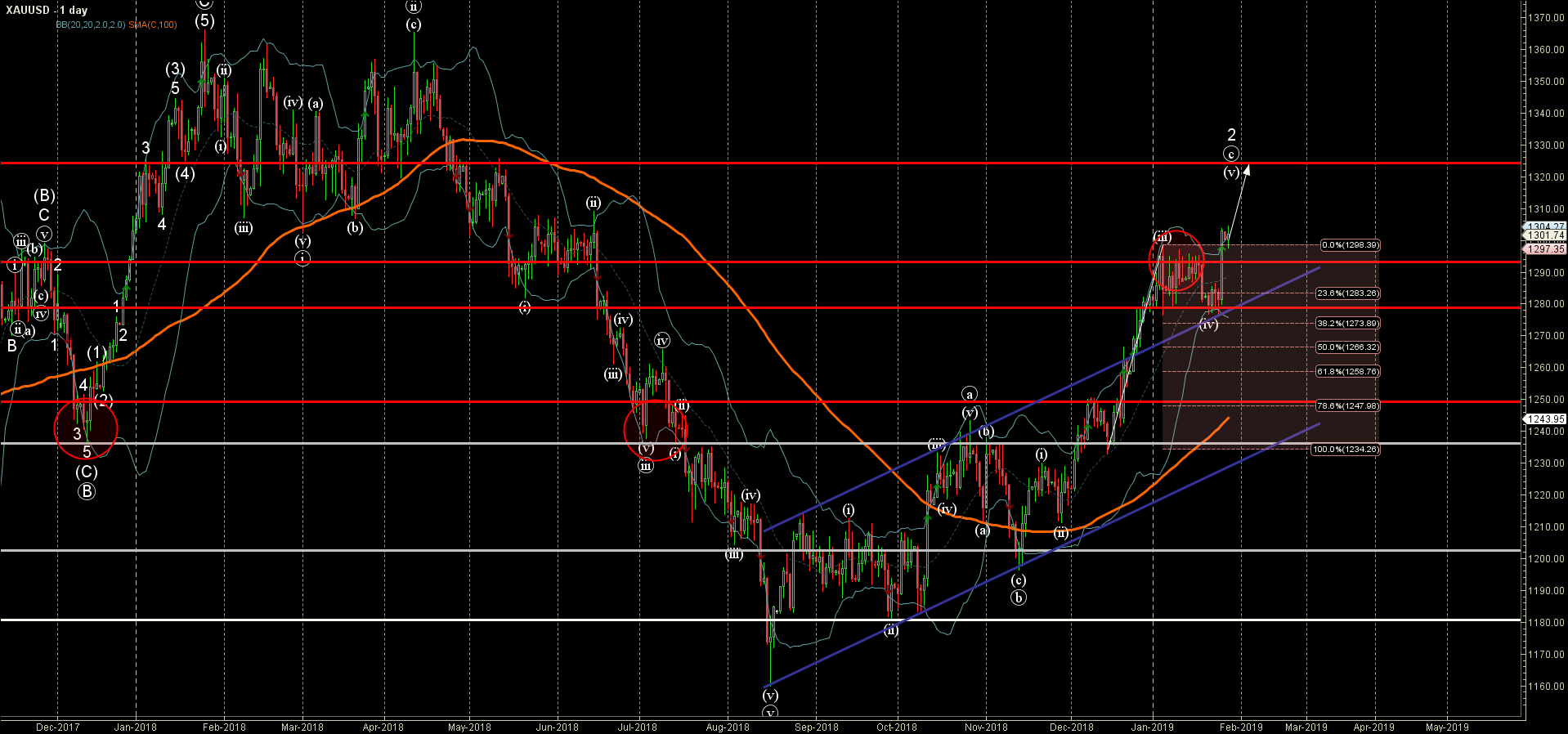

Gold broke resistance area Further gains are likely Gold recently broke the resistance area lying between the resistance levels 1300.00 (which has been reversing the price from the start of January) and 1305.00 (previous monthly high from June). The breakout.

January 30, 2019

NZDUSD broke resistance area Further gains are likely NZDUSD recently broke the resistance area lying between the resistance level 0.6850 (previous high from the start of January) – intersecting with the resistance trendline from the middle of April. This price.

January 29, 2019

Silver broke resistance area Further gains are likely Silver recently broke the resistance area lying between the resistance level 15.75 (which has been reversing the price from the start of January) and the 50% Fibonacci correction of the long-term downward.

January 29, 2019

EURCHF broke resistance level 1.1330 Further gains are likely EURCHF continues to rise after the earlier breakout of the resistance level 1.1330 (which has been reversing the price from the middle of December) – intersecting with the 50% Fibonacci correction.

January 28, 2019

NZDCAD rising inside impulse wave (3) Further gains are likely NZDCAD continues to rise inside the medium-term impulse wave (3) which started earlier with the daily Morning Star from the support area surrounding the strong support level 0.8920 (which has.