Technical analysis - Page 433

February 13, 2019

NZDCAD reversed from support area Further gains are likely NZDCAD today reversed up from the support area lying between the pivotal support level 0.8920 (which has been reversing the price from the end of November), 100-day moving average, lower daily.

February 13, 2019

Corn reversed from support area Further gains are likely Corn recently reversed up from the support area lying between the key support level 372.00 (which has been reversing the price from the end of December), lower daily Bollinger Band and.

February 12, 2019

EURUSD reversed from support area Further gains are likely EURUSD recently reversed up from the support area lying between the key support level 1.12700 (which has been reversing the price from the start of October) and the lower daily Bollinger.

February 12, 2019

Copper reversed from resistance area Further losses are likely Copper recently reversed down from the resistance area lying between the strong resistance level 283.00 (which has been steadily reversing the price from the start of October), upper daily Bollinger Band.

February 8, 2019

NZDUSD falling inside impulse wave 3 Further losses are likely NZDUSD continues to fall inside the short-term impulse wave 3 – which started earlier from the resistance area lying between the key resistance level 0.6940 (which reversed wave (2).

February 8, 2019

Cotton reversed from resistance area Further losses are likely Cotton recently reversed down from the resistance area lying between the strong resistance level 75.30 (former multi-month support from February), upper daily Bollinger Band and the 50-day moving average. The downward.

February 7, 2019

CADJPY reversed from resistance area Further losses are likely CADJPY recently reversed down sharply from the resistance area lying between the strong resistance level 84.00 (former major support from August, September and December), upper daily Bollinger Band and the 61.8%.

February 7, 2019

Soy reversed from resistance area Further losses are likely Soy recently reversed down from the resistance area lying between the key resistance level 927.00 (which has been reversing the price from the end of November), upper daily Bollinger Band and.

February 6, 2019

NZDUSD reversed from resistance area Further losses are likely NZDUSD recently reversed down from the resistance area lying between the pivotal resistance level 0.6940 (which reversed wave (2) in January), upper daily Bollinger Band and the 50% Fibonacci correction of.

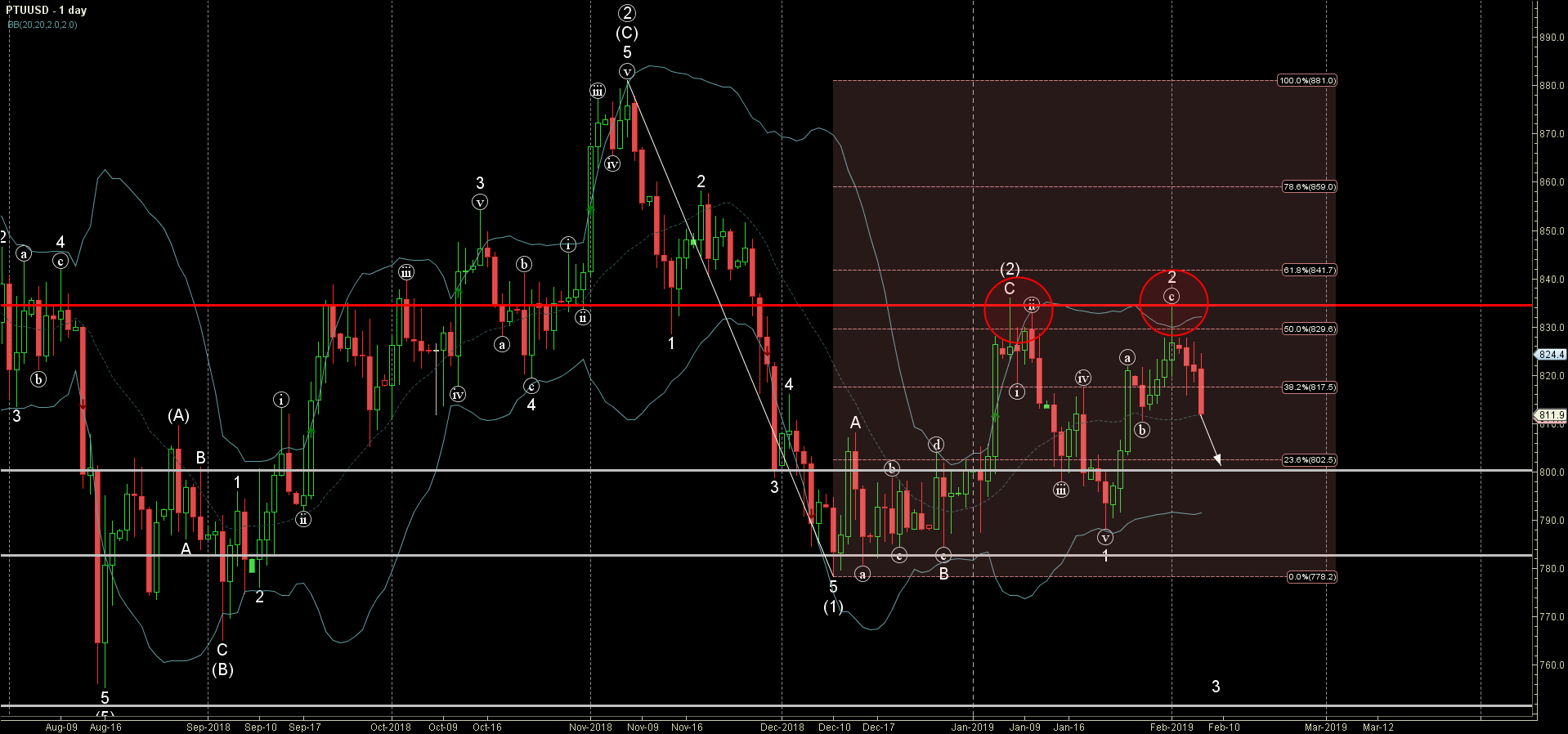

February 6, 2019

Platinum reversed from resistance area Further losses are likely Platinum recently reversed down from the resistance area lying between the key resistance level 834.5 (which stopped the previous upward correction (2) in January), upper daily Bollinger Band and the 50%.

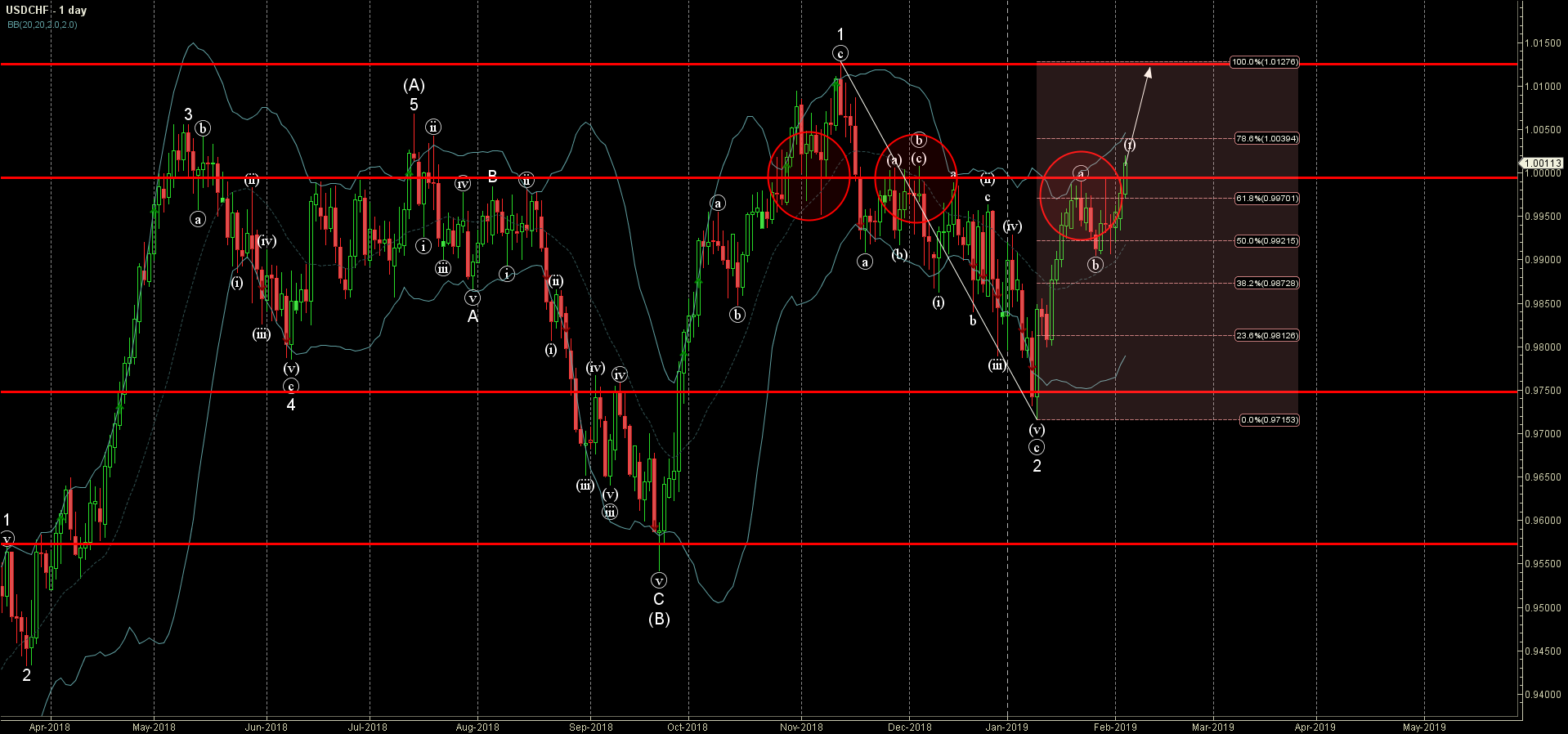

February 5, 2019

USDCHF broke resistance area Further gains are likely USDCHF today broke the resistance area lying between the parity (which has been steadily reversing the price from the end of November) and the 61.8% Fibonacci correction of the previous sharp downward.