Technical analysis - Page 429

March 19, 2019

AUDCAD reversed from resistance area Further losses are likely AUDCAD recently reversed down from the resistance area lying between the key resistance level 0.9460 (which has been reversing the price from February), upper daily Bollinger Band and the resistance trendline.

March 19, 2019

Copper reversed from support area Further gains are likely Copper recently reversed up from the support area lying between the key support level 290.00 (former powerful resistance level from the end of September) and the lower daily Bollinger Band. The.

March 18, 2019

Gold reversed from support area Further gains are likely Gold recently reversed up from the support area lying between the strong support level 1280.00 (monthly low from January), 100-day moving average and the lower daily Bollinger Band. The upward reversal.

March 18, 2019

USDCHF reversed from resistance area Further losses are likely USDCHF recently reversed down from the resistance area lying between the key resistance level 1.0100 (which has been steadily reversing the price from November) and the upper daily Bollinger Band. The.

March 15, 2019

Soy reversed from support area Further gains are likely Soy recently reversed up from the support area lying between the pivotal support level 890.00 (which has been reversing the price from the middle of January) and the 38.2% Fibonacci correction.

March 15, 2019

USDCAD reversed from support area Further gains are likely USDCAD recently reversed up from the support area lying between the key support level 1.3320 (former strong resistance from February) and the 38.2% Fibonacci correction of the previous upward impulse from.

March 14, 2019

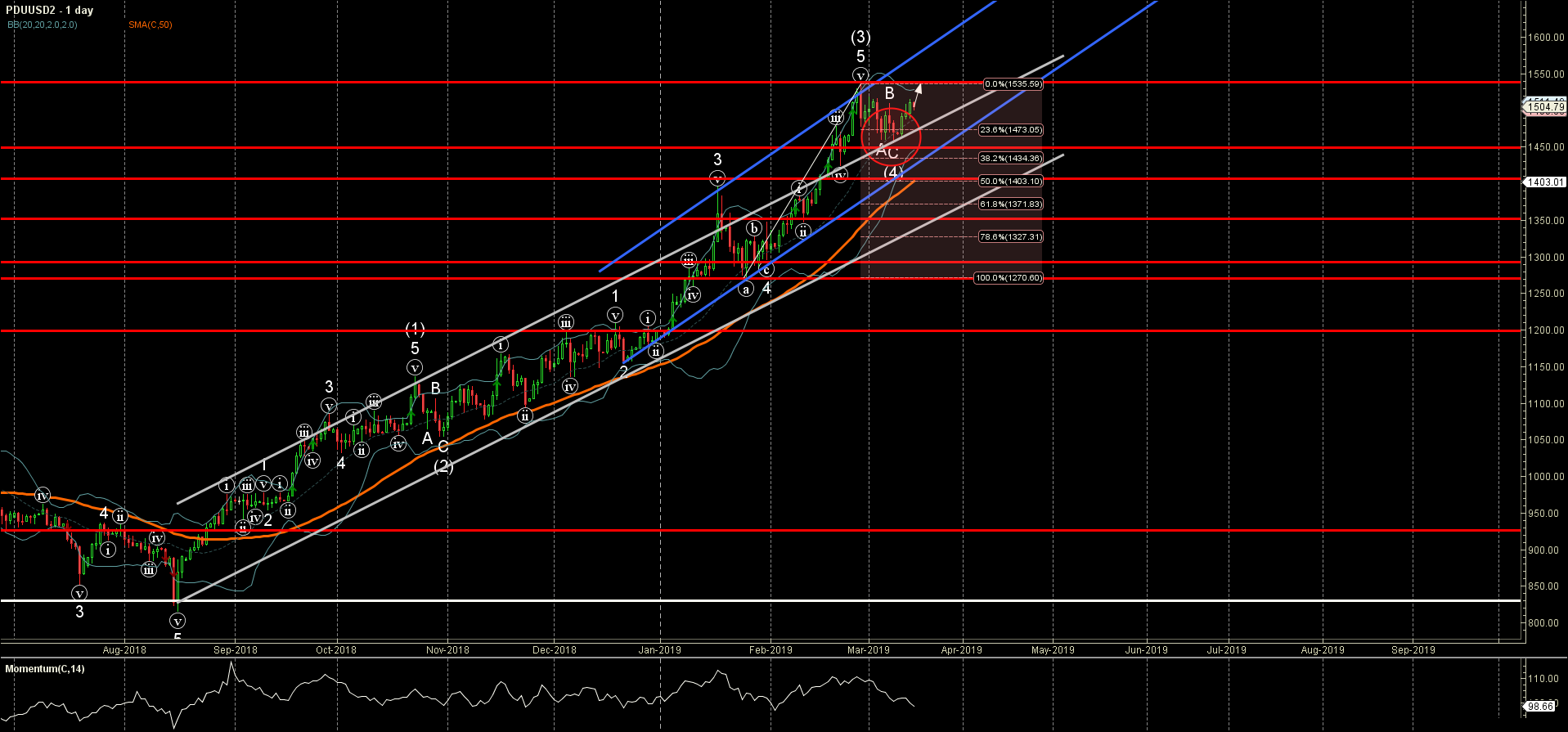

Palladium reversed from key support area Further gains are likely Palladium recently reversed up from the key support area lying near the support level 1450.00 and the upper trendline of the recently broken extended up channel from August. This support.

March 14, 2019

AUDUSD reversed from the resistance level 0.7100 Further losses are likely AUDUSD recently reversed down from the key resistance level 0.7100 (former strong support from the middle of February). This support level was further strengthened by the 50% Fibonacci correction.

March 13, 2019

GBPAUD rising inside the impulse wave (iii) Further gains are likely GBPAUD continues to rise inside the active impulse wave (iii) – which stared earlier from the key support level 1.0400 (which has been reversing the price from the.

March 13, 2019

Cotton broke key resistance level 74.8 Further gains are likely Cotton recently broke the key resistance level 74.8 (which has been reversing the price from the middle of February) – intersecting with the resistance trendline from July. The breakout of.

March 12, 2019

Copper reversed from support level 287.00 Further gains are likely Copper recently reversed up from the support level 287.00 (former multi-month resistance level from July) – strengthened by the 38.2% Fibonacci correction of the previous upward impulse 5. The upward.