Technical analysis - Page 428

March 27, 2019

Wheat reversed from resistance area Further losses are likely Wheat recently reversed down from the resistance area lying between the key resistance level 470.00 (former powerful support from 2018), upper daily Bollinger Band and the 38.2% Fibonacci correction of the.

March 27, 2019

NZDJPY broke daily up channel Further losses are likely NZDJPY recently broke the support trendline of the daily up channel from the start of January. The breakout of this up channel follows the earlier downward reversal from the key resistance.

March 26, 2019

Cotton rising inside wave (c) Further gains are likely Cotton continues to rise inside the wave (c) of the short-term ABC correction 2 from the middle of February. The price earlier broke though the resistance area lying between the key.

March 26, 2019

AUDJPY reversed from support area Further gains are likely AUDJPY recently reversed up from the support area lying between the key support level 77.50 and the lower daily Bollinger Band. If the price closes today near the current levels it.

March 25, 2019

NZDCAD broke resistance area Further gains are likely NZDCAD recently broke through the resistance area lying between the key resistance level 0.9250 (monthly high from November) and the resistance trendline of the wide weekly down channel from the middle of.

March 25, 2019

Silver reversed from support area Further gains are likely Silver recently reversed up from the support area lying between the key support level 13.30 (which reversed the price at the end of January), lower daily Bollinger Band and the 38.2%.

March 22, 2019

EURGBP reversed from resistance area Further losses are likely EURGBP recently reversed down with the daily Shooting Star from the resistance area lying between the upper daily Bollinger Band, resistance level 0.8700 and the 38.2% Fibonacci correction of the previous.

March 22, 2019

Platinum reversed from resistance area Further losses are likely Platinum recently reversed down from the resistance area lying between the multi-month resistance level 875.00 (which has been reversing the price from last December) and the upper daily Bollinger Band. The.

March 21, 2019

Gold broke key resistance level 1310.00 Further gains are likely Gold recently broke through the resistance level 1310.00 (which stopped the (a)-wave of the active B-wave earlier this month). The breakout of the resistance level 1310.00 strengthened the bullish pressure.

March 21, 2019

NZDUSD reversed from resistance area Further losses are likely NZDUSD recently reversed down from the resistance area lying between the key resistance level 0.6940 (which has been reversing the price from start of December) and the upper daily Bollinger Band..

March 20, 2019

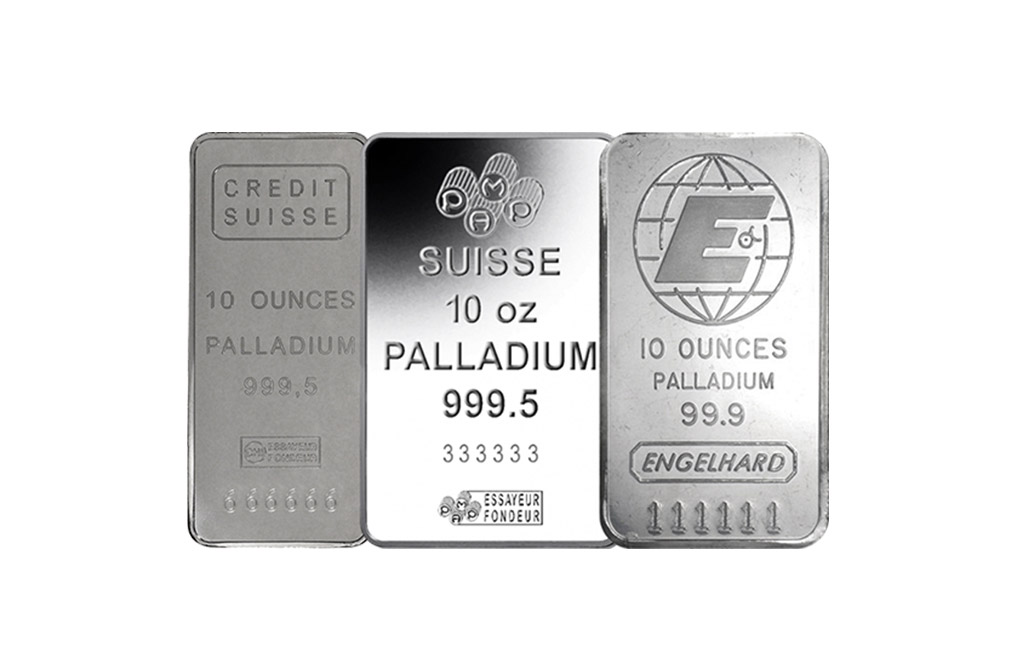

Palladium broke resistance level 1540.00 Further gains are likely Palladium recently broke through the resistance level 1540.00 (which stopped the previous impulse wave (3) in February). The breakout of the resistance level 1540.00 accelerated the active short-term impulse wave 3.