Technical analysis - Page 402

September 23, 2019

Google reversed from resistance area Likely to fall to 1200.00 Google today reversed down from the resistance area lying between the strong resistance level 1250.00 (which has reversed the price multiple times from the middle of 2018, as can be.

September 23, 2019

EURNZD reversed from resistance area Likely to fall to 1.7310 EURNZD today reversed down from the resistance area lying between the strong resistance level 1.7600 (which has been reversing the price from the star of August) and the upper daily.

September 20, 2019

NZDCHF falling inside impulse wave (iii) Further losses likely toward 0.6160 NZDCHF continues to fall inside the short-term impulse wave (iii) which started earlier from the resistance area located between the resistance level 0.6400 (former support from June) and the.

September 20, 2019

Palladium broke round resistance level 1600.00 Likely to rise to 1660.00 Palladium recently broke above the strong round resistance level 1600.00 (which stopped the previous sharp upward impulse wave 1 in the middle of July). The breakout of the resistance.

September 19, 2019

Platinum reversed from support area Further gains likely toward 963.00 Platinum recently reversed up from the support area lying between the support levels 928.00 (which stopped the earlier waves (iv) and (a)), 920.00, 50% Fibonacci correction of the previous upward.

September 19, 2019

AUDJPY reversed from resistance zone Likely to correct down to 73.00 AUDJPY recently reversed down from the resistance area lying between the resistance level 74.50 (former support from June), upper daily Bollinger Band, 100-day moving average and the 38.2% Fibonacci.

September 18, 2019

Corn reversed from resistance zone Further losses are likely Corn recently reversed down from the resistance area lying between the resistance level 372.00 (top of the previous Evening Star from the end of August), upper daily Bollinger Band, resistance trendline.

September 18, 2019

AUDUSD reversed from resistance zone Further losses are likely AUDUSD under bearish pressure today after the earlier downward reversal from the resistance area lying between the resistance level 0.6870 (former monthly support from the middle of May), upper daily Bollinger.

September 17, 2019

Sugar reversed from resistance zone Further losses are likely Sugar recently reversed down with the daily Falling Star from the resistance zone lying between the resistance level 11.25 (former strong support from August), upper resistance trendline of the daily down.

September 17, 2019

NZDUSD reversed from resistance zone Further losses are likely NZDUSD recently reversed down from the resistance zone lying between the resistance level 0.6430 (former strong support from October of 2018), upper daily Bollinger Band and the 38.2% Fibonacci correction of.

September 17, 2019

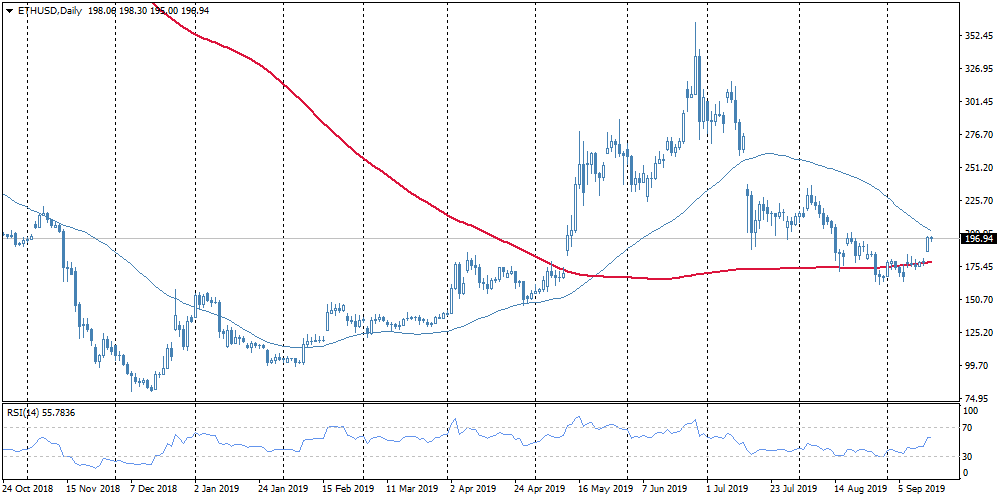

The Bitcoin price has remained virtually unchanged over the past 24 hours, remaining close to $10,200. As for the tech analysis, the first cryptocurrency remains trapped in the triangle, showing a weakening of the oscillation amplitude since late June. Among.