Technical analysis - Page 398

November 8, 2019

Exxon Mobil broke resistance area Likely to rise to 75.00 Exxon Mobil has been under bullish pressure after the earlier breakout of the resistance level 70.00 (previous upward target). The price earlier broke the resistance area lying between the resistance.

November 8, 2019

GBPNZD reversed from support zone Likely to rise to 2.0400. GBPNZD recently reversed up from the support zone lying between the round support level 2.000 (former monthly high from May and September) and the 50% Fibonacci correction of the.

November 8, 2019

Platinum broke support level 900.00 Likely to fall to 880.00 Platinum recently broke the support zone lying between the round support level 900.00 (former resistance from October) and the 50% Fibonacci correction of the previous upward impulse from October. The.

November 7, 2019

General Electric broke key resistance level 10.50 Likely to rise to 11.50 General Electric recently broke above the key resistance level 10,50 (which has reversed multiple upward impulses from the start of May). The breakout of the resistance level 10.50.

November 7, 2019

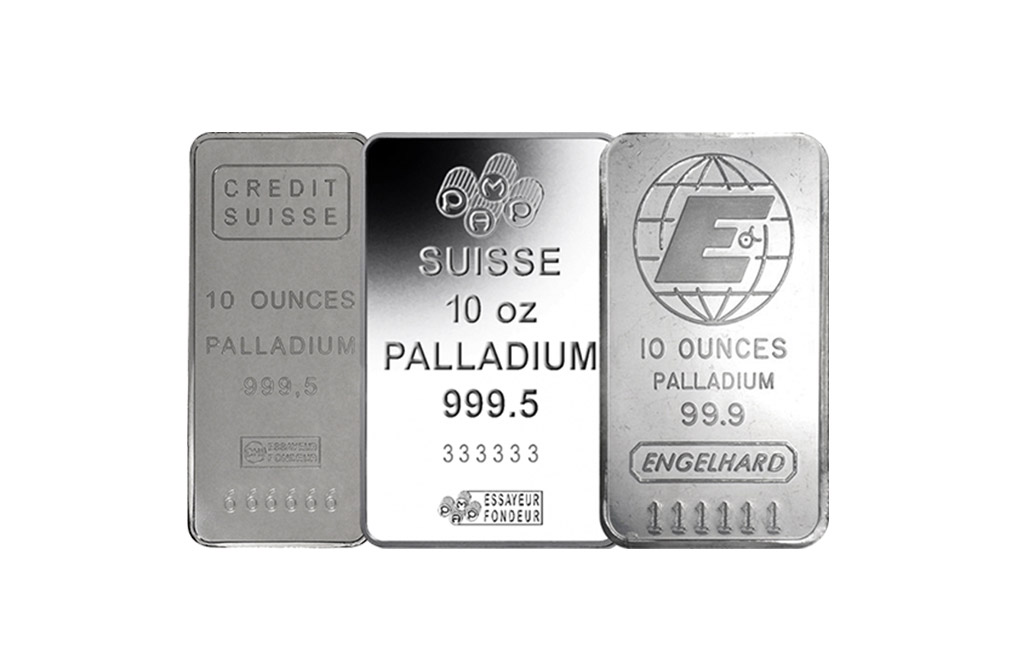

Palladium reversed from support zone Likely to rise to 1800.00 Palladium recently reversed up from support zone lying between the key support level 1750.00 (former resistance from October), lower daily Bollinger Band and the 38,2% Fibonacci correction of the previous.

November 7, 2019

GBPCAD reversed from resistance zone Likely to fall to 1.6700 GBPCAD recently reversed down from resistance zone lying between the strong resistance level 1.7040 (top of the previous impulse wave 1), upper daily Bollinger Band and the 61.8% Fibonacci correction.

November 6, 2019

Goldman Sachs reversed from resistance zone Likely to fall to 212.00 Goldman Sachs recently reversed down from the resistance area lying between the multi-month resistance level 220.00 (which has been reversing the price from July) and the upper daily Bollinger.

November 6, 2019

Copper reversed from resistance zone Likely to fall to 262.00 Copper under bearish pressure after the earlier downward reversal from the resistance area lying between the key resistance level 270.40 (top of the daily Evening Star from September), upper daily.

November 6, 2019

USDJPY reversed from resistance zone Likely to fall to 108.50 USDJPY recently reversed down from resistance zone lying between the strong resistance level 109.2 (which has been reversing the price from the start of August), upper daily Bollinger Band and.

November 5, 2019

Boeing reversed from powerful support level 320.00 Likely to rise to 360.00 Boeing recently reversed up sharply from the powerful support level 320.00 (former multi-month low from the middle of August). The upward reversal from the support level 320.00 started.

November 5, 2019

Brent Crude Oil broke key resistance level 61.90 Likely to rise to 64.00 Brent Crude Oil recently broke above the key resistance level 61.90 (top of the previous impulse wave (i) from the end of October). The breakout of the.