Technical analysis - Page 398

October 17, 2019

GBPAUD reversed from resistance area Likely to fall to 1.8630 GBPAUD under pressure after the earlier downward reversal from the resistance area lying between the strong resistance level 1.8870 (monthly high form March and May) and the upper daily Bollinger.

October 17, 2019

Wheat broke the resistance area Likely to rise to 530.00 Wheat recently broke the resistance area lying between the resistance level 516.40 (former resistance from July) and the 61.8% Fibonacci retracement of the previous downward impulse from June. The breakout.

October 16, 2019

Comcast rising inside shot-term impulse wave 3 Likely to rise to 47.00 Comcast continues to rise inside the shot-term impulse wave 3 which started earlier from the support level 43.45, intersecting with the support trendline from December. The active impulse.

October 16, 2019

EURNZD reversed from support area Likely to rise to 910.00 EURNZD today broke above the key multi-month resistance level 1.7560 (which has been reversing the price from the start of August). The breakout of the resistance level 1.7560 continues the.

October 16, 2019

Platinum reversed from support area Likely to rise to 910.00 Platinum recently reversed up from the support area lying between the broke the key support level 880.00 (former resistance from July) and the 61.8% Fibonacci retracement of the previous upward.

October 15, 2019

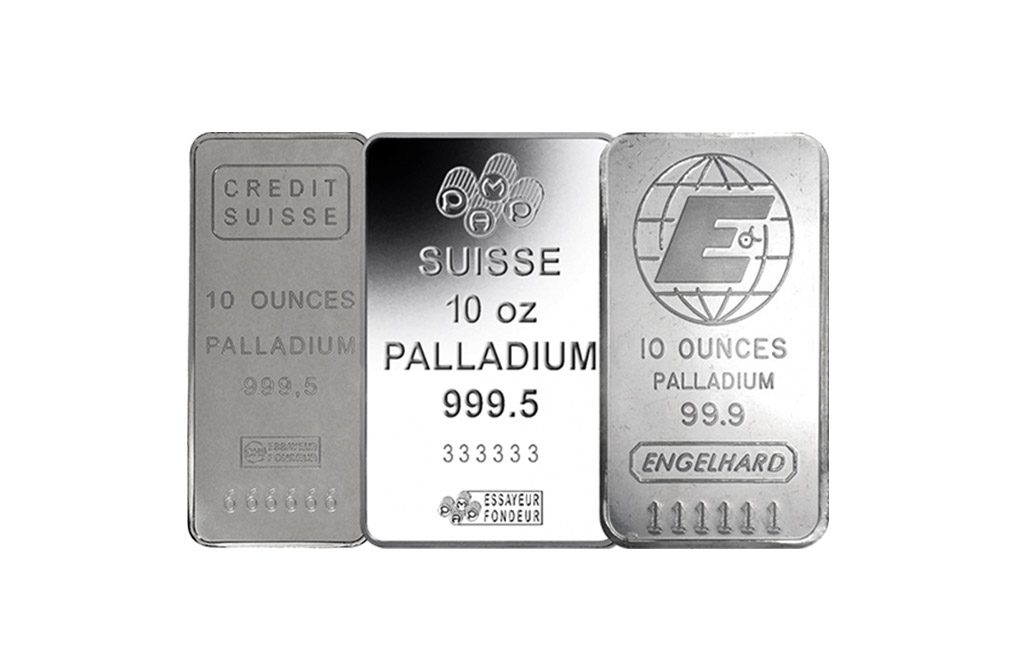

Palladium broke resistance area Likely to rise to 1725.00 Palladium continues to rise after the earlier breakout of the resistance area lying between the resistance levels 1650.00 and 1675.0. The breakout of this resistance area accelerated the active impulse wave.

October 15, 2019

Exxon reversed from long-term support level 66.90 Likely to rise to 70.00 Exxon recently reversed up sharply from the support area lying between the long-term support level 66.90 (which has been reversing the price from 2015) and the lower weekly.

October 15, 2019

GBPNZD broke round resistance level 2.0000 Likely to rise to 2.0400 GBPNZD recently broke the key round resistance level 2.0000 which previously reversed the price sharply in May and September (top of waves A and (i)). The breakout of the.

October 14, 2019

Apple broke multi-month resistance level 230.00 Likely to rise to 242.00 Apple recently broke above the powerful, multi-month resistance level 230.00 (which stopped the sharp daily uptrend in October of 2018, as can be seen below). The breakout of the.

October 14, 2019

Cotton reversed from resistance zone Likely to fall to 62.70 Cotton today reversed down from the resistance area located between the resistance level 64.60 (which reversed the price in July), upper daily Bollinger Band and the 38.2% Fibonacci correction of.

October 14, 2019

AUDCAD reversed from resistance zone Likely to fall to 0.8840 AUDCAD recently reversed down from the resistance zone lying between the key resistance level 0.9010 and the 61.8% Fibonacci correction of the previous downward impulse from September. The downward reversal.