Technical analysis - Page 392

November 20, 2019

EURCAD reversed from resistance level 1,470 Likely to fall to 1,4550 EURCAD today reversed down from the key resistance level 1,4700 (which has been reversing the price form the middle of September) – intersecting with the upper daily Bollinger Band..

November 20, 2019

ExxonMobil falling inside impulse wave C Likely to fall to 75.00 ExxonMobil continues to fall inside the short-term impulse wave C, which belongs to the medium-term ABC correction (2) from the start of November. The active wave (2) is a.

November 19, 2019

GBPAUD reversed from key resistance area Likely to fall to 1.8920 GBPAUD recently reversed down from the key resistance area lying between the resistance level 1.9070 (monthly high from October) and the upper daily Bollinger Band. The downward reversal from.

November 19, 2019

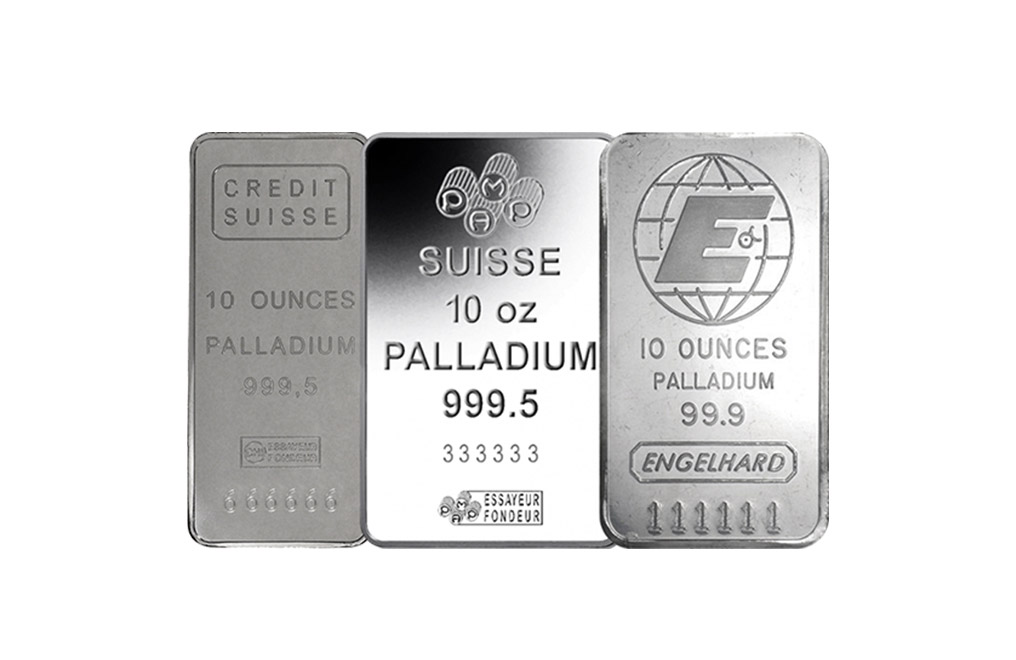

Palladium reversed from support zone Likely to rise to 1750.00 Palladium recently reversed up from the support zone lying between the support level 1650.00 (low of the earlier wave (ii), lower daily Bollinger Band and the 61.8% Fibonacci correction of.

November 19, 2019

JPMorgan Chase rising inside impulse wave 5 Likely to rise to 135.00 JPMorgan Chase continues to rise inside the short-term impulse wave 5, which started earlier from the upper trendline of the recently broken up channel from January (acting as.

November 18, 2019

Wheat broke support area Likely to fall to 490.00 Wheat recently broke the support area located between the support level 502.00 (which stopped the earlier impulse wave 1) and the 38.2% Fibonacci correction of the previous ABC correction (2) from.

November 18, 2019

GBPCAD broke resistance area Likely to rise to 1.7300 GBPCAD recently broke the resistance area lying between the resistance level 1.7040 (which reversed the price twice in October) and the 61.8% Fibonacci correction of the previous downward impulse from May..

November 18, 2019

Adobe rising inside impulse wave (3) Likely to rise to 310.00 Adobe continues to rise inside the sharp medium-term impulse wave (3) from the start of November (in line with our earlier forecast for this instrument). The price earlier broke.

November 15, 2019

Home Depot reversed from support area Likely to rise to 238.60 and 245.00 Home Depot recently reversed up from the support zone located at the intersection of the support level 230.0 (which also reversed the price at the start of.

November 15, 2019

CADCHF reversed from support area Likely to rise to 0.7500 CADCHF recently reversed up from the support zone lying between the support level 0.7440 (which earlier reversed multiple downward corrections from September), lower daily Bollinger Band and the 50% Fibonacci.

November 15, 2019

Natural gas reversed from support area Likely to rise to 2.700 Natural gas recently reversed up from the support area lying between the support level 2.600, lower daily Bollinger Band and the 50% Fibonacci correction of the previous upward impulse.