Technical analysis - Page 391

December 18, 2019

EURUSD reversed from resistance area Likely to fall to 1.1100 EURUSD recently reversed down from the resistance area lying between the key resistance level 1.1165 (which has been steadily reversing the price from August), upper daily Bollinger Band and the.

December 18, 2019

Natural Gas reversed from resistance area Likely to fall to 2.155 Natural Gas recently reversed down from the resistance area lying between the resistance level 2.300 (former strong support from October) and the 38.2% Fibonacci correction of the previous downward.

December 17, 2019

Catepillar reversed from resistance area Likely to fall to 540.00 Catepillar recently reversed down from the resistance area lying between the key resistance level 148.00 (which stopped the sharp impulse wave (1) in November) and the upper daily Bollinger Band..

December 17, 2019

Wheat reversed from resistance area Likely to fall to 540.00 Wheat recently reversed down from the resistance area lying between the key resistance level 552.00 (which stopped the sharp uptrend in June) and the upper daily Bollinger Band. The downward.

December 17, 2019

EURAUD reversed from resistance area Likely to fall to 1.6100 EURAUD currently trading close to the resistance area lying between the key resistance level 1.6300 (which has been reversing the price from October) and the upper daily Bollinger Band. The.

December 17, 2019

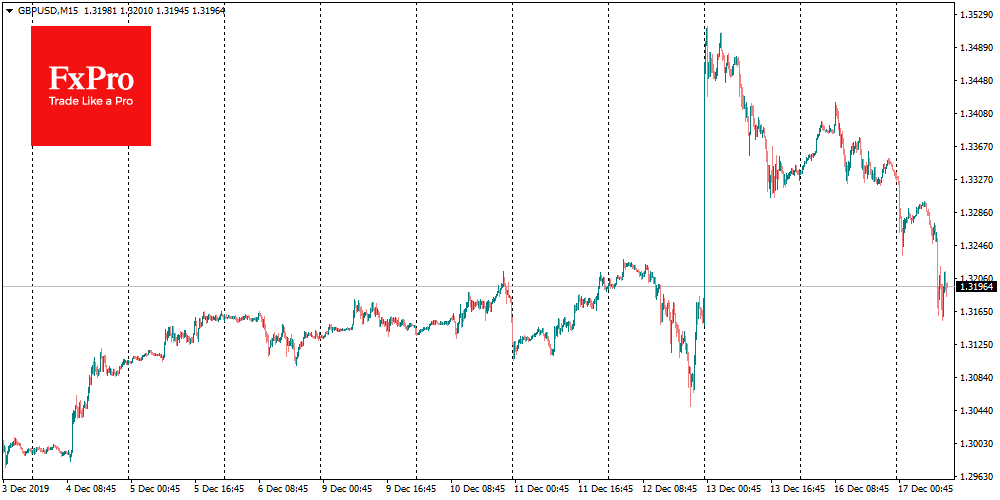

Boris Johnson has tightened up the deadlines again, pushed Pound Sterling lower. The official Brexit date remains 31 January 2020. Further, there should be a transition period of 2-3 years aimed to conclude a comprehensive trade deal with the EU..

December 16, 2019

Apple reversed from support level 267.25 Likely to rise to 280.0 Apple recently reversed up from the support level 267.25 (former resistance level which stopped earlier impulse waves (iii) and 3 – acting as support after was broken recently). The.

December 16, 2019

Wheat rising inside impulse wave (v) Likely to rise to 545.30 Wheat continues to rise inside the short-term impulse wave (v), which started earlier from the support area lying between the support level 520.00 and the 50-day moving average. The.

December 16, 2019

AUDCAD reversed from resistance area Likely to fall to 0.9000 AUDCAD recently reversed down from the resistance area lying between the key resistance level 0.911 (which has been reversing the price from September), 38.2% Fibonacci correction of the previous downward.

December 13, 2019

Bank of America broke key resistance level 33.60 Likely to rise to 36.00 Bank of America recently broke through the key resistance level 33.60 (which stopped the previous waves 3 and (b) in November). The breakout of the resistance level.

December 13, 2019

Sugar broke resistance level 13.40 Likely to rise to 4.00 Sugar recently broke through the multi-month resistance level 13.40 (which stopped the previous ABC correction 2 in February). The breakout of the resistance level 13.40 is aligned with active short-term.