Technical analysis - Page 384

January 7, 2020

AUDCAD broke strong support level 0.8980 Likely to fall to 0.8900 AUDCAD continues to fall inside the sharp impulse wave (1), which previously broke through the strong support level 0.8980 (which has reversed the price multiple times from November). The.

January 6, 2020

General Electric broke resistance level 11.50 Likely to rise to 12.30 General Electric recently broke the powerful, multi-month resistance level 11.50 (which has been reversing the price from February). The breakout of the resistance level 11.50 accelerated the active short-term.

January 6, 2020

Sugar reversed from support area Likely to rise to 13.60 Sugar recently reversed up from the support area lying between the support level 13.20, support trendline of the daily up channel from October, lower daily Bollinger Band and 38.2% Fibonacci.

January 6, 2020

GBPJPY reversed from support area Likely to rise to 144.00 GBPJPY recently reversed up from the support area lying between the key support level 141.00 (former monthly top from October) – intersecting with lower daily Bollinger Band and 38.2% Fibonacci.

January 3, 2020

Intel broke long-term resistance level 59.00 Likely to rise to 63.00 Intel recently broke the multi-month resistance level 59.00 (which has been steadily reversing the price from last April, as can be seen below). The breakout of the resistance level.

January 3, 2020

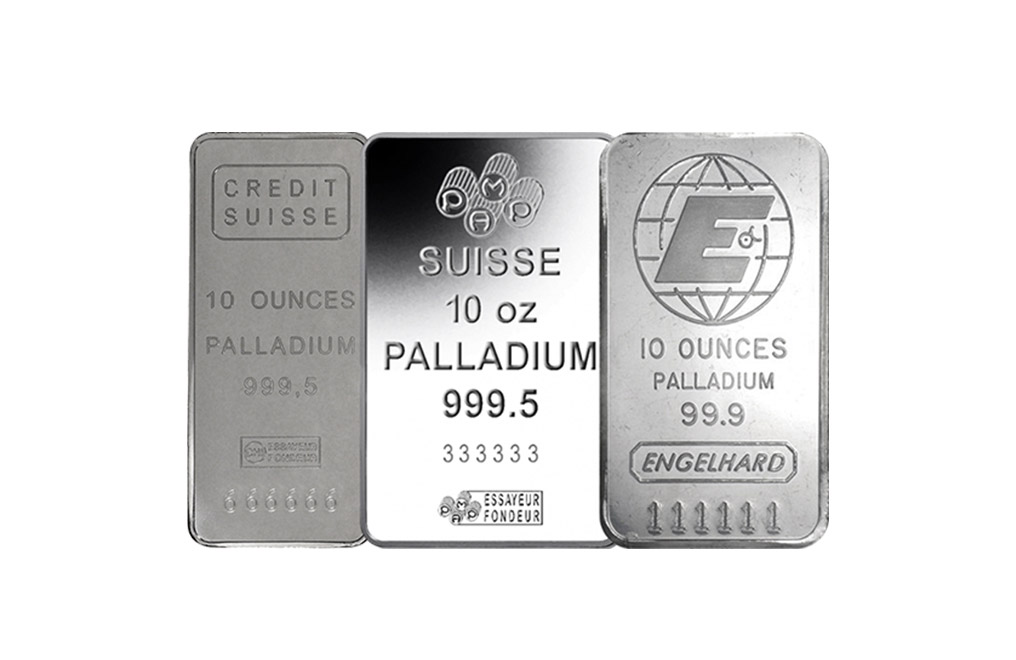

Palladium rising inside impulse wave (iii) Likely to rise to 1975,00 Palladium has been rising in the last few trading session inside the sharp impulse wave (iii), which started recently from the strong round support level 1800,00 (former resistance from.

January 3, 2020

AUDJPY reversed from key resistance level 76.20 Likely to fall to 74.60 AUDJPY recently reversed down from the key resistance level 76.20 (which has been reversing the price from the middle of May) – intersecting with the resistance trendline of.

January 2, 2020

Soy broke resistance level 945.00 Likely to rise to 970.00 Soy recently broke with the upward gap above the resistance level 945.00 (which stopped the previous waves (A) and B in October and November respectively). The breakout of the resistance.

January 2, 2020

USDCHF reversed from support area Likely to rise to 0.9750 USDCHF recently reversed up from the support area lying between the key support level 0.9665 (which stopped the sharp downward impulse in August) and the lower daily Bollinger Band. The.

January 2, 2020

Alibaba reversed from key support level 210.20 Likely to rise to 217.40 Alibaba recently reversed up from the key support level 210.20 (former multi-month resistance level which stopped the previous weekly impulse wave I in the middle of 2018). The.

December 31, 2019

Ebay reversed from resistance area Likely to fall to support level 34.50 Ebay previously reversed down from the resistance area lying between resistance level 36.50 (lower border of the gap area which formed at the end of October), upper daily.