Technical analysis - Page 383

January 13, 2020

CHFJPY rising inside impulse wave С Likely to rise to 113.70 CHFJPY recently broke the resistance area lying between the resistance level 112.40 (top of the previous wave (i)) and the 50% Fibonacci correction of the previous downward impulse from.

January 10, 2020

Cotton broke resistance area Likely to rise to 72.00 Cotton recently broke the resistance area lying at the intersection of the strong round resistance level 70.00 (monthly high from June) and the resistance trendline of the daily up channel from.

January 10, 2020

Groupon reversed from long-term support area Likely to rise to 2.60 Groupon recently reversed up sharply from the long-term support area lying between the strong support level 2.12 (which stopped the sharp downtrend at the start of 2016) and the.

January 10, 2020

USDCHF rising inside impulse wave (c) Likely to rise to 0.9775 USDCHF has been rising in the last few trading sessions inside the short-term impulse wave (c) – which started recently from the support area lying between the strong support.

January 9, 2020

Coca-Cola reversed from support area Likely to rise to 55.30 Coca-Cola recently reversed up from the support area lying between the key support levels 53.70, lower daily Bollinger Band and the 38.2% Fibonacci correction of the previous sharp upward impulse.

January 9, 2020

Brent Crude Oil reversed from resistance area Likely to fall to 64.00 Brent Crude Oil recently reversed down from the resistance area lying between the resistance levels 70,00 and 68.80 (top of the previous sharp wave (A) from September) and.

January 9, 2020

CADJPY reversed from resistance area Likely to fall to 83.00 CADJPY recently reversed down from the resistance area lying between the resistance level 83.80 (which has been reversing the price from last April) and the upper daily Bollinger Band. The.

January 8, 2020

Charles Schwab Corporation reversed from support area Likely to rise to 49.00 Charles Schwab Corporation recently reversed up from the support area lying between the strong support level 46.50 (former multi-month resistance level from last year) and the 38.22% Fibonacci.

January 8, 2020

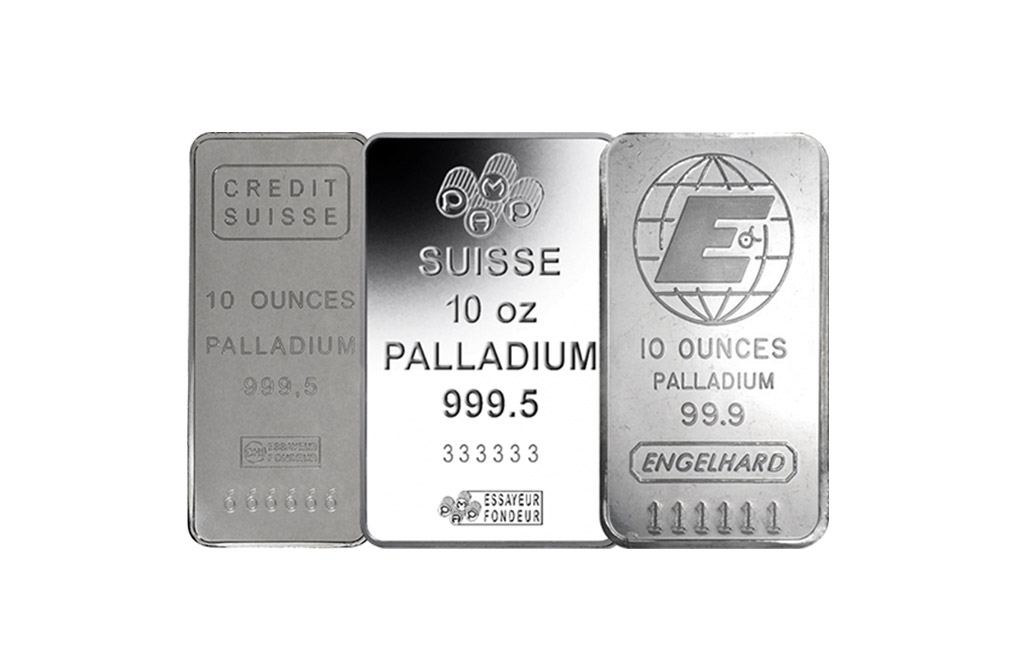

Palladium broke resistance area Likely to rise to 2150.00 Palladium recently broke the resistance area lying between the round resistance level 2000.00 and the resistance trendlines of the two daily up channels from November and August. The breakout of this.

January 8, 2020

EURAUD reversed from resistance area Likely to fall to 1.6300 EURAUD recently reversed down from the resistance area lying between the resistance level 1.6300 (which has been reversing the price from October), upper daily Bollinger Band and the 61.8% Fibonacci.

January 7, 2020

Facebook broke strong resistance level 208.00 Likely to rise to 218.00 Facebook recently broke above the strong resistance level 208.00 (former strong resistance level which stopped the sharp uptrend in July, and also wave 3 in December). The breakout of.