Technical analysis - Page 382

February 11, 2020

USDCAD reversed from resistance area Likely to fall to support level 1.3250 USDCAD recently reversed down from the resistance area lying between the key resistance level 1.3320 (which has been reversing the price from October), upper daily Bollinger Band and.

February 10, 2020

JPMorgan Chase broke daily down channel Likely to rise to 140.65 JPMorgan Chase continues to rise inside the medium-term impulse wave (3) – which started earlier from the combined support zone surrounding the key support level 130.00. The price previously.

February 10, 2020

Palladium reversed from support area Likely to rise to 2400.00 Palladium recently reversed up from the support zone located between the key level 2155.00 (low of the previous short-term correction 4), lower daily Bollinger Band and the 38.2% Fibonacci correction.

February 10, 2020

GBPJPY reversed from support area Likely to rise to 143.40 GBPJPY recently reversed up from the support area lying between the pivotal support level 141.00 (which has been reversing the price from October), lower daily Bollinger Band and the 38.2%.

February 7, 2020

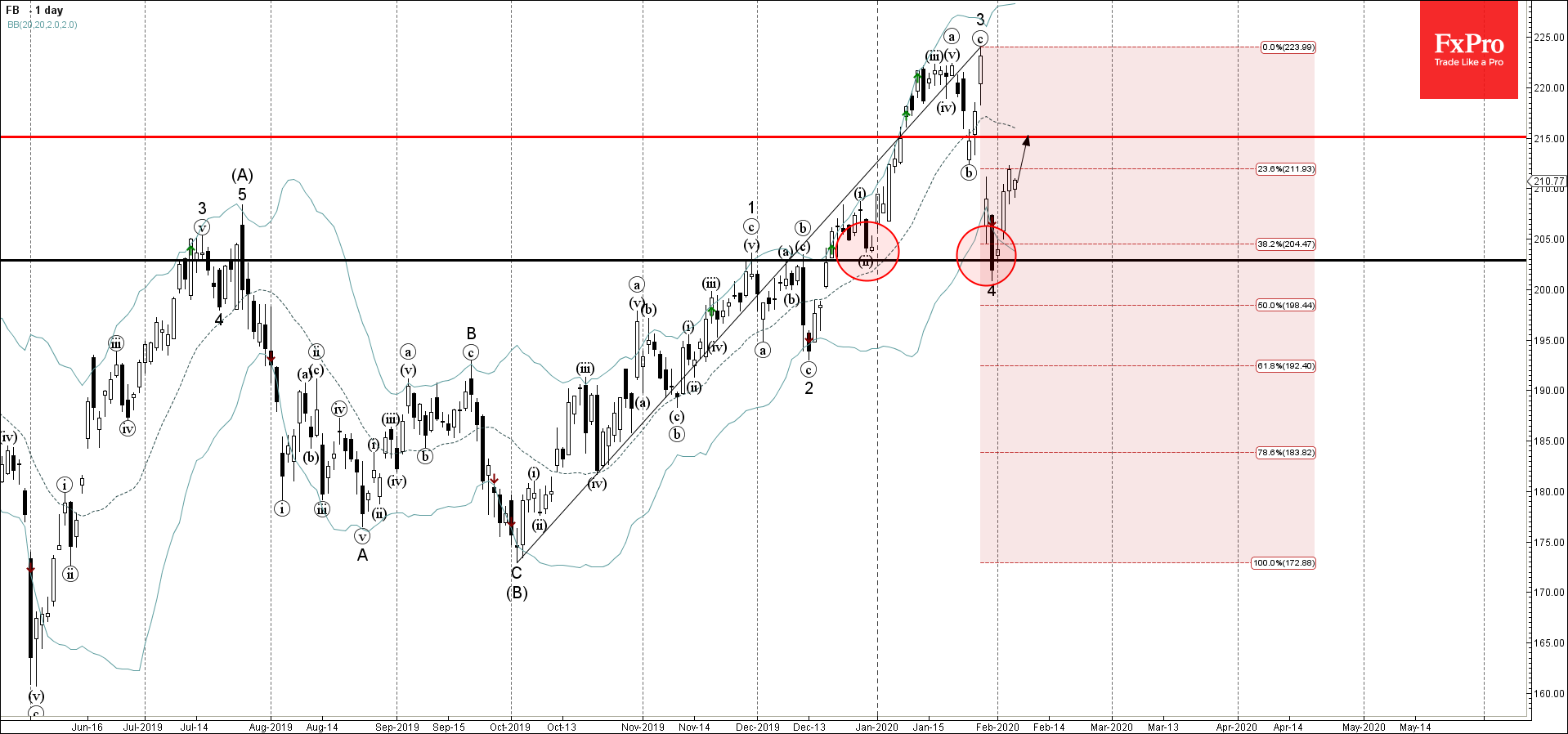

Facebook reversed from support area Likely to rise to 215.00 Facebook recently reversed up with the daily Morning Star from the support area lying between the support level 203.00, lower daily Bollinger Band and the 38.2% Fibonacci correction of the.

February 7, 2020

Palladium reversed from resistance area Likely to fall to 2155.00 Palladium recently reversed down with the daily Evening Star from the resistance area lying between the key resistance level 2400.00 and the upper daily Bollinger Band. The downward reversal from.

February 7, 2020

EURUSD broke key support level 1.0990 Likely to fall to 1.0920 EURUSD recently broke the key support level 1.0990 (which has been reversing the price from October) and the 61,8% Fibonacci correction of the pervious upward ABC correction (2) ..

February 6, 2020

IBM broke long-term resistance level 152.00 Likely to rise to 160.00 IBM recently broke through the powerful long-term resistance level 152.00 (which stopped the earlier sharp upward impulse sequence (1) in August). The breakout of the resistance level 152.00 accelerated.

February 6, 2020

Gold reversed from support area Likely to rise to 1600.00 Gold recently reversed up from the support zone lying between the key support level 1550.00 (former strong resistance from August), lower daily Bollinger Band and the 38.2% Fibonacci correction of.

February 6, 2020

CADCHF reversed from support area Likely to rise to 0.7360 CADCHF recently reversed up with the daily reversal pattern Morning Star from the support area lying between the key support level 0.7270 (which reversed the price twice in August) and.

February 5, 2020

Qualcomm reversed from support area Likely to rise to 90.00 Qualcomm recently reversed up from the support zone located between the key support level 85,00 (low of the previous correction (ii) from the start of January), lower daily Bollinger Band.