Technical analysis - Page 371

March 27, 2020

EURGBP broke round support level 0.9000 Likely to fall to 0.8800 EURGBP under bearish pressure following the earlier breakout of the key round support level 0.9000 (former strong resistance from last year). The breakout of the support level 0.9000 coincided.

March 26, 2020

USDCHF reversed from resistance level 0.9850 Likely to fall to 0.9620 USDCHF recently reversed down from the pivotal resistance level 0.9850 (former lower boundary of the sideways price range from 2019), standing close to the upper daily Bollinger Band. The.

March 26, 2020

Gold broke resistance zone Likely to rise to 1690.00 Gold under bullish pressure after the earlier breakout of the resistance zone lying between the round resistance level 1600.00 and the 61.8% Fibonacci retracement of the previous sharp downward correction (2)..

March 26, 2020

EURUSD reversed from combined support zone Likely to rise to 1.1200 EURUSD recently reversed up from the combined support zone lying between the key support level 1.0600 (which started the sharp uptrend in 2017), lower weekly Bollinger Band and the.

March 26, 2020

Coca-Cola reversed from major support zone Likely to rise to 48.00 Coca-Cola recently reversed up sharply from the major support zone lying between the long-term support level 36.50 (yearly low from 2015) and the lower daily Bollinger Band. The price.

March 25, 2020

Caterpillar reversed from resistance zone Likely to fall to 80.00 Caterpillar recently reversed down from the resistance zone located between the pivotal resistance level 103.65 (which has been reversing the price from the middle of March) and the 38.2% Fibonacci.

March 25, 2020

AUDCAD reversed from resistance area Likely to fall to 0.8500 AUDCAD recently reversed down from the resistance area lying between the resistance level 0.8670 (former strong support from February) and the 61.8% Fibonacci correction of the previous sharp downward impulse.

March 25, 2020

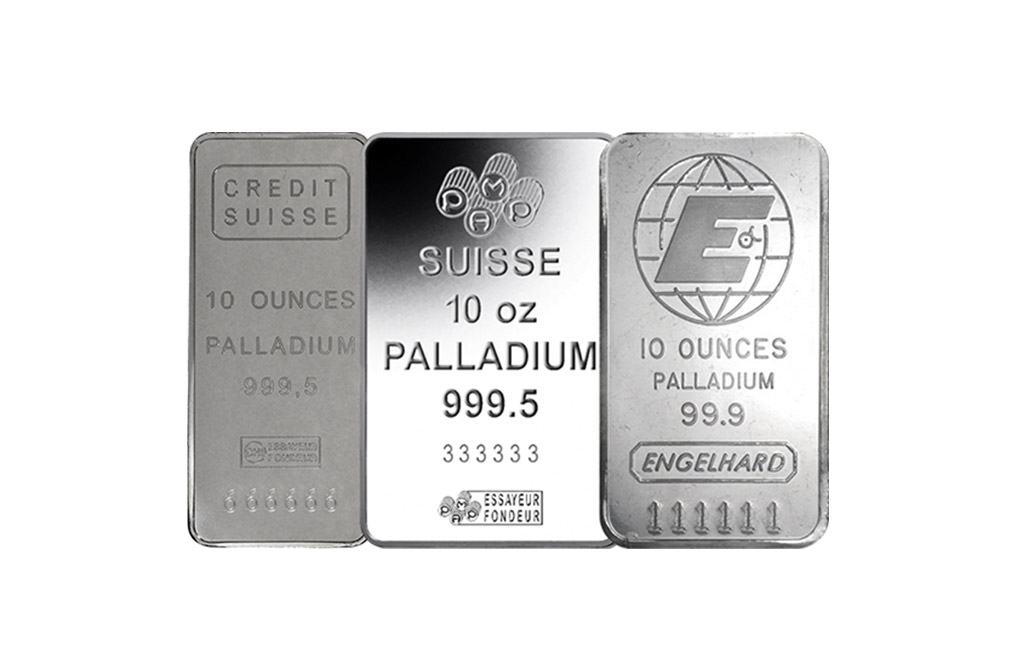

Palladium approached resistance level 2000.00 Likely to rise to 2200.00 Palladium has been rising sharply in the last few trading sessions the daily upward impulse sequence ③ – which started earlier from the key support level 1400.00, standing close to.

March 25, 2020

USDJPY rising inside impulse wave ③ Likely to reach 112.00 soon USDJPY continues to rise inside the sharp weekly upward impulse wave ③ – which started earlier from the powerful long-term support level 101.15, intersecting with the support trendline of.

March 25, 2020

The United States is now the third country with the highest number of COVID-19 cases at 46,168. Within ten days, the number of confirmed cases the country skyrocketed nearly 2,000%. As shocking as it may look, statistics show that the.

March 24, 2020

GBPJPY under bullish pressure Likely to rise to 135.00 GBPJPY under bullish pressure after the earlier upward reversal from the long-term support level 126.80 (which stopped the two strong weekly downtrends in 2016 and 2019 respectively). The price is still.