Technical analysis - Page 287

January 21, 2021

• USDCHF reversed from resistance level 0.8910 • Likely to fall 0.8800 USDCHF recently reversed down from the resistance level 0.8910 (which has been steadily reversing the price from the start of December – as can be seen below). The.

January 21, 2021

• EURAUD reversed from key support level 1.5600 • Likely to rise 1.5760 EURAUD previously reversed up from the key support level 1.56025 (which stopped the previous sharp downward impulse wave (3) in the middle of January). This upward reversal.

January 21, 2021

• Cotton broke resistance level 81.90 • Likely to rise 85.00 Cotton recently broke the resistance level 81.90 (which reversed the price with the daily candlesticks reversal pattern Dark Cloud Cover at the start of this year). The breakout of.

January 21, 2021

• GBPUSD broke above the resistance level 1.3700 • Likely to rise to 1.3800 GBPUSD recently broke above the resistance level 1.3700 (which has been repeatedly reversing this currency pair from the end of December). The breakout of the resistance.

January 21, 2021

• BMY reversed from major resistance level 66.10 • Likely to test support level 64.00 BMY recently reversed down from the major resistance level 66.10 (monthly high from October) – standing well above the upper daily Bollinger Band. The same.

January 20, 2021

• Silver reversed from support level 24.0 • Likely to rise to resistance level 27.45 Silver recently reversed up from the support level 24.0 intersecting with the lower daily Bollinger band and the 61.8% Fibonacci correction level of the previous.

January 20, 2021

• GBPNZD reversed from resistance level 1.9140 • Likely to fall to support level 1.8925 GBPNZD recently reversed down from the major resistance level 1.9140 (which has been reversing the price from the start of December), intersecting with the upper.

January 20, 2021

• AUDUSD reversed from key support level 0.7665 • Likely to rise to resistance level 0.7800 AUDUSD recently reversed up from the key support level 0.7665 – standing near the 38,2% Fibonacci correction level of the previous upward impulse wave.

January 20, 2021

• NASDAQ-100 broke resistance level 13130.00 • Likely to rise to 13500.00 NASDAQ-100 recently broke above the resistance level 13130.00 (which formed the daily reversal pattern Bearish Engulfing at the start of January). The breakout of the resistance level 13130.00.

January 20, 2021

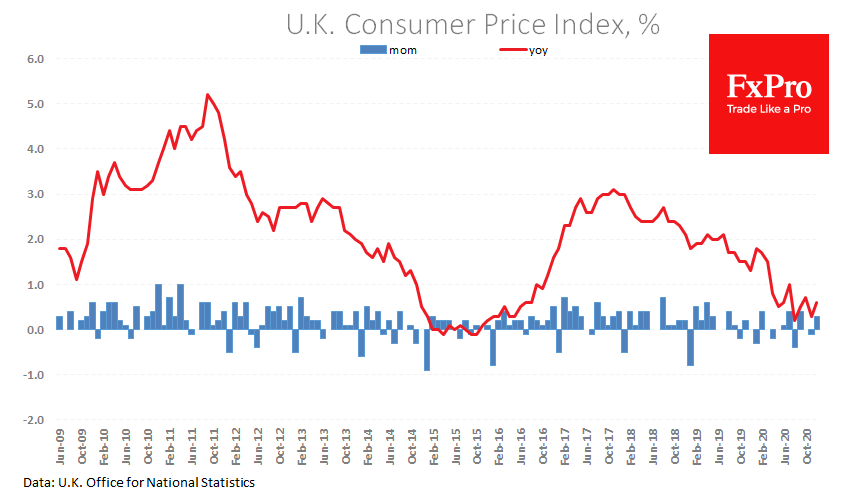

GBPUSD hit 32-month highs on Wednesday on a weaker dollar and was also helped by stronger-than-expected inflation in December. Consumer prices rose 0.3% last month, accelerating to 0.6% y/y. The core index accelerated from 1.1% y/y to 1.4% y/y. Besides,.

January 20, 2021

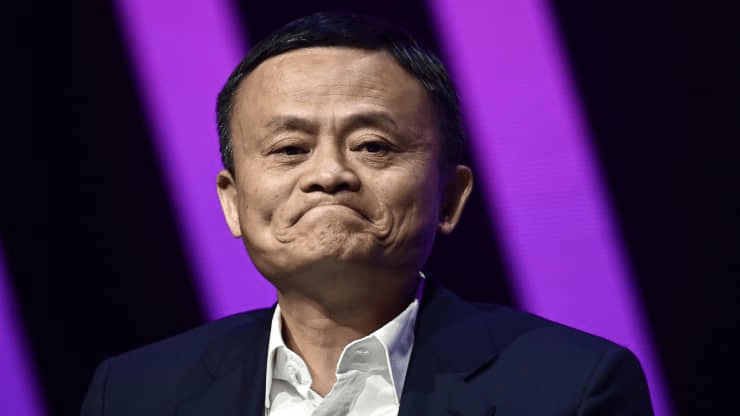

Wealthy investors rushed to offload stock in Alibaba Group Holding Ltd. after China began an investigation into alleged monopolistic practices at billionaire Jack Ma’s internet giant, according to Citigroup Inc.’s private bank. Once hailed as drivers of economic prosperity and.