Technical analysis - Page 205

June 27, 2022

• WTI reversed from support area• Likely to rise to resistance level 110.00 WTI recently reversed up from the support area located between the key support level 103.25 (the previous Hammer low from May), lower daily Bollinger Band and the.

June 27, 2022

• EURCHF reversed from key support level 1.0090• Likely to rise to resistance level 1.0215 EURCHF currency pair earlier reversed up from the key support level 1.0090 (the previous monthly low from April), strengthened by the lower daily Bollinger Band..

June 24, 2022

• GBPNZD reversed from resistance level 1.9600• Likely to test support level 1.9400 GBPNZD recently reversed down from the key resistance level 1.9600 (which has been continuously reversing the pair from the start of May), standing above the upper daily.

June 24, 2022

• Silver reversed from support level 20.60• Likely to rise to resistance level 21.50 Silver recently reversed up from the key support level 20.60 (which stopped wave (5) at the start of May), standing below the lower daily Bollinger Band.

June 24, 2022

• EURAUD reversed from resistance level 1.5260• Likely to fall to support level 1.5100 EURAUD currency pair recently earlier reversed down from the key resistance level 1.5260 (which has been reversing the pair from March), upper daily Bollinger Band and.

June 23, 2022

• Bank of America continues daily downtrend• Likely to fall to support level 31.00 Bank of America earlier reversed down from the pivotal resistance level 33.00 (former monthly low from the middle of May). The resistance level 33.00 was strengthened.

June 23, 2022

• EURNZD reversed from strong resistance level 1.6835• Likely to fall to support level 1.6600 EURNZD currency pair recently reversed down from the strong resistance level 1.6835 (which has been repeatedly reversing the price from the start of May). The.

June 22, 2022

• NZDCAD reversed from resistance level 0.8280• Likely to fall to support level 0.8065 NZDCAD currency pair earlier reversed down from the key resistance level 0.8280 – standing close to the 61.8% Fibonacci correction of the downward impulse from May..

June 22, 2022

• AT&T rising inisde corrective wave (2)• Likely to rise to resistance level 20.77 AT&T earlier reversed up from the key support level 18.80 – standing close to the lower daily Bollinger Band and the 61.8% Fibonacci correction of the.

June 22, 2022

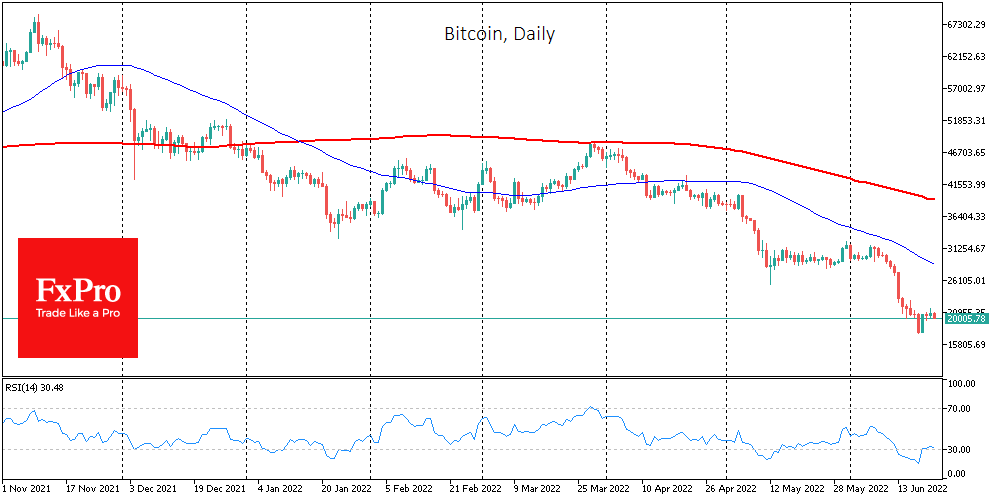

Bitcoin rallied from $20.5K to $21.6K during the day on Tuesday but later reversed to decline and went back on Wednesday morning. Ether corrected deeply, losing 4.4% over the last 24 hours. The top ten altcoins showed mixed dynamics, ranging.

June 21, 2022

• USDJPY broke key resistance level 135.50• Likely to rise to resistance level 137.25 USDJPY currency pair today broke above the key resistance level 135.50 (which stopped the earlier minor impulse wave 1 at the start of June). The breakout.