Technical analysis - Page 161

April 17, 2023

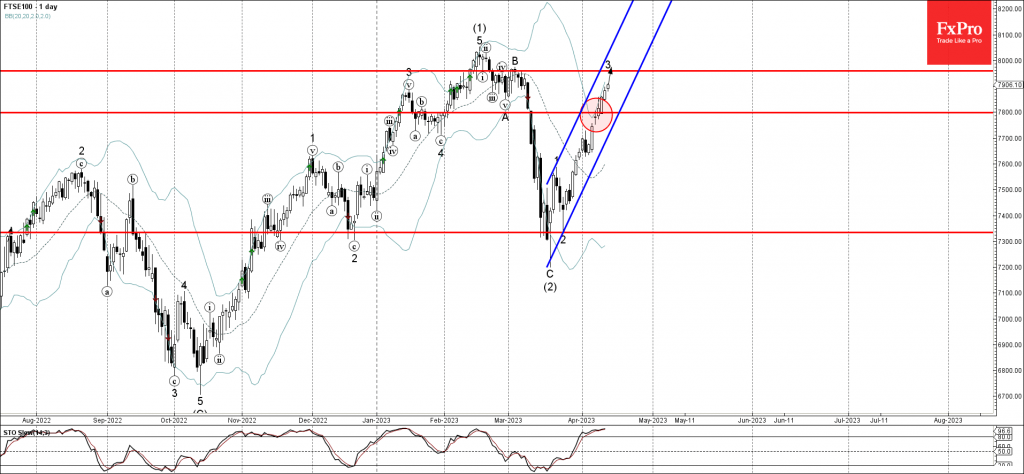

• FTSE 100 rising inside impulse wave 3 • Likely to reach resistance level 7960.00 FTSE 100 index rising inside the sharp minor impulse wave 3, which previously broke above the resistance level 7800.00 (upward target set in our earlier.

April 17, 2023

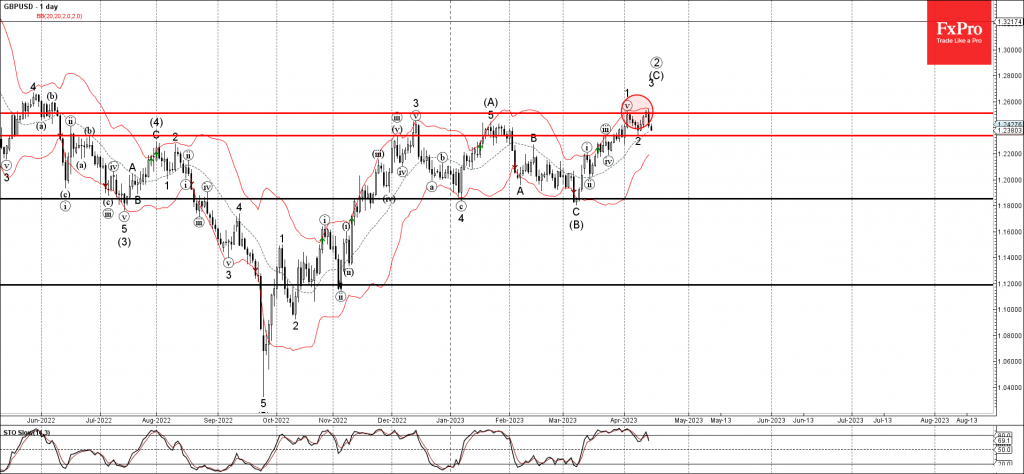

• GBPUSD reversed from resistance level 1.2510 • Likely to fall to support level 1.2340 GBPUSD continues to fall after the price reversed down from the key resistance level 1.2510 (which stopped the previous minor impulse wave 1 at.

April 14, 2023

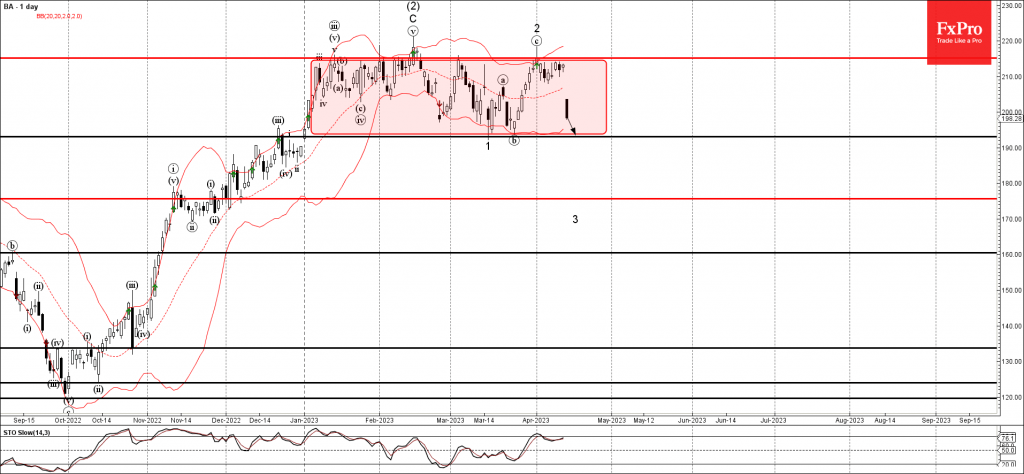

• Boeing falling inside impulse waves 3 and (3) • Likely to reach support level 193.10 Boeing continues to fall inside the minor impulse wave 3, which belongs to the intermediate impulse wave (3) from February. Both of the active.

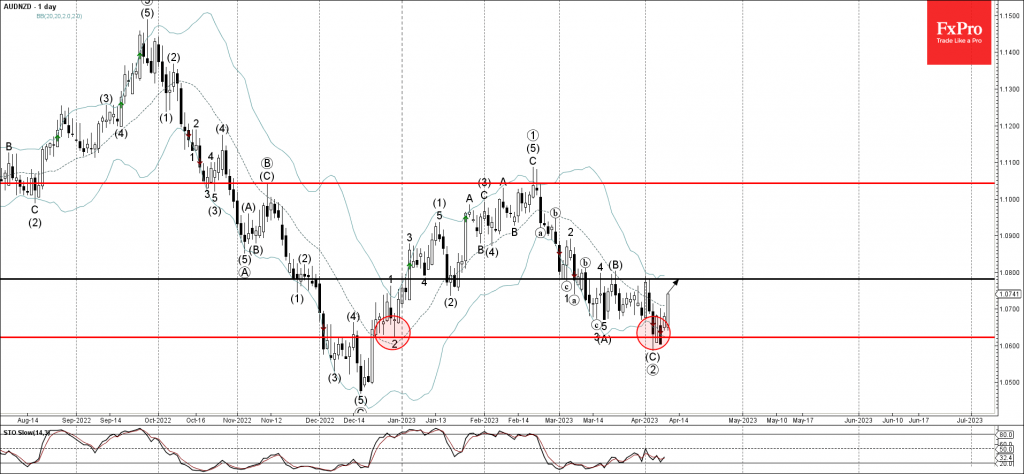

April 14, 2023

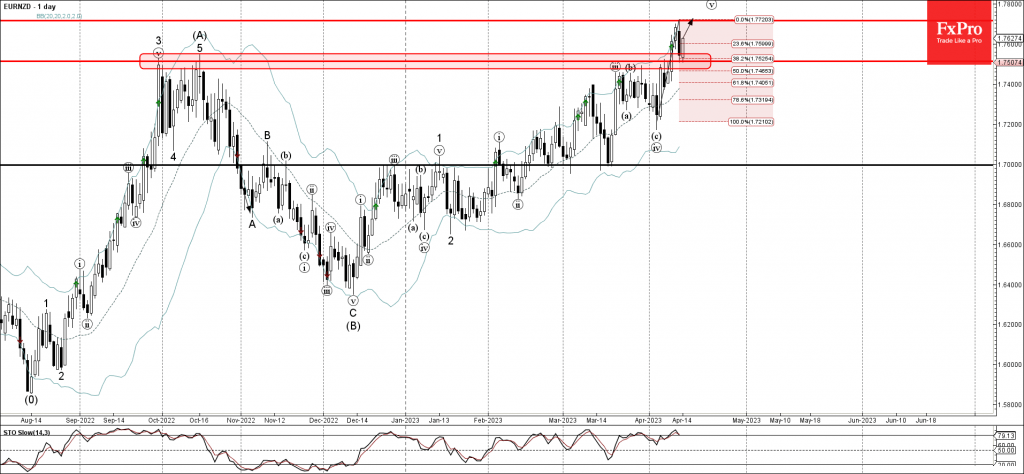

• EURNZD reversed from key support level 1.75000 • Likely to rise to resistance level 1.7720 EURNZD currency pair earlier reversed up from the key support level 1.75000 (former strong resistance from last October). The support level 1.7500 was further.

April 14, 2023

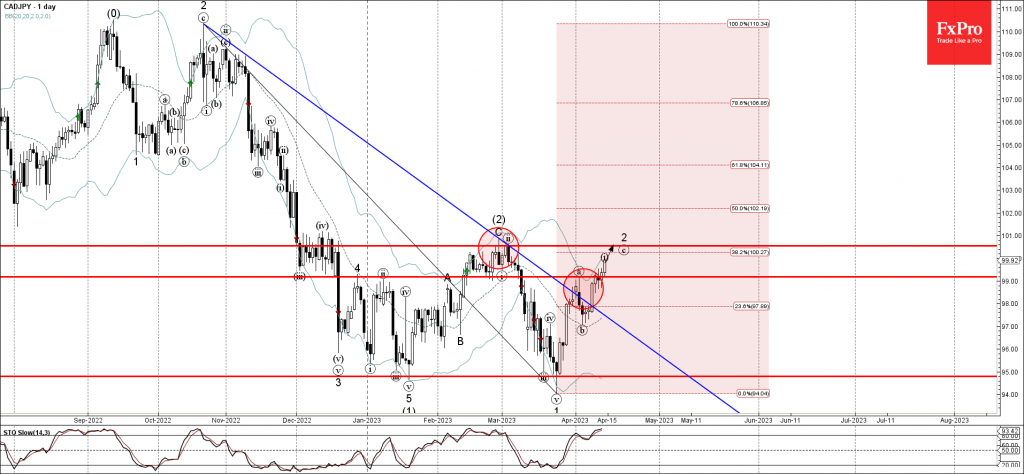

• CADJPY broke resistance level 99.20 • Likely to rise to resistance level 100.55 CADJPY currency pair recently broke the resistance level 99.20 (which stopped the previous minor wave (a) at the start of April). The breakout of the.

April 13, 2023

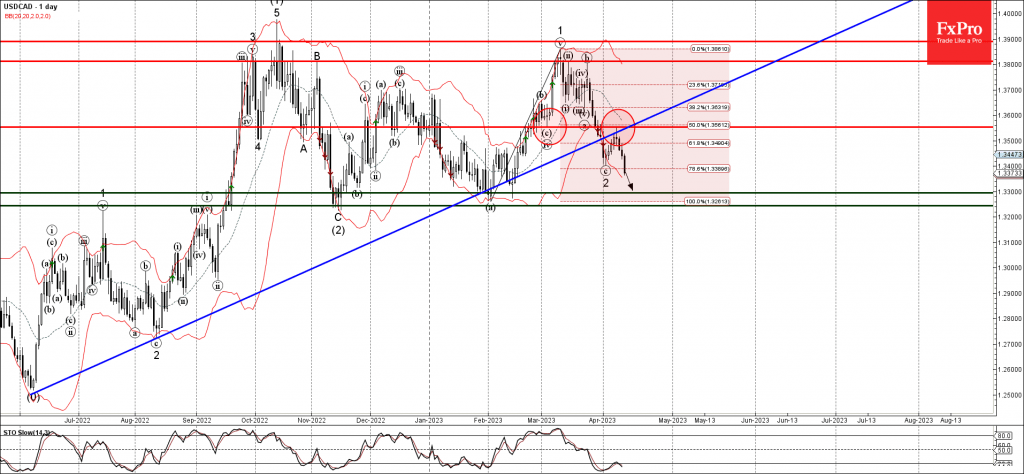

• USDCAD reversed from key resistance level • Likely to fall to support level 1.3295 USDCAD currency pair continues to fall after the earlier downward reversal from the key resistance level 1.3555 (former support from the start of March). The.

April 13, 2023

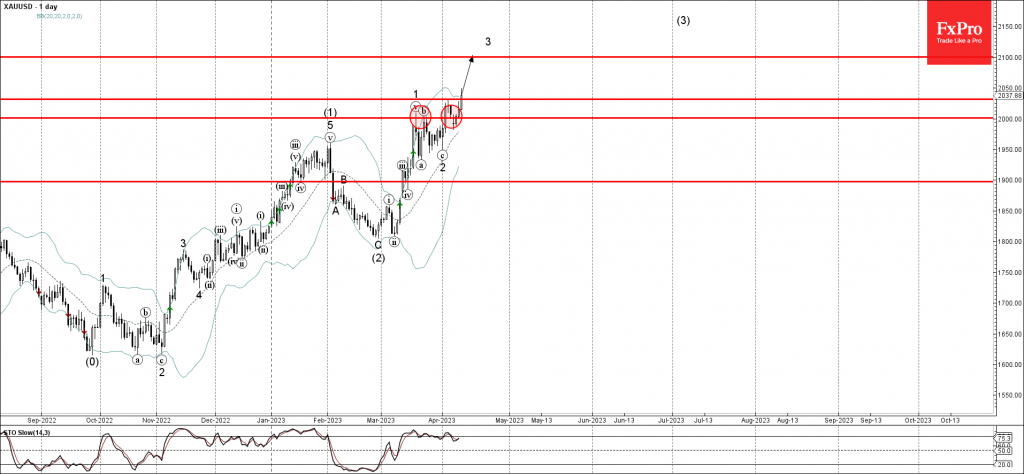

• Gold broke resistance level 2030.00 • Likely to rise to resistance level 2100. Gold continues to rise after the price broke the minor resistance level 2030.00 (which reversed the price at the start of this month). The breakout of.

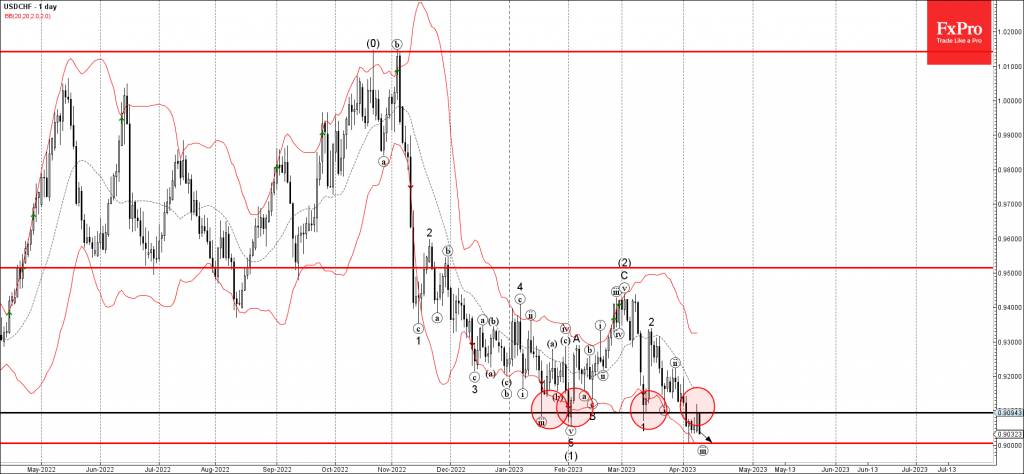

April 13, 2023

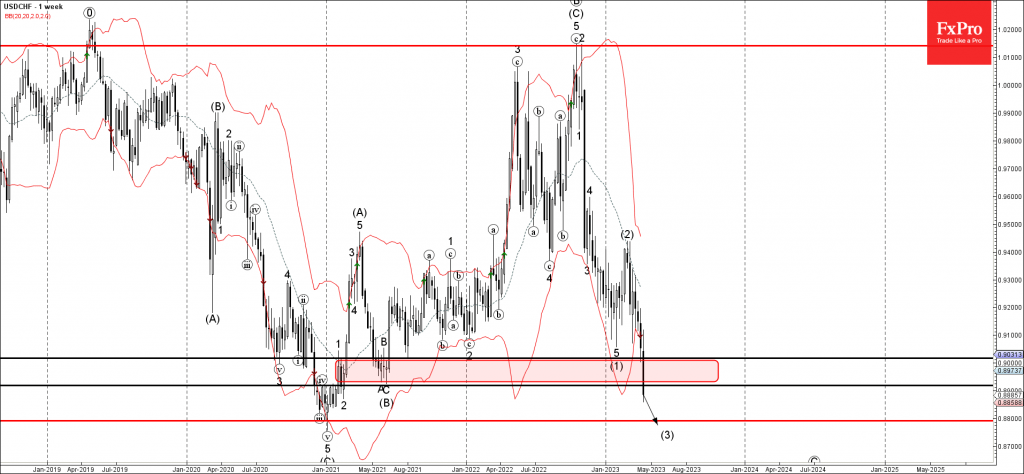

• USDCHF under strong bearish pressure • Likely to fall to support level 0.8800 USDCHF under the strong bearish pressure after the pair broke the support area located between the support levels 0.9020 and 0.8920 (former multi-month low from.

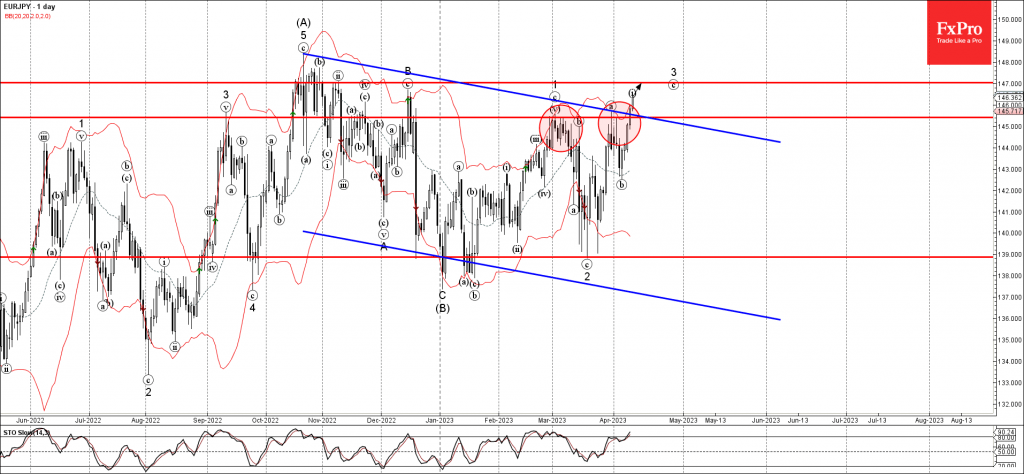

April 12, 2023

• EURJPY broke resistance area • Likely to rise to resistance level 147.00 EURJPY recently broke the resistance area located at the intersection of the resistance level 145.40 (former monthly high from March) and the resistance trendline of the.

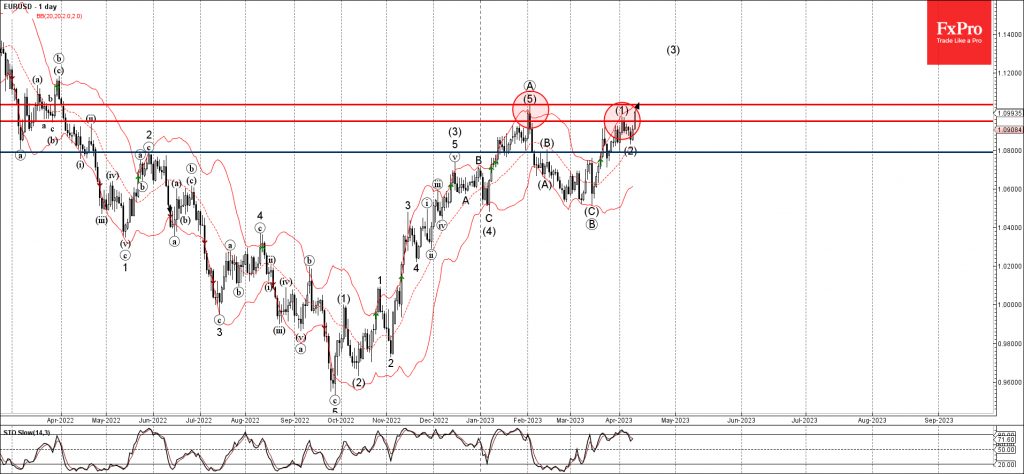

April 12, 2023

• EURUSD under bullish pressure • Likely to rise to resistance level 1.1035 EURUSD currency pair under the bullish pressure after the earlier breakout of the resistance level 1.0950 (former top of the previous impulse wave (1) from the end.

April 11, 2023

• USDCHF reversed from resistance level 0.9095 • Likely to fall to support level 0.9000 USDCHF currency pair recently reversed down from the key resistance level 0.9095 (former powerful support which has been reversing the price from the middle of.