Technical analysis - Page 146

August 8, 2023

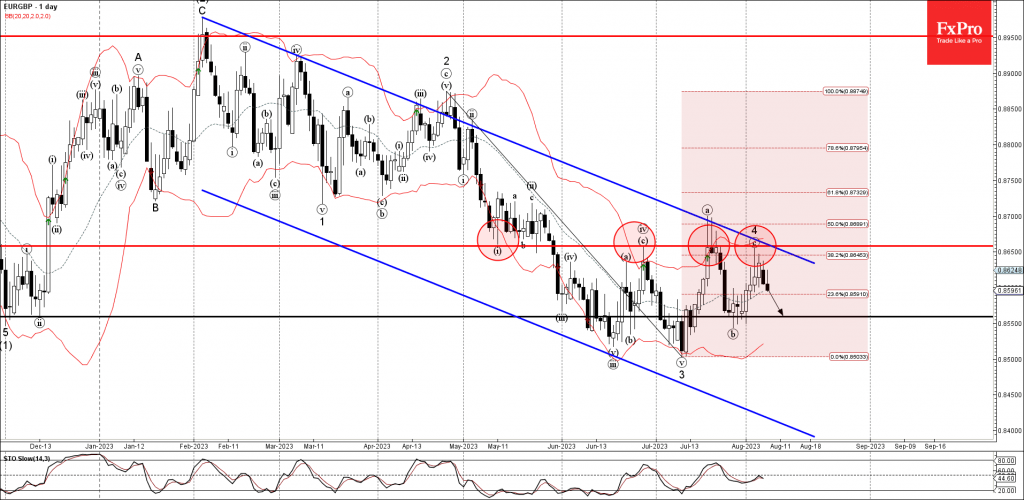

– EURGBP reversed from resistance level 0.8660 – Likely to fall to support level 0.8560 EURGBP currency pair recently reversed down from the pivotal resistance level 0.8660, former support from May, which has been reversing the pair from June. The.

August 7, 2023

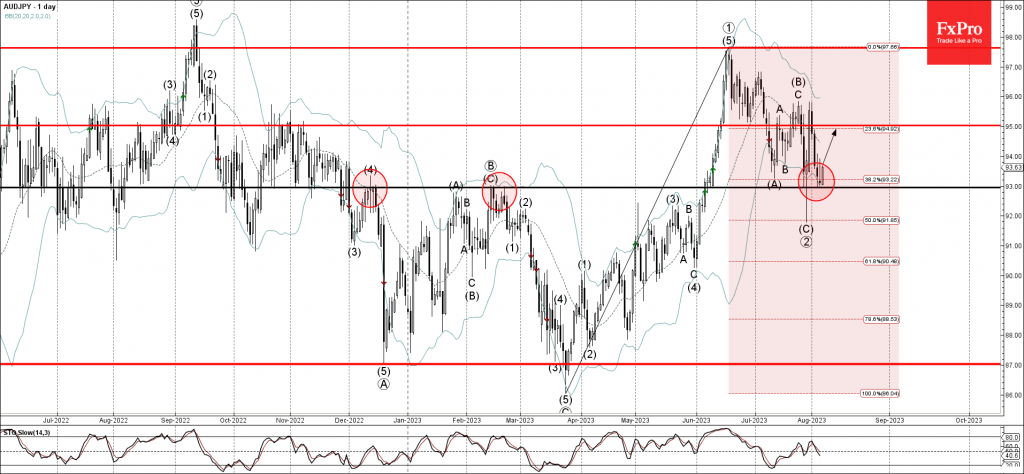

– AUDJPY reversed from pivotal support level 93.00 – Likely to test resistance level 95.00 AUDJPY currency pair recently reversed up from the pivotal support level 93.00, former strong resistance from December and February, which also reversed the pair sharply.

August 7, 2023

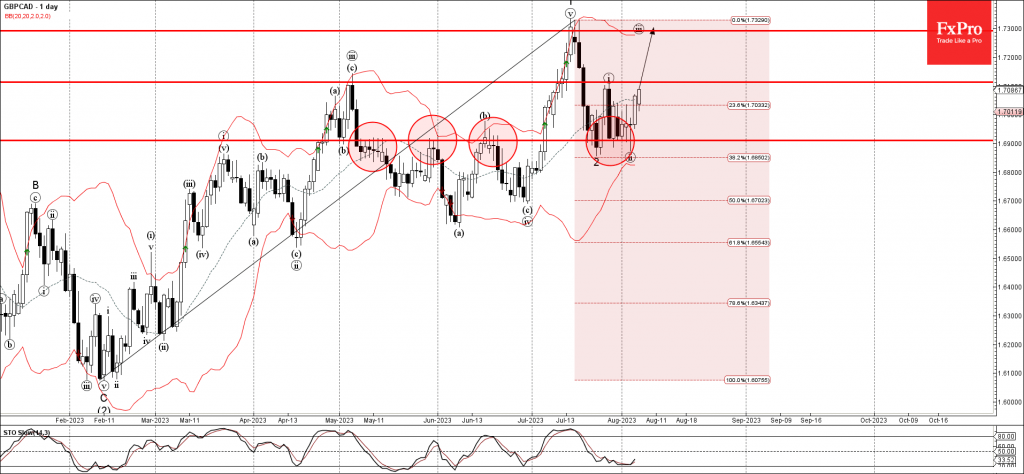

– GBPCAD reversed from key support level 1.6900 – Likely to test resistance levels – 1.7110 and 1.7290 GBPCAD recently reversed up from the key support level 1.6900, former strong resistance from May and June. The support level 1.6900 was.

August 4, 2023

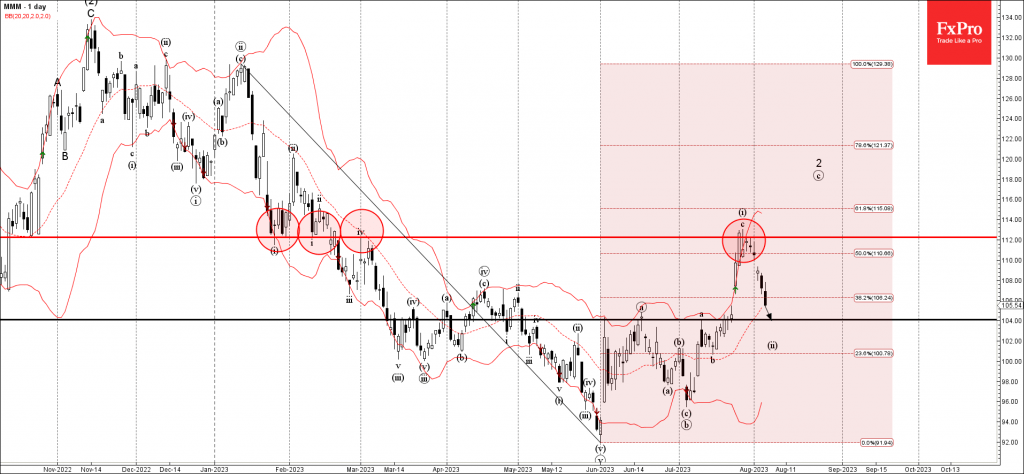

– 3M reversed from key resistance level 112.00 – Likely to fall to support at 104.00 3M recently reversed up from the key resistance level 112.00, former powerful support from January and February. The resistance level 112.00 was strengthened by.

August 4, 2023

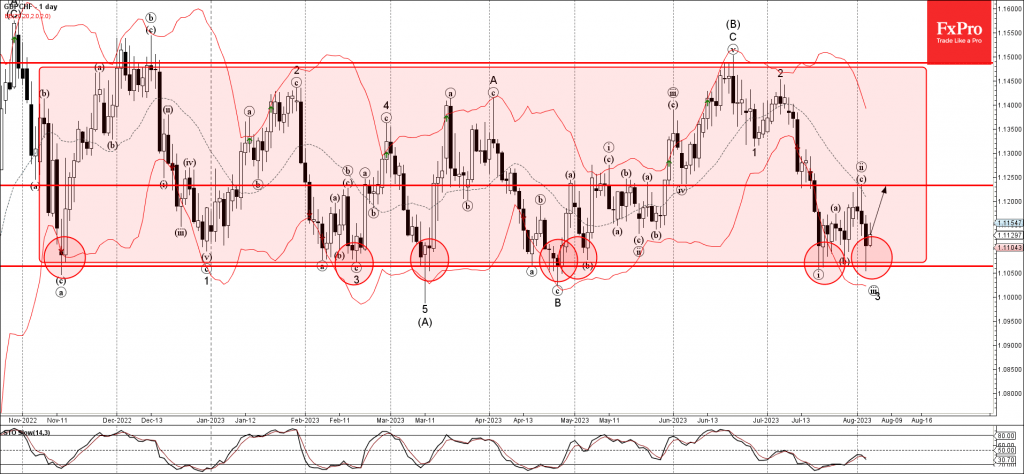

– GBPCHF reversed from powerful support level 1.2600 – Likely to rise to resistance at 1.1230 GBPCHF recently reversed up from the powerful support level 1.2600, which is the lower boundary of the wide sideways price range from last November..

August 4, 2023

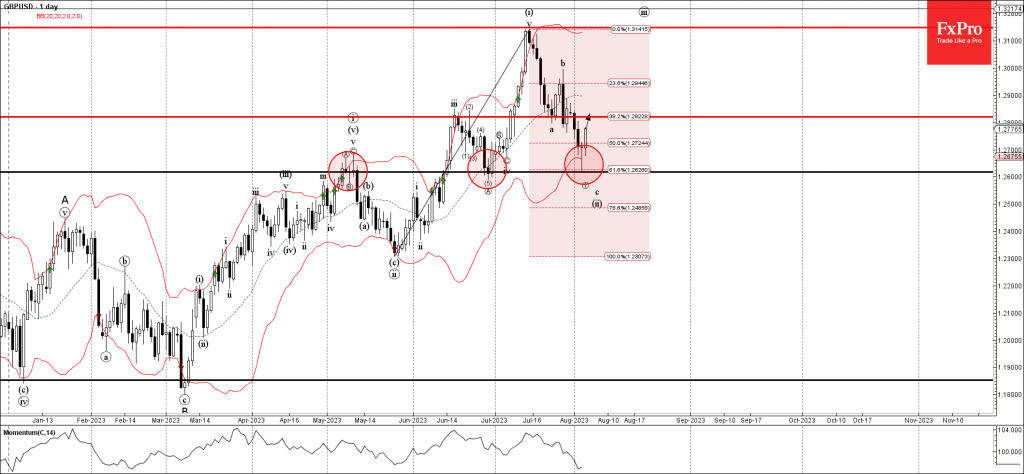

– GBPUSD reversed from support level 1.2600 – Likely to rise to resistance at 1.2820 GBPUSD recently reversed up from the key support level 1.2600, former resistance from May, which formed the daily Morning Star at the end of.

August 3, 2023

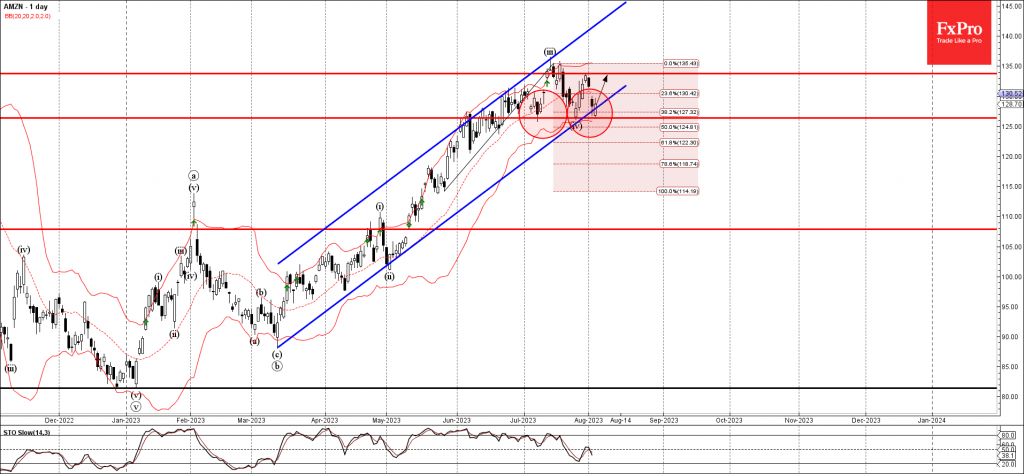

– Amazon reversed from support level 126.40 – Likely to rise to resistance at 133.75 Amazon recently reversed up from the key, multi-month support level 126.40, former resistance from June, which has been reversing the price from the start of.

August 3, 2023

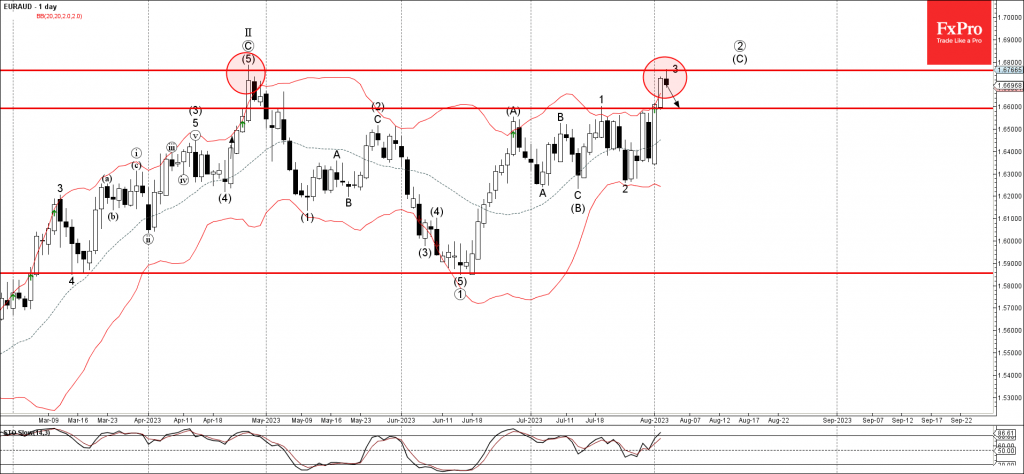

– EURAUD reversed from resistance level 1.6765 – Likely to fall to support at 1.6600 EURAUD currency pair recently reversed down from the powerful, multi-month resistance level 1.6765, which stopped the clear daily uptrend in last April. The resistance level.

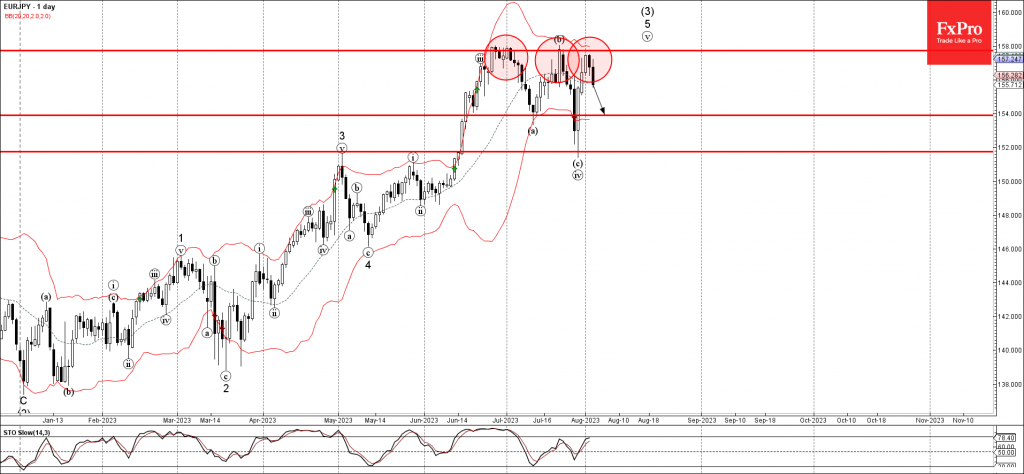

August 3, 2023

– EURJPY reversed from key resistance level 157.75 – Likely to fall to support at 154.00 EURJPY currency pair recently reversed down with the Dark Cloud Cover from the key resistance level 157.75, which has been reversing the price from.

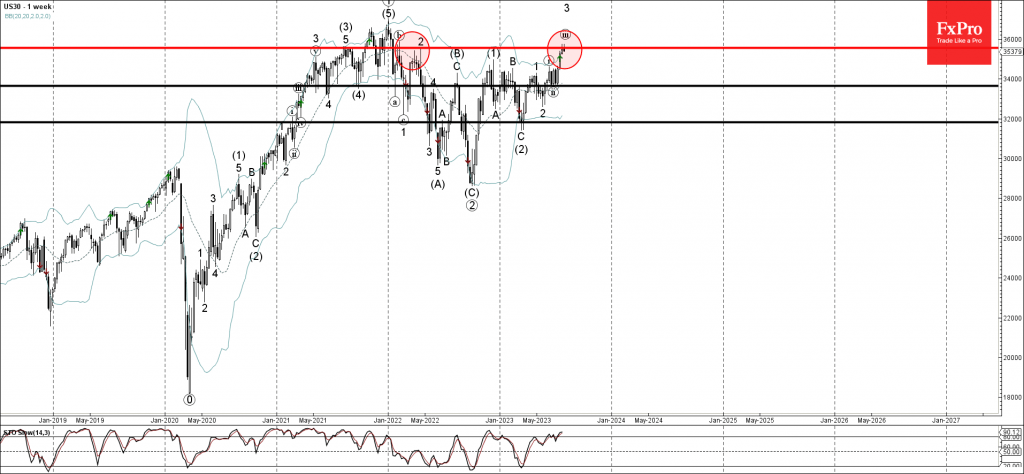

August 2, 2023

– Dow Jones index reversed from major resistance level 35550.00 – Likely to fall to support at 34675.00 Dow Jones index recently reversed down strongly from the major resistance level 35550.00, which reversed the price multiple times from the start.

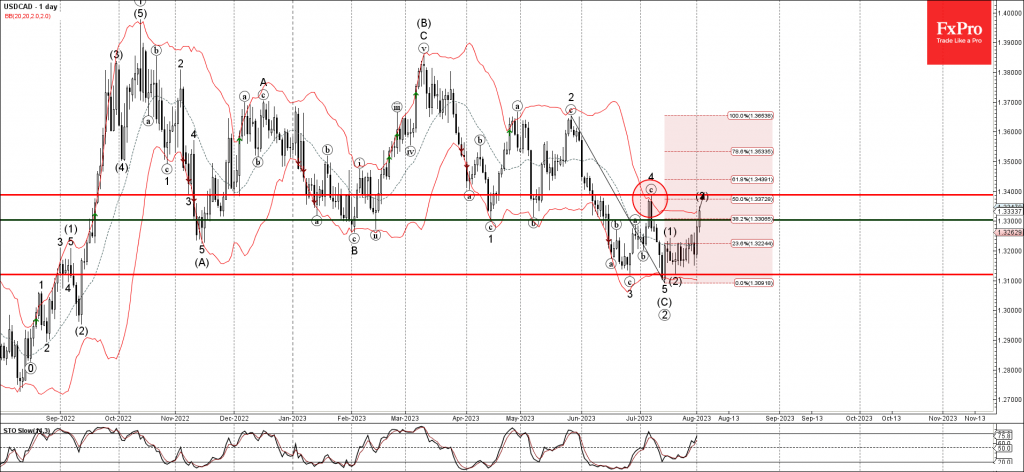

August 2, 2023

– USDCAD broke resistance level 1.3300 – Likely to rise to resistance level 1.3400 USDCAD currency pair recently broke the resistance level 1.3300 intersecting with the 61.8% Fibonacci correction of the previous downward impulse from May. The breakout of the.