Technical analysis - Page 144

August 21, 2023

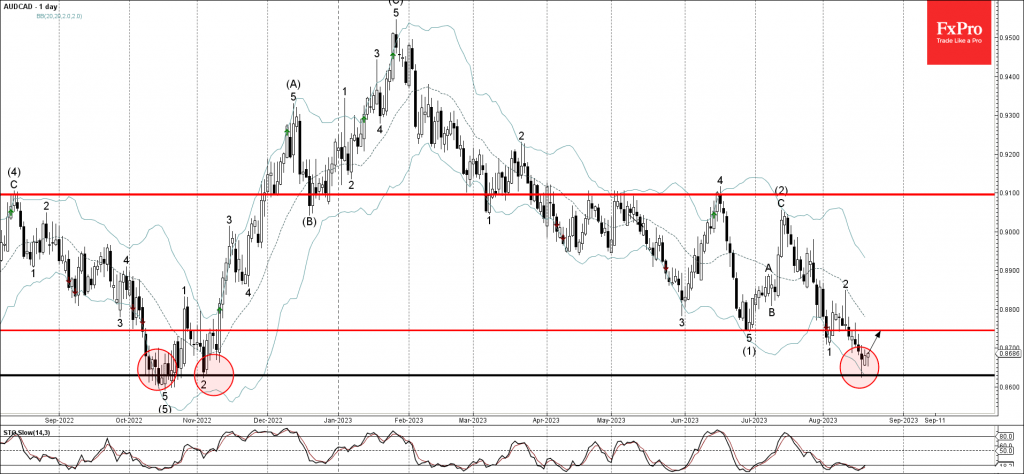

– AUDCAD reversed from support level 0.8630 – Likely to rise to resistance level 0.8745 AUDCAD currency pair recently reversed up from the major long-term support level 0.8630 (former strong support from October and November), coinciding with the lower.

August 18, 2023

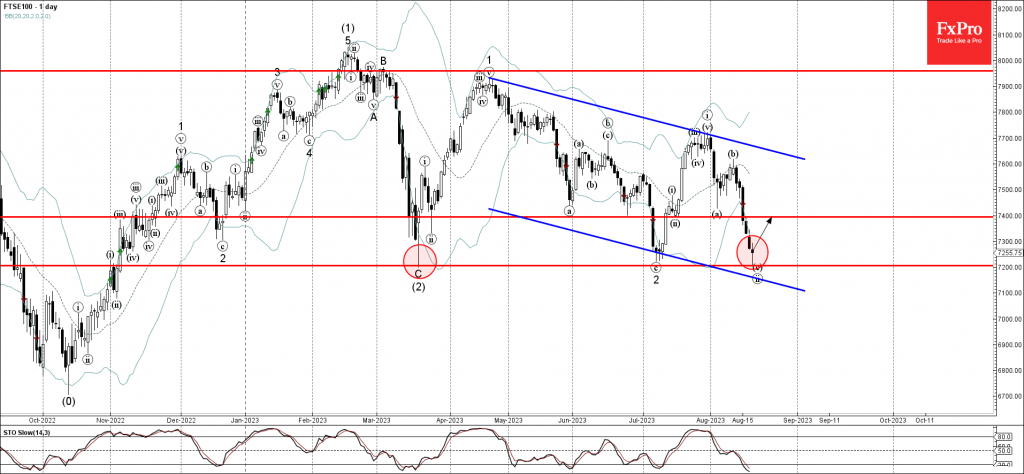

– FTSE100 index reversed from support level 7200.00 – Likely to rise to resistance level 7400.00 FTSE100 index recently reversed up from the powerful support level 7200.00 (former multi-month low from March), coinciding with the lower daily Bollinger Band..

August 18, 2023

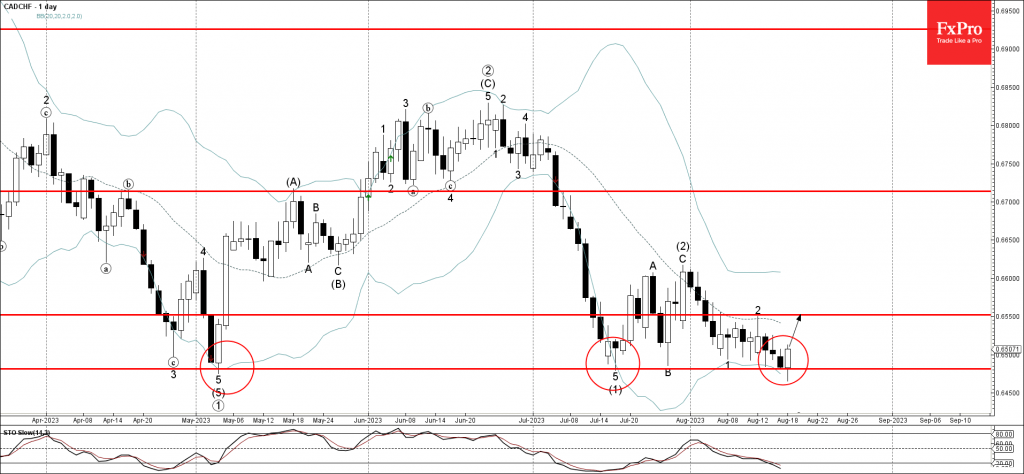

– CADCHF reversed from support level 0.6480 – Likely to rise to resistance level 0.6550 CADCHF currency pair recently reversed up from the powerful support level 0.6480 (which has been reversing the price from May), coinciding with the lower.

August 18, 2023

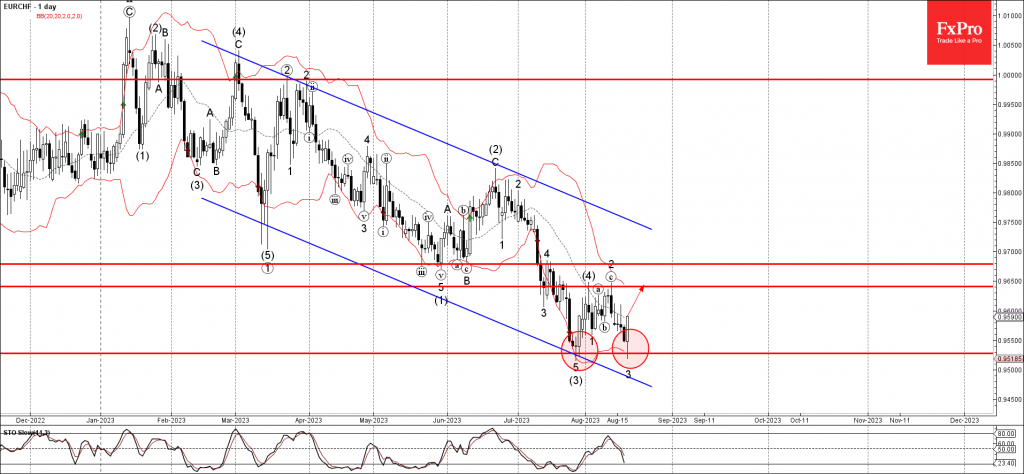

– EURCHF reversed from support level 0.9530 – Likely to rise to resistance level 0.9640 EURCHF currency pair recently reversed up from the key support level 0.9530 (which stopped the sharp downtrend in July), coinciding with the lower daily.

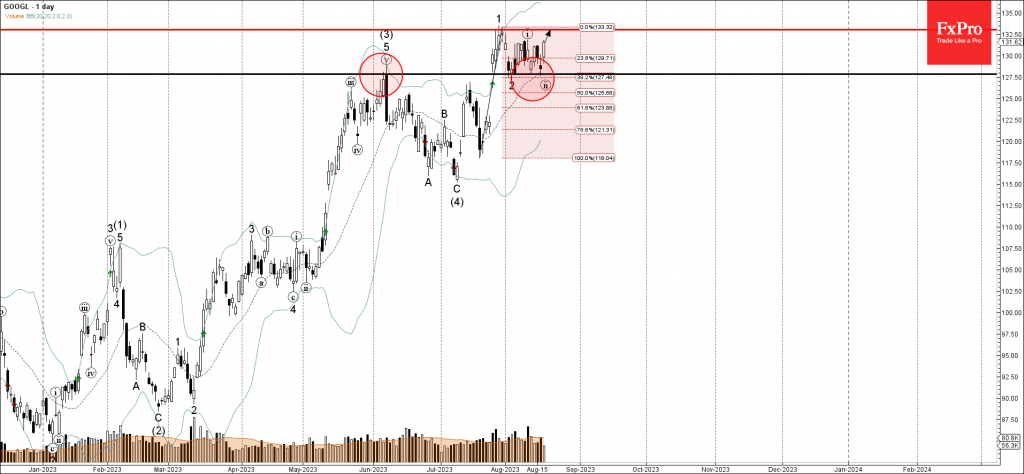

August 17, 2023

– Google reversed from support level 127.90 – Likely to rise to resistance level 132.50 Google recently reversed up from the pivotal support level 127.90 (former strong resistance from the start of June), coinciding with the 20-day moving average and.

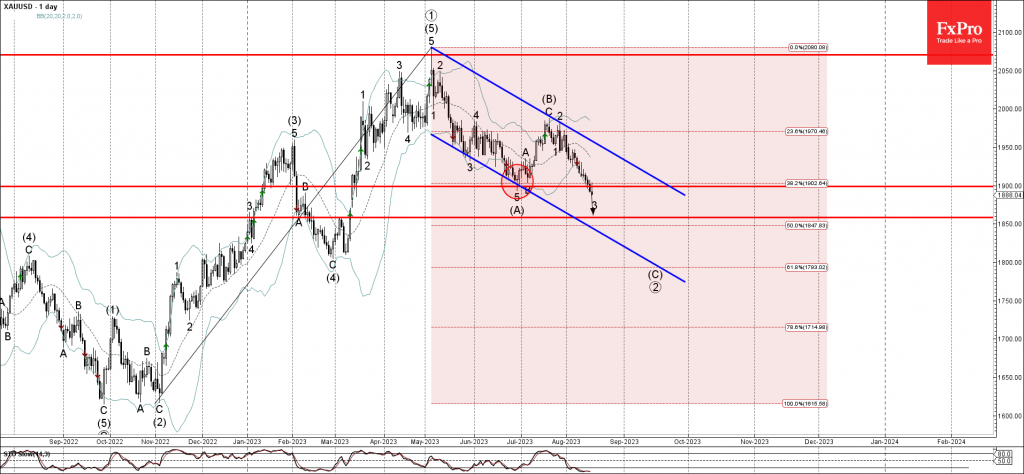

August 17, 2023

– Gold under bearish pressure – Likely to fall to support level 1860.00 Gold under the bearish pressure after the price broke the key support level 1900.00 (which stopped the previous intermediate impulse wave (A) at the end of June)..

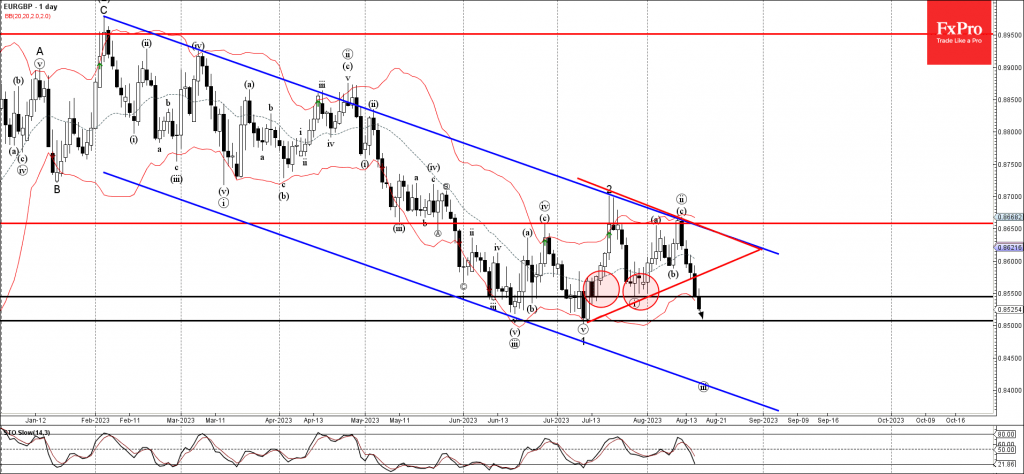

August 17, 2023

– EURGBP broke key support level 0.8550 – Likely to fall to support level 0.8500 EURGBP currency pair recently broke the key support level 0.8550 (which stopped the previous minor impulse wave (i) at the end of July). The.

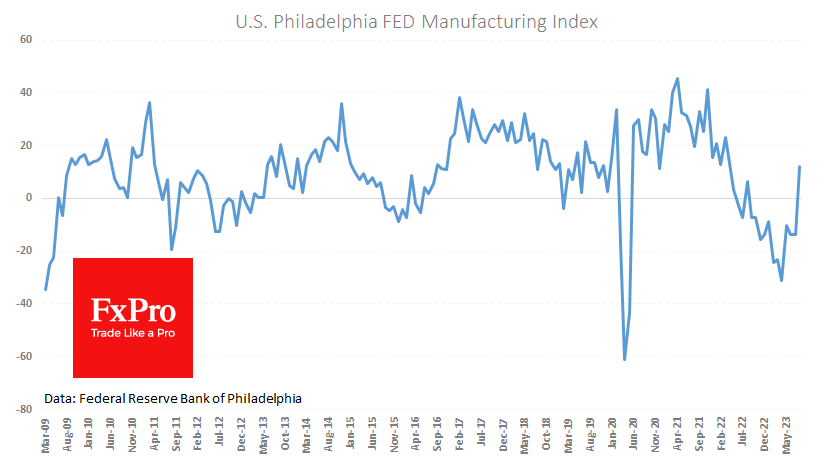

August 17, 2023

The US manufacturing sector is showing impressive expansion. The latest data from the Philadelphia Fed Manufacturing Business Outlook Index jumped from -13.5 to +12.0 in August, against forecasts of -9.8. This is the first time since August last year that.

August 16, 2023

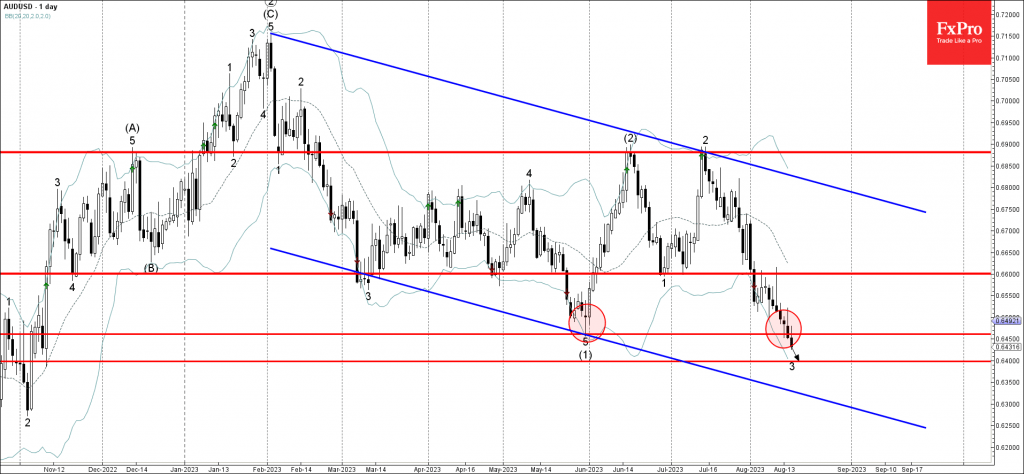

– AUDUSD broke support level 0.6460 – Likely to fall to support level 0.6400 AUDUSD currency pair under the bearish pressure after breaking below the key support level 0.6460 (which stopped the previous intermediate impulse wave (1) at the.

August 16, 2023

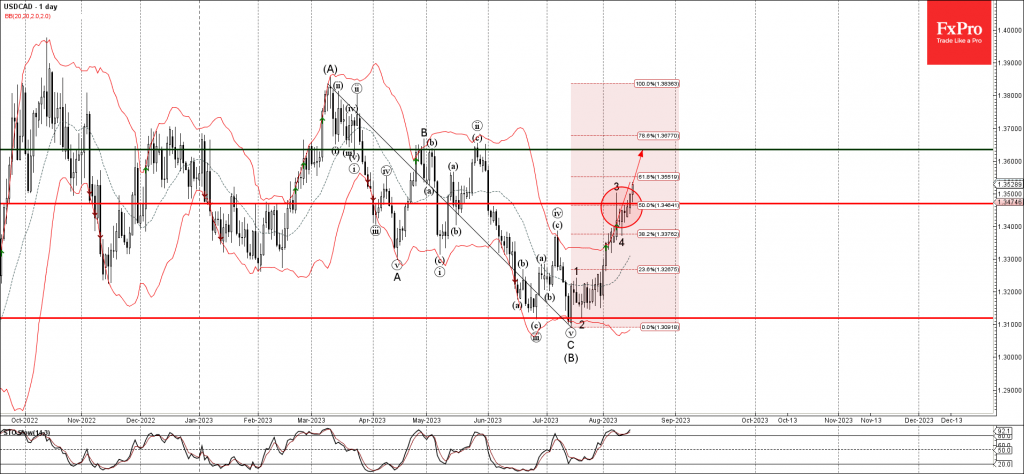

– USDCAD broke resistance level 1.3470 – Likely to rise to resistance level 1.3635 USDCAD currency pair recently broke the key resistance level 1.3470 (which stopped the previous impulse wave 3 at the start of August). The breakout of the.

August 15, 2023

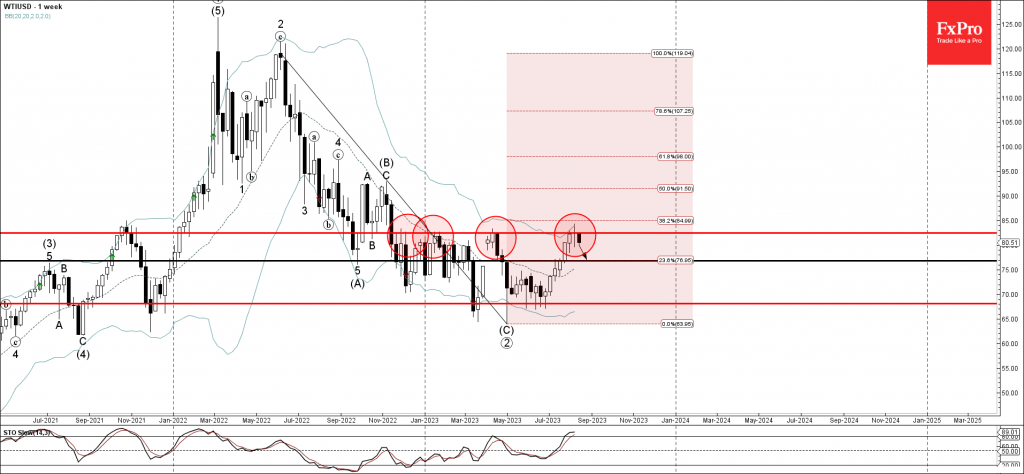

– WTI reversed from resistance level 82.50 – Likely to fall to support level 76.80. WTI crude oil recently reversed down from the major long-term resistance level 82.50 (which has been reversing the price from the end of last.