Technical analysis - Page 136

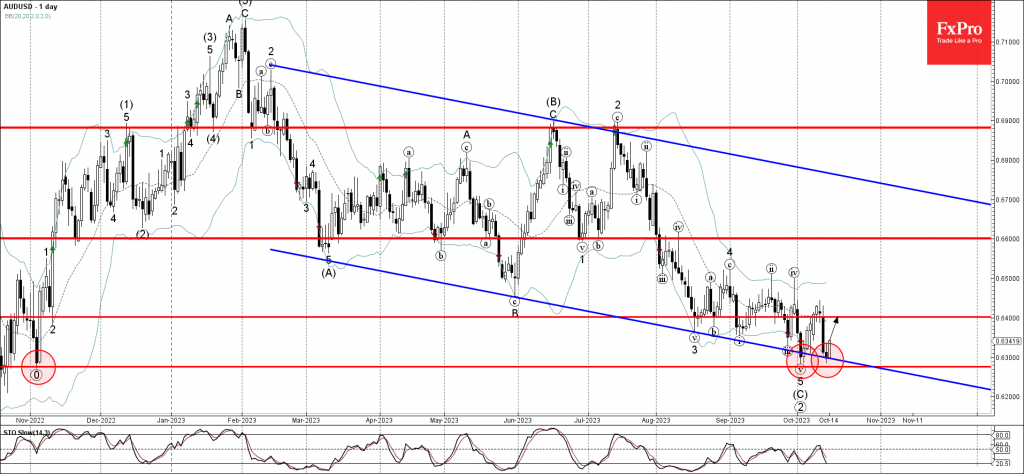

October 23, 2023

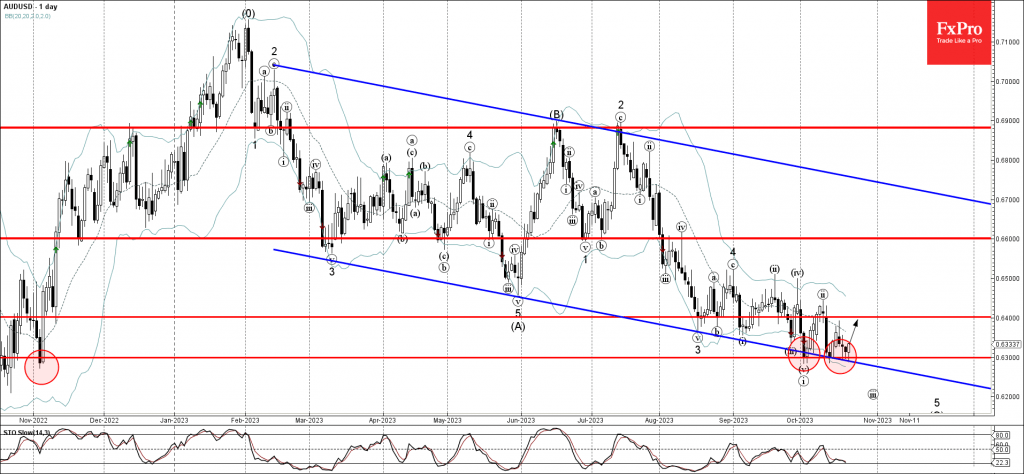

– AUDUSD reversed from key support level 0.6300 – Likely to rise to resistance level 0.6400 AUDUSD currency pair recently reversed up from the key support level 0.6300 (which has been reversing the pair from November). The support level 0.6300.

October 23, 2023

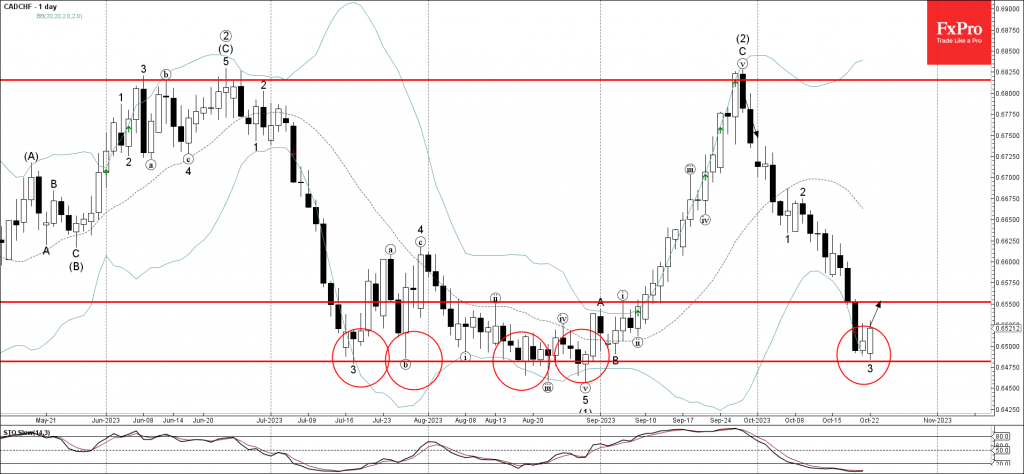

– CADCHF reversed from support level 0.6480 – Likely to rise to resistance level 0.6550 CADCHF currency pair recently reversed up from the powerful support level 0.6480 (which has been reversing the pair from July) coinciding with the lower daily.

October 20, 2023

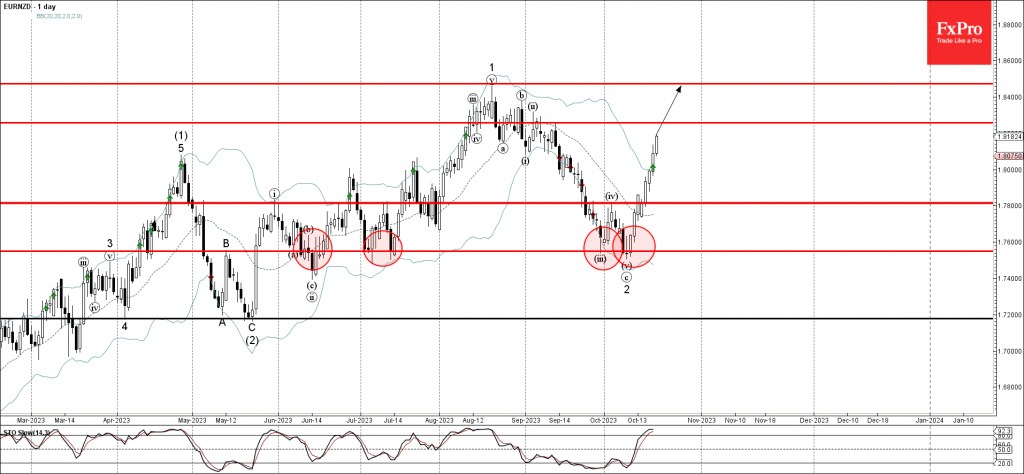

– EURNZD rising inside sharp impulse wave 3 – Likely to test resistance level 1.8260 EURNZD currency pair rising inside the sharp upward impulse wave 3, which previously broke the key resistance level 1.7800 (top of the previous minor correction.

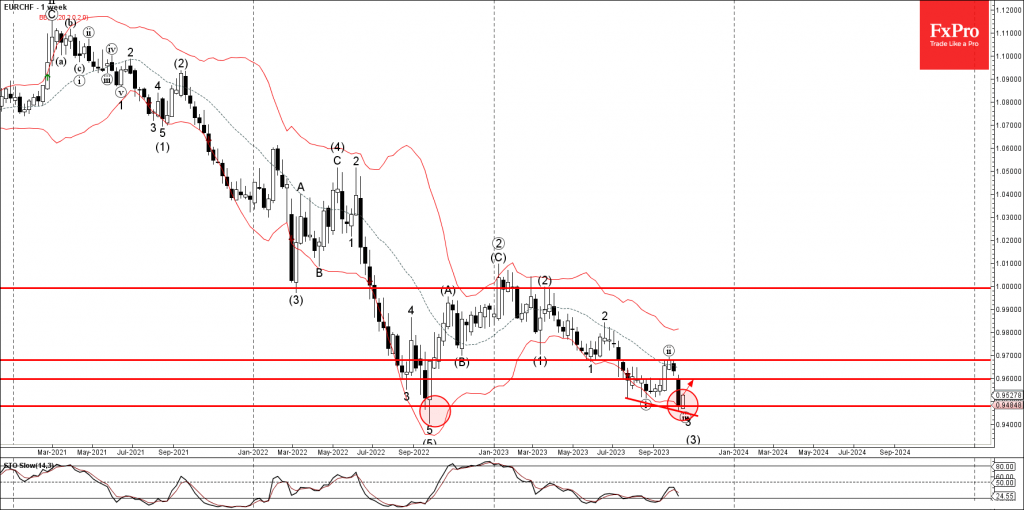

October 20, 2023

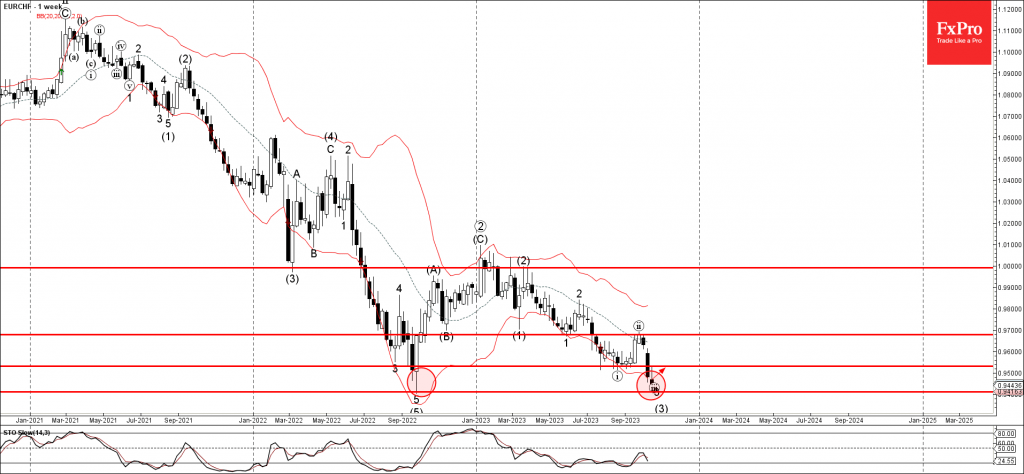

– EURCHF reversed from support level 0.9420 – Likely to test resistance level 0.9530 EURCHF currency pair recently reversed up from the major support level 0.9420 (which stopped the sharp weekly downtrend in 2022 as can be seen below). The.

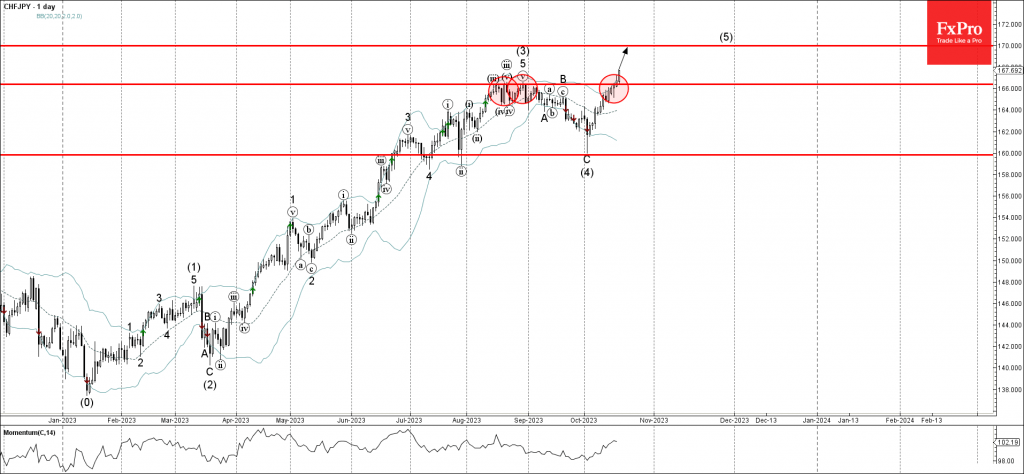

October 19, 2023

– CHFJPY under bullish pressure – Likely to test resistance level 170.00 CHFJPY currency pair under the bullish pressure after the pair broke above the key resistance level 166.10 (which reversed the pair 3 times in August as can be.

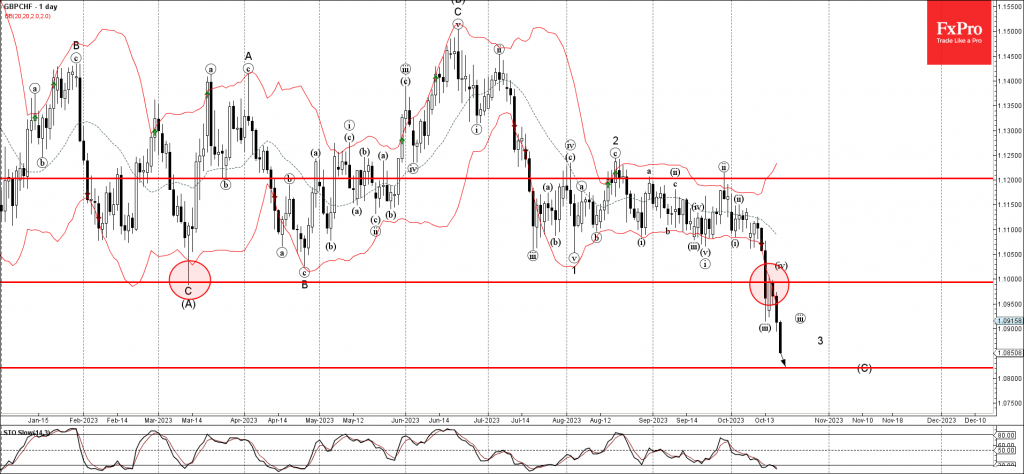

October 19, 2023

– GBPCHF falling inside minor impulse wave 3 – Likely to fall to support level 1.0820 GBPCHF currency pair continues to fall inside the minor impulse wave 3, which reversed earlier from the resistance level 1.1000 (former multi-month support level.

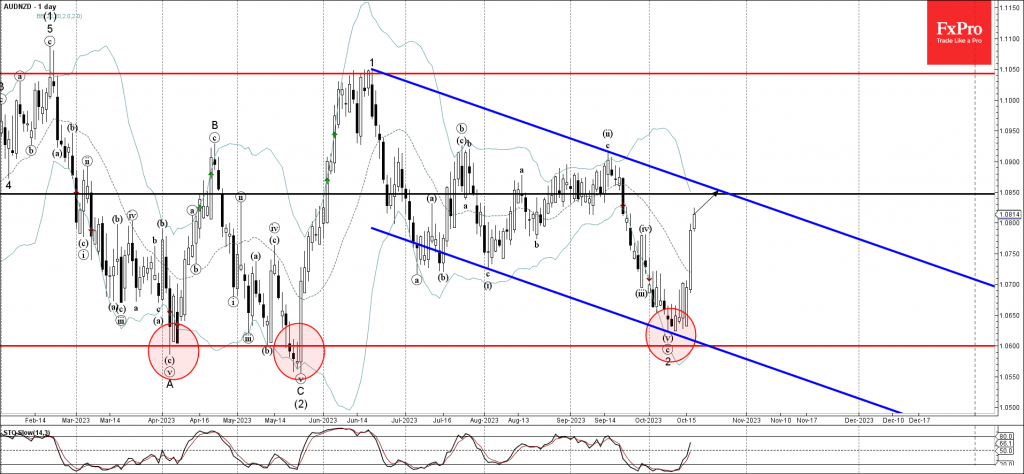

October 18, 2023

AUDNZD reversed from support level 20.70 Likely to rise to resistance level 23.50 AUDNZD recently reversed up sharply from the powerful support level 1.0600 (which has been reversing the pair from April) intersecting with the lower daily Bollinger Band and.

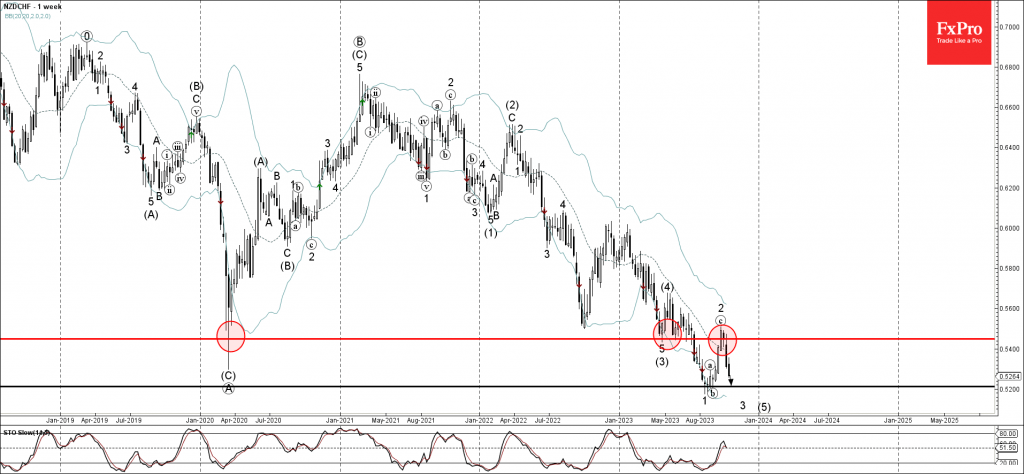

October 18, 2023

– NZDCHF falling inside weekly impulse 3 – Likely to fall to support level 0.5200 NZDCHF continues to fall inside the sharp weekly downward impulse 3, which started earlier from the key resistance level 0.5450 (former strong support from the.

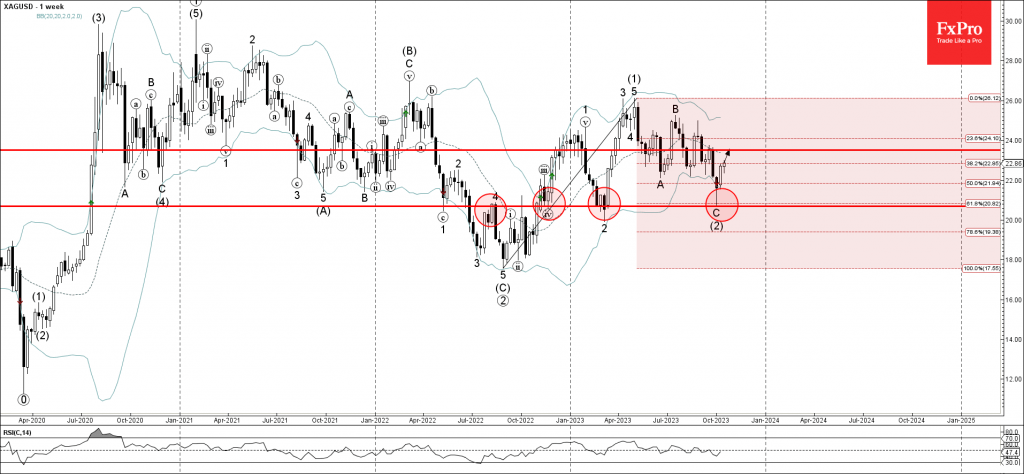

October 17, 2023

– Silver reversed from support level 20.70 – Likely to rise to resistance level 23.50 Silver recently reversed up with the weekly Hammer from the key support level 20.70 (which has been reversing the pair from the end of 2022.

October 17, 2023

– EURCHF reversed from strong support level 0.9480 – Likely to rise to resistance level 0.9600 EURCHF currency pair recently reversed up from the strong support level 0.9480 (which stopped the weekly downtrend in 2022 as can be seen below).

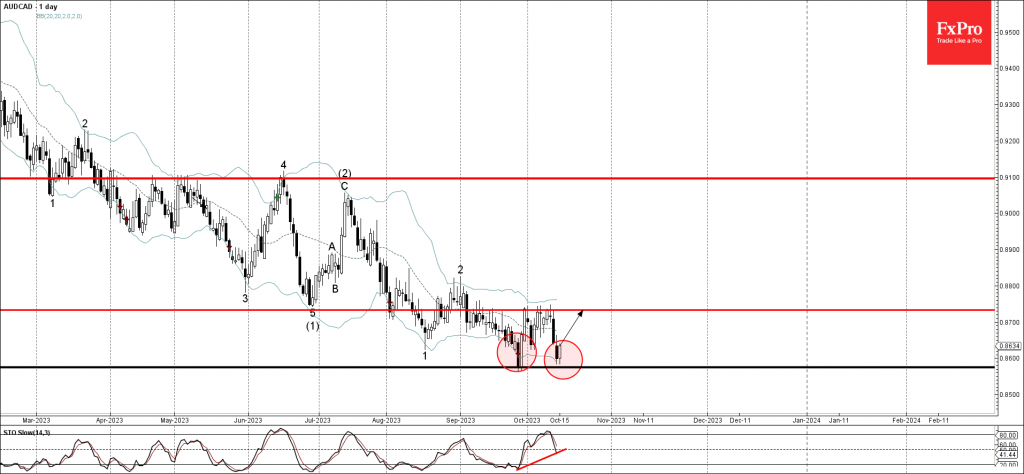

October 16, 2023

– AUDCAD reversed from support level 0.8575 – Likely to rise to resistance level 0.8735 AUDCAD recently reversed up from the pivotal support level 0.8575 (former monthly low from November) which formed the daily candlesticks reversal pattern Bullish Engulfing in.