Technical analysis - Page 135

October 31, 2023

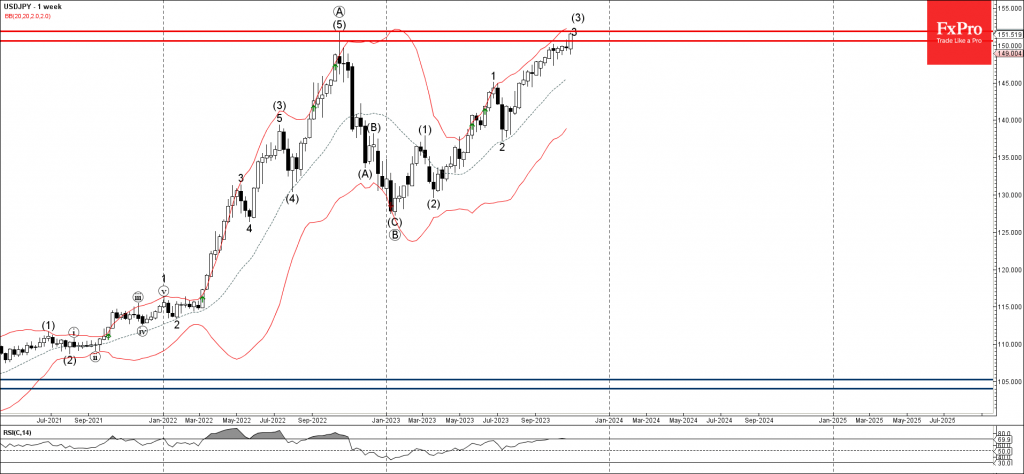

– USDJPY broke key resistance level 150.85 – Likely to rise to resistance level 151.90 USDJPY recently broke the key resistance level 150.85 (top of the previous daily Evening Star reversal pattern from last week). The breakout of the resistance.

October 31, 2023

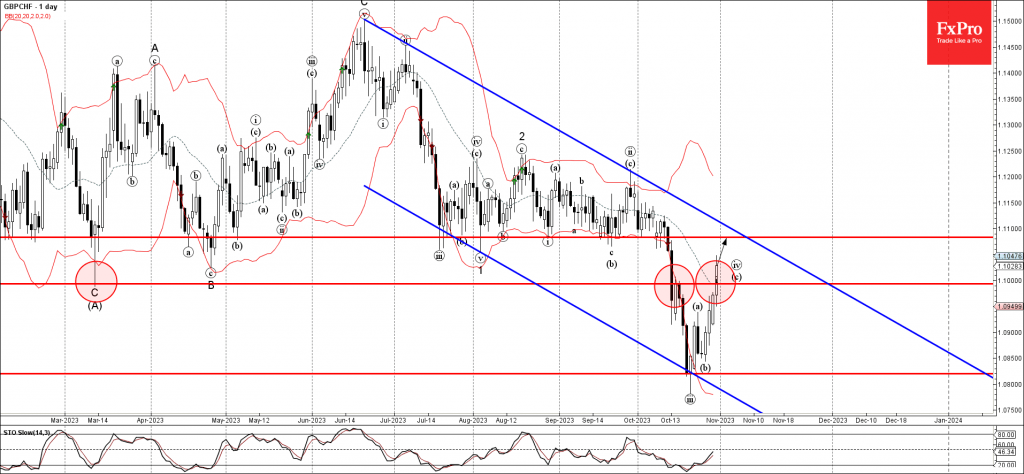

– GBPCHF broke key resistance level 1.1000 – Likely to rise to resistance level 1.1080 GBPCHF recently broke the key resistance level 1.1000 (top of the previous minor correction from the middle of October). The breakout of the resistance level.

October 30, 2023

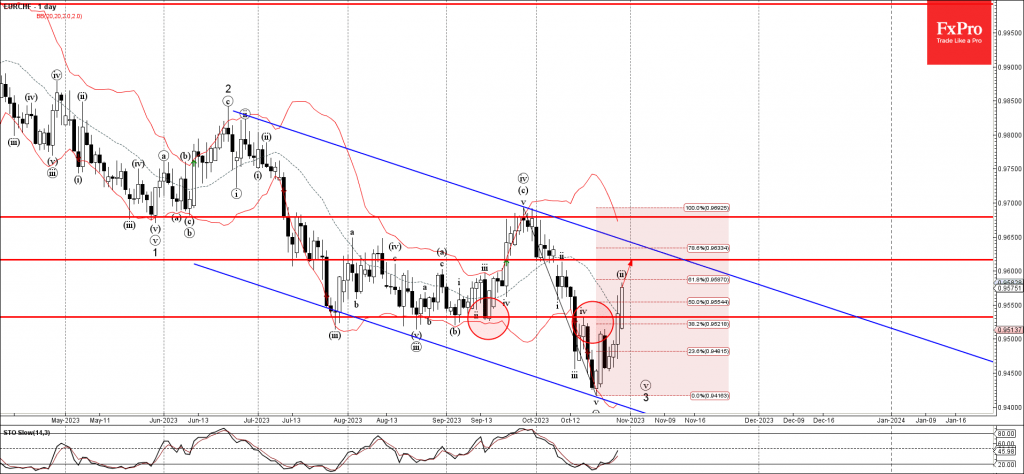

– EURCHF broke resistance level 0.9530 – Likely to rise to resistance level 0.9615 EURCHF recently broke the resistance level 0.9530 (top of the previous minor correction iv) coinciding with the 38.2% Fibonacci correction of the previous downward impulse v.

October 30, 2023

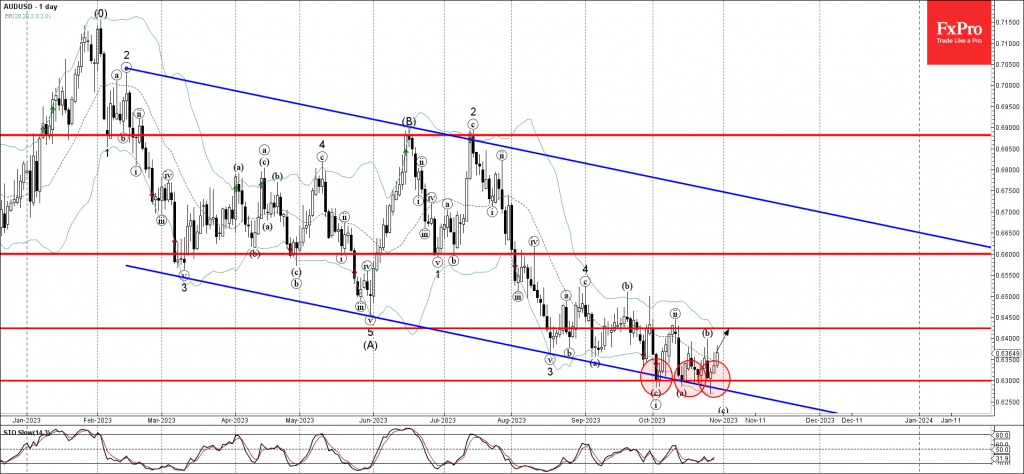

– AUDUSD reversed from key support level 0.6300 – Likely to rise to resistance level 0.6425 AUDUSD recently reversed up from the key support level 0.6300, which has been steadily reversing the index from the start of October. The support.

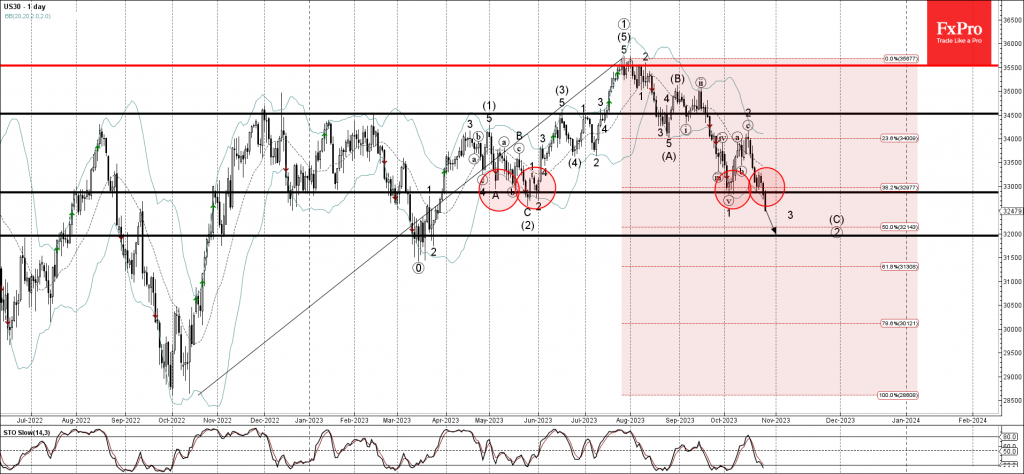

October 27, 2023

– Dow Jones index broke key support level 32875.00 – Likely to fall to support level 32000.00 Dow Jones index recently broke the key support level 32875.00, which has been repeatedly reversing the index from the start of May. The.

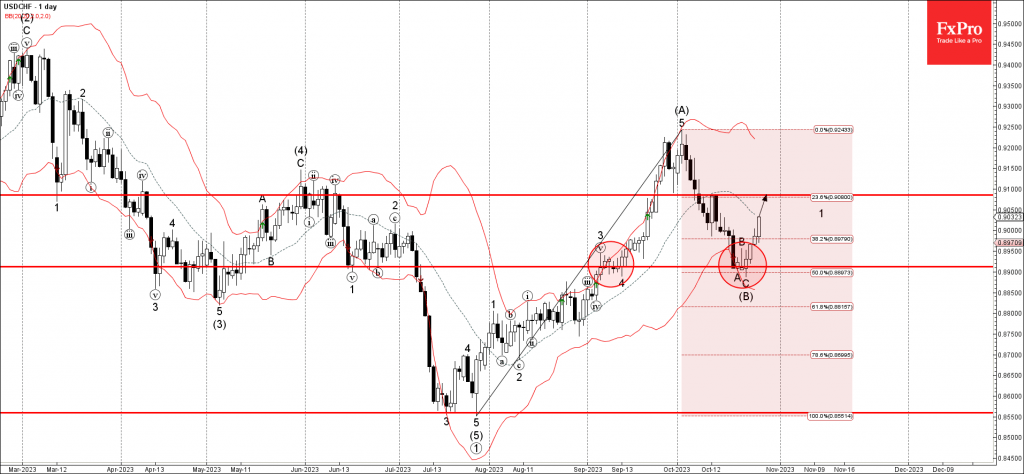

October 27, 2023

– USDCHF reversed from support level 0.8900 – Likely to rise to resistance level 0.9085 USDCHF currency pair recently reversed up from the key support level 0.8900 (which has been reversing the pair from September) standing near the lower daily.

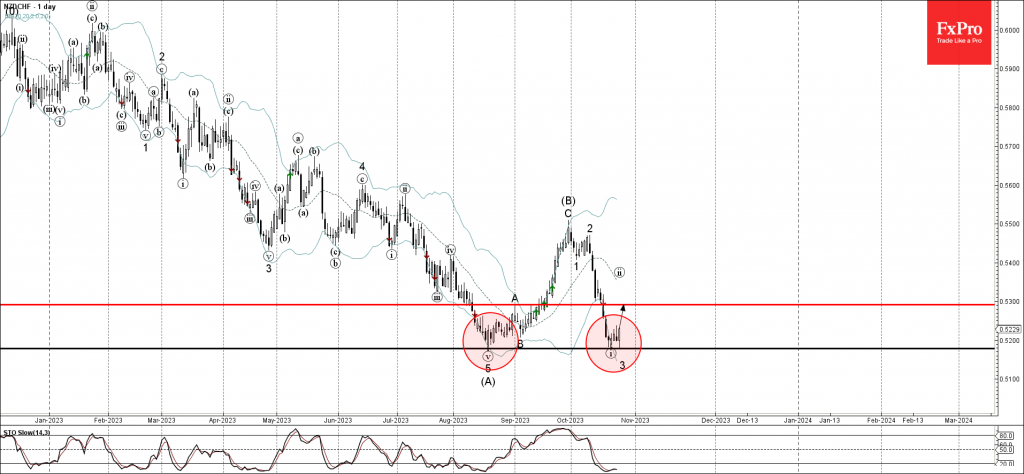

October 26, 2023

– NZDCHF reversed from key support level 0.5180 – Likely to rise to resistance level 0.5300 NZDCHF currency pair recently reversed up from the key support level 0.5180 (which stopped the prolonged daily downtrend in August as can be seen.

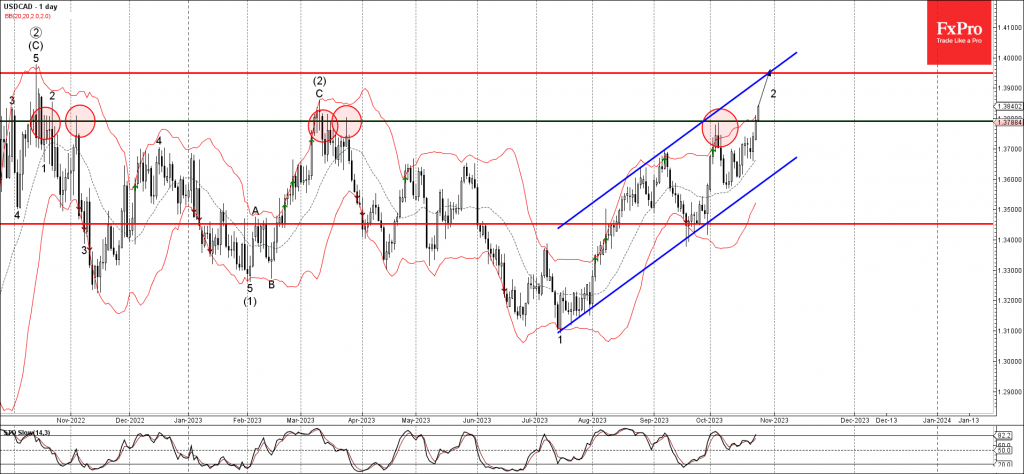

October 26, 2023

– USDCAD broke key resistance level 1.3790 – Likely to rise to resistance level 1.3950 USDCAD previously broke above the key resistance level 1.3790 (which has been steadily reversing the pair from last October). The breakout of the resistance level.

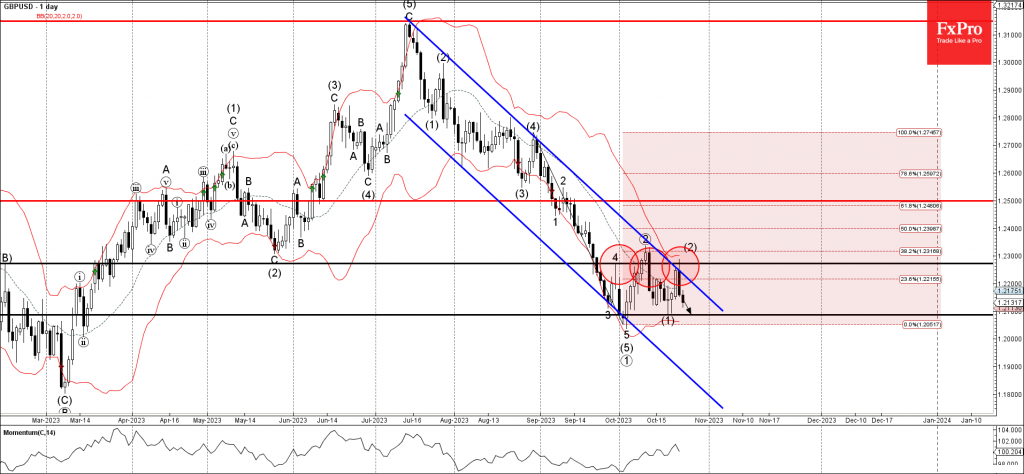

October 25, 2023

– GBPUSD reversed from resistance level 1.2270 – Likely to fall to support level 1.2085 GBPUSD earlier reversed down with the Piercing Line candlesticks pattern from the key resistance level 1.2270 (which also stopped the previous waves 4 and 2)..

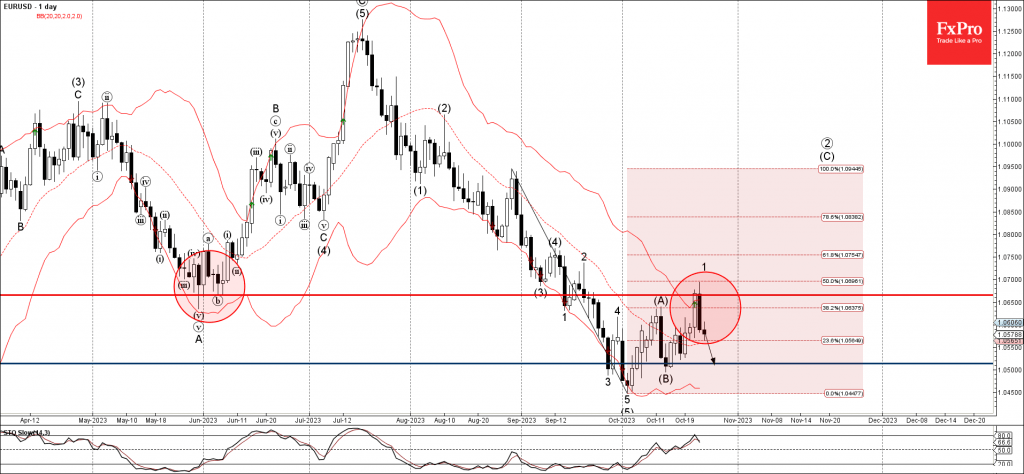

October 25, 2023

– EURUSD reversed from resistance level 1.0665 – Likely to fall to support level 1.0515 EURUSD currency pair recently reversed down with the Bearish Engulfing from the key resistance level 1.0665 (former strong support from May and June) intersecting with.

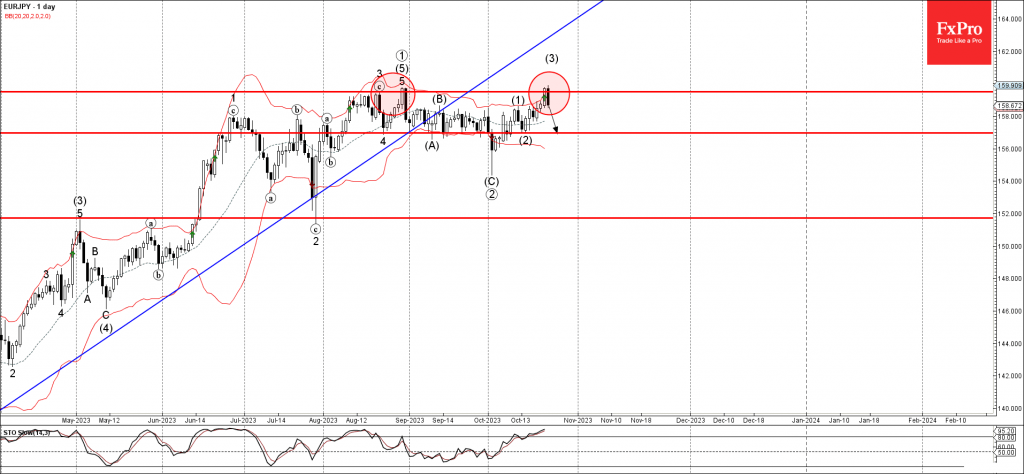

October 24, 2023

– EURJPY reversed from resistance level 159.50 – Likely to fall to support level 0.8100 EURJPY currency pair recently reversed down from the powerful resistance level 159.50 (which reversed the pair twice in August) intersecting with the upper daily Bollinger.