Technical analysis - Page 110

June 26, 2024

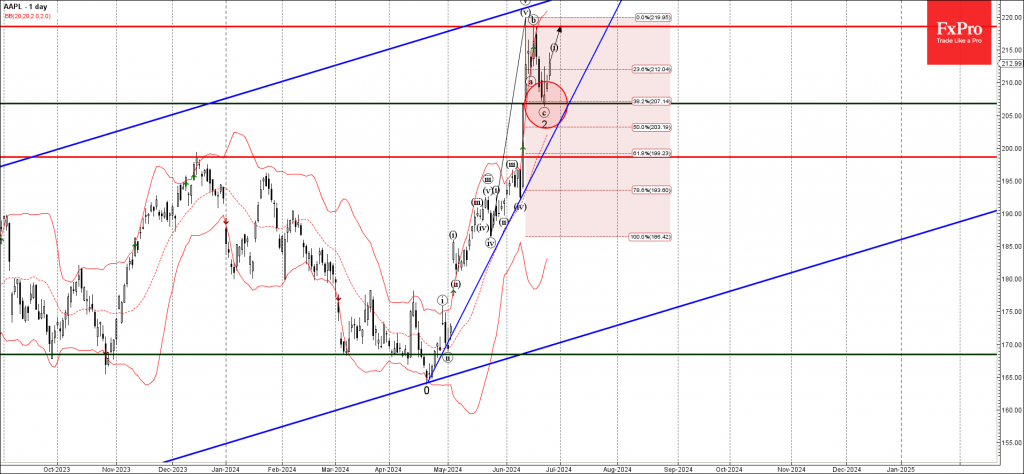

– Apple rising inside impulse wave 3 – Likely to rise to resistance level 218.60 Apple recently reversed up from the 38.2% Fibonacci correction level of the previous sharp upward impulse from May. The upward reversal from this support level.

June 26, 2024

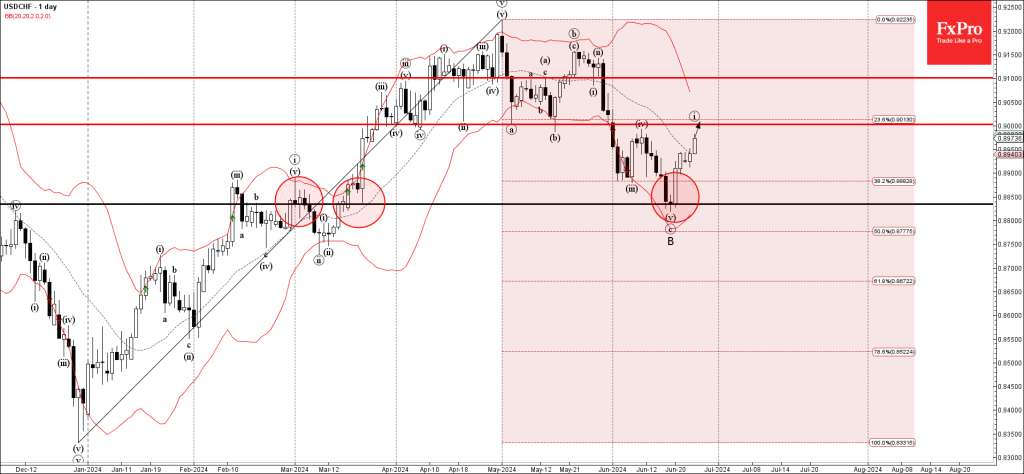

– USDCHF rising inside impulse wave i – Likely to reach resistance level 0.9000 USDCHF continues to rise inside the minor impulse wave i, which started earlier, when the pair reversed up from the key support level 0.8835, standing near.

June 25, 2024

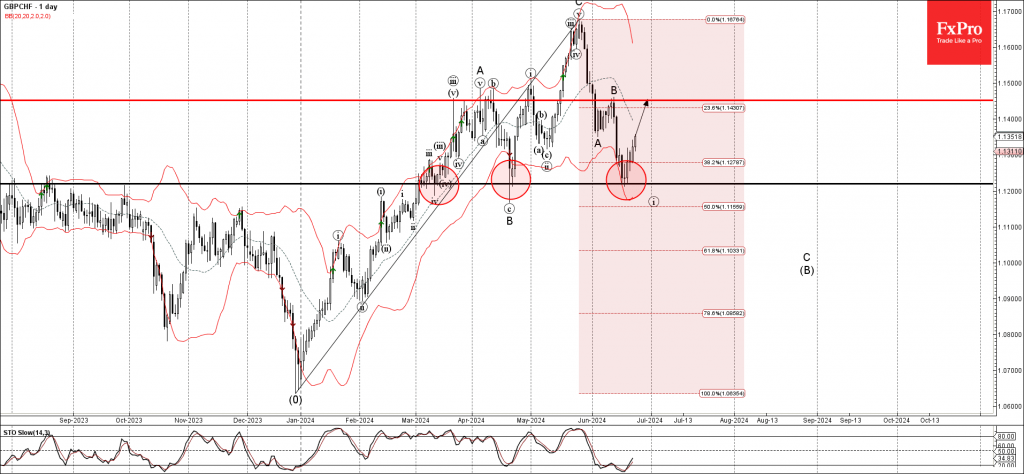

– GBPCHF reversed from support level 1.1220 – Likely to rise to resistance level 1.1450 GBPCHF currency pair continues to rise after the earlier upward reversal from the pivotal support level 1.1220 (which stopped the two previous corrections iv and.

June 25, 2024

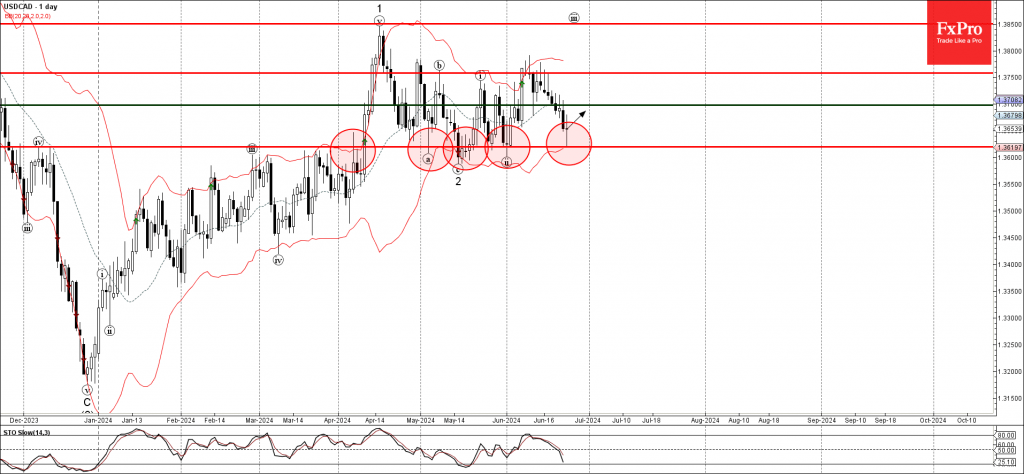

– USDCAD reversed from key support level 1.3620 – Likely to rise to resistance level 1.3700 USDCAD currency pair today reversed up with the long-legged Doji from the key support level 1.3620 (which has been steadily reversing the price from.

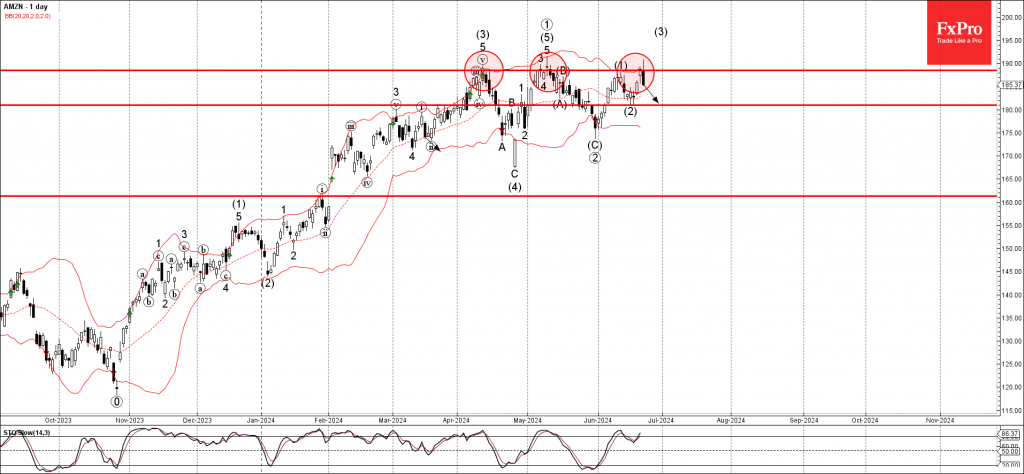

June 24, 2024

– Amazon reversed from key resistance level 188.50 – Likely to fall to support level 181.00 Amazon recently reversed down from the key resistance level 188.50 (which has been steadily reversing the price from April, stopping earlier waves (3) and.

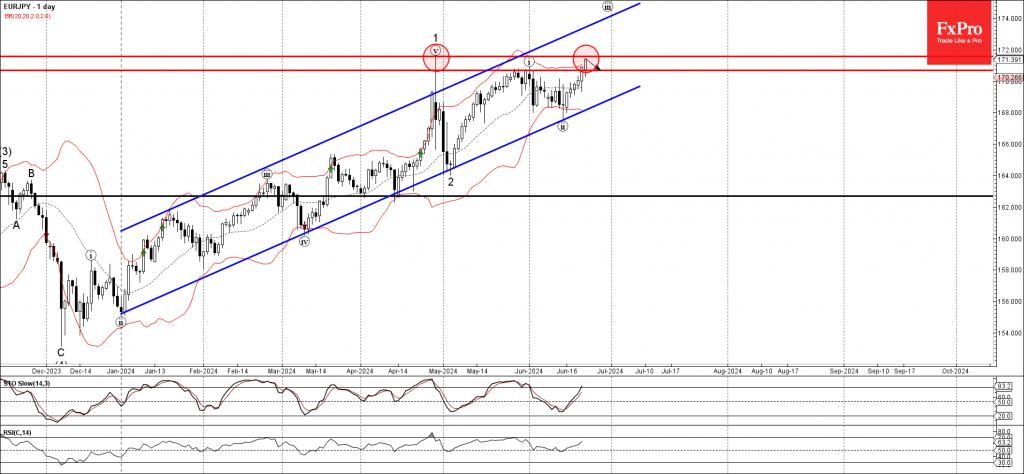

June 24, 2024

– EURJPY approaching strong resistance level 171.55 – Likely to correct down from 171.55 EURJPY currency pair approaching the strong resistance level 171.55 (which stopped the previous sharp upward impulse wave 1 at the end of April, as you can.

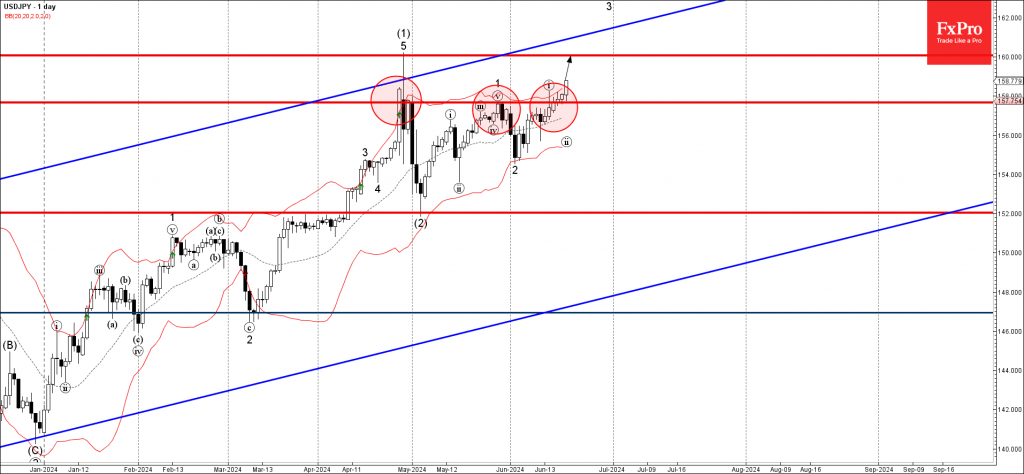

June 20, 2024

– USDJPY broke strong resistance level 157.65 – Likely to rise to resistance level 160.00 USDJPY currency pair recently broke above the strong resistance level 157.65 (which has been steadily reversing the price from the end of April, as you.

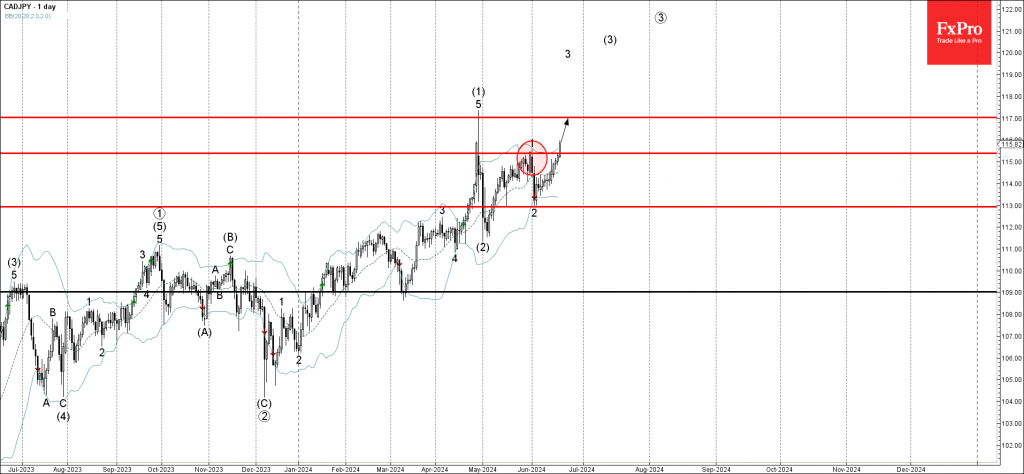

June 20, 2024

– CADJPY under bullish pressure – Likely to rise to resistance 117.00 CADJPY currency pair under the bullish pressure after the price broke above the key resistance level 115.40 (which stopped the previous impulse wave 1 at end of May)..

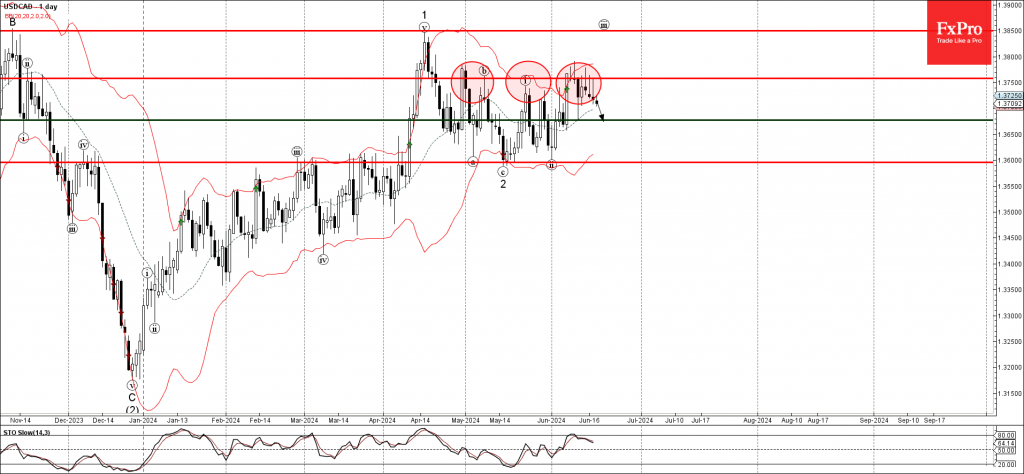

June 19, 2024

– USDCAD reversed from pivotal resistance level 1.3760 – Likely to fall to support level 1.3675 USDCAD currency pair under the bearish pressure after the price reversed down 3 times in a row from the pivotal resistance level 1.3760 (which.

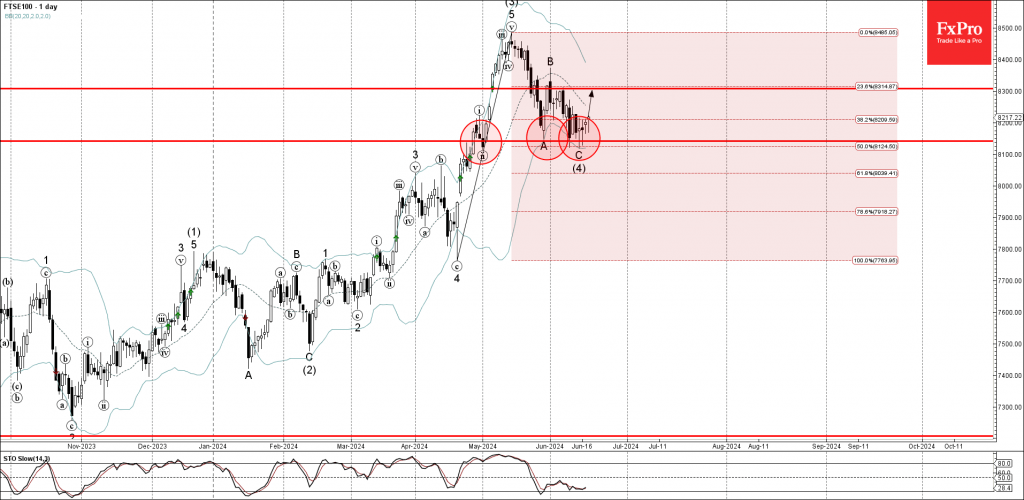

June 19, 2024

– FTSE 100 index reversed from support level 8140.00 – Likely to rise to resistance level 8300.00 FTSE 100 index recently reversed up from the key support level 8140.00 (which has been reversing the price from the end of April),.

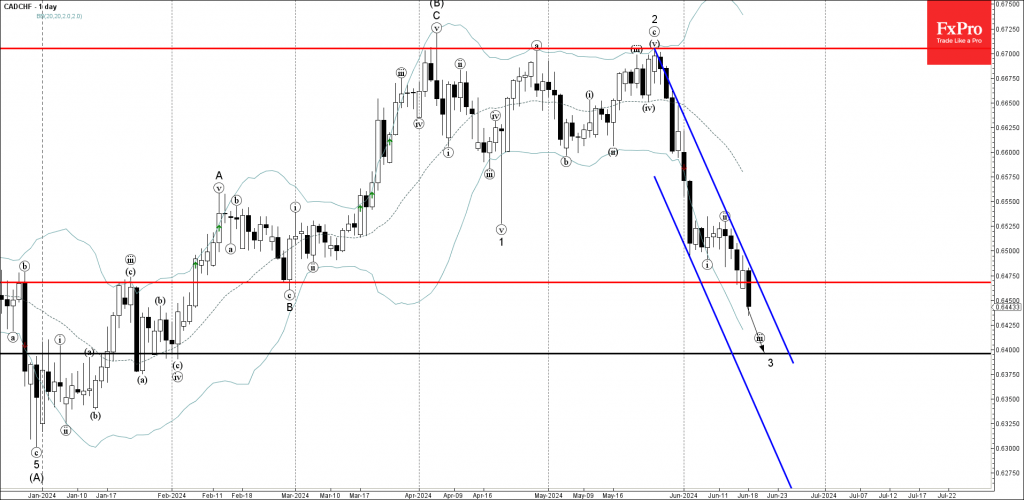

June 18, 2024

– CADCHF broke key support level 0.6465 – Likely to fall to support level 0.6400 CADCHF currency pair under the bearish pressure after breaking the key support level 0.6465 (which started the impulse wave C in February). The breakout of.