Technical analysis - Page 107

July 22, 2024

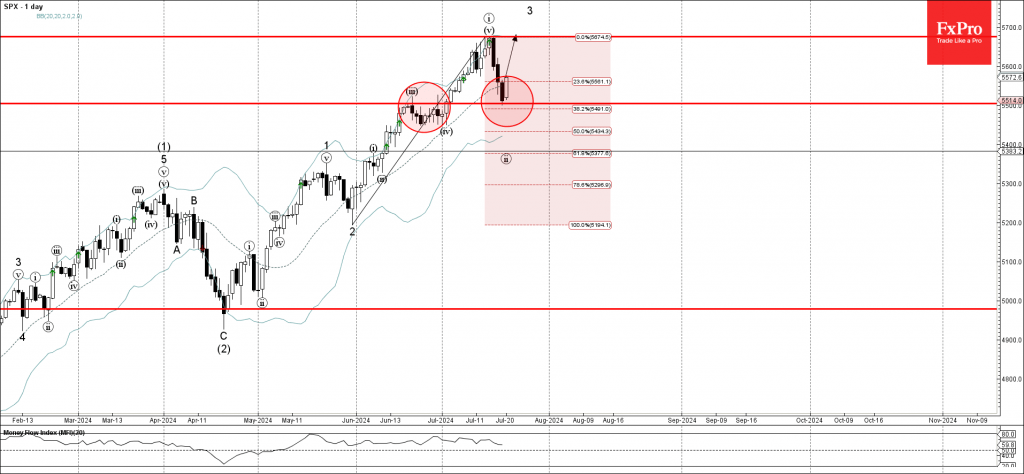

– S&P 500 continues daily uptrend – Likely to rise to resistance level 5675.00 S&P 500 Index recently reversed from the support area between the key support level 5500.00 (former resistance from June) and the 38.2% Fibonacci correction of the.

July 19, 2024

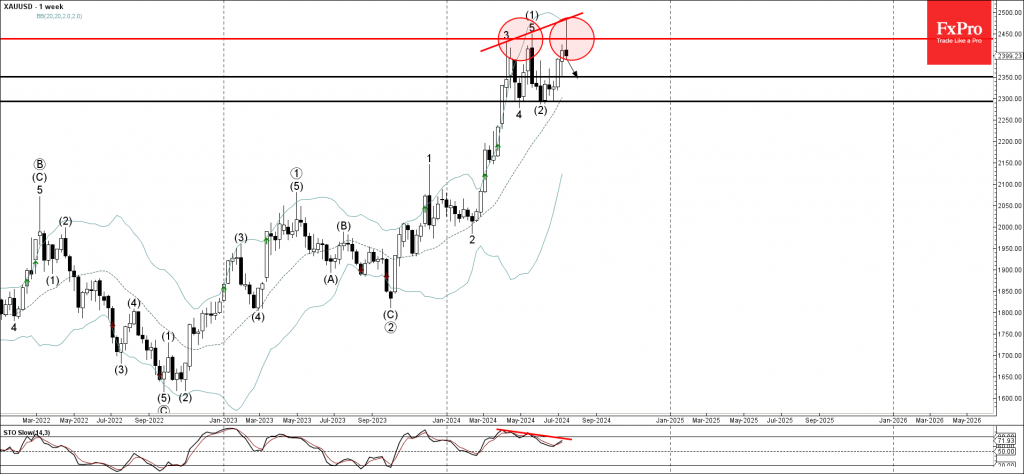

– Gold reversed from resistance area – Likely to fall to support level 2350.00 Gold recently reversed down from the resistance area located between the pivotal resistance level 2440.00 (which stopped the previous waves 3 and 5, as can be.

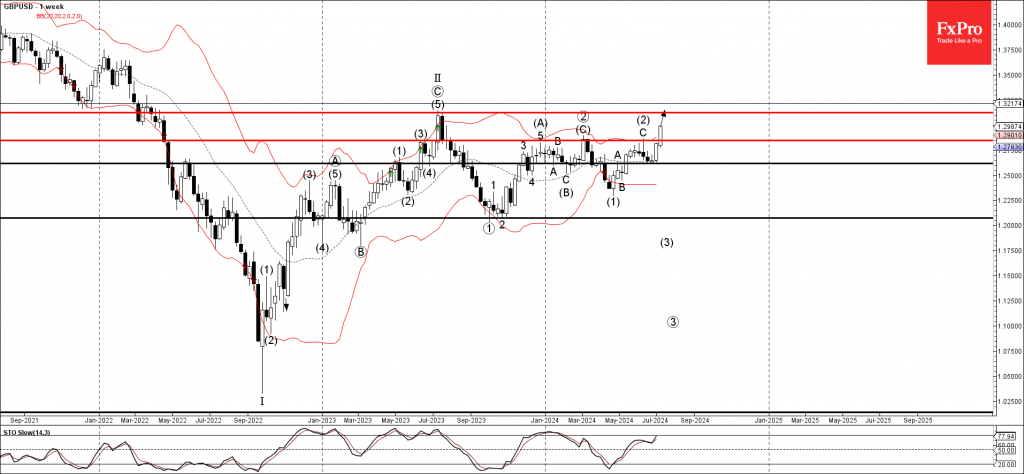

July 19, 2024

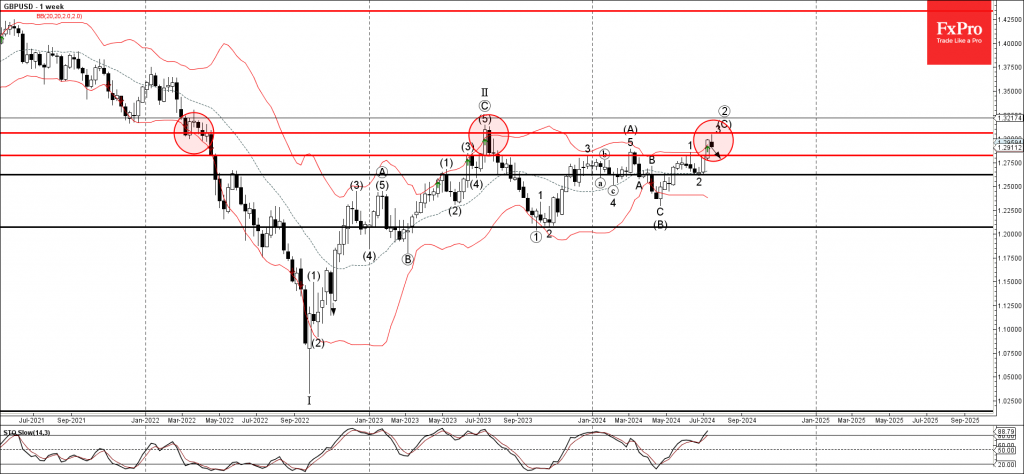

– GBPUSD reversed from resistance area – Likely to fall to support level 1.2820 GBPUSD currency pair earlier reversed down from the resistance area located between the key resistance level 1.3060 (which stopped the multi-month uptrend in July) and the.

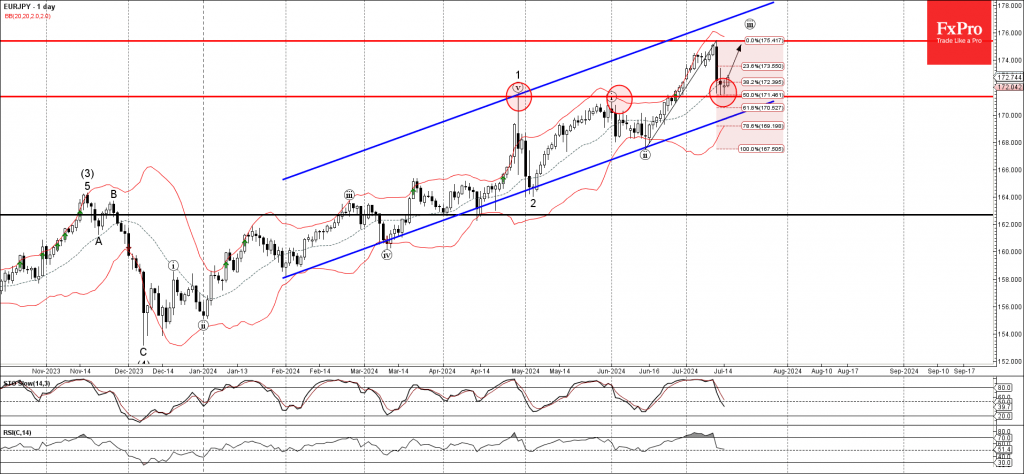

July 18, 2024

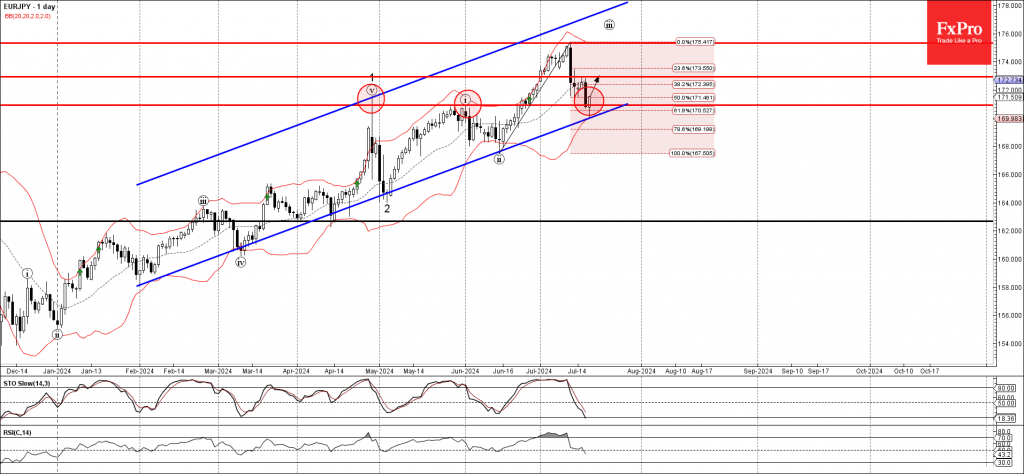

– EURJPY reversed from support area – Likely to rise to resistance level 172.95 EURJPY currency pair today reversed up from the support area located between the pivotal support level 170.95 (which stopped the pair in April and May), lower.

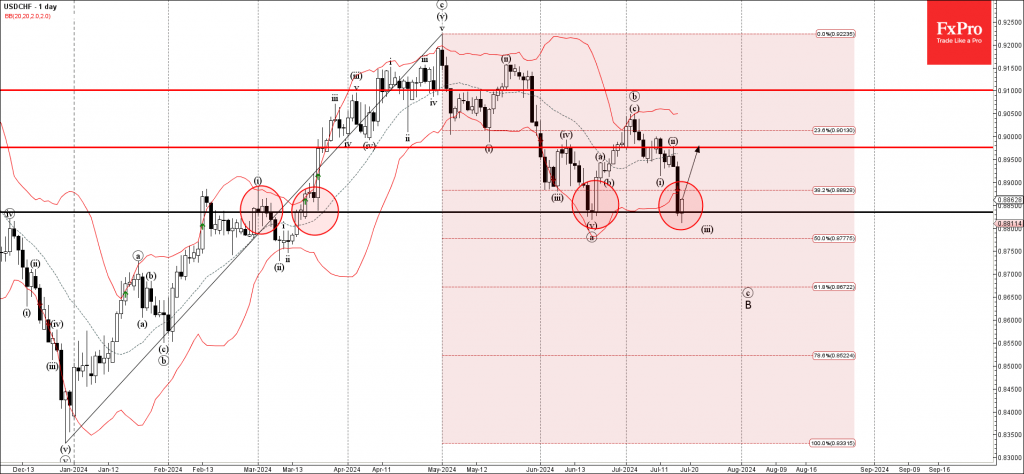

July 18, 2024

– USDCHF reversed from support area – Likely to rise to resistance level 0,9000 USDCHF currency pair today reversed up from the support area located between the key support level 0.8835 (which created the Morning Star in June), 38.2% Fibonacci.

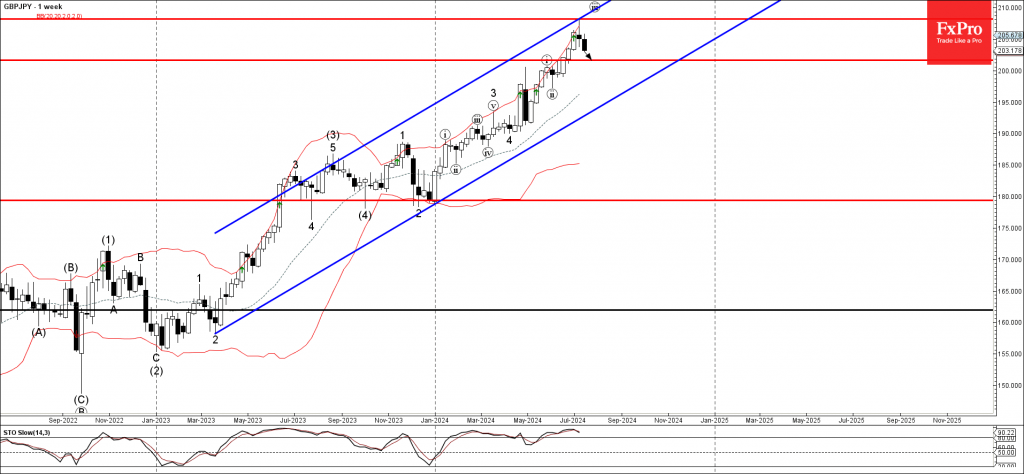

July 17, 2024

– GBPJPY reversed from the resistance area – Likely to fall to support level 201.65 GBPJPY currency pair continues to fall after the price reversed down from the resistance area located between the upper trendline of the weekly up channel.

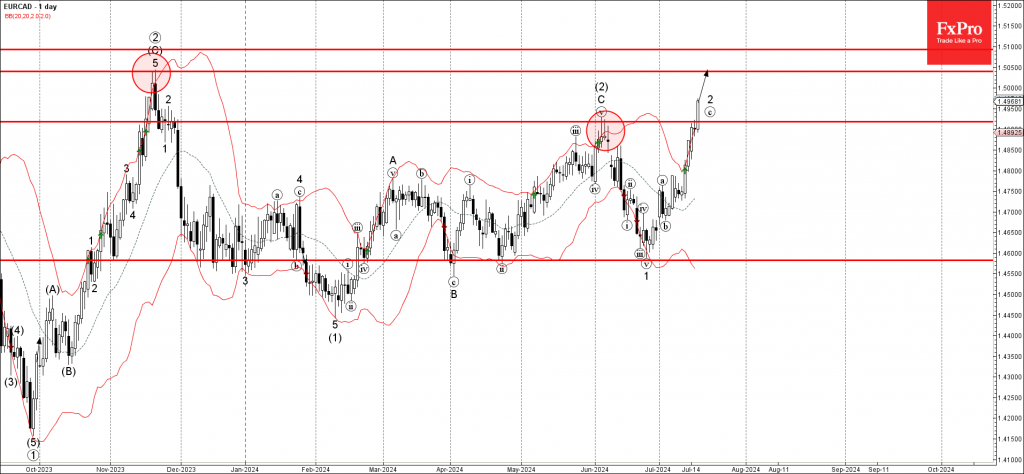

July 17, 2024

– EURCAD broke key resistance level 1.4920 – Likely to rise to resistance level 1.5040 EURCAD currency pair recently broke above the key resistance level 1.4920, which stopped the previous correction (2) at the start of June. The breakout of.

July 16, 2024

– EURJPY reversed from pivotal support level 171.35 – Likely to rise to resistance level 175.40 EURJPY currency pair recently reversed up from the pivotal support level 171.35, which has been reversing the price from the end of April. The.

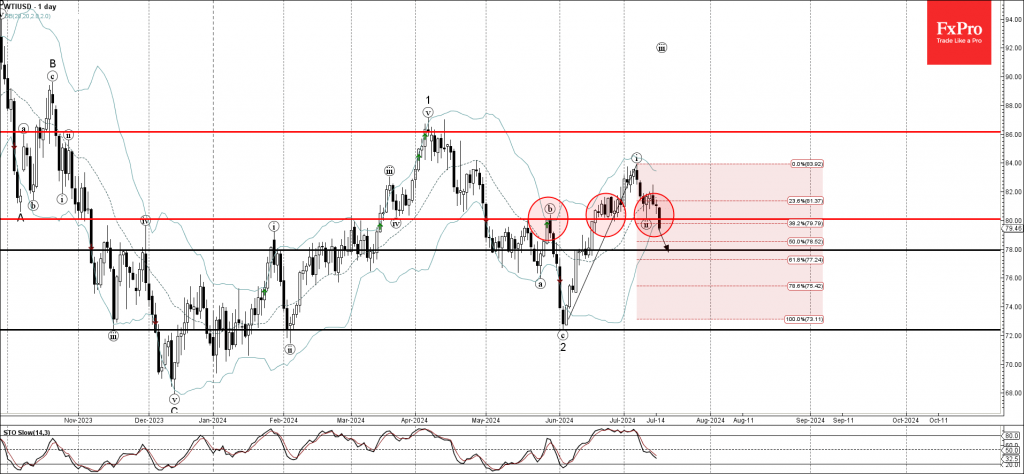

July 16, 2024

– WTI broke support level 80.00 – Likely to fall to support level 78.00 WTI crude oil just broke the round support level 80.00, former resistance from May, which has been reversing the price from June. The breakout of the.

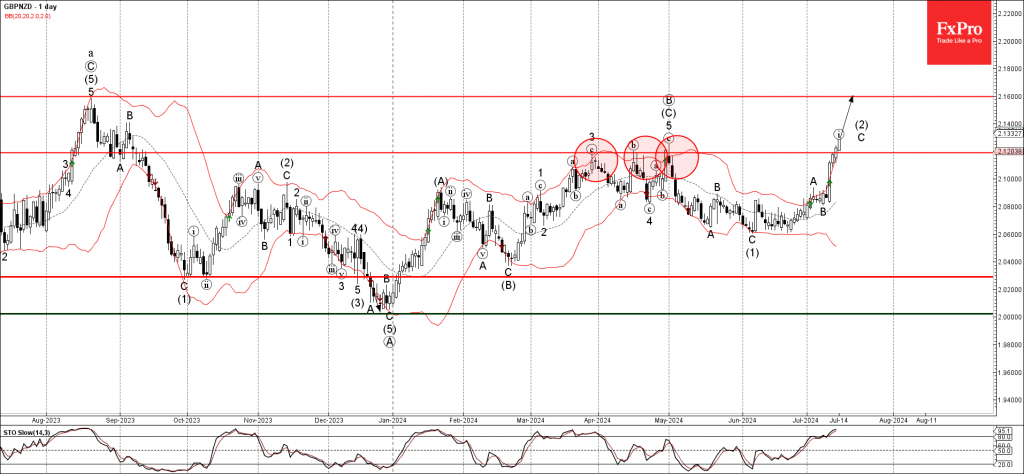

July 15, 2024

– GBPNZD broke pivotal resistance level 2.1190 – Likely to fall to support level 2.00 GBPNZD recently broke above the pivotal resistance level 2.1190, which reversed the price multiple times from March to May. The breakout of the resistance level.

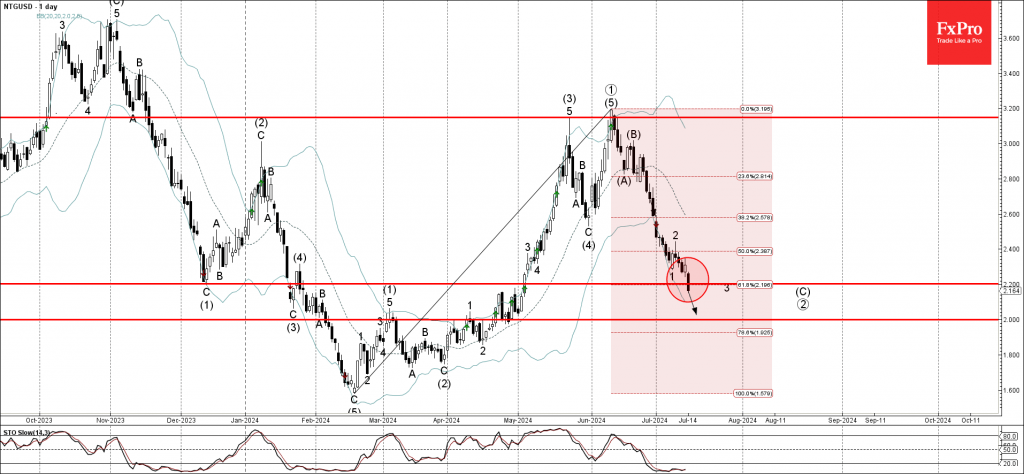

July 15, 2024

– Natural gas broke key support level 2.200 – Likely to fall to support level 2.00 Natural gas recently broke the key support level 2.200, intersecting with the 61.8% Fibonacci correction of the sharp upward impulse from February. The breakout.