Technical analysis - Page 105

August 8, 2024

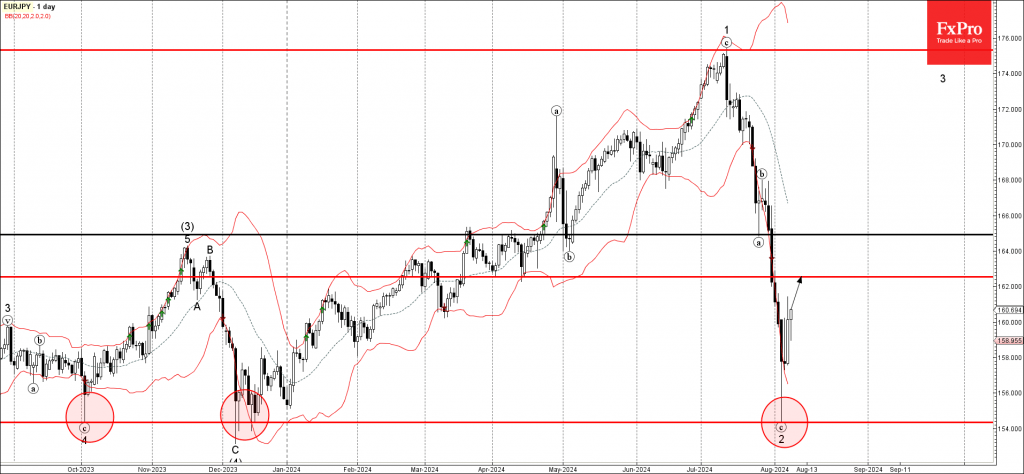

– EURJPY reversed from support zone – Likely to rise to resistance level 162.50 EURJPY currency pair recently reversed up sharply from the support zone located between the multi-month support level 154.30 (which has been reversing the price from October).

August 8, 2024

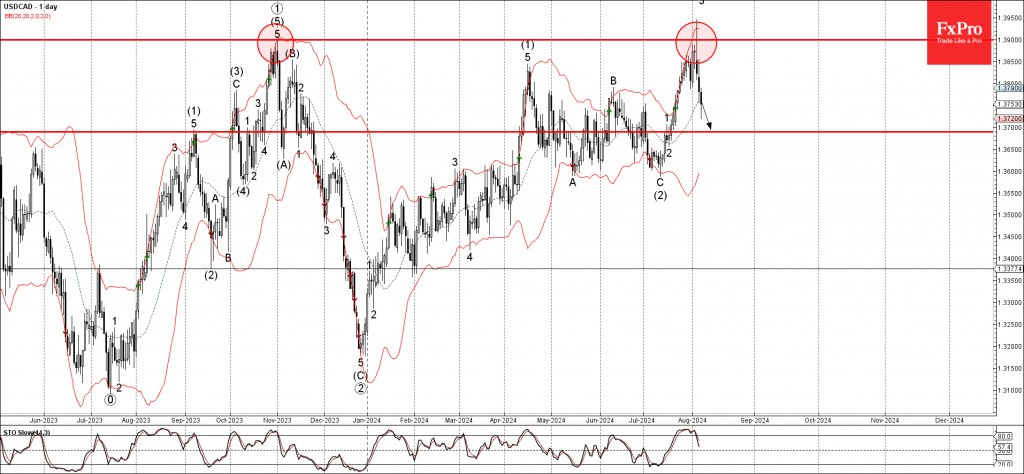

– USDCAD reversed from long-term resistance level 1.3900 – Likely to fall to support level 1.3700 USDCAD currency pair recently reversed down from the resistance zone located between the long-term resistance level 1.3900 (which stopped the weekly uptrend at the.

August 8, 2024

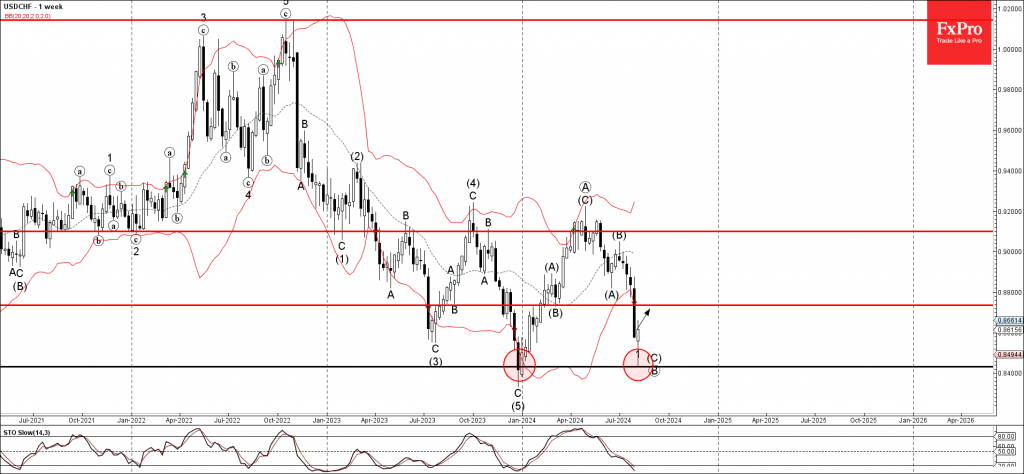

– USDCHF reversed from support zone – Likely to rise to resistance level 0.8735 USDCHF currency pair recently reversed up from support zone located between the support level 0.8430 (which stopped the weekly downtrend at the end of 2023) and.

August 6, 2024

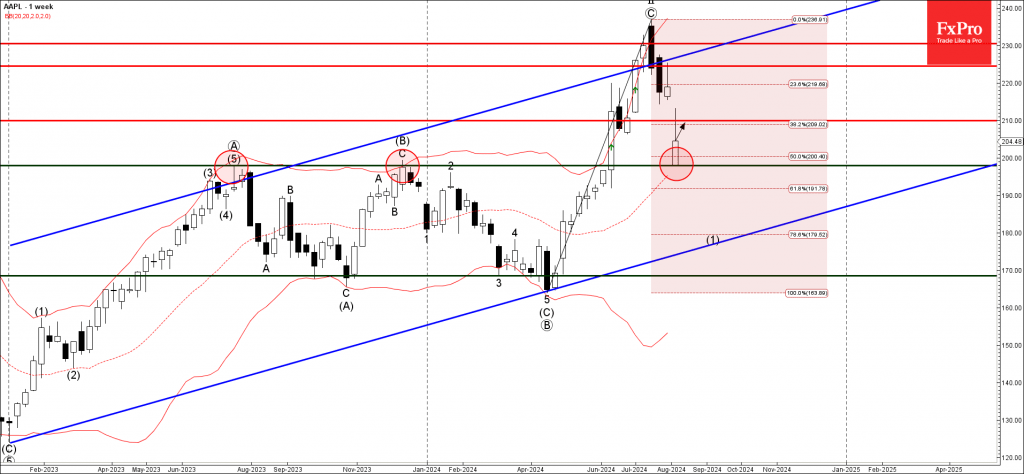

– Apple reversed from support zone – Likely to rise to resistance level 210.00 Apple recently reversed up from support zone located between the support level 197.90 (former Double Top from 2023), 20-week moving average and the 50% Fibonacci correction.

August 6, 2024

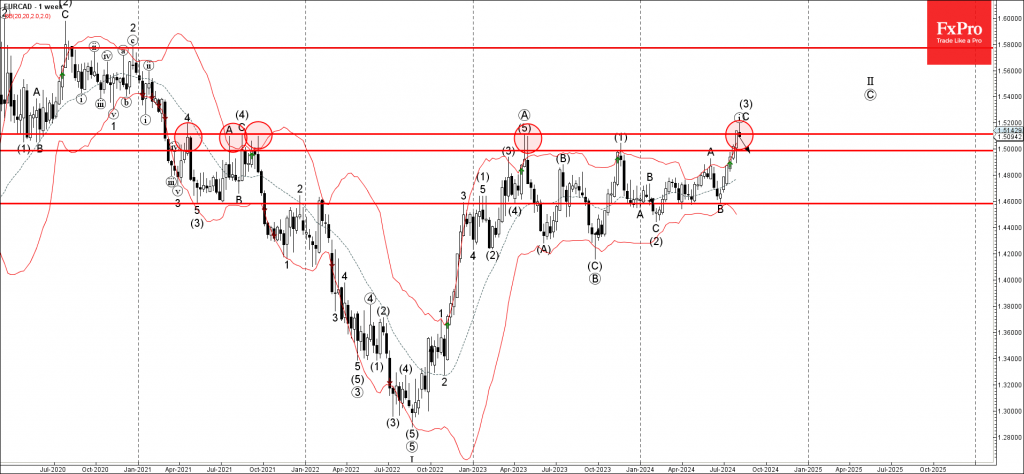

– EURCAD reversed from resistance level 1.5110 – Likely to fall to support level 1.5000 EURCAD currency pair recently reversed down from the long-term resistance level 1.5110 (which has been reversing the price from the start of 2011), standing close.

August 6, 2024

– Nikkei 225 reversed from support level 30600.00 – Likely to rise to resistance level 35000.00 Nikkei 225 index recently reversed up from the key support level 30600.00, former support from the end of 2023. The support level 30600.00 was.

August 6, 2024

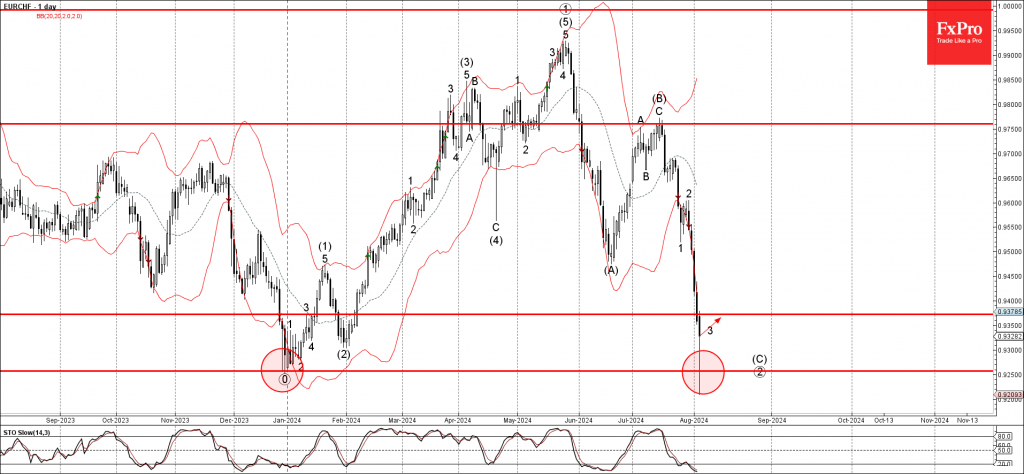

– EURCHF reversed from support level 0.9255 – Likely to rise to resistance level 0.9370 EURCHF currency pair today reversed up from the powerful support level 0.9255, which stopped the weekly downtrend at the end of 2023. The support level.

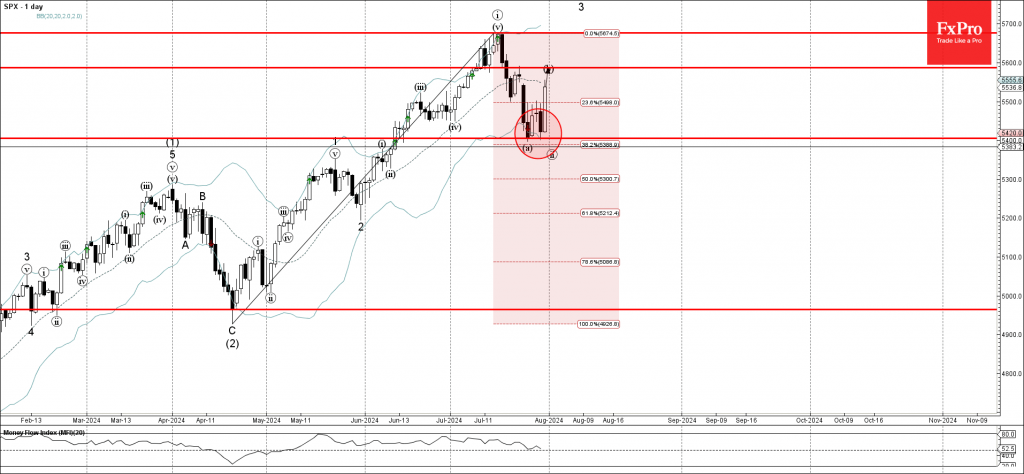

August 2, 2024

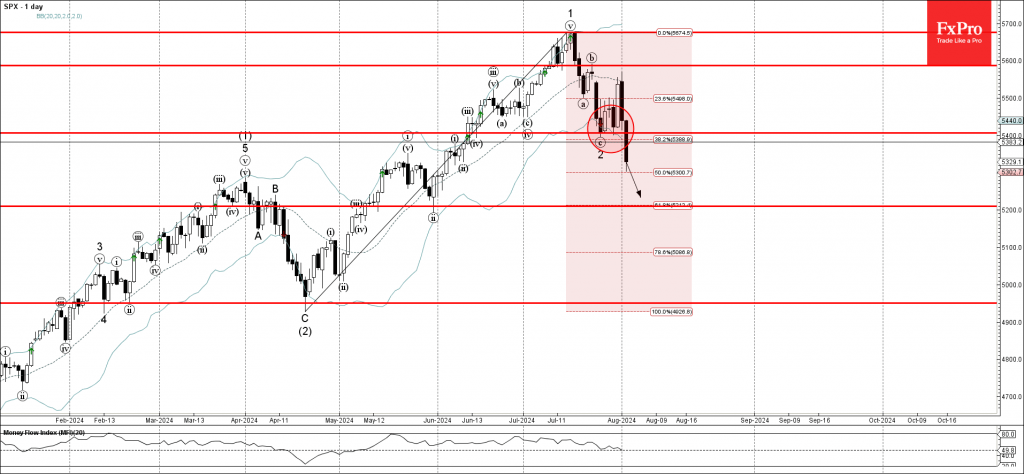

– S&P 500 Index under bearish pressure – Likely to fall to support level 5200.00 S&P 500 Index is under the bearish pressure after the price broke below the key support level 5400.00, which reversed the price with two consecutive.

August 2, 2024

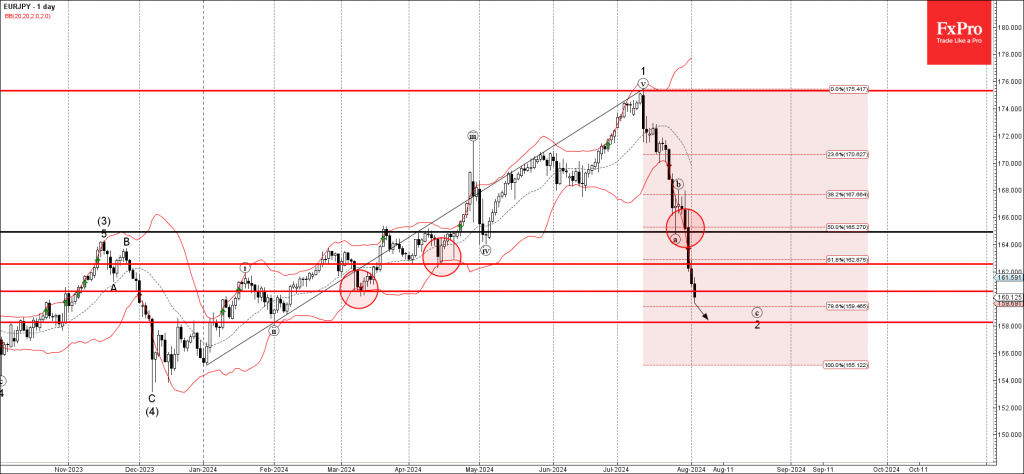

– EURJPY falling inside accelerated impulse wave c – Likely to test support level 158.00 EURJPY currency pair continues to fall inside the accelerated downward impulse wave c of the minor ABC correction 2 from the start of July. The.

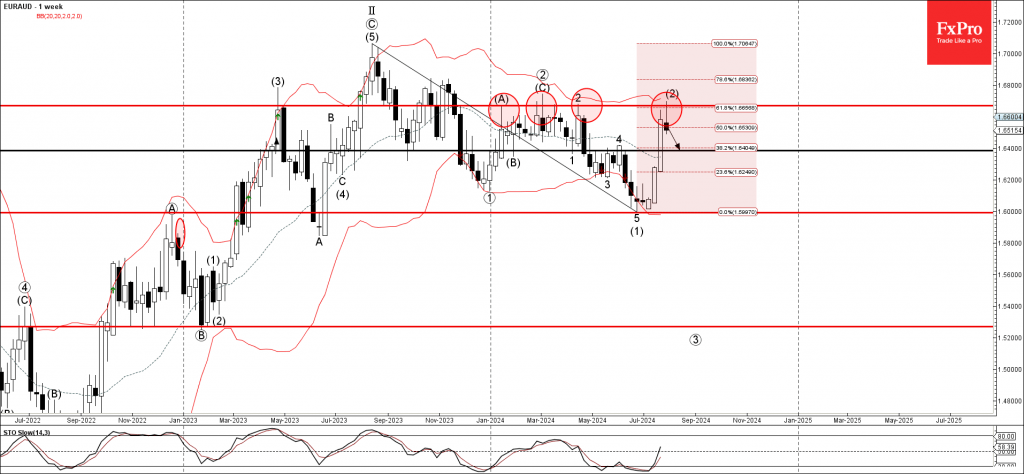

August 1, 2024

– EURAUD reversed from long-term resistance level 1.6670 – Likely to fall to support level 1.6400 EURAUD currency pair recently reversed down from the resistance area located between the major long-term resistance level 1.6670 (which has been reversing the pair.

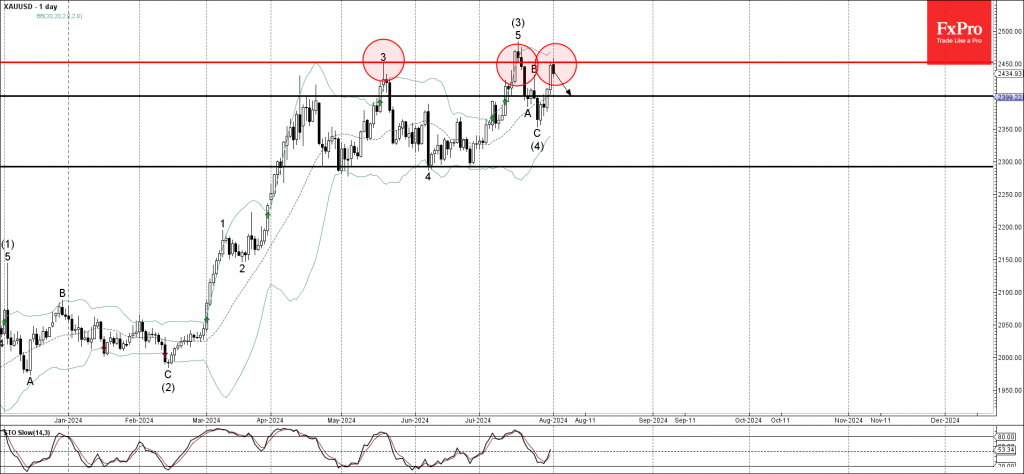

August 1, 2024

– Gold reversed from resistance zone – Likely to fall to support level 2400.00 Gold recently reversed down from the resistance zone located between the pivotal resistance level 2450.00 (which has been reversing the price from the middle of May).