Technical analysis - Page 103

August 23, 2024

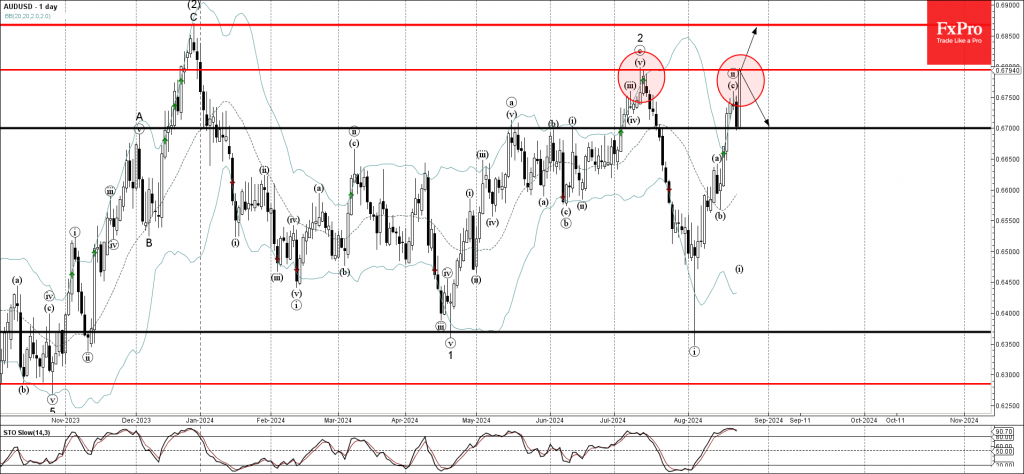

– AUDUSD approached key resistance level 0.6795 – Likely to rise to resistance level 0.6865 AUDUSD currency pair just approached the key resistance level 0.6795 (which stopped the previous minor correction 2 at the start of July) standing above the.

August 22, 2024

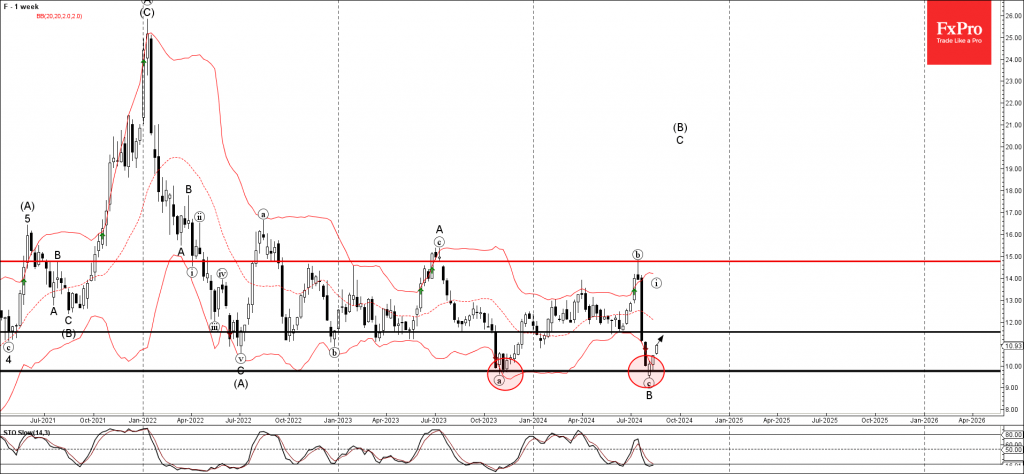

– Ford reversed from round support level 10.00 – Likely to rise to resistance level 11.50 Ford recently reversed up from the strong round support level 10.00 (which previously stopped the multi-year downtrend at the end of 2023) coinciding with.

August 22, 2024

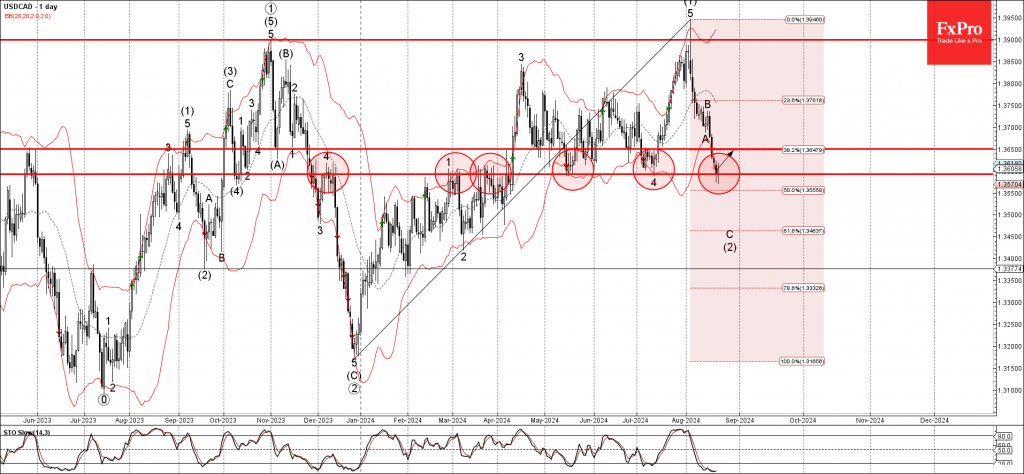

– USDCAD reversed from key support level 1.3590 – Likely to rise to resistance level 1.3650 USDCAD currency pair recently reversed up from the key support level 1.3590 (former resistance from February and March, which has been reversing the price.

August 21, 2024

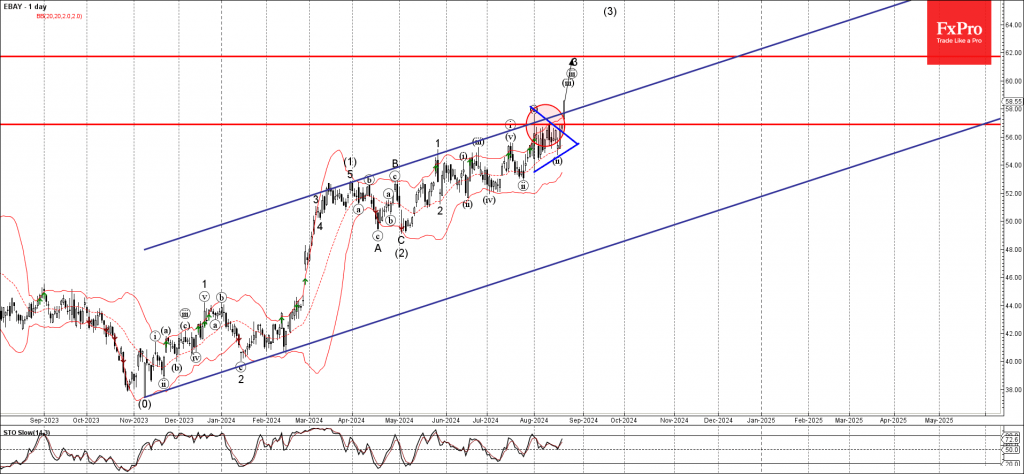

– Ebay broke daily up channel – Likely to rise to resistance level 62.00 Ebay recently broke resistance level 56.90 (which reversed the price from the end of July) coinciding with the resistance trendline of the daily Triangle from last.

August 21, 2024

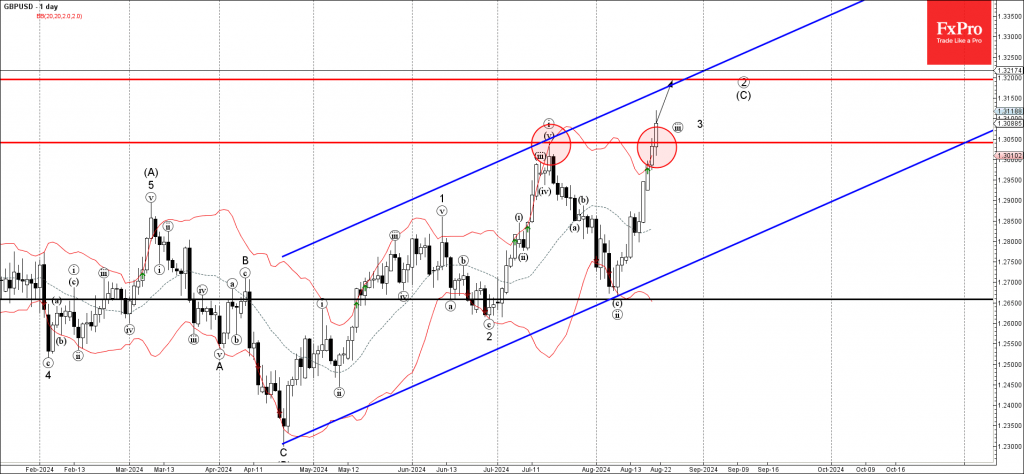

– GBPUSD broke key resistance level 1.3040 – Likely to reach resistance level 1.3200 GBPUSD currency pair recently broke above the key resistance level 1.3040 (previous monthly high from the middle of July). The breakout of the resistance level 1.3040.

August 20, 2024

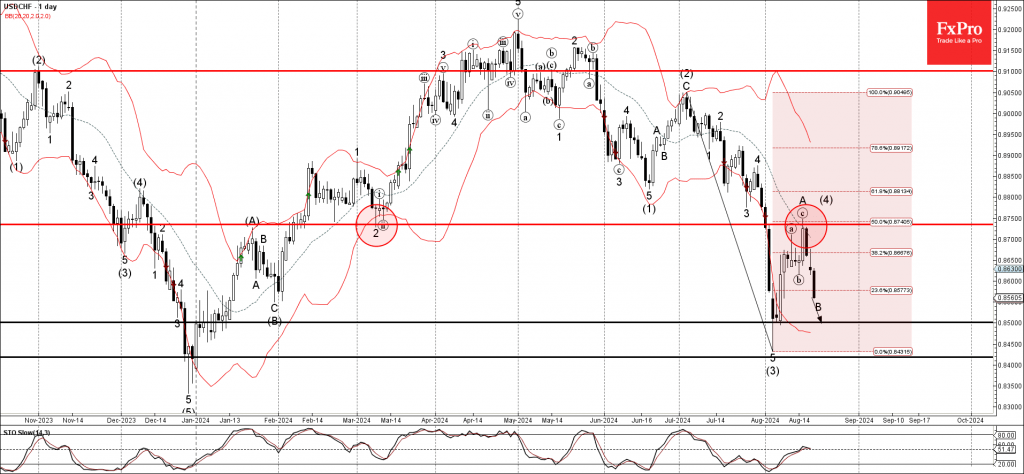

– USDCHF reversed from resistance area – Likely to fall to support level 0.8500 USDCHF currency pair recently reversed down from the resistance area set between the resistance level 0.8735 (former monthly low from March), 20-day moving average and the.

August 20, 2024

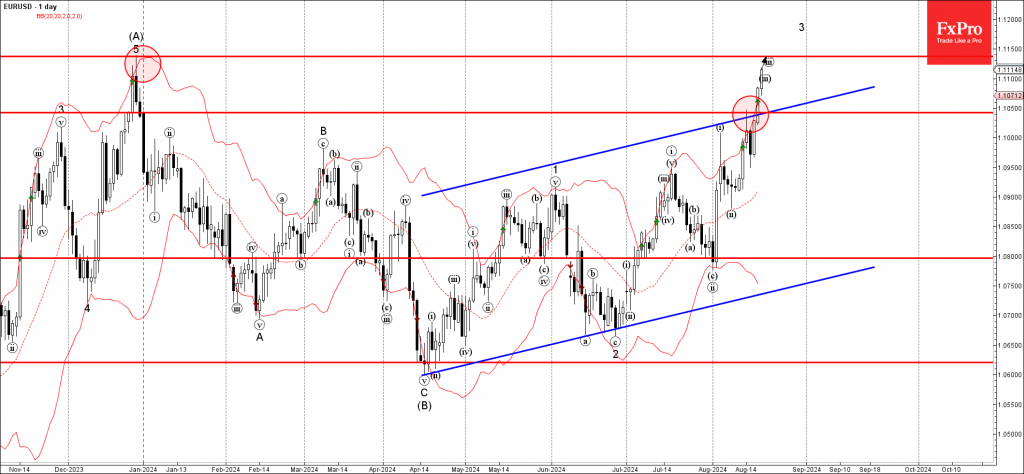

– EURUSD broke resistance area – Likely to rise to resistance level 1.1135 EURUSD currency pair just broke the resistance area located between the resistance level 1.105 (which reversed the price last week) and the resistance trendline of the daily.

August 16, 2024

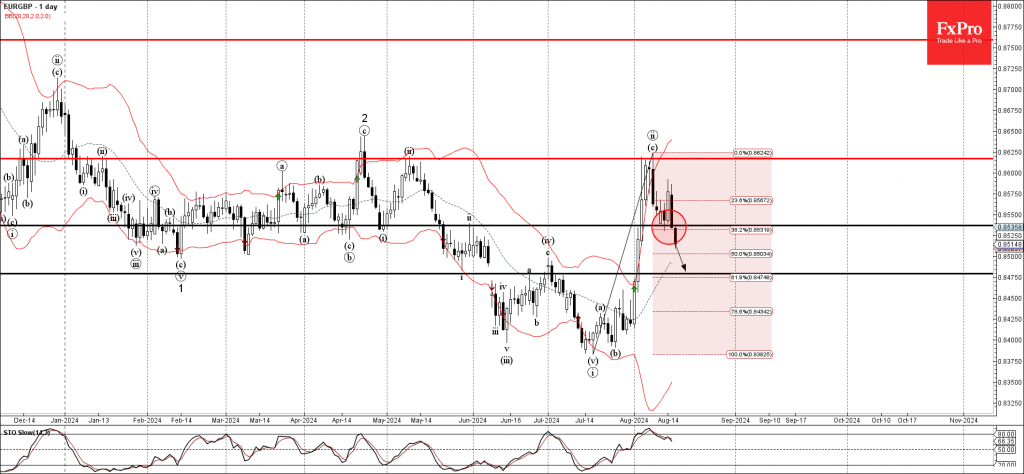

– EURGBP broke support area – Likely to fall to support level 0.8475 EURGBP currency pair just broke the support area set between the support level 0.8535 (which reversed the price twice earlier this week) and the 38.2% Fibonacci correction.

August 16, 2024

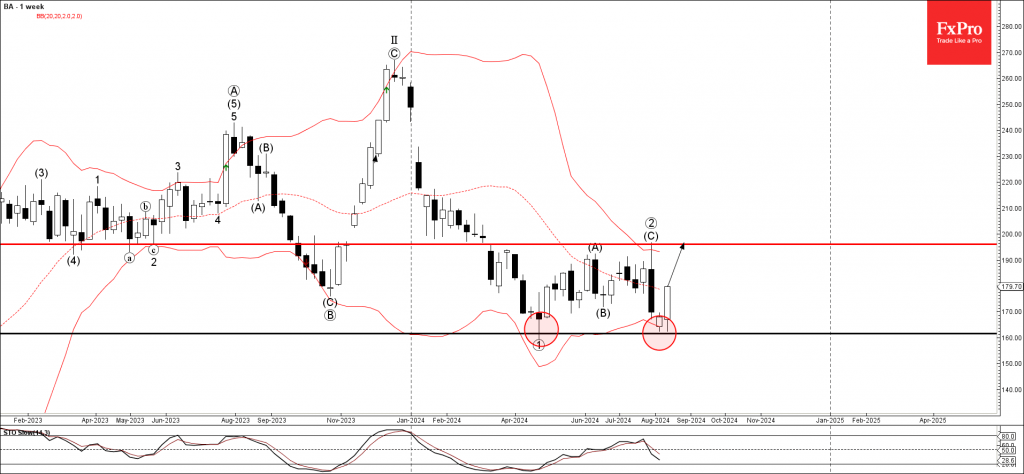

– Boeing reversed from support area – Likely to rise to resistance level 196.00 Boeing recently reversed up from the strong support area located between the support level 161.60 (which stopped the weekly wave 1 April) and the lower weekly.

August 15, 2024

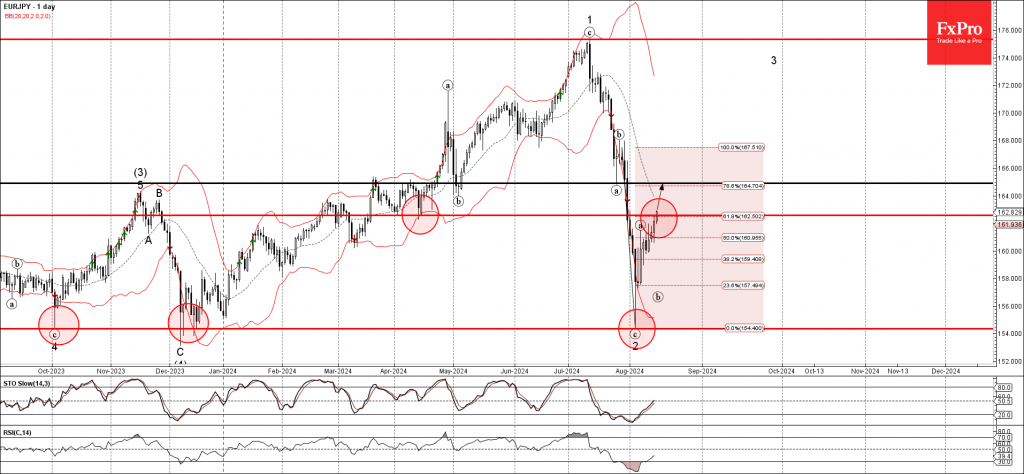

– EURJPY broke resistance area – Likely to rise to resistance level 164.90 EURJPY currency pair just broke the resistance area located between the resistance level 162.50 and the 61.8% Fibonacci correction of the earlier sharp downward impulse (c) from.

August 15, 2024

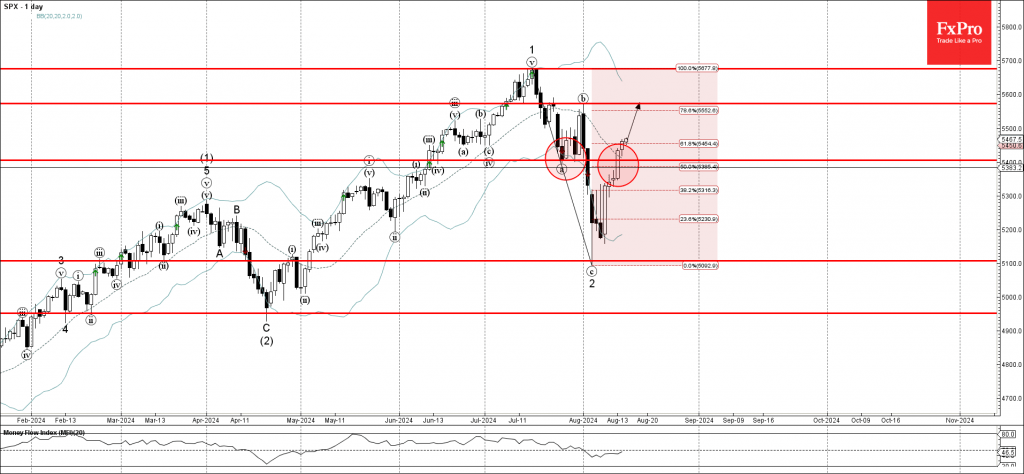

– S&P 500 index rising inside impulse wave 3 – Likely to test resistance level 5570.00 S&P 500 index recently continues to rise inside the impulse wave 3 which previously broke the resistance area located between the strong resistance level.