Technical analysis - Page 10

December 29, 2025

Bitcoin Cash: ⬇️ Sell – Bitcoin Cash reversed from resistance zone – Likely to fall to support level 566.00 Bitcoin Cash cryptocurrency recently reversed from the resistance area between the multi-month resistance level 633.60 (which has been reversing the price.

December 29, 2025

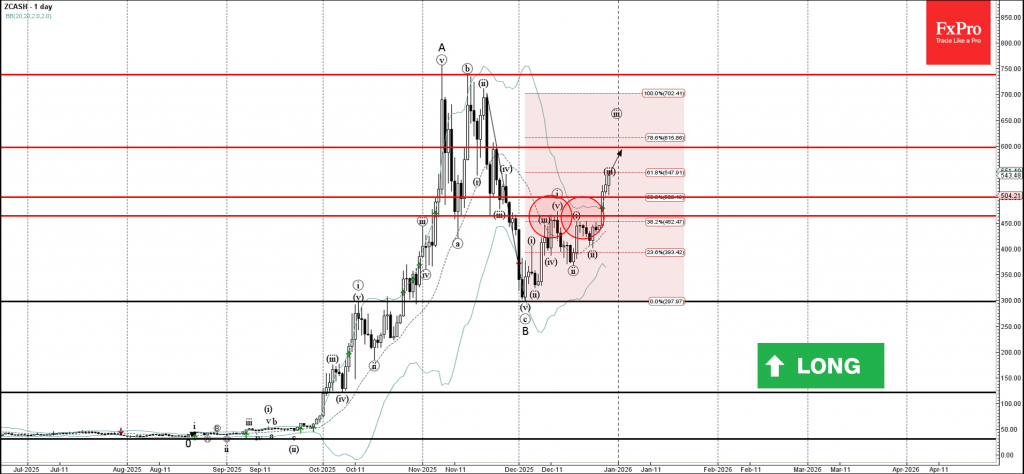

Zcash: ⬆️ Buy – Zcash broke resistance area – Likely to rise to resistance level 600.00 Zcash cryptocurrency recently broke the resistance area between the resistance level 464.65 (which stopped the previous impulse waves (i) and i) and the 38.2%.

December 26, 2025

CADJPY: ⬆️ Buy – CADJPY broke resistance level 114.30 – Likely to rise to resistance level 115.00 CADJPY currency pair recently broke above the resistance level 114.30 – which reversed the price in the middle of December. The breakout of.

December 26, 2025

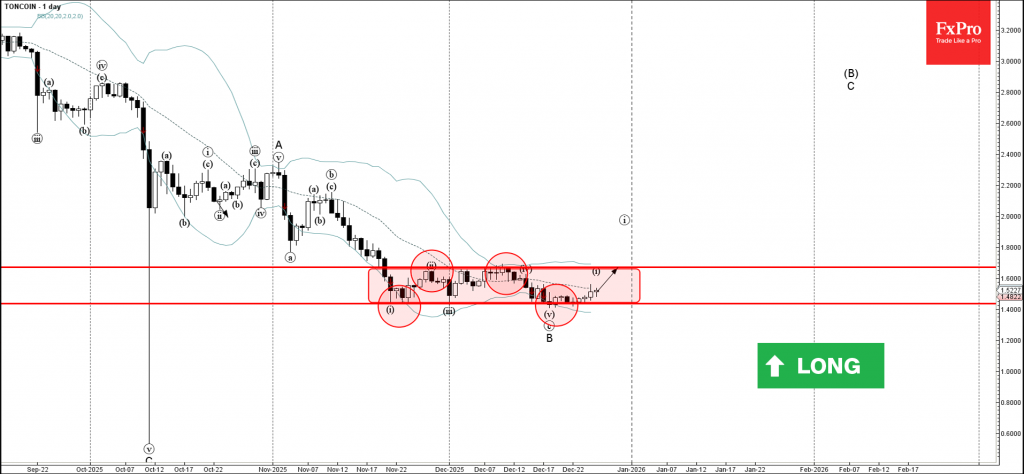

Toncoin: ⬆️ Buy – Toncoin reversed from support zone – Likely to rise to resistance level 1.6720 Toncoin cryptocurrency recently reversed up from the support zone between the key support level 1.4350 (lower border of the narrow sideways price range.

December 26, 2025

Nvidia: ⬆️ Buy – Nvidia reversed from support zone – Likely to rise to resistance level 200.00 Nvidia recently broke the resistance zone between the resistance level 190.00 (top of the previous impulse wave (1)) and the 50% Fibonacci correction.

December 26, 2025

Palladium: ⬆️ Buy – Palladium reversed from support zone – Likely to rise to resistance level 2000.00 Palladium recently reversed from the support zone between the support level 1700.00, upper trendline of the recently broken up channel from April and.

December 24, 2025

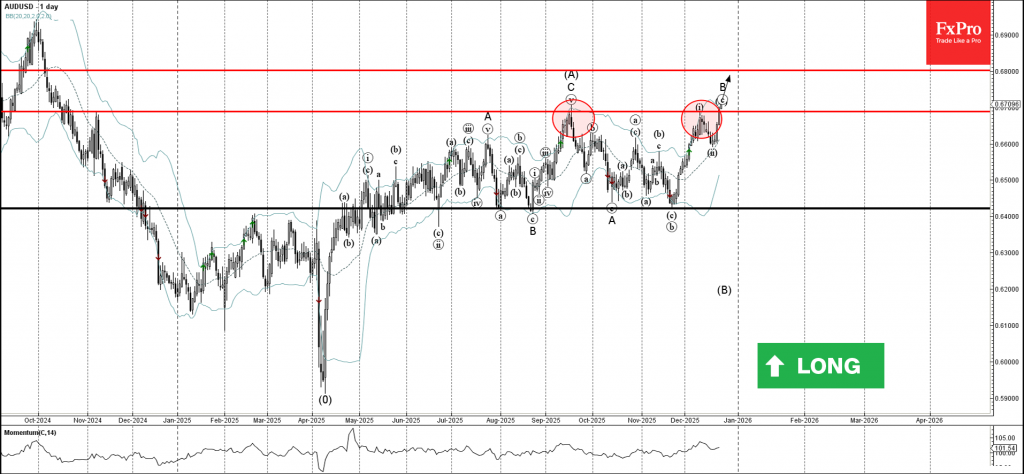

AUDUSD: ⬆️ Buy – AUDUSD broke key resistance level 0.6690 – Likely to rise to resistance level 0.6800 AUDUSD currency pair recently broke above the key resistance level 0.6690 (which has been reversing the price from the middle of September)..

December 24, 2025

Tron: ⬇️ Sell – Tron reversed from resistance zone – Likely to fall to support level 0.2700 Tron cryptocurrency earlier reversed from resistance zone between the resistance level 0.2865 (top of the previous minor correction 2 from the start of.

December 24, 2025

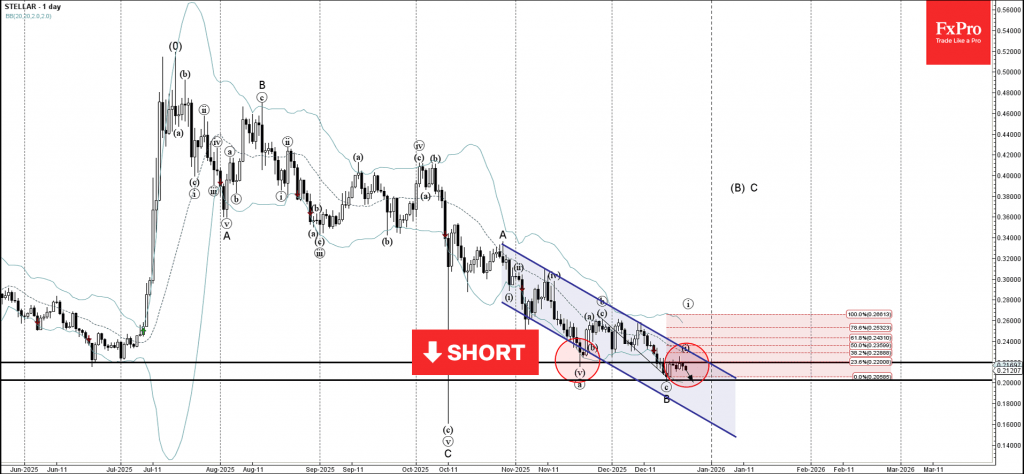

Stellar: ⬇️ Sell – Stellar reversed from pivotal resistance level 0.2200 – Likely to fall to support level 0.2000 Stellar cryptocurrency recently reversed down from the pivotal resistance level 0.2200 (former monthly low from November, as can be seen from.

December 24, 2025

USDCHF: ⬇️ Sell – USDCHF broke support level 0.7885 – Likely to fall to support level 0.7800. USDCHF currency pair recently broke the support level 0.7885, which is the lower border of the multi-month sideways price range inside which the.

December 23, 2025

Silver: ⬆️ Buy – Silver broke round resistance level 70.00 – Likely to rise to resistance level 75.00 Silver continues to rise after the earlier breakout of the resistance zone between the round resistance level 70.00 (earlier upward target) and.